Exercises in Life Insurance Mathematics

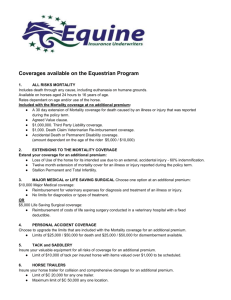

advertisement

Exercises in Life Insurance Mathematics

Edited by

Bjarne Mess

Jakob Christensen

University of Copenhagen

Laboratory of Actuarial Mathematics

Introduction

This collection of exercises in life insurance mathematics replaces the collection of

Steen Pedersen and all other exercises and problems in any text or article in the

FM0L curriculum.

The following abbreviations are being used for the contributors of exercises:

AM

BM

BS

FW

JC

JH

MSC

MS

RN

SH

SK

SP

SW

Bowers et al. “Actuarial Mathematics”,

Society of Actuaries, Itasca, Il 1986

Bjarne Mess

Bo Søndergaard

Flemming Windfeld

Jakob Christensen

Jan Hoem “Elementær rentelære”,

Universitetsforlaget, Oslo, 1971.

Michael Schou Christensen

Mogens Steffensen

Ragnar Norberg

Svend Haastrup

Stephen G. Kellison “The theory of Interest”,

Richard D. Erwing, Inc., Homewood, Il 1970

Steen Pedersen “Opgaver i livsforsikringsmatematik”

Schwartz “Numerical Analysis”, Wiley, 1989

Copenhagen, August 2, 1997

Bjarne Mess

Jakob Christensen

4

Exercises in Life Insurance Mathematics

Exercises

1.

FM0 S91, 1

FM0 S93, 2

Interest

FM0 S92, 1

FM0 S94, 1

FM0 S93, 1

Exercise 1.1 Show that an | < an| < än| when i > 0.

(JH(1), 1971)

Exercise 1.2 Show that an | /n decreases as n increases and i > 0.

(JH(2), 1971)

Exercise 1.3 Show that an | (i1 )/an| (i2 ) decreases as n increases if i1 > i2 .

(JH(3), 1971)

Exercise 1.4 A man needs approximately $2.500 and raises in that connection a

loan in a bank. The principal, which is to be fully repaid after 6 months, is $2.600.

From this amount the bank deducts the future interest $84,50 and other fees of $5,70,

so that the bank pays out the man $2.509,80 cash. The interest rate of the bank is

6.5%.

(a) What is the effective interest rate p. a. for the bank?

(b) What is the effective interest rate p. a. for the borrower?

(JH(4 rev.), 1971)

Exercise 1.5 One day a company receives an american loan offer: Principal of

$5.000.000, rate of course 99% and nominal interest rate 6.5%. The loan is free of

installments for 5 years and is after that to be amortized over 15 years: Interests

and installments are due annually. Assume that the dollar-rate of exchange decreases

exponentially from DKK 6,75 at the initial time to DKK 4,75 at the end of the loan.

How can one determine the effective interest rate of the loan?

Interest

5

(SP(19))

Exercise 1.6 By calculation of the interest rate for a fraction of a year, a bank will

usually calculate with linear payment of interest instead of exponential payment of

interest. If the interest rate is i p. a. and we have to calculate interest for a period

of time α (0 < α < 1), the bank will calculate interest as αi per kr. 1. – in capital,

instead of calculating the interest as

(1 + i)α − 1

per. kr. 1. – in capital. Is this for the benefit of the borrower?

(JH(7), 1971)

Exercise 1.7 A man is going to buy new furniture on an installment plan. In the

hire-purchase agreement he finds the following account:

Cash payment for the furniture

− In advance to the salesman

= Net balance

+ Installment fee for 18 mths.

= Net balance for installment

The monthly installments are

$6.306,00

$2.217, 00

$4.089,00

$501, 00

$4.590, 00

$255, 00

What effective interest rate p. a.

(JH(10), 1971)

Exercise 1.8 A man has been promised some money. He can choose from two

alternatives for the payment.

Under alternative (i) A5 = $4.495 and A9 = $5.548 are paid out after 5 and 9 years

respectively.

Under alternative (ii) B7 = $10.000 is paid out after 10 years.

Denote the market interest rate by i.

For which value (values) of i is (i) just as good as (ii), and when is (i) more profitable

for the man? What if A9 = $5.562, i. e. $14 more?

(JH(11), 1971)

6

Exercises in Life Insurance Mathematics

Exercise 1.9 A says to B: “I would like to borrow $208 in one year from today.

In return for your kindness I will pay $100 cash now, and $108,15 in two years from

today by the end of the loan.”

What is the effective interest rate p. a. for B if he accepts this?

(JH(12), 1971)

Exercise 1.10 Consider a usual annuity loan with principal H, interest rate i and

n installments. Show that the installment which falls due in period t is

Ft =

i(1 + i)t−1

H,

(1 + i)n − 1

and find an expression for the remaining debt immediately after this period.

(SP(6))

Exercise 1.11 Consider a linearly increasing annuity. At time t = 1, 2, . . . the

amount t is being paid. The present value of this cash flow is denoted by Ian | .

(a) Show that

Ian| =

n−1

X

t| an−t| ,

t=0

and interpret this equation intuitively.

(b) Give an explicit expression for Ian | .

(c) What does the symbol Ia n| mean? Give expressions corresponding to the ones

from (a) and (b).

(SP(10))

Exercise 1.12 A person has a table of annual annutities with different interest rates

and durations to his disposal. However, he needs some present values of half-year

annuities. These annuities do all have the same interest rate and the corresponding

whole-year annuities can be found in the table.

What is the easiest way to find the desired annuities?

(SP(11))

Interest

7

Exercise 1.13 A debtor is going to pay an amount of 1 some time in the future.

He does not know this point of time in advance; he only knows that it is a stochastic variable T with a known distribution. Now consider the expected present value

denoted by

Aδ(T ) = E(e−δT ).

(a) Show that the variance of the present value is given by

δ

2

Var(e−δT ) = A2δ

(T ) − (A(T ) ) .

Now assume that creditor has to pay a continuous T -year annuity. The present value

is aδT | . Let the expected present value be denoted by

aδ(T ) = E(aδT | ).

(b) Show that

Aδ(T ) = 1 − δaδ(T )

and interpret the equation.

(c) Give an expression for the variance Var(a δT | ) corresponding to the one from (a).

(d) Show that

Aδ(T ) > v ET ,

and find a similar inequality for aδ(T ) . (Hint: Use Jensen’s inequality.)

(e) Find at least two situations where these considerations are relevant.

(SP(16))

Exercise 1.14 Consider a loan, principal H, nominal interest rate i 1 , rate of course

k and installment Ft in period t, where t = 1, . . . , N . Show that the effective interest

rate ie satisfies

1−S

i1

ie =

k−S

where

N

1 X

S=

Ft vet .

H t=1

(SP(20))

Exercise 1.15 A loan with principal H and fixed interest rate i 1 has to be amortized

annually over a period of N years. The borrower can each year deduct half the interest

8

Exercises in Life Insurance Mathematics

expenses on his tax declaration. Construct the installment plan in a way so that the

amount of amortisation minus deductible (actual net payment) will be the same in

all periods (assume tax is payable by the end of each year). Find the annual net

installment.

(RN “Opgaver til FM0 (rentelære)” 18.05.93)

Exercise 1.16 Consider a general loan. Show that for t ≥ 1 we have

At = (1 + i1 )Rt−1 − Rt

Rt =

n−t

X

At+j v1j

(1.1)

j=1

v1t Rt = H −

t

X

Aj v1j

(1.2)

j=1

with the use of standard notation. Formula (1.1) is called the prospective formula for

the remaining debt. Formula (1.2) is called the retrospective formula for the remaining

debt.

(JH(20), 1971)

Exercise 1.17 A loan is being repaid by 15 annual payments. The first five installments are $400 each, the next five $300 each, and the final five are $200 each. Find

expressions for the remaining debt immediately after the second $300 installment –

(a) prospectively,

(b) retrospectively.

(SK(1) p. 122, 1970)

Exercise 1.18 A loan of $1.000 is being repaid with annual installments for 20 years

at effective interest of 5% . Show that the amount of interest in the 11th installment

is

50

.

1 + v 10

(SK(10) p. 123, 1970)

Exercise 1.19 A borrower has mortgage which calls for level annual payments of 1 at

the end of each year for 20 years. At the time of the seventh regular payment he also

Interest

9

makes an additional payment equal to the amount of principal that according to the

original amortisation schedule would have been repaid by the eighth regular payment.

If payments of 1 continue to be made at the end of the eighth and succeding years

until the mortgage is fully repaid, show that the amount saved in interest payments

over the full term of the mortgage is

1 − v 13 .

