6-‹#› LEARNING OBJECTIVES The Contribution Margin Concept

advertisement

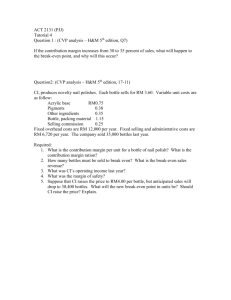

6-‹#› 6-1 LEARNING OBJECTIVES 1. 2. 3. 4. 5. 6. 7. 8. Interpret a cost-volume-profit (CVP) graph. Use the contribution margin (CM) ratio to compute changes in contribution margin and net operating income resulting from changes in sales volume. Show the effects on contribution margin of changes in variable costs, fixed costs, selling price, and volume. Compute the break-even point. Determine the level of sales needed to achieve a desired target profit with and without taxes. Use the margin of safety and explain its significance. Compute the degree of operating leverage at a particular level of sales and explain how the degree of operating leverage can be used to predict changes to net operating income. Compute the break-even point for a multiple-product company and explain the effects of shifts in the sales mix on contribution margin and the break-even point. 6-2 The Contribution Margin Concept For each additional unit Wind sells, $200 more in contribution margin will help to cover fixed expenses and profit. Sales (500 bikes) Less: variable expenses Contribution margin Less: fixed expenses Net income Total $250,000 150,000 $100,000 80,000 $ 20,000 Per Unit $ 500 300 $ 200 Percent 100% 60% 40% 6-3 CVP Relationships in Graphic Form Viewing CVP relationships in a graph gives managers a perspective that can be obtained in no other way. Consider the following information for Wind Co.: Sales Sales Less: Less: variable variable expenses expenses Contribution Contribution margin margin Less: Less: fixed fixed expenses expenses Net Net income income (loss) (loss) Income Income 300 300 units units 150,000 150,000 90,000 90,000 $$ 60,000 60,000 80,000 80,000 $$ (20,000) (20,000) $$ Income Income 400 400 units units $$ 200,000 200,000 120,000 120,000 $$ 80,000 80,000 80,000 80,000 $$ -- Income Income 500 500 units units $$ 250,000 250,000 150,000 150,000 $$ 100,000 100,000 80,000 80,000 $$ 20,000 20,000 6-‹#› 6-4 CVP Graph 450,000 400,000 350,000 rea tA ofi Pr Dollars 300,000 250,000 200,000 150,000 Break-even point ea Ar ss Lo 100,000 50,000 - 100 200 300 400 500 600 700 800 Units 6-5 6-15 6-6 Contribution Margin Ratio The contribution margin ratio is: CM Ratio = Contribution margin Sales For Wind Bicycle Co. the ratio is: $200 $500 = 40% 6-‹#› 6-7 Break-Even: Equation Method Profits = Sales – (Variable expenses + Fixed expenses) OR Sales = Variable expenses + Fixed expenses + Profits At the break-even point profits equal zero. 6-8 Break-Even: Contribution Margin Method Break-even point = in units sold Fixed expenses Unit contribution margin Break-even point in total sales dollars = Fixed expenses CM ratio 6-9 Target Profit Calculations: CM Approach Units sold to attain = the target profit Fixed expenses + Target profit Unit contribution margin Target Profit Calculations With Taxes Units sold to attain = the target profit Fixed expenses + Target profit/(1-t) Unit contribution margin 6-‹#› 6-10 The Margin of Safety Excess of budgeted (or actual) sales over the break-even volume of sales. The amount by which sales can drop before losses begin to be incurred. Margin of safety = Total sales - Break-even sales ($ or units) ($ or units) 6-11 6-6 6-17 6-12 Operating Leverage A measure of how sensitive net income is to percentage changes in sales. With high leverage, a small percentage increase in sales can produce a much larger percentage increase in net income. Degree of operating leverage = Contribution margin Net income 6-‹#› 6-13 6-21 6-14 The Concept of Sales Mix Sales mix is the relative proportions in which a company’s products are sold. Different products have different selling prices, cost structures, and contribution margins. Break-even analysis: Weighted average contribution margin approach Product “bundling” approach 6-15 6-11 6-‹#› 6-16 Assumptions of CVP Analysis Selling price is constant throughout the entire relevant range. Costs are linear throughout the entire relevant range. In multi-product companies, the sales mix is constant. In manufacturing companies, inventories do not change (units produced = units sold). 6-17 6-22