Go Shops: A Ticket to Ride Past a Target Board's Revlon Duties?*

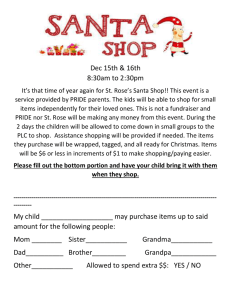

advertisement