(SK(16) p. 124, 1970)

Exercise 1.20 A man has some money invested at an effective interest rate i. At

the end of the first year he withdraws 162.5% of the interest earned, at the end of

the second year he withdraws 325% of the interest earned, and so forth with the

withdrawal factor increasing in arithmetic progression. At the end of 16 years the

fund exhausted. Find i.

(SK(40) p. 127, 1970)

Exercise 1.21 A loan of a25 | is being repaid with continuous payments at the annual

rate of 1 p. a. for 25 years. If the interest rate i is 0.05, find the total amount of interest

paid during the 6th through the 10th years inclusive.

(SK(42) p. 127, 1970)

Exercise 1.22 After having made six payments of $100 each on a $1.000 loan at

4% effective, the borrower decides to repay the balance of the loan over the next five

years by equal annual principal payments in addition to the annual interest due on

the unpaid balance. If the lender insists on a yield rate of 5% over this five-year

period, find the total payment, principal plus interest, for the ninth year.

(SK(45) p. 127, 1970)

Exercise 1.23 A student has heard of a bank that offers a study loan of L = 10.000

kr. The rate of interest is 3% p. a. and the student applicates for the loan on the

following conditions:

(i) The first m = 5 years he will only pay an interest of 300 kr. per year.

(ii) After that period of time he will pay interests and installments of 900 kr. per year

until the loan is fully amortized (the last installment may be reduced).

(a) For how long N does he have to pay installments and how big is the last amount

of amortisation?

10

Exercises in Life Insurance Mathematics

(b) Which amount αt has to be paid at time t if the loan (with interest earned) is to

be fully paid back at time t (t = 1, 2, . . . , N )?

(Aktuarembetseksamen, Oslo 1960)

Aggregate Mortality

11

2.

Aggregate Mortality

Exercise 2.1 Let T be a stochastic variable with distribution function F . Assume F

is concentrated on the interval [a, b] and that F is continuous with continuous density

f . Assume F (t) < 1 for t ∈ [a, b). Define

µ(t) =

f (t)

, t ∈ [a, b).

1 − F (t)

We say that µ is the intensity of F .

(a) Show that

Rb

a

µ(t)dt = ∞.

(b) Can we conclude that µ(t) → ∞ for t → b − ?

Let T be the life length of a newly born. Let a = 0 and b = ω where ω is the maximum

life length.

(c) Show that µ is the force of mortality.

(HRH(1))

Exercise 2.2 Use the decrement tables of G82M to find the following probabilities:

(a) The probability that a 1 year old person dies after his 50th year, but before his

60th year.

(b) The probability that a 30 year old dies within the next 37 years.

(c) The probability that two persons now 26 and 31 years old, and whose remaining

life times are assumed to be stochastically independent, both are alive in 12 years.

(SP(28))

Exercise 2.3 Explain why each of the following functions cannot serve in the role

indicated by the symbol:

µx = (1 + x)−3 , x ≥ 0

F (x) = 1 −

22x 11x2 7x3

+

−

, 0≤x≤3

12

8

24

12

Exercises in Life Insurance Mathematics

f (x) = xn−1 e−x/2 , x ≥ 0, n ≥ 1.

(AM(3.4) p. 77, 1986)

Exercise 2.4 Consider a population, where the distribution functions for a man’s

and a woman’s total life lengths are x q0M and x q0K respectively. Assume that these

K

probabilities are continuous so that the forces of mortality µ M

x and µx are defined.

Let s0 denote the probability that a newly born is a female. Assume moreover that s 0

and the forces of mortality are not being altered during the period of time considered

in this exercise.

(a) Find the distribution function x q0 for the total life time for a person of unknown

sex and find t qx . Find the force of mortality µx for a person of unknown sex.

(b) What is the probability sx that a person aged x is a woman?

K

Using decrement series `M

x and `x for men and women respectively, work out a decrement serie `x for the total population:

K

(c) How should one appropriately choose ` M

0 and `0 ?

K

(d) Express ax in terms of aM

x and ax .

(SP(32))

Exercise 2.5 Consider a random survivorship group consisting of two subgroups:

(1) The survivors of 1.600 births.

(2) The survivors of 540 persons joining 10 years later at age 10.

An excerpt from the appropriate mortality table for both subgroups follows:

x

0

10

70

`x

40

39

26

If γ1 and γ2 are the numbers of survivors under the age of 70 out of subgroups (1)

and (2) respectively, estimate a number c such that P (γ 1 + γ2 > c) = 0.05. Assume

the lives are independent.

Aggregate Mortality

13

(AM(3.13) p. 78, 1986)

Exercise 2.6 When considering aggregate mortality the probability that an x-year

old person is going to die between x + s and x + s + t, is denoted by the symbol s|t qx .

(a) Express this probability by the distribution function of the person’s remaining life

time.

(b) Is there a connection between

s|t qx

and t qx ?

(c) Show that

s|t qx =

Z

s+t

u px µx+u du,

s

and interpret this expression.

When t = 1 we write s| qx = s|1 qx .

(d) Show that for integer x and n we have

n| qx

(e) Show that

s|t qx

=

dx+n

.

`x

can be expressed similarly (use the function ` instead of d).

(f) Prove the following identities:

n|m qx

=

n px

n| qx

=

n px

n+m px

=

n px

− n+m px

· qx+n

· m px+n .

(SP(24))

Exercise 2.7 Let e◦x:n| denote the expected future lifetime of (x) between the ages

of x and x + n. Show that

e◦x:n|

=

=

n

Z

tt px µx+t dt + nn px

Z0 n

0

This is called the partial life expectancy.

t px dt.

14

Exercises in Life Insurance Mathematics

(AM(3.14) p. 78, 1986)

Exercise 2.8 The force of mortality µ x is assumed to be

µx = βcx .

Three persons are x, y and z years old respectively. What is the probability of dying

in the order x, y, z?

(Tentamen i försikringsmatematik, Stockholms Högskola 1954)

Exercise 2.9 If F (x) = 1 − x/100, 0 ≤ x ≤ 100, find µ x , F (x), f (x) and P (10 <

X < 40).

(AM(3.5) p. 77, 1986)

Exercise 2.10 If µx = 0.0001 for 20 ≤ x ≤ 25, evaluate

2|2 q20 .

(AM(3.7) p. 77, 1986)

Exercise 2.11 Assume that the force of mortality µ x is Gompertz-Makeham, i. e.

µx = α+βcx . For at certain cause of death, the force of mortality is given by α 1 +β1 cx .

Show that the probability of dying from the above disease for an x-year old is

β1 α1 β − αβ1

ex .

+

β

β

(Tentamen i försikringsmatematik, Stockholms Högskola 1954)

Exercise 2.12 Show that constants a and b can be determined so that

µx = a log(1 − qx ) + b log(1 − qx+1 ).

when µx can be put as a linear function for x < t < x + 2.

(Tentamen i försikringsmatematik, Stockholms Högskola 1954)

Exercise 2.13 Assuming the force of mortality to be Gompertz-Makeham, i. e.

µx = α + βcx , show that for each age x we have

−

log c

log(1 − qx ) < µx < − log(1 − qx ).

c−1

Aggregate Mortality

15

(Tentamen i försikringsmatematik, Stockholms Högskola, 1954)

Exercise 2.14 Given that `x+t is strictly decreasing for t ∈ [0, 1] show that

(a) if `x+t is concave down, then qx > µx ,

(b) if `x+t is concave up, then qx < µx .

(AM, 1986)

Exercise 2.15 Prove the following expressions:

d

d

`x µx < 0, when

µx < µ2x

dx

dx

d

d

`x µx = 0, when

µx = µ2x

dx

dx

d

d

`x µx > 0, when

µx > µ2x .

dx

dx

(AM(3.12) p. 77, 1986)

Exercise 2.16 Show the following identities:

∂ t px

∂t

∂ t px

∂x

= −µx+t · t px

= (µx − µx+t ) · t px

1 =

`x =

Z

Z

ω−x

t px µx+t dt

0

ω−x

`x+t µx+t dt.

0

(SP(26))

Exercise 2.17 If the force of mortality µ x+t , 0 ≤ t ≤ 1, changes to µx+t − c where c

is a positive constant, find the value of c for which the probability of (x) dying within

a year will be halved. Express the answer in terms of q x .

(AM(3.34) p. 80, 1986)

Exercise 2.18 From a standard mortality table, a second table is prepared by

doubling the force of mortality of the standard table. Is the rate of mortality, q x , at

16

Exercises in Life Insurance Mathematics

any given age under the new table, more than double, exactly double or less than

double the mortality rate, qx , of the standard table?

(AM(3.35) p. 80, 1986)

Exercise 2.19 If µx = Bcx , show that the function `x µx has a maximum at age x0 ,

where µx0 = log c. (Hint: Exercise 2.15).

