Pricing according to cost

advertisement

Pricing according to cost

Cost-based pricing

Cost of a service = value of economic means used in order to

provide the service: Cost is a relative notion!

Tariffs must cover some notion of cost related to service

provisioning

Cost definition: different incentives

Replacement of equipment, introduction of new

technologies, encourage or deter entry, invest in sunk

costs

We investigate

Theoretical aspects of cost-sharing

Cost-based pricing in practice

2

Theories of cost-sharing

Prices based on cost

N = { 1,2,...,n} = set of

= stand-alone cost of subset T ⊆ N

services

Economies of scale, scope:

The service provider must share the total cost of the

services amongst the customers in a fair manner

è prices based on costs

Stable under competition

No incentives for bypass and self-production

Solutions of bargaining games

Not unique!!

4

Subsidy-free prices

The firm sells services in quantities xi ,i = 1,…,n

The charges ri = pi xi are subsidy free if they satisfy:

The stand-alone cost test

∑px

i i

≤ c(A), ∀A ⊆ N

i∈A

The incremental cost test

∑p x

i

i

≥ c(N) − c(N \ A), ∀A ⊆ N

i∈A

If these are violated, a new entrant can attract customers

Imply

∑p x

i

i

= c(N)

i∈N

The corresponding prices are subsidy free

5

Subsidy-free charge example

A1 x1 = 2

A2 x2 = 1

A12 = 10

In order to be subsidy-free, the revenues from product A1

and product A2 must satisfy

2 ≤ r1 (A1 x1 ) ≤ 12, 1 ≤ r2 (A2 x2 ) ≤ 11, r1 (A1 x1 ) + r2 (A2 x2 ) = 13

A possible set of charges are (6, 7)

6

7

8

Support prices

= cost of producing quantities

is a support price for

at

if it satisfies:

Price are subsidy-free for all sub-quantities of x

Note that these imply economies of scale,

Consumers have no incentives for bypass

We also need D( p) = x

9

Sustainable Prices

Potential competition:

incumbent sets prices

to cover costs, competitor (E)

tries to take part of the incumbent’s market by posting

prices

which are lower for at least one service

We say

are sustainable prices if there is no

and

s.t.

for some i, and

Necessary conditions for sustainable prices

1. must operate with zero profits

2. must produce at minimum cost

3. prices for all subsets of output must be subsidy free

10

Axiomatic cost sharing: Shapley value

Cost is to be fairly shared amongst customers.

Charging algorithm: function φ (N) = (φ1 (N),..., φ n (N))

dividing c(N), N ⊆ {1,…,n}

Problem: find

that no customer can have a valid

argument against

If φ j (N) − φ j (N − {i}) > 0 then customer is paying

more than he would if customer were not being served

He might argue this is unfair, unless customer

can

argue that he’s just as disadvantaged because of :

φ i (N) − φ i (N − { j}) = φ j (N) − φ j (N − {i})

Same reasoning if customer

benefits from customer

φ j (N) − φ j (N − {i}) < 0

Unique φ : charge average incremental cost

11

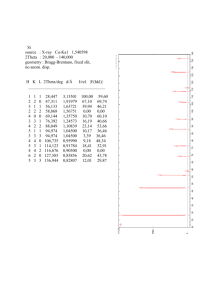

Sharing the Cost of a Runway

Three airplanes share a runway, require 1,2 and 3 km to

land. Cost = 1$/km.

Problem: How to share the cost?

