Tutorial 10 (ACT 3131—CVP analysis)

advertisement

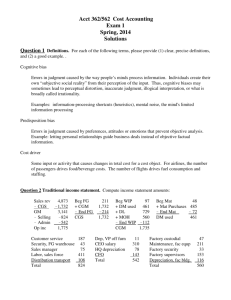

ACT 2131 (PJJ) Tutorial 4 Question 1 : (CVP analysis – H&M 5th edition, Q7) If the contribution margin increases from 30 to 35 percent of sales, what will happen to the break-even point, and why will this occur? Question2: (CVP analysis – H&M 5th edition, 17-11) CI, produces novelty nail polishes. Each bottle sells for RM 3.60. Variable unit costs are as follow: Acrylic base RM0.75 Pigments 0.38 Other ingredients 0.35 Bottle, packing material 1.15 Selling commission 0.25 Fixed overhead costs are RM 12,000 per year. Fixed selling and administrative costs are RM 6,720 per year. The company sold 35,000 bottles last year. Required: 1. What is the contribution margin per unit for a bottle of nail polish? What is the contribution margin ration? 2. How many bottles must be sold to break even? What is the break-even sales revenue? 3. What was CI’s operating income last year? 4. What was the margin of safety? 5. Suppose that CI raises the price to RM4.00 per bottle, but anticipated sales will drop to 30,400 bottles. What will the new break-even point in units be? Should CI raise the price? Explain. Question 3: (CVP analysis – H&M 5th edition, 17-18) GI is a manufacturer of exercise equipment. The budgeted income statement for the coming year is as follows. RM Sales 900,000 Less: Variable expenses 342,000 Contribution margin 558,000 Less: Fixed expenses 363,537 Income before taxes 194,463 Less: Income taxes 77,785 Net income 116,678 Required: 1. What is GI’s variable cost ration? Its contribution margin ration? 2. Suppose GI’s actual revenues are RM 150,000 greater than budgeted. By how much will before-tax profits increase? Give the answer without preparing a new income statement. 3. How much sales revenue must GI earn in order to break even? What is the expected margin of safety? (Round your answers to the nearest RM). 4. How much sales revenue must GI generates to earn a before-tax profit of RM200,000? An after-tax profit of RM120,000? Prepare a contribution margin income statement to verify the accuracy of your last answer. Solution: Question 1 The increase in contribution margin ratio means that the amount of every sales dollar that goes toward covering fixed cost and profit has just gone up. As a result, the breakeven point will go down. Question 2 1. Contribution margin per unit = $3.60 – $2.88* = $0.72 *Variable unit cost = $0.75 + $0.38 + $0.35 + $1.15 + $0.25 = $2.88 Contribution margin ratio = $0.72/$3.60 = 0.20 2. Break-even in units Break-even in sales = ($12,000 + $6,720)/$0.72 = 26,000 bottles = 26,000 × $3.60 = $93,600 or = ($12,000 + $6,720)/0.20 = $93,600 3. Sales ($3.60 × 35,000) ............................... $ 126,000 Variable costs ($2.88 × 35,000) .....................100,800 Contribution margin....................................... $ 25,200 Fixed costs ...................................................... 18,720 Operating income............................................ $ 6,480 4. Margin of safety = $126,000 – $93,600 = $32,400 5. Break-even in units = $18,720/($4.00 – $2.88) = 16,714.3, or 16,715 if rounded to whole units New operating income = $4(30,400) – $2.88(30,400) – $18,720 = $121,600 – $87,552 – $18,720 = $15,328 Yes, operating income will increase by $8,848 ($15,328 – $6,480). Question 3 1. Variable cost ratio = $342,000/$900,000 = 0.38 Contribution margin ratio = $558,000/$900,000 = 0.62 2. $150,000 × (0.62) = $93,000 3. Revenue = ($363,537 + 0)/0.62 0.62 × Revenue = $363,537 Revenue = $586,350 Margin of safety = $900,000 – $586,350 = $313,650 4. Revenue = ($363,537 + $200,000)/0.62 = $908,931 Operating income = $120,000/(1 – 0.4)* = $200,000 *$77,785/$194,463 = 0.4 tax rate. Revenue = ($363,537 + $200,000)/0.62 = $908,931 Sales Less: Variable expenses ($908,931 × 0.38) Contribution margin Less: Fixed expenses Profit before taxes Taxes ($200,000 × 0.40) Net income $ 908,931 345,394 $563,537 363,537 $ 200,000 80,000 $ 120,000