(AM(3.36) p. 80, 1986)

Exercise 2.20 Assume

µx =

Acx

1 + Bcx

for x > 0.

(a) Find the survival function F (x).

(b) Verify that the mode of the distribution of X, the age of death, is given by

x0 =

log(log c) − log A

.

log c

(AM(3.37) p. 80, 1986)

Exercise 2.21. (Interpolation in Life Annuity Tariffs) Consider a table with the

present value ax:u−x| for an integer expiration age u with age at issue x = 0, 1, . . . , u

and futhermore a table of the one year survival probabilities p x for the same ages. Let

t be a real number, 0 ≤ t < 1. We are trying to find a way to determine a x+t:u−x−t|

from the data of the table; this method will, of course, depend on how the mortality

varies with the age.

Assume that the force of mortality is constant on one year age intervals, i. e. µ x+t = µx

for all t with 0 ≤ t < 1.

(a) Find

t−s px+s

in terms of px for 0 ≤ s < t ≤ 1.

(b) Find an expression for ax+t:1−t| .

(c) Show that for every t there exists a λ so that

ax+t:u−x−t| = λax:u−x| + (1 − λ)ax+1:u−x−1| ,

and express λ in terms of the discount rate v, t and p x .

(d) How should one interpolate in a corresponding table for A x:u−x| .

Aggregate Mortality

17

(FM1 exam, summer 1983)

Exercise 2.22 For insurances where the policies are issued on aggravated circumstances, one operates with excess mortality. Let µ x be the force of mortality corresponding to the normal mortality. A person is said to have an excess mortality if his

force of mortality is given by

µ0x = (1 + k)µx .

(a) Show that for all positive k, x and t we have

0

t qx

< (1 + k)t qx .

(b) Show that if there exists a constant ∆ so that µ 0x = µx+∆ is valid for all x then

a0x = ax+∆

for all x; in this case the insurance is issued with an increase of age ∆.

(c) Show that the condition in (b) is fulfilled if the mortality satisfies Gompertz’s law,

i. e. there exist constants β and γ so that µ x = β exp(γx) for all x.

(d) Show, oppositely, that if µx is strictly increasing in x and if there for any k ≥ 0

exists a constant ∆k so that

µx+∆k = (1 + k)µx ,

then the mortality satisfies Gompertz’s law.

(SP(43))

18

Exercises in Life Insurance Mathematics

3.

Insurance of a Single Life

FM0 S92, 3

Exercise 3.1 Prove the identities:

äx = 1 + vpx äx+1

1 − n Ex = äx:n| − ax:n|

dax:n|

= (µx + δ)ax:n| + n Ex − 1.

dx

(SP(29))

Exercise 3.2 Let µx be a weakly increasing function of x and assume that µ x → ∞

as x → ∞.

(a) Show that ax → 0 as x → ∞.

(b) Examine if Ax has a finite limit as x tends to infinity.

(SP(31))

Exercise 3.3 Consider an insurance contract issued to an x-year old. At death

within the first n years, the level continuous premium is paid back with interest and

compound interest earned. Rewrite the integral expression for the present value after

t years (t < h) of the future return of premium per unit of the premium in order to

show that this value is

Dx+h

(st| + ax+t:n−t| ) −

s ,

Dx+t h|

where st| is defined by JH. Interpret the expression.

(Eksamen i Forsikringsvidenskab og Statistik, KU, winter 1943-44)

Exercise 3.4 Show that

n Ex

= 1 − iax:n| − (1 + i)A1x:n| ,

and interpret this formula (i is the interest rate).

(Eksamen i Forsikringsvidenskab og Statistik (rev.), winter 1946-47)

Insurance of a Single Life

19

Exercise 3.5 Assume there exist positive constants k and α, so that

x

`x = k(1 − )α

ω

for all x ∈ [0, ω].

(a) Find an expression for µx .

(b) Find an expression for e◦x (see exercise 2.7).

Now assume that α = 1.

(c) Show that

n| qx

is independent of n.

(d) Show that for n = ω − x we have

ax =

n − an|

.

nδ

(SP(30))

Exercise 3.6 Ax:n| denotes the expected present value of a life insurance contract,

where the amount of 1 is to be paid out by the end of the year in which the insured

dies, not later than n years after the time of issue, or if he survives until the age of

x + n. x is the age at entry.

(a) Give an expression for Ax:n| and show that

Ax:n| = 1 − däx:n| ,

where d is the discount rate.

A1x:n| denotes the expected present value of a life insurance where the amount of 1

is paid out by the end of the year, during which he dies if he dies before the age of

x + n. x is the age at entry.

(b) Give an expression for A1x:n| and show that

A1x:n| = 1 − n Ex − däx:n| .

(c) Try to interpret the formulas in (a) and (b).

(SP(33))

Exercise 3.7 Assume that active persons have force of mortality µ ax as a function

of age and force of disability νx as a function of age. Assume moreover that disabled

20

Exercises in Life Insurance Mathematics

persons have force of mortality µix . There is no recovery. The force of interest is

denoted by δ.

The four quantities defined below are the single net premiums an insured with age

at entry x has to pay for a level continuous annuity with sum 1 p. a. The insurance

cancels n years after issue.

aix:n | The single net premium for an insured who is disabled at the time of issue. The

annuity is payable from issue until the time of death of the insured.

aax:n | Single net premium for active persons. The annuity is payable from the time of

issue until death of the insured.

aaa

x:n | As above except that the premium is due for a contract that cancels by death

or by disability of the insured.

aai

x:n | Single net premium for an active. The annuity is payable if the insured is being

disabled within n years from time of issue. Expires if he dies.

a

i

(a) Express aai

x:n| in terms of µx , νx , µx and δ.

aa

i

(b) Assume that µax = µix for all x. Express aai

x:n| in terms of ax:n| and ax:n| .

(c) Assume that µax = µix + ε and νx = ν where ε and ν are independent of x and

aa

i

ε 6= ν. Express aai

x:n| by ax:n| and ax:n| (and ε and ν).

(Aktuarembetseksamen i Oslo (rev.), fall 1953)

Exercise 3.8 Assume the force of mortality is a strictly increasing function of the

age, when this is greater than or equal to a certain x 0 .

Show that for x ≥ x0 and 0 < n ≤ ∞ the following inequalities hold:

ax:n|

∂ax:n|

∂x

<

1 − v n n px

,

µx + δ

< 0,

ax <

1

.

δ

(SP(37))

Insurance of a Single Life

21

Exercise 3.9 The quantity

e◦x:n| =

Z

n

t px dt

0

is the expected period of insurance for a term insurance or an n-year temporary

annuity, age of entry x and age of expiration x + n.

Define

=

ex:n|

ëx:n|

=

n

X

t=1

n−1

X

t px

t px .

t=0

Give a similar interpretation of these identities. Define

at|

=

ät|

=

1 − vt

i

1 − vt

d

and show that for integer values of t the following inequalities are valid:

ax:n|

< aex:n ||

äx:n|

< äëx:n |.

|

(SP(39))

Exercise 3.10 Show that

ax =

Z

∞

t px Ax+t dt.

0

(SP(41))

Exercise 3.11 Assume that µx is a weakly increasing function of x and consider

for given x two insurance contracts with initial age x: First consider a whole-life life

insurance with sum insured 1 and secondly a whole-life continuous annuity with level

payment intensity determined so that the expected present value of the two insurance

contracts are equal. The one with the biggest variance of the present value is naturally

the one with the biggest risk for the company.

Show that there exists an x0 ≥ 0 so the annuity is more risky than the life insurance

iff x > x0 .

22

Exercises in Life Insurance Mathematics

(SP(42))

Exercise 3.12. (Multiplicative Hazard Model) The mortality in a population varies

from person to person; some has greater or lesser mortality than the average. This

can be modelled as follows:

There exists a underlying force of mortality µ x and for each person a constant θ

independent of age exists so that the force of mortality for a person aged x is θµ x .

The value of θ for a randomly chosen person is assumed to be a realisation of a

stochastic variable Θ, and we assume moreover that EΘ = 1.

Show that in this model the expected present value of a continuous temporary n-year

annuity with payment intensity 1 is greater than or equal to

ax:n| =

Z

n

e−δt t px dt,

0

and examine under which conditions the two present values are equal.

(SP(44))

Exercise 3.13 Consider an n-year endowment insurance, sum insured S, age at

entry x and premium paid continuously during the entire period with level intensity

p. Expenses are disregarded.

(a) What is the surplus of this contract for the company in terms of the remaining

life time of the insured?

(b) Find the mean and variance of the surplus.

(c) Explain how p should be determined so that the probalility of getting a negative

surplus is lesser than a certain ε. (Hint: Tchebychev’s inequality.)