Adds cost

Order

1

2

3

1,2,3

1

1

1

1,3,2

1

0

2

2,1,3

0

2

1

2,3,1

0

2

1

3,1,2

0

0

3

3,2,1

0

0

3

avg

2/6

5/6

11/6

12

Pricing in Practice

The key principles for pricing

In practice, we can identify some key principles

Cost causation: service cost should be closely related

to the cost of the factors consumed by the service

Objectivity: the cost of the service should be related to

the right cost factors in an objective way

Transparency: the relation of the cost of the service to

the cost factors should be clear and analytical

Danger of leaving the biggest part of the cost, i.e., the

common cost, unrecovered

14

Historic and current costs

Historic cost: the actual amount paid to purchase the

various factors (equipment, etc)

Top-down models, such as FDC, use the historic

costs found in the accounting records

Current cost: the equipment cost if it were bought today

Bottom-up models are naturally combined with

current costs (the network model is built from scratch)

The use of historic or current costs provides very

different incentives to network service providers

Examples: access service and interconnection prices

15

Types of cost from accounting

Direct cost: the part of the cost attributed solely to the

particular service, ceases to exist if service is not produced

Indirect cost: other cost related to the service provision

Indirectly attributable cost: arises from the provision of

a group of services and there is a logical way to specify the

percentage of the cost that is related to the provision of

each service

Un-attributable cost: cannot be divided straightforwardly

amongst the services, -> common cost

16

Definitions related to the cost function

Variable cost (VC): cost of those factors whose

quantities depend on the amount of the service produced

marginal

cost (MC)

variable

cost

Fixed cost (FC): the sum of all factor costs that remain

constant when the quantity of the service changes

1

1

Fixed

cost

total volume

17

Incremental cost concepts

Short-Run Incremental Cost (SRIC): cost of providing a

variable amount of the service in the short run assuming

that all other services are provided at the same levels (=VC)

Long-Run Incremental Cost (LRIC): cost difference of not

providing the given service assuming that the facility provides

the other services at the same levels as before but can reoptimize its operation (in the long-run), forward looking

includes the direct fixed cost of the service

LRIC(A) ≈

VC B

VC A

FC A

FC B

FCC AB

VC C

FC C

true fixed common cost

VC A

SRIC(A)

VC A

FC A

Note: cost(S-A) ≤ cost(S) – (VC(A)+FC(A))

hence LRIC(A) = cost(S)-cost(S-A) ≥ VC(A)+FC(A)

18

Stand-alone cost

Stand-alone cost (SAC): The cost of building a facility

from scratch that provides the single service at the given

quantity

higher because no economies of scale and scope

lower because optimized to offer this service

LRIC, SAC need bottom-up models to be correctly

estimated

VC A

VC B

VC A

FC A

SAC(A) ≈

VC C

FC B

FCC AB

FC C

FCC(A,B,C)

FC A

FCC(A,B)

FCC(A,B,C)

In practice we use top-down models

19

Pricing in practice

In practice, we lack a function that can tell us the cost of

producing or not any given bundle of services. All we

know is the current cost of various factors involved in

production

Common cost cannot be directly attributed to any

particular service, so far as the accounting records show.

Only a small part of the total cost concerns factors that

can be are uniquely related to a single service

This is a major problem when trying to construct

cost-related prices

direct costs

C

B

indirect common cost

from accounting records

A

VC B

VC A

FC A

FC B

FCC AB

VC C

FC C

true fixed common cost

20

Methodologies for constructing prices

The Fully Distributed Cost (FDC) approach: make each

service pay for part of the (historic) common cost

Problem: ad-hoc division of the common cost ! since

the common cost is large, prices can be ``cooked’’

LRIC (or IC) (Subsidy-free prices): construct prices by

calculating the long-run incremental cost of a service in

a network designed to be forward looking

Hard to compute the true long run incremental cost IC

Needs bottom-up models of the network, current costs,

modern equivalent assets

Problem: The sum of the incremental costs of the

services leaves some common cost unaccounted for

21

Methodologies for constructing prices (2)

LRIC+ : add common cost (or the cost that is not covered)

to the LRIC prices in a proportional fashion

Reasonable approximation of subsidy-free prices since

LRIC(A) ≤ LRIC+(A) ≤ SAC(A)

Problem: prices not necessarily truly subsidy-free

according to theory since we don’t analyze each

possible subset of services

Better approximation than FDC since incremental cost is

better approximated than just direct cost

Uses current costs instead of historic, bottom-up models,

approximates prices in a competitive market

22

The Fully Distributed Cost approach

FDC divides the total cost that the firm incurs amongst

the services that it sells

All the cost of factors that are not uniquely identified with

a single service go to a common cost pool (directly

attributable costs)

Next, one defines a way to split the common cost among

the services

23

Evaluation of FDC

§

Advantages:

§

Covers total cost, easy to compute (top-down model) and audit,

practical, covers past investments, transparency.

