Defining Your Real Risk

advertisement

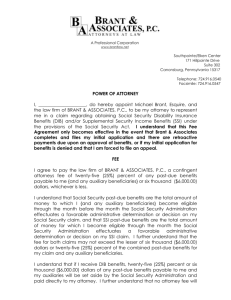

Brant’s Market View Keith McMeekin April 2008 Defining Your Real Risk One of the most common questions I am asked by potential clients is: “How can I reduce my financial risk?” To which I must always ask: “How are you defining risk? Is your real risk the degree to which your portfolio changes in value over the short term or, is your risk the possibility of not meeting your long term investment objectives? I submit that not having enough money for your retirement is a much greater risk than having your portfolio produce negative returns in any one year. Investors should focus on attaining superior long term results rather than avoiding short term price volatility. The chart below1 compares the returns generated over the past 10 years by three conventional2 funds and two non-conventional or “aggressive” funds managed in my opinion by two of the best managers in Canada. The two non-conventional funds are ones I have bought for my clients; the three conventional funds I choose at random from globefund.com3. My definition of a conventional fund is one in which the manager more or less mimics the index, thus having performance and volatility more or less in line with the index, while on the other hand these non-conventional funds are managed by individuals who develop their own ideas and act accordingly. 1 2 3 All calculations made to produce this graph are solely those of Brant Securities Limited. The categorization of the funds as to aggressive or conservative is solely that of Brant Securities Limited. The Globe and Mail website dedicated to mutual funds. 1 of 3 Brant Securites Ltd. www.brantsec.com Aggressive/Conservative Fund Comparison $200,000 $180,000 $160,000 $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $- AGG - 1 AGG - 2 CON - 1 CON - 2 CON - 3 1998 2000 2002 2004 2006 Over the ten-year period ending December 31, 2007, the aggressive funds have outperformed the more conservative funds by factors of 6:1 and almost 8:1. Even if either of the aggressive funds had a decline of 50% next year, each would still be far ahead of the three conventional funds. Most investment management firms try to focus you on the year-over-year volatility, or short-term risk, facing your portfolio. On the contrary, your main concern should your portfolio’s long-term risk of not having the amount of money you planned on having in it at the time you planned on having it! If you are happy with market returns then you should buy an index fund and pay one-half of one percent and not the 2.5% charged by traditional funds. As the man says on television: “Save your money!” 2 of 3 Brant Securites Ltd. www.brantsec.com If on the other hand you want to pay the same fees you are presently paying, for the services of two of the best managers in Canada, then do something about it and act! Please excuse me for being blunt but, you – not the managers you hire – are ultimately responsible for the returns you achieve on your investments. The information contained herein may not be reproduced, quoted, published, displayed or transmitted without the prior written consent of Brant Securities Limited (‘Brant’). The opinions expressed are solely those of the author(s). They are based on information obtained from sources believed to be reliable, but it is not guaranteed as being accurate. The report should not be regarded by recipients as a substitute for the exercise of their own judgment. Any opinion expressed in this report is subject to change without notice and Brant is not under any obligation to update or keep current the information contained herein. Brant employees and their clients may or may not have positions in any of the companies mentioned in this report. Brant accepts no liability whatsoever for any loss or damage of any kind arising out of the use of any or all of this report. 3 of 3 Brant Securites Ltd. www.brantsec.com