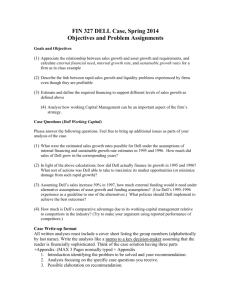

The Internet and the Production Network of Dell Computer

advertisement