§

Disadvantages:

§

There is no reason that the prices constructed are in any sense

optimal (competitive) or have any stability property. They hide

potential inefficiencies of the network such as excess capacity,

out-of-date equipment, bad routing, inefficient operation and

resource allocation.

§

Here is where the refinement of the activity model helps. The

definition of activities helps to link a larger part of the common

cost to particular services, so improves the subsidy-free

properties of the resulting pricing scheme

24

The LRIC, LRIC+ approach

Two services A, B

LRAIC: Long-run average incremental cost

A : average variable cost if variable cost not linear

Costs are computed per unit of the service using a

bottom up model

var. cost A

fixed cost A

var. cost B

fixed cost B

common cost A,B

LRIC(A) + LRIC(B) < total cost

LRIC+(A) + LRIC+(B) = total cost

LRIC(A) = FC(A) + VC(A)

LRIC+(A) = LRIC(A) + CC(A,B) x LRIC(A)/(LRIC(A)+LRIC(B)

25

Evaluation of LRIC+

Prices promote the correct economic signals to the

network operator for improving efficiency

Approximate better a competitive market

But need bottom-up models which are harder to

implement

Don’t necessarily cover the actual cost of the network

26

Ordering of the various cost definitions

Which cost definition to use for regulation?

In a competitive market MC, IC make more sense

Low prices (LRIC) in wholesale of the incumbent help

competitors

High prices in retail (FDC) promote entry by competitors

MC

Low

LRIC

LRIC+

LRIC+

FDC

LRIC+

SAC

High

27

Practical approximations

How do we compute fixed costs, variable costs, etc?

Easier to use top-down models than bottom-up: use the

existing cost accounting records of the firm

Usually directly attributable cost is a very small percentage

of the total cost

Need better understanding of the operation of the firm

and the causation of costs to allocate indirect costs

=> the activity based model helps in “constructing” the

cost function and answering questions about the

incremental cost of a service, the fixed costs associated

with subsets of services, etc.

Allows in practice an approximation for the LRIC of

services (within ≈15% of the bottom up calculations)

28

Activity-Based Costing approach

Activity-Based Costing (ABC) approach defines

intermediate activities that contribute to the production

of end products

Each activity cost can be computed from accounting

information about the amounts of input factors that are

consumed by each activity

Þ A large part of the common cost is attributed to the

activities and so be subtracted from common cost

Refinement of the FDC approach: By reducing the

unaccounted-for common cost, it reduces the

inaccuracy that stems from the ad-hoc cost splitting

Useful for LRIC+ approximations since it allows the

calculation of the incremental and fixed costs

29

Activity-Based Costs (I)

Bottom level: the input factors

consumed by the net operator,

such as labor, power, cost of

infrastructure and bandwidth

Activity level: processes that

must run in order for the network

to operate and produce services.

An activity has a well-defined

purpose, such as the maintenance

of certain equipment, the network

management, the links’ operation

Next level defines the allocation of

the activity costs to the network

elements such as routers, links

Service level: Services such as

calls, IP connectivity

30

Activity-Based Costs (II)

Hides inefficiencies of the network provider (e.g. if a

network element is underutilized)

No incentive for the provider to improve his efficiency

unless he were only allowed to recover the cost of a

network element in proportion to its actual utilization

Activity-based pricing is not really suitable for

determining the long run incremental cost of a service

If a service is not produced, the facility can be

reorganized to provide the remaining services at a

lesser cost (long-run IC)

Nevertheless it provides some lower approximation

31

Εφαρµογή ABC, LRIC+ σε δίκτυα

Επιµέρους υπηρεσίες δικτύου

Α

Β

...........