(d) Show (by applying the central limit theorem) how it is possible to obtain a probability of a negative surplus for the entire portfolio lesser than ε by using a smaller p

than the one found in (c).

(SP(50))

We have so far worked with continuous insurance benefits - annuities that are due

continuously and life insurances that are due upon death. The pure endowment seems

to be of another origin, because the time of possible single payment is determined in

advance. In the next exercise we will consider more general kinds of non-continuous

or discrete benefits. For at start consider an x-year old whose remaining life time T

Insurance of a Single Life

23

is determined by the survival function

F (t | x) = e−

R∞

0

µx+τ dτ

,

where µx+t is the force of mortality at the age of x + t, t > 0. As usual let v denote

the annual discount rate.

The results of the following exercise will show that continuous benefits can be concidered as limits for discrete benefits. We will also see that both continuous and discrete

annuities and life insurances are closely related to pure endowment benefits.

Exercise 3.14 The present value of a t-year pure endowment with sum 1 is

Cte = v t 1{T >t} .

(a) Find the expectation, t Ex , of Cne and find Cov(Cse , Cte ) for s 6= t.

A brute-forth generalisation of the pure endowment is produced by summing more

benefits like this. A simple variant is the n-year temporary deferred annuity payable

annually with fixed amounts as long as the insured is alive. This is the sum of n pure

endowments with deferment times 1, . . . , n. The present value at time t = 0 is

Cna(1)

=

n

X

Cte .

t=1

If the annuity is payable h times a year with fixed amounts

be

Cna(h) =

hn

X

1

,

h

the present value will

e

Ct/h

.

t=1

a(h)

(b) Find the expectation, a(h)

.

x:n| , and the variance of the present value C n

An n-year temporary life insurance with sum insured 1, payable at the end of the

year of death, has present value

Cnti(1) =

n

X

v t 1{t−1<T ≤t} ,

t=1

and the corresponding insurance payable at the end of the

occurs, has present value

Cnti(h) =

hn

X

t=1

t

v n 1{ t−1

t .

h <T ≤ h }

1

th

h

year, in which death

24

Exercises in Life Insurance Mathematics

(c) Express the present value Cnti(h) in terms of present values of annuities given by

Cna(h) . Compare with similar expressions for continuous benefits.

(h)

(d) Find the expectation, Ax:n| , and the variance of the present value C nti(h) .

(e) Use the results from (b) and (d) to prove the well known formulas

ax:n|

1

Ax:n|

=

=

n

Z

Z0 n

0

t

v F (t | x)dt =

Z

n

t Ex dt

0

v t F (t | x)µx+t dt

= 1 − δax:n| − n Ex ,

for the expectations of Cna and Cnti and also to find their variances. (Hint: By monom

tone convergence we have Cnα(2 ) % Cnα as m → ∞, α ∈ {a, ti}. Then use the

monotone convergence for the expectation).

(f) Use the technique in (e) to find formulas for the expectations and variances of

continuous benefits in the usual Markov model. Consider an annuity, payable with

level intensity of 1 by staying in state j, and an insurance where a sum of 1 is paid

upon every transition j → k.

(RN “Opgave E7” 29.01.90)

Exercise 3.15 The functions that occur in insurance mathematics often depend on

several variables, e. g. m| ax:n| , and are often hard to tabulate. In order to solve this

problem, we introduce the so-called commutation functions. In connection with life

insurances of one life we consider the following:

Cx

Dx

Mx

Nx

Rx

Sx

=

=

=

=

=

=

v x dx

v x `x

Cx

Dx

Mx

Nx

Rx

Sx

Pω

v ξ dξ

Pξ=x

ω

ξ

ξ=x v `ξ

Pω

(ξ − x)v ξ dξ

Pξ=x

ω

ξ

ξ=x (ξ

− x)v `ξ

=

=

=

=

=

=

R x+1 ξ

v ` µ dξ

Rxx+1 ξ ξ ξ

v ` dξ

Rxω ξ ξ

v

` µ dξ

Rxω ξ ξ ξ

v `ξ dξ

Rxω

(ξ

− x)v ξ `ξ µξ dξ

Rxω

ξ

x

(ξ − x)v `ξ dξ.

(a) Show that

m| ax:n|

=

N x+m − N x+m+n

.

Dx

1

(b) Find corresponding expressions for a x:n| , Ax:n| , Ax , Ax:n| , n Ex , ax:n| and äx:n| .

(c) What can we possibly use R x for?

Insurance of a Single Life

25

(SP(35))

26

Exercises in Life Insurance Mathematics

4.

The Net Premium Reserve and Thiele’s Differential Equation

FM0 S91, 1

FM0 S92, 2

FM0 S93, 2

FM0 S94, 2

FM0 S95, 1

Exercise 4.1 Consider an n-year pure endowment, sum insured S, premium payable

continuously during the insurance period with level intensity π. Upon death two

thirds of the premium reserve is being paid out.

(a) Put up Thiele’s differential equation for V t . What are the boundary conditions?

(b) Find an expression for the premium reserve at time t, t ∈ [0, n)

(c) Determine the premium intensity π by adopting the equivalence principle.

(SH and MSC, 1995)

Exercise 4.2 We have the choice of two different premium payment schemes.

• For an insurance of a single life a level continuous premium is due with force

p as long as the insured is alive at the most for n years from the issue of the

contract.

• Every year an annual premium of the size

p(1) = p · a1|

is paid in advance. If the insured dies during the insurance period the return of

premium is

a |

R = p(1) · θ = p · aθ| ,

a1|

where θ denotes the remaining part of the year at time of death.

(a) Show that these two premium payment schemes are equivalent in the manner

that regardless of when the insured is going to die, the present values of the premium

payments under the two schemes are equal.

(b) Find the expected present value of the return of premium at the time of issue.

Let the prospective reserves at time t from the time of issue of the two premium

schemes be denoted by V t and Vt .

The Net Premium Reserve and Thiele’s Differential Equation

(c) Show that for t ≤ n

27

Vt = V t + p · a[t]−t |

where [t] is the integer part of t.

(SP(53))

Exercise 4.3 Consider a linearly increasing n-year term insurance. If the insured

dies at time t after the time of issue where t < n, the amount tS is paid out. If the

insured is alive at time n, the amount nS is paid out at this time. The age of the

insured at entry is x. The net premium determined by the equivalence principle, is

due continuously with level intensity p.

(a) Find an expression for p.

(b) Find a prospective and a retrospective expression for the reserve V t at any time

t, 0 < t < n.

(c) Show that the two expressions found in (b) are equal for all t, 0 ≤ t < n.

(d) Derive Thieles differential equation.

(e) Find the savings premium and the risk premium.

(SP(54))

Exercise 4.4 An n-year insurance contract has been issued to a person (x). The

premium is composed of a single premium π 0 at the beginning of the contract and

by a continuous intensity (πt )t∈(0,n) as long as (x) is alive, at the most for n years.

The benefits are a pure endowment, sum insured S n at time n, a term insurance, sum

insured St at time t ∈ (0, n), and a continuous flow with intensity (s t )t∈(0,n) as long

as (x) is alive during the insurance period.

(a) Put up Thiele’s differential equation.

(b) Find a boundary condition without assuming the equivalence principle.

(c) Find a prospective expression for the premium reserve by solving the differential

equation.

(d) Adopt the equivalence principle and find an alternative boundary condition.

(e) Find, by applying the new boundary condition a retrospective expression for the

premium reserve.

28

Exercises in Life Insurance Mathematics

Now assume that the benefits moreover consist of a pure endowment, sum insured S

at time m (0 < m < n).

(f) Has this altered Thiele’s differential equation?

(g) Which extra boundary condition are now to be added in order to solve the differential equation?

Assume that π0 = 0, πt = π for t ∈ (0, m) and that π is determined by the equivalence

principle.

(h) Find the net premium.

(i) Find the premium reserve at any time.

(SH “Opgave til 14/10-94” (rev.))

Exercise 4.5. (Prospective Widow Pension in Discrete Time) Consider a policy

with widow pension, insurance period n years, issued to a man aged x and his wife

aged y. During the insurance period the premium Π falls due annually in advance

as long as both are alive. If the man dies, the benefit is a widow pension of sum 1

paid out on every following anniversary of the policy during the insurance period if

the widow is still alive. All expenses are disregarded.

(a) Put up an expression for the premium reserve for this policy at its tth anniversary.

(b) Show how the premium reserve at any time t can be expressed in terms of the

reserve at time t + 1 for t = 0, 1, . . . , n − 1 so that the premium reserves can be

calculated recursively.

(c) Define the savings premium and the risk premium and find an interpretable expression for the latter.

