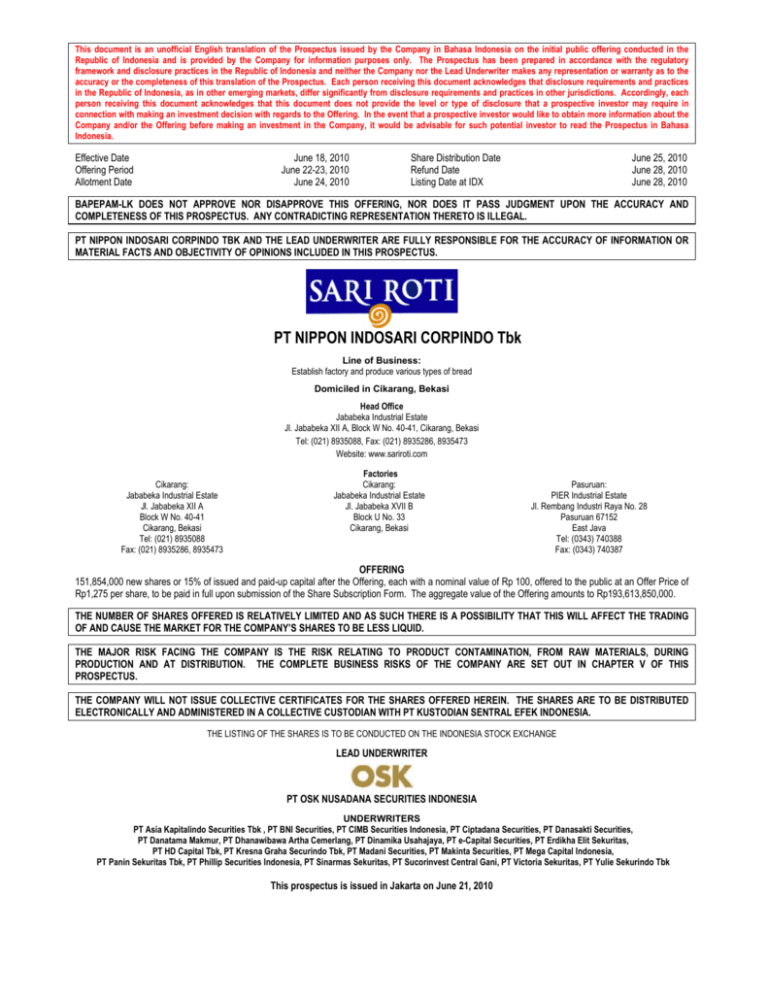

NIC-IPO Prospectus

advertisement