N

Κοινό εντός του Δικτύου κόστος

(ISFC- Increment Specific

Fixed Cost)

Συνεργασία µε

Σάνδρα Κοέν

Επιµέρους υπηρεσίες πρόσβασης

a

...........

b

n

Κοινό εντός της Πρόσβασης

κόστος (ISFC- Increment

Specific Fixed Cost)

Κοινό κόστος µεταξύ πρόσβασης και Δικτύου

(FCC – Fixed Common Cost)

Η κάθε υπηρεσία είναι ένα Increment

To Δίκτυο και η Πρόσβαση είναι ευρύτερα increments

Μεταξύ των υπηρεσιών του δικτύου υπάρχουν κοινά κόστη

Μεταξύ των υπηρεσιών της πρόσβασης υπάρχουν κοινά κόστη

Μεταξύ των Increments του δικτύου και της πρόσβασης υπάρχουν κοινά κόστη

32

Εφαρµογή ABC, LRIC+ σε δίκτυα

LRIC+ υπηρεσίας

Incremental cost (σταθ. + µετβλ.) υπηρεσίας (IC) +

Αναλογία κοινού εντός του σχετικού increment

κόστους (ISFC) +

Αναλογία κοινού µεταξύ των Increments κόστους

(FCC)

ICΝι

...........

Κοινό εντός του Δικτύου κόστος

(ISFCΝ)

...........

Κοινό εντός της Πρόσβασης

κόστος (ISFCΑ)

Κοινό κόστος µεταξύ πρόσβασης και Δικτύου

(FCC)

33

Εφαρµογή ABC, LRIC+ σε δίκτυα

Αναλογία κοινού εντός του increment κόστους (ISFC)

ICNi

ISFCNi =

ISFCnetwork

∑ ICNj

n

ICΝι

...........

Κοινό εντός του Δικτύου κόστος

(ISFCΝ)

...........

Κοινό εντός της Πρόσβασης

κόστος (ISFCΑ)

Κοινό κόστος µεταξύ πρόσβασης και Δικτύου

(FCC)

34

Εφαρµογή ABC, LRIC+ σε δίκτυα

Αναλογίου κοινού µεταξύ των Increments κόστους (FCC)

FCCNi =

ICΝι

∑

n

ICNi + ISFCNi

FCC

ICNj + ISFCN + ∑ ICAj + ISFCA

...........

Κοινό εντός του Δικτύου κόστος

(ISFCN)

n

...........

Κοινό εντός της Πρόσβασης

κόστος (ISFCA)

Κοινό κόστος µεταξύ πρόσβασης και Δικτύου

(FCC)

35

Εφαρµογή ABC, LRIC+ σε δίκτυα

Σταθερό + µεταβλητό κόστος υπηρεσίας (IC)

Αναλογία κοινού εντός του increment κόστους (ISFC)

Αναλογίου κοινού µεταξύ των Increments κόστους (FCC)

ICΝι

...........

Κοινό εντός του Δικτύου κόστος

(ISFCΝ)

...........

Κοινό εντός της Πρόσβασης κόστος

(ISFCΑ)

Κοινό κόστος µεταξύ πρόσβασης και Δικτύου

(FCC)

LRICNi+ = ICNi + ISFCNi + FCCNi

36

An application (1)

A factory produces souvenirs from wood and bronze

The only factors directly attributed to the souvenirs

production are the amounts of wood and bronze and

Common cost: Other factors used in producing

souvenirs, such as the labor and electricity

A single accounting record for each, no info on how to

attribute these costs to the souvenirs production

Problem: How to define the cost of each product?