(FM1 exam, summer 1977)

Exercise 4.6 Consider an n-year term insurance, sum insured S, age at entry x.

Continuous premium during the entire period with level intensity p determined by

the equivalence principle.

(a) Find Thieles differential equation for the premium reserve V t .

(b) Which initial conditions would be natural to use for t = 0 and t = n − respectively?

(c) Solve the differential equation with each of the initial conditions and compare the

solutions.

The Net Premium Reserve and Thiele’s Differential Equation

29

(SP(55))

Exercise 4.7 If the insured dies before time n (from the time of issue) the benefit is

a continuous annuity with force 1, duration m from the time of death. If he is alive

at time n, the benefit is a similar annuity from this time and if he is still alive at time

n + m he receives a whole-life annuity with intensity 1. There is a single net premium

at the time of issue and the equivalence principle is adopted.

(a) Find the single net premium.

(b) Find the prospective premium reserve at any time.

(c) Derive Thieles differential equation.

Let Rc denote the risk sum at time t.

(d) Prove that

Rt =

m

(1 − v )ax+t:n−t| − n+m−t| ax+t

−n+m−t| ax+t

−a

x+t

(t < n)

(n ≤ t < n + m)

(n + m ≤ t).

In particular we have

and since

R0 = (1 − v m )ax:n| − n+m| ax ,

lim R0 = (1 − v m ax ) > 0,

n→∞

we have R0 > 0 if only n is big enough. Assume that R 0 > 0. Because Rt is a strictly

increasing continuous function on [0, n] and R n < 0, there exists a unique τ ∈ (0, n)

so that Rτ = 0.

(e) Show that this τ is determined by

N x+τ = N x+n +

N x+n+m

.

1 − vm

(SP(56))

Exercise 4.8 Consider a pension insurance contract, where the benefit is an n-year

annuity of 1 deferred m years (expected present value m|n ax ). Premium is paid with

level intensity c during the deferment period (expected present value ca x:m| ).

(a) What is the equivalence premium c and the development of the reserve when

x = 30, m = 30, n = 20 and the technical basis is G82M, i. e. i = 0.045 and µ x =

0.0005 + 10−4.12+0.038x .

30

Exercises in Life Insurance Mathematics

(b) Do similar calculations as in (a) for an extended contract where k times the

premium reserve is being paid out by possible death during the deferment period,

k = 0.5, k = 1.

(RN “Opgave til FM0” 15.10.93)

Exercise 4.9 Consider a single-life status (x) with force of mortality µ x . Define the

premium reserve by Vt = E(U[t,∞) | T > t) as usual.

(a) Show that the premium reserve always is right continuous.

(b) Discuss under which conditions it is left continuous.

Consider the following benefits at time t

• st dt1{T >t} , annuities

• St 1{T ∈dt} , life insurances

• Bt 1{T >t} , pure endowment,

and show that if the premium is being paid with level intensity π and there isno lump

sum at time t then Vt is left continuous.

(c) If there is a lump sum at time t, what does V t − Vt− look like?

NB: Assume that µx+t , st , St are continuous, and assume that there only exist a finite

number of t’s where Bt 6= 0.

(SH “Opgave til 13/10-95”)

Exercise 4.10 Consider an insurance of a single life, age at entry x. At time t

(t = 0, 1, 2, . . .) the premium Pt is being paid if the insured is still alive, and if he dies

during [t − 1, t) then St is the benefit. The equivalence principle is adopted for the

insurance and all expenses are disregarded. Let the premium reserve at time t be V t

and let the stochastic variable Gt be given by

Gt =

0

V + P − vS

t

t

t+1

V + P − vV

t

t

t+1

(the insured is dead at time t− )

(the insured dies during the interval [t, t + 1))

(the insured is alive at time t + 1).

Let the stochastic variable Y be the present value at time 0 of the company’s surplus

of the insurance.

The Net Premium Reserve and Thiele’s Differential Equation

(a) Interpret Gt and show that

Y =

∞

X

31

v t Gt .

t=0

(b) Show that

VarY =

∞

X

Var(v t Gt ).

t=0

G1 , G2 , . . . are not necessarily stochastically independent, but note that (b) is valid

regardless of whether G0 , G1 , . . . are stochastically independent or not.

(c) Show that Hattendorf’s Formula

VarY =

∞

X

t=0

t px v

2t+2

px+t qx+t (St+1 − Vt+1 )2

is valid.

(SP(58))

Exercise 4.11 In this exercise we are to study an endowment insurance with return

of premium paid at death before expiration. Consider a person of age x who wishes

to buy an insurance with age of expiration x + n, and where the premium is paid

continuously with level intensity p as long as he is alive during the insurance period.

The lump sum S = 1 is paid if he is alive at age x + n and if he dies before that

the premium paid so far will be returned with interest (basic interest i) earned. We

disregard expenses.

(a) Show that the variable payment at death is given by

Bt = pat| (1 + i)t .

(b) Determine the continuous premium intensity p.

(c) Find the net premium reserve Vt at time t, t ∈ [0, n).

(d) Put up Thiele’s differential equation and determine the risk sum.

(e) Comment on the results and evaluate whether or not you will recommend the

insurance company to issue this kind of insurance.

(FM1 exam, summer 1985)

32

Exercises in Life Insurance Mathematics

Exercise 4.12 An n-year deferred whole-life annuity on the longest lasting life has

been issued to two persons (x) and (y). Annual amount of 1 and level continuous

premium on the longest lasting life with intensity π during the deferment period. The

forces of mortality are denoted by µ x and νy

Put up a retrospective expression for the net reserve at time t assuming that both

are alive.

(Eksamen i Forsikringsvidenskab og Statistik (rev.), winter 1944-45)

Exercise 4.13 A family annuity is an insurance contract of one life that assures

payment of a continuous annual annuity from the possible death of the insured during

the insurance period until the expiration of the contract after n years. Force of

mortality µx , interest rate i, age at entry x.

(a) Put up the formulas for the net premium reserves, prospectively and retrospectively, with level continuous premium payment π. Show that if the insured does not

die during the insurance period the reserve will at least once become negative.

(b) Discuss how the total premium reserve of this contract for a portfolio of identical

contract issued at the same time will develop during the insurance period. Show that

this reserve never becomes negative.

(The students of 1946 had 10 hours to complete this exercise!)

(Aktuarembetseksamen (rev.), Oslo fall 1946)

Exercise 4.14 During construction of a technical basis with mortality of death and

mortality of survival it is a problem that the premium for an insurance can depend

on whether the insurance stands alone or it is combined with other insurances.

This exercise describes the attempts made under construction of G82 in order to solve

this problem of additivity.

Consider an insurance

Ax:n| + s · n| ax

issued against a single premium.

Thiele’s differential equation for the net premium reserve is

∂Vx (t)

=

∂t

(

δVx (t) − µ̃x+t (1 − Vx (t)) (0 < t < n)

δVx (t) − s + µ̃x+t Vx (t)

(n < t)

(4.1)

The Net Premium Reserve and Thiele’s Differential Equation

33

where µ̃x+t is the actual expected force of mortality. Introduce the first order forces

of mortality µ and µ̂ which satisfy

µx+t < µ̃x+t < µ̂x+t ,

and replace (4.1) by

∂Vx (t)

=

∂t

(

(δ + µx+t )Vx (t) − µ̂x+t (0 < t < n)

(δ + µx+t )Vx (t) − s

(n < t).

(4.2)

Thus we get a smaller increase of the reserve and we get a technical basis “on the safe

side”.

(a) Determine the single premium on the first order technical basis by solving (4.2).

Consider the special case

µ̂x = (µx + g2 )(1 + g1 ),

and let

µ∗x = µx + g2

and

δ ∗ = δ − g2 .

(b) What will the single premium be in this case? Comment on the result.

Now consider an educational endowment a x|n| .

(c) Put up the differential equations (4.1) and (4.2) and solve (4.2) for the special

case above. What is the problem in this case?

Finally consider a survival annuity a x|y .

(d) Answer the same question as in (c).

(SP(99))

34

Exercises in Life Insurance Mathematics

5.

Expenses

Exercise 5.1 Work out the details in RN in the case where α 00 = β 00 = γ 00 = 0.

(RN(1) “Expenses, gross premiums and reserves” 12.10.90 rev. 13.03.93)

Exercise 5.2 Express Vtg and cg in terms of Vtn and cn and α0 in the case where

α00 = β 00 = γ 00 = γ 000 = 0.

(RN(2) “Expenses, gross premiums and reserves” 12.10.90 rev. 13.03.93)

Exercise 5.3 Treat the case of a level annuity payable upon death in (m, n) against

level premiums in (0, m).

