Retirement Reform 2015

advertisement

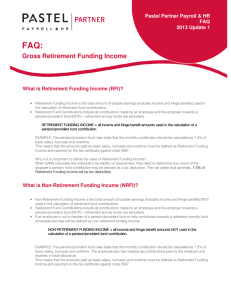

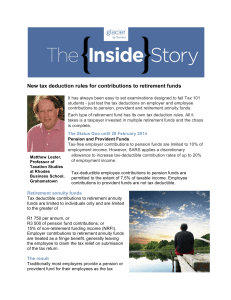

Retirement Reform 2015 Sharon Nieuwoudt Tax deduction allowed in respect of member contribution Pension fund Maximum deductible is the greater of: R1 750 p.a. Or 7,5% of Retirementfunding employment Provident fund Member Contribution not Deductible Retirement Annuity Fund Maximum deductible is the greater of: 15% of taxable income from non-retirement funding income (subject to certain exclusions) or R3 500 less deductible pension fund contribution or R1 750 Tax deduction allowed in respect of employer contribution Pension fund SARS generally allows 20% of an employee‟s “approved remuneration” The 20% is the total for employer contributions to pension, provident and benefit funds (e.g. medical scheme) in respect of an Employee Provident fund Same as for Pension Fund Retirement Annuity Fund If the employers pay premium on behalf of its employee = taxable benefit but also with a deduction for the employee within the limits. The payment on behalf of the employee is a deductible expense for the employer What will change on 1 March 2015 (T-Day) Employer contributions to all pension / provident / retirement annuity funds will form part of an employee‟s taxable income. The maximum deduction will be 27.5 per cent of the greater of remuneration or taxable income. A maximum tax deduction of R350 000 in one tax year will be permitted and any unused deductions can be rolled over to another year. Employer contributions to all approved retirement funds will be deductible against income The new regime is aimed at having a uniform regime for all contributions and so to encourage individuals to save towards achieving an adequate level of retirement income. What will change on March 2015 (T-Day) E X A M P L E S Comparison of Retirement Funds (Current)~Withdrawal at Retirement Pension fund Maximum 1/3 lump sum – the balance used for mandatory annuitisation. Provident fund Employee has a choice to take full benefit or any portion of full benefit as a lump sum payment (1/3 rule does not apply). Retirement Annuity Fund Maximum 1/3 lump sum – the balance used for mandatory annuitisation. Comparison of Retirement Funds (Current)~Withdrawal(Pre-retirement) Pension fund Full amount in cash; or part in cash and rest as transfer to another approved retirement fund Provident fund Same as for Pension Fund Retirement Annuity Fund N/A What will change on 1 March 2015 (P-Day) As from 1 March 2015, provident fund members will be required to annuitise two-thirds of their retirement interest upon retirement , but the vested rights of existing members will be protected by not requiring annuitisation (irrespective of whether member remains in the fund) – in respect of any accumulated savings as at 1 March 2015 and any growth thereon; plus for provident fund members above 55 years on 1 March 2015, any contributions made after 1 March 2015 to that provident fund and any growth thereon. De minimus requirement to be raised to R150 000 (currently R75 000) for a lump sum. Income Protection Policies Two types of personal „disability‟ insurance cover currently offered to individuals: Income protection (covers actual loss of future income) contributions are tax deductible and pay-outs are taxed. Capital protection (covers the loss of income-earning capacity, e.g. loss of limb) contributions are not tax deductible and tax-free on pay-outs. As from 1 March 2015, there be no tax deduction for premiums / contributions, and pay-outs will be free from tax on all personal insurance cover, even if the plans are pre-existing(affecting both personal and employer-provided provided policies). The result will be greater equity and certainty as all personal insurance cover will be treated the same for income tax purposes. Way forward? Be informed Plan for change Be equipped Take action