37

An application (2)

FDC: We must find a way to split the common cost

This approach can give prices that are far from being

subsidy-free

For instance, suppose we take

Þ The bronze souvenirs cost that must be recovered is

that is probably greater

than the stand-alone cost for producing the same

quantity

38

An application (3)

Incremental cost approach: computes the difference of

the cost of the facility that produces both types from the

cost of the facility that produces a single type

Problems:

accounting records hold only the actual cost

and

must be evaluated

is greater than

hence inaccurate

computation of

39

Two solutions

1. Bottom-up approach: Construct

and

from

scratch, by building models of fictitious facilities that

specialize in the production of a given product

2. Top-down approach: starts from the given cost structure

and tries to allocate the cost to the various products but

attempt to reduce the unaccounted-for common costs

How? Refine the accounting information, by keeping

more information on how common cost is generated

Use the activity-based model

40

More on activity based costing and

FDC

The FDC approach revisited

Formally, suppose service is produced in quantity and

has a variable cost

that is directly attributable to

that service. There is a shared cost

that is attributable to all services. The price for the quantity

of service is defined to be its cost, i.e.,

The price per unit is defined as

The s

may be chosen in various ways: as proportions of

revenue, variable costs, quantities supplied, or revenue,

i.e., proportional to

or

Clearly, once the coefficients

are defined, then the

construction of the prices is rather trivial and can be done

automatically using accounting data

42

FDC example (I)

Consider, as above, a facility that produces wooden and

bronze souvenirs, with the cost function

c(y w , y b ) = s f x f + sl (x 0l + α w y w + α b y b ) + swθ w y w +sb θ b y b ,

where

is the per unit cost of the fixed factor , is the per

unit cost of the labor factor,

are the per unit costs of

wood and bronze respectively,

the fixed amount of labor

that is consumed independently of the production,

and

are coefficients that relate the levels of production of the

artifacts to the amount of consumed labor that is directly

attributed to the production, and and relate these levels

of production to the amount of raw materials consumed

ü Note that

are fixed costs, whereas

is the variable part of the cost

43

FDC Example (II)

Consider first the case of simple FDC pricing without

activity definitions and no explicit accounting info on

how labor effort is spent

In this case

the

common cost is the remaining part

and the FDC prices are of the form

[

pw (y w ) = s θ w y w + γ w s x + s ( x + α w y w + α b y b )

w

f

[

f

l

l

0

] (1)

]

pb (y b ) = sbθ b y b + (1 − γ w ) s f x f + sl ( x 0l + α w y w + α b y b ) (2)

44

FDC Example (III)

Now suppose two activities defined, related to the

production of the artifacts. In each activity, there is exact

accounting of the labor effort required for the production

of each artifact Now

and the common cost is reduced to

The resulting FDC prices are

(3)

(4)

45

Observations (I)

The prices in the simple FDC approach less accurately

relate prices to actual costs

Suppose,

i.e., wooden artifacts are

extremely easy to construct and the greater part of labor

effort is spent on bronze artifacts. Let there be equal

sharing of the common cost, so

Þ Then the price of wooden artifacts in (1) subsidizes the

production of bronze artifacts as it pays for a substantial

part of the labor for making them

ü This cross-subsidization disappears in (3)

46

Observations (II)

Suppose that the facility is built inefficiently and that the

amount of building space is larger than would be required if

new technologies were used

This fact is hidden in both (1) and (3). However, if one

develops a bottom-up model for the facility, the

corresponding factor in this model will be less, say

This will reduce the corresponding prices in (3)

Thus with the activity-based approach one can trace the

reason for the price discrepancy between the top-down

and the bottom-up model, as being due to the second

term, and hence one can trace the inefficiency in the

existing system

47

Observations (III)

Consider the price of wooden artifacts. The variable part

of the price in (3) is a better approximation of the longrun incremental cost of producing the amount

of

wooden artifacts than the variable part in (1)

The reason that it may not be equal to the long-run

incremental cost is that if only one artifact is produced,

then the common cost could be reduced (perhaps a

smaller facility is needed, or one secretary will suffice

rather than two). Unfortunately this reduction can’t be

extracted from the accounting data

One must construct a `virtual' model of the facility

specialized in constructing only bronze artifacts, to

subtract the corresponding total production costs

This again shows the weakness of the top-down

48

models that are the basis of FDC pricing