(RN(3) “Expenses, gross premiums and reserves” 12.10.90 rev. 13.03.93)

Exercise 5.4 Consider an n-year deferred whole-life annuity, age at entry x, payable

with level continuous intensity S. Level gross continuous premium intensity p payable

during the deferment period. The premium is determined by the equivalence principle. For now assume that the expenses are initial expenses αS, loading for collection

fees due continuously with level intensity βp and administration costs also due continuously with level intensity γS.

(a) Find p and the prospective gross premium reserve V tg .

Because of inflation, loading for collection fees and administration expenses are paid

with intensities βf (t)p and γf (t)S at time t.

(b) Put up exspressions for p and Vtg .

(b) Find p and Vtg when f (t) = 1 + kt and where f (t) = exp(ct).

(SP(62))

Exercise 5.5 Consider a whole-life life insurance, sum insured 1, age at entry x,

single net premium B.

(a) Show that the expected effective interest rate for the insured is

Z

∞

0

1

B − t t px µx+t dt − 1.

Expenses

35

Assume that the company has some initial expenses α, but no other expenses.

(b) What is the expected effective interest rate?

(SP(60))

Exercise 5.6 A simple capital insurance, sum insured S, duration n, pays out S at

time n from the time of issue no matter if the insured is alive or not.

(a) Put up an expression for the net payment for this insurance and explain why it is

independent of the age at entry.

A simple capital insurance only makes sense if it is not paid by a single payment (when

dealing with insurance). Assume that the premium is paid continuously during the

entire insurance period with level intensity p, but only if the insured is alive. The

premium is determined by the equivalence principle.

(b) What will the net premium be?

In the gross premium p, initial expenses αS are included as well as loading for collection fees βp and administration expenses γS paid continuously.

(c) Determine p.

(d) Put up an expression for the prospective gross premium reserve, both when the

insured is alive as well as when he is dead.

(SP(61))

The following exercise examines what happens to the insurance technical quantities

when we bring surrender into consideration.

Exercise 5.7 Consider an n-year endowment insurance, age of entry x, benefits are

S1 if one dies during the insurance period and S 2 if one obtains the age of x + n.

Life conditioned equivalence premium is paid continuously until time n (from the age

of entry). Moreover assume that surrender can take place at any time during the

premium payment period, and that the present value of the conventionally calculated

gross premium reserve, liquidated by surrender, is positive. By surrender at time t

the company pays out G(t).

(a) Now disregard all expenses and assume that G(t) is lesser than or equal to the

conventionally calculated (net) premium reserve at time t. Instead of using a conventional technique, the company could itself bring surrender into consideration and

36

Exercises in Life Insurance Mathematics

into its own technical basis. Show that the equivalence principle then would lead to a

premium P 0 ≤ P . Discuss conditions for P 0 = P and give a lower limit for how small

P 0 can get when G(·) varies. Here and in the following it might be useful to study

Thiele’s differential equation.

Now assume that some administration costs are not neglectible. The expenses consist

of the amount α in initial expenses, of γ in administration costs per time unit and

of a fraction β of the actual annual gross premium P in loading for collection fees, P

calculated conventionally. Upon surrender 100θ% of the gross premium reserve is paid

out if the reserve is positive, 0 ≤ θ ≤ 1. By surrender where the gross premium reserve

is positive, a fixed percentage of the reserve is deducted to cover the loss experienced

by surrender where the gross premium reserve is negative. For now disregard expenses

that fall upon surrender. This gross premium reserve is calculated without respect to

surrender.

(b) Show that you will get a lesser gross premium reserve if you bring surrender

into consideration. Assume that θ is chosen so that the equivalence principle can be

applied anyway.

(c) Now assume that in the above situation a constant expense ξ is associated with

the actual payment of G(t). If G(t) calculated in (b) is smaller than ξ, nothing is paid

out by surrender. When the value upon surrender mentioned exceeds ξ the difference

is paid out. Show that the actual gross premium reserve still will be lesser than the

conventional when surrender is brought into consideration. Can θ still be determined

so that the equivalence premium still can be applied?

(FM1 exam (rev.), summer 1979)

Exercise 5.8 It has been proposed that the administration expenses should be calculated as being proportional to the gross premium reserve instead of being proportional

to the sum insured. Now consider an n-year endowment insurance, level continuous

gross premium intensity p, sum insured S, age at entry x. Acquisition expenses αS.

Loading for collection fees βp and γV t at time t, respectively. Vt denotes the gross

premium reserve. Administration costs fall due continuously with level intensity γV t

at time t.

(a) Put up Thiele’s differential equation for V t .

(b) Solve the differential equation with initial conditions for t = 0 and t = n − and

show that the solutions can be expressed by expected present values for annuities

with another interest rate than the interest rate of the technical basis.

(c) Determine the equivalence premium.

Expenses

37

In G82 the interest rate is i = 5% p. a. but gross premiums and gross reserves are

calculated with an interest rate of 4.5% p. a.

(d) What is the corresponding value of γ?

(SP(64))

Exercise 5.9. (Equipment Insurance) By an equipment insurance, sum insured S,

insurance period n, the sum S is paid out at time n if the insured is still alive; if he

dies during the insurance period, the company returns the up till now paid premiums

without interest earned. The level gross premium intensity p is payable during the

entire insurance period. The expenses are initial expenses αS, loading for collection

fees due with continuous level intensity βp and continuous administration costs due

with level intensity γS.

Put up an expression for p applying the equivalence principle.

(SP(66))

Exercise 5.10. (Child’s Insurance) A person aged x has been issued a child’s

insurance: If the insured dies during [x, y) the gross premium is paid back with

earned interest according to the technical basis. If he dies during [y, u) the sum S is

immediately paid out and if he is alive at age u, then S is paid out. The level gross

premium p, the administration costs γS and loading for collection fees βp fall due

continuously during the insurance period. Acquisition expenses are αS.

(a) Put up Thiele’s differential equation for this insurance.

(b) Find the prospective gross premium reserve at any time during the insurance

period.

(c) What is the gross (equivalence) premium intensity, and what is the risk sum at

any time with this premium.

(SP(68))

Exercise 5.11 Consider an n-year endowment insurance, sum insured S, age at

issue x, premium payable until time m, initial expenses αS, administration costs and

loading for collection fees due during the entire insurance period continuously with

level intensities γS and βpg respsctively, where pg is the level gross premium intensity.

Assume that m ≤ n and γ < δ.

(a) Give an expression for pg applying the equivalence principle and prove that it can

38

Exercises in Life Insurance Mathematics

be cast as

pg =

Ax:n| + γ̃ax:n|

(1 − β̃)ax:m|

S.

(b) Show that β̃ > β and γ̃ > γ.

The numerator of the expression is the so-called passive with added sum, because it

is produced from the net passive Ax:n| increased by the present value of γ̃ during the

S

entire insurance period. This passive is denoted by A x:n| .

Let Vt be the net premium reserve at time t (calculated from the time of issue) and

let Vt1 be Vt increased by the reserve of the future administration costs.

(c) Give expressions for Vt and Vt1 .

The company ought to set aside the reserve V t1 but normally the reserve

S

Vt2 = SAx+t:n−1| − (1 − β̃)pg ax+t:m−t|

is set aside.

(d) Compare Vt , Vt1 and Vt2 and try to explain why one prefers to set aside V t2 instead

of Vt1 .

If the insured wishes to surrender his contract at time t, the company pays him the

surrender value of the contract Gt , which is the reserve Vt1 less the part of the initial

expenses that have not yet been amortized.

(e) Show that the surrender value can be cast as

Gt = S(Ax+t:n−t| + γax+t:n−t| ) − (1 − β)pg ax+t:m−t| .

g

The coefficient for S is the surrender value passive and is denoted by A x:n| .

(f) Find an expression for the difference between the net premium reserve and the

surrender value and prove that for m = n it is α(S − V t ).

If the insured wishes to cancel the payment of premiums without entirely to surrender

the contract, it is called a premium free policy. The size of this policy is determined by

letting the surrender value of the new policy equal the surrender value of the original

policy at the time of change.

(g) Give an expression for the sum of the premium free policy and show that its

reserve at the time of change is lesser than the reserve of the original policy.

Expenses

39

Assume that the annual gross premium is given by

p̈g = εpg ,

where ε is called the continuity factor.

(h) Explain why the surrender value and the reserve can be cast as

g

SAx+t:n−t| − ζ p̈g ax+t:m−t|

and

S

SAx+t:n−t| − η p̈g ax+t:m−t| ,

respectively.

(SP(70 rev.))

Exercise 5.12 A married man considers a life insurance on the following conditions:

(i) If he dies before time r from time of issue of the contract, the company has to pay

a continuous pension with level intensity s in a period of time m.

