FAsB AsC subtopic 820-10 (“AsC 820-10”), Fair Value

advertisement

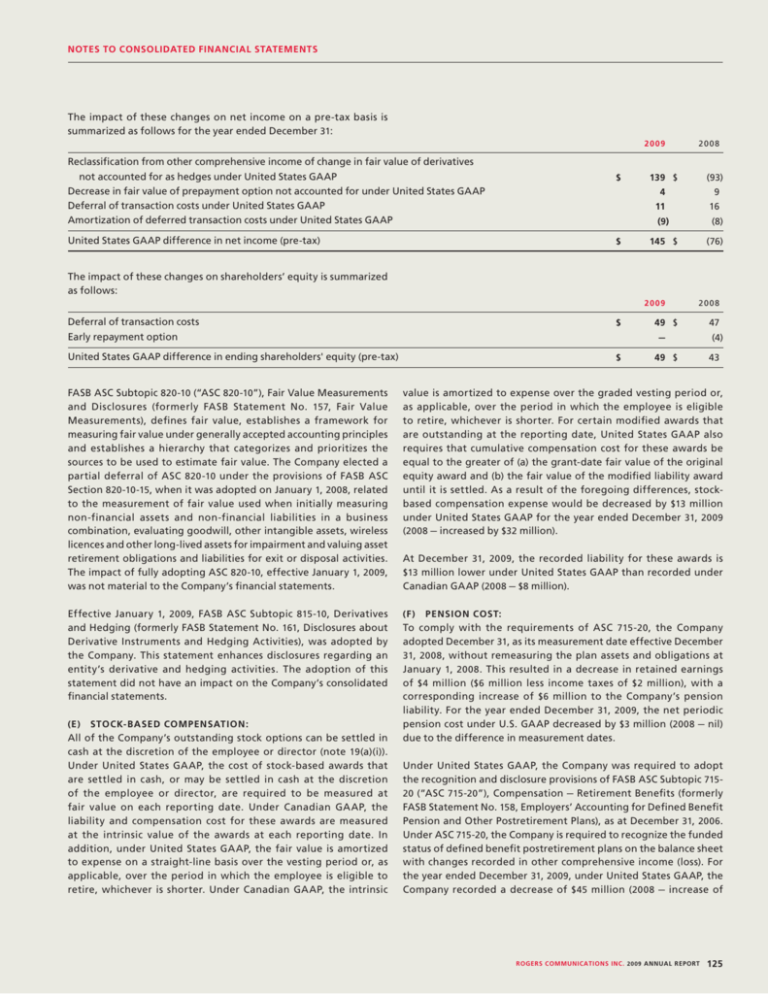

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The impact of these changes on net income on a pre-tax basis is summarized as follows for the year ended December 31: 2009 Reclassification from other comprehensive income of change in fair value of derivatives not accounted for as hedges under United States GAAP Decrease in fair value of prepayment option not accounted for under United States GAAP Deferral of transaction costs under United States GAAP Amortization of deferred transaction costs under United States GAAP United States GAAP difference in net income (pre-tax) 2008 $ 139 $ 4 11 (9) (93) 9 16 (8) $ 145 $ (76) The impact of these changes on shareholders’ equity is summarized as follows: 2009 2008 Deferral of transaction costs Early repayment option $ 49 $ – 47 (4) United States GAAP difference in ending shareholders' equity (pre-tax) $ 49 $ 43 FASB ASC Subtopic 820-10 (“ASC 820-10”), Fair Value Measurements and Disclosures (formerly FASB Statement No. 157, Fair Value Measurements), defines fair value, establishes a framework for measuring fair value under generally accepted accounting principles and establishes a hierarchy that categorizes and prioritizes the sources to be used to estimate fair value. The Company elected a partial deferral of ASC 820-10 under the provisions of FASB ASC Section 820-10-15, when it was adopted on January 1, 2008, related to the measurement of fair value used when initially measuring non-financial assets and non-financial liabilities in a business combination, evaluating goodwill, other intangible assets, wireless licences and other long-lived assets for impairment and valuing asset retirement obligations and liabilities for exit or disposal activities. The impact of fully adopting ASC 820-10, effective January 1, 2009, was not material to the Company’s financial statements. value is amortized to expense over the graded vesting period or, as applicable, over the period in which the employee is eligible to retire, whichever is shorter. For certain modified awards that are outstanding at the reporting date, United States GAAP also requires that cumulative compensation cost for these awards be equal to the greater of (a) the grant-date fair value of the original equity award and (b) the fair value of the modified liability award until it is settled. As a result of the foregoing differences, stockbased compensation expense would be decreased by $13 million under United States GAAP for the year ended December 31, 2009 (2008 – increased by $32 million). Effective January 1, 2009, FASB ASC Subtopic 815-10, Derivatives and Hedging (formerly FASB Statement No. 161, Disclosures about Derivative Instruments and Hedging Activities), was adopted by the Company. This statement enhances disclosures regarding an entity’s derivative and hedging activities. The adoption of this statement did not have an impact on the Company’s consolidated financial statements. (f ) Pension cost: (e) Stock-based compensation: All of the Company’s outstanding stock options can be settled in cash at the discretion of the employee or director (note 19(a)(i)). Under United States GAAP, the cost of stock-based awards that are settled in cash, or may be settled in cash at the discretion of the employee or director, are required to be measured at fair value on each reporting date. Under Canadian GAAP, the liability and compensation cost for these awards are measured at the intrinsic value of the awards at each reporting date. In addition, under United States GAAP, the fair value is amortized to expense on a straight-line basis over the vesting period or, as applicable, over the period in which the employee is eligible to retire, whichever is shorter. Under Canadian GAAP, the intrinsic At December 31, 2009, the recorded liability for these awards is $13 million lower under United States GAAP than recorded under Canadian GAAP (2008 – $8 million). To comply with the requirements of ASC 715-20, the Company adopted December 31, as its measurement date effective December 31, 2008, without remeasuring the plan assets and obligations at January 1, 2008. This resulted in a decrease in retained earnings of $4 million ($6 million less income taxes of $2 million), with a corresponding increase of $6 million to the Company’s pension liability. For the year ended December 31, 2009, the net periodic pension cost under U.S. GAAP decreased by $3 million (2008 – nil) due to the difference in measurement dates. Under United States GAAP, the Company was required to adopt the recognition and disclosure provisions of FASB ASC Subtopic 71520 (“ASC 715-20”), Compensation – Retirement Benefits (formerly FASB Statement No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans), as at December 31, 2006. Under ASC 715-20, the Company is required to recognize the funded status of defined benefit postretirement plans on the balance sheet with changes recorded in other comprehensive income (loss). For the year ended December 31, 2009, under United States GAAP, the Company recorded a decrease of $45 million (2008 – increase of ROGERS COMMUNICATIONS INC. 2009 ANNUAL REPORT 125