He furthermore considers a supplementary pension, also with level intensity s which is

due to initiate right after the expiration of the pension (i). He considers two options:

(ii) The supplementary pension is due as long as his wife lives.

(iii) The supplementary pension is due as long as his wife lives, at the most until time

n from the time of issue, n > m + r.

As a second alternative he considers a survival annuity, also with payment intensity

s. Here he considers two options:

(iv) The annuity initiates if the man dies before time r from the time of issue and is

due as long as his wife lives.

(v) The annuity initiates if the man dies before time r from the time of issue and is

due as long as his wife lives, at the most until time n from the time of issue, n > r.

(a) Put up an expression for the single net premium for these five contracts.

Assume that the above contracts are issued against an annual premium payment paid

in advance as long as the man and his wife are alive, at the most until time r from

the time of issue. If one of the two dies during the insurance period, the amount

(aθ| /a1| )P is being returned (in Danish: Ristorno), where θ is the remaining part of

the last premium payment period and P is the term premium.

40

Exercises in Life Insurance Mathematics

(b) How would you calculate the annual net premiums?

(c) Put up an expression for the net premium reserve at any time during the insurance

period for the last insurance (v) applying the recently described premium payment

principles.

When calculating the gross premiums, the company uses the following expense rates:

Initial expenses αS, loading for collection fees β times the gross premium, administration costs due continuously with intensityand γ times the gross premium reserve

at any time, and finally payment costs of ε times the amount paid out.

(d) Find the continuous gross premium intensity, applying the equivalence principle.

(e) Find the gross premium when the premium payment takes place as described

before (b).

(SP(76) rev.)

Select Mortality

41

6.

Select Mortality

Exercise 6.1

(a) What could be the meaning of the symbol

(b) Put up an expression for

period of selection is 5 years.

2|6 q[30]+2

s|t q[x]+u ?

in terms of ` under the assumption that the

(c) Express the following three quantities with one symbol:

• The probability that a person now 50 years old who got insured 3 years ago dies

between the ages of 58 and 59, presuming the period of selection is 5 years,

• the probability that a new born dies between 67 and 72 years of age,

• the number of deaths between the ages of 29 and 30 in the third year of an

insurance portfolio, presuming the period af selection now is 3 years.

(SP(25))

Exercise 6.2 In this exercise we will try to explain the presence of select mortality

for a portfolio of insured and study its properties.

For two functions f and g we shall use the obvious notation

f g(t) = f (t)g(t), (f + g)(t) = f (t) + g(t).

The portfolio is assumed to be divided between the two states active and disabled

according to the figure below where the course of events is modelled by a Markov

process {Xt }t≥0 , and t is the age of the insured.

σ(t)

1. Active

K

KKK o

KK

/

ρ(t)

µ(t)K

KKK

KK%

2. Disabled

sss

sss

ν(t)

ss

s

s

ys

s

3. Dead

The transition probabilities of the model are denoted by

pij (s, t) = P (Xt = j | Xs = i), s ≤ t, i, j = 1, 2, 3

42

Exercises in Life Insurance Mathematics

and the intensities µij (t) are assumed to exist and are given by

µij (t) = lim

h&0

pij (t, t + h)

, i 6= j.

h

We assume that the intensities are continuous functions. Define

µ(t) = µ13 (t), ν(t) = µ23 (t), σ(t) = µ12 (t), ρ(t) = µ21 (t)

and

µ1 (t) = µ(t) + σ(t), µ2 (t) = ρ(t) + ν(t).

We take it that

µ(t) < ν(t), ∀t ≥ 0,

i. e. the mortality for a disabled is always greater than for an active person.

When we cannot observe whether an insured is active or disabled at any time after

entry (as an active), one gets a filtration (of the above Markov model) which is

determined by the force of mortality for a random insured. Let µ̃(τ, x) denote this

intensity for an insured of age x with age of entry τ, τ ≤ x.

(a) Explain that µ̃ is given by

p12

p11

(τ, x) + ν(x)

(τ, x)

p11 + p12

p11 + p12

p12

= µ(x) + {ν(x) − µ(x)}

(τ, x)

p11 + p12

µ̃(τ, x) = µ(x)

and thus give the grounds for the presence of select mortality.

We obviously want τ → µ̃(τ, x) to be decreasing for fixed x which will be shown by

differentiation in the following.

(b) Explain that τ → µ̃(τ, x) is decreasing iff the fraction τ → (p 12 /p11 )(τ, x) is

decreasing and give an interpretation of this.

(c) Show that

d

dτ

σ(τ )(p12 p21 − p11 p22 )(τ, x)

p12

(τ, x) =

p11

p211 (τ, x)

and

d

(p12 p21 − p11 p22 )(τ, x) = {µ1 (τ ) + µ2 (τ )}(p12 p21 − p11 p22 )(τ, x),

dτ

and explain why τ → µ̃(τ, x) is decreasing.

Let p̂ij (s, t) denote the transition probabilities corresponding to the model without

recovery, i. e. ρ(t) = 0, ∀t ≥ 0.

Select Mortality

43

(d) Find expressions for p̂11 (τ, x) and p̂12 (τ, x) as a function of the intensities and

show that

p12

p̂12

(τ, x) <

(τ, x).

p11

p̂11

Give an interpretation of this and explain how µ̃ is affected by changing to the model

without recovery.

It is a common opinion that the selection the insured goes through at entry disappears

after a period of time, called the period of selection. We will try to explain this

phenomenon mathematically. Lad τ0 be the age of entry for an insured.

(e) Show that

x → exp

Z

x

τ0

µ1 (s)ds p11 (τ0 , x), x ≥ τ0

is an increasing function. Assume that µ 2 (t) ≥ µ1 (t), ∀t ≥ 0 and that there exists a

w > τ0 so that

Z

w

τ0

Show that

(µ2 (t) − µ1 (t))dt = ∞.

d

lim

x%w dτ

monotonically with

p12

p11

(τ0 , x) = 0

d p12

(τ0 , x) = 0, ∀x ≥ w,

dτ p11

and explain why this verifies the presence of a period of selection of w.

(FM1 exam, 1989-ordning, opgave 1, summer 1995)

Exercise 6.3 Mortality in a portfolio of insured lives will usually be different from

the mortality of the general population because the insured lives are a selected part

of the population. We will in this exercise study one relationship that is assumed to

contribute a great deal to the effect of selection, i. e. the fact that people with illnesses that cause severe excess mortality are not allowed to underwrite life insurances

(under the usual terms). In the following such persons will be called “ill”. Thus the

population can be divided according to the figure below.

ρx

/ 1. Insured, not ill

QQQ

QQQ κ

nnn

κx nnnn

QQQx

n

QQQ

n

QQQ

nnn

(

vnnn

σx

4. DeadhP

PPP

mm6

m

P

m

PPPλx

λx mmm

PPP

mmm

m

PPP

m

m

P m

m

0. Not insured, not ill

σx

3. Not insured, ill

2. Insured, ill

44

Exercises in Life Insurance Mathematics

Now assume that every person enters state “0” at birth and that the transitions

between the states afterwards go on as a time continuous Markov chain with transition

intensities only dependent on the age x as indicated in the figure. Excess mortality

for the ill persons means that

λx ≥ κx , x > 0,

(6.1)

with “>” for some values of x.

With the usual notation for the transition probabilities the following are satisfied

p11 (x − t, x) = e

p12 (x − t, x) =

−

Z

e

p02 (0, x) =

p03 (0, x) =

Z

Rx

0

Rx

0

x

e

0

0

x

(σu +κu )du

−

x−t

−

Z

x−t

x

p00 (0, x) = e−

p01 (0, x) = e

Rx

Rz

x−t

,

(σu +κu )du

(σu +κu +ρu )du

(σu +κu )du

−

e−

Rz

0

Rz

0

(6.2)

σz e−

Rx

z

λu du

dz, 0 < t < x;

,

(1 − e

(σu +κu )du

(6.3)

(6.4)

−

Rx

0

(1 − e

(σu +κu +ρu )du

ρu du

−

Rz

σz e−

0

ρu du

Rx

z

),

(6.5)

)σz e

λu du

−

Rx

z

λu du

dz, 0 < x.

dz,

(6.6)

(6.7)

(a) Prove the formulas (6.2) and (6.3) by putting up and solving differential equations.

(b) Assume that (6.4) is given. Give direct, informal grounds for the expressions (6.5)

– (6.7).

The insured lives are either in state “1” or in state “2” (those in state “2” received

the insurance contract before they were struck by illness). The insurance company

does not observe in which of the two states the insured is. All the company knows is

the time of entry and age. Let µ[x−t]+t denote the force of mortality for an insured of

age x who received the insurance t years ago.

(c) Derive an expression for µ[x−t]+t . Show that under the condition (6.1), µ [x−t]+t is

a non-decreasing function of t for constant x (it might be desirable to express µ [x−t]+t

as a weighted average of κx and λx ). How will you explain this result to a person who

has no knowledge of actuarial science?

(d) Discuss the formula for µ[x−t]+t to find theoretical explanations as to why insurance

companies operate with a period of selection s so that the mortality is considered to

be aggregate for t > s.

Let µx denote the force of mortality for a randomly chosen person of age x in the

population (that is, we do not observe in which of the states “0” – “3” the person is).

Select Mortality

45

(e) Find an expression for µx . Show that under the condition (6.1) the inequality

µx ≥ µ[x−t]+t , 0 < t < x

is satisfied. The result clarifies the preliminary remarks of this exercise. Try to give an

explanation that is comprehensible for a person without any knowledge of actuarial

mathematics.

(FM1 exam (1), winter 1985/86)

46

Exercises in Life Insurance Mathematics

7.

Markov Chains in Life Insurance

FM0 S94, 1

Exercise 7.1 Consider a model for competing risks with k + 1 states, 0: “alive” and

1, . . . , k denoting death from k different reasons; denote the partial probabilities of

death by

Z

(j)

t qx

t

= 1 − exp −

0

µ0j

,

x+τ dτ

and define

(j)

t px

= 1 − t qx(j) .

(a) Prove that

00

t px

=

k

Y

(j)

t px .

j=1

(b) Prove that

k

X

0j

t px

=

j=1

k

X

(j)

t qx

j=1

+

−

X

X

(i) (j)

t qx t qx

1≤i<j≤k

(h) (i) (j)

t qx t qx t qx

1≤h<i<j≤k

− · · · + (−1)k+1 t qx(1) · · · t qx(k) .

Now assume that for given j there exist constants c and t 0 > 0 so that

(j) 0j

t px µx+t

= c,

for all t ∈ [0, t0 ].

(c) Prove that for all t ∈ [0, t0 ]

(j)

t qx

=

0j

t px

=

t

· t q (j)

t0 0 x

Z t

1

πh6=j τ px (h) dτ.

· t qx(j)

t

0

(SP(83))

Exercise 7.2. (Life Insurance with Exemption from Payment of Premium by Disability) In this exercise we will consider a policy that can attend one of N states

Markov Chains in Life Insurance

47

enumerated 1, . . . , N . The development of the policy is being described by a Markov

process with transition intensities µ jk

t for transition from state j to state k at time t

from issue.

In the contract it is stated that the amount B tjk is payable upon transition from state

j to state k at time t. As long as the policy stays in state j, a continuous payment

with intensity Btj is due, i. e. in the time interval [t, t + ∆t) the amount B tj ∆t + o(∆t)

is paid out. Assume that all amounts B tjk are non-negative and that the force of

interest δ is independent of time. For now we disregard administration expenses.

(a) There are no assumptions regarding the sign of B tj . How should negative values

of Btj be interpreted?

Let Vtj denote the premium reserve in state j at time t. It is defined as the expected

present value of the out payments in the time interval [t, ∞) discounted back until

time t, given that the policy is in state j at time t.

(b) Show that the premium reserve satisfies the differential equation system

−Btj =

X jk jk

d j

µt (Bt + Vtk − Vtj ), j = 1, . . . , N.

Vt − δVtj +

dt

k6=j

(c) Interpret this differential equation system intuitively in terms of savings premium

and risk premium.

A special case of the this general Markov model is the disability model. This model

has three states, 1, 2 and 3, corresponding to active, disabled and dead. The insured’s

age at entry is x and the intensities are denoted by

µ12

= σx+t (from active to disabled),

t

µ21

= ρx+t (recovery),

y

µ13

= µx+t (dead as active),

y

µ23

= νx+t (dead as disabled).

t

All other transition intensities are 0.

Apply this model for an investigation of an endowment insurance with exemption

from payment of premiums by disability. Assume the insured is active at entry. The

insurance period is n, so the insurance cancels when the insured has reached the age

of x + n or if he dies before that.

In question (d) it is assumed that the equivalence premium is paid continuously with

level intensity π as long as the insured is active and that a constant sum insured S

48

Exercises in Life Insurance Mathematics

is payable upon the expiration of the policy; hence, with the notation from above we

have

Bt1 = −π, Bt2 = 0, Bt13 = Bt23 = S.

(d) Come up with formulas for π, Vt1 and Vt2 for 0 ≤ t < n in terms of the transition

probabilities and transition intensities in the model and the discounting rate v, by

direct prospective reasoning.

If the premium and the benefits depend on the reserves, the premium and the premium

reserve cannot be determined directly as in (d); instead the differential equation

system from (b) must be solved with appropriate boundary conditions. Now it is

assumed that the premium and the payment of benefit at age x + n are due as above,

but upon death of the insured before time x + n, the premium reserve of the policy is

paid out as a supplement to the sum insured; B tj3 = S +Vtj for j = 1, 2 and 0 < t < n.

(e) Show that the differential equation system from (b) gives the grounds for a differential equation of first order in V t1 − Vt2 . What is the initial condition? Solve the

differential equation.

(f) What are π, Vt1 and Vt2 for 0 ≤ t < n.

(g) Show that if νx+t ≥ µx+t for all t < n then Vt2 > Vt1 for all t < n. Interpret this

result.

Assume that we have the following expenses: Initial expenses due at time 0 with

an amount of αS, loading for collection fees βp, where p is the level gross premium

intensity and administration costs due with an intensity at time t equal to γV tj if the

policy is in state j.

(h) Explain, without performing any detailed calculations, what changes would follow

from these assumptions in the theory discussed in (e) – (g).

(FM1 exam , summer 1984)

Exercise 7.3 An active person aged x considers a disability annuity, which falls due

continuously with level intensity b upon disability before the age of x + n. Premium is

payable at rate π as long as the person is active during the contract period. Assume

that the state of the policy is S(t) at time t after the time of issue where {S(t)} t≥0 is

a time continuous Markov model with state space and transitions as follows

Markov Chains in Life Insurance

0. Active

K

49

σ(x+t)

KKK

KK

µ(x+t)

K

KKK

KK%

/ 1. Disabled

ttt

ttt

ν(x+t)

tt

t

t

yt

t

2. Dead

(a) Give, without any proof, expressions for the transition probabilities

pjk (s, t) = P (S(t) = k | S(s) = j), 0 ≤ s ≤ t, j, k ∈ {0, 1, 2}.

(7.1)

The present value at time s of benefits less premiums in [s, n] can be cast as

C(s) =

Z

n

s

v t−s (b1{S(t)=1} − π1{S(t)=0} )dt,

where 1A is the indicator function for the event A.

(b) Find, for 0 ≤ s ≤ n and j = 0, 1, 2, the conditional expection

Vj (s) = E(C(s) | S(s) = j)

(7.2)

Zj = Var(C(s) | S(s) = j)

(7.3)

and the conditional variance

as expressions of integrals of functions of the transition probabilities from (7.1).

(c) Find EC(s) and VarC(s) in terms of the transition probabilities (7.1) above and

the functions (7.2) and (7.3).

(d) Now assume that the equivalence principle is being adopted, i. e. V 0 (0) = 0, where

π is the net premium intensity and Vj (s) in (7.2) above is the net premium reserve in

state j at time s. Does the net reserve ever become negative?

(FM1 exam opgave 1, summer 1989)

Exercise 7.4 The figure below illustrates an expansion of the model discussed in

exercise 7.3. There are two states of disability i 1 and i2 representing two degrees of

disability. Assume that ν2 (x+t) ≥ ν1 (x+t). Let {S̃}t≥0 be the corresponding Markov

chain and define the stochastic process {S(t)} t≥0 by S(t) = S̃(t) for S̃(t) ∈ {a, d} and

S(t) = i for S̃(t) ∈ {i1 , i2 }. If one does not know the degree of disability, {S(t)} is

the observable process.

50

Exercises in Life Insurance Mathematics

i1 .

rr8

r

r

rr

σ1 (x+t)

r

rrr

r

r

r

/

σ2 (x+t)

a. LL

i2 .

LLL

rr

r

ν1 (x+t)

LL

r

rr

µ(x+t)

ν2 (x+t)

LLL

r

r

LLL

r

& xrrr

d.

The transition intensities for the S(t)-process are

µjk (t, {S(s)}s<t ) = lim

dt&0

P (S(t + dt) = k | S(t) = j, {S(s)}s<t )

dt

for j 6= k and any specification of {S(s)} s<t .

(a) Prove that

µai (t, {S(s)}s<t ) = σ1 (x + t) + σ2 (x + t)

and

µad (t, {S(s)}s<t ) = µ(x + t)

(both independent of {S(s)}s<t ) and