BIR-CHART

advertisement

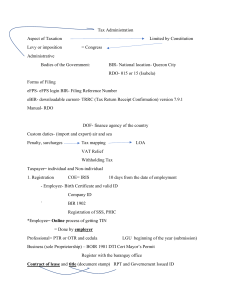

BUREAU OF INTERNAL REVENUE (BIR) Malita Davao del Sur ORGANIZATIONAL CHART EFREN M. SIMPRON, JR. Revenue Collection Officer BIR Malita – Head ANN LYNNETTE C. SARIPA Administrative Assistant II BIR Staff/ Clerk ANALIZA C. MARQUEZ Job Order BIR Staff/ Encoder DUTIES AND FUNCTIONS 1. EFREN M. SIMPRON, JR. manage the business establishments with its registration, invoicing & bookkeeping requirements assess internal revenue taxes do tax collection & issuance of corresponding tax receipts do tax remittances in authorized agent banks do tax mapping activities (inspection of business establishments in the entire municipality) preparation of monthly report of tax collection inventory of monthly tax collections & delinquencies signs all vouchers and pertinent documents relative to office record apprehend the taxpayers with no documents on registration, invoicing & bookkeeping requirements and license to operate its business 2. ANN LYNNETTE C. SARIPA assist business establishments with its registration, invoicing & bookkeeping requirements assist tax collection & issuance of corresponding tax receipts. assist in tax mapping activities (inspection of business establishments in the entire municipality) assist in the preparation of monthly report of tax collection assist in the inventory of monthly tax collections & delinquencies records management assist in preparation of office forms & all other office functions that maybe assigned from time to time voucher processor 3. ANALIZA C. MARQUEZ encode tax collection on cash receipts record assist in preparation of monthly reports of tax collection assist in tax mapping activities assist in preparation of office forms & all other office functions that maybe assigned from time to time encode voucher and any pertinent documents relative to office record SCHEDULE OF PAYMENT: TAXES DOCUMENTARY STAMP TAX WITHHOLDING TAX VALUE ADDED TAX: MONTHLY QUARTERLY PERCENTAGE TAX INCOME TAX: 1ST QUARTER 2nd QUARTER 3rd QUARTER ANNUAL ANNUAL REGISTRATION FEE REGISTRATION OF BOOKS OF ACCOUNTS DUE DATE every 5th day of the following month every 10th day of the following month BIR FORM NO. 2000 1600/1601E/1601C every 20th day of the following month every 25th day of the following month every 20th day of the following month 2550M 2550Q 2551M 15th day of April 15th day of August 15th day of November 15th day of April 31st day of January 1701Q 1701Q 1701Q 1700/1701/1702 0605 29th day of December PENALTIES FOR LATE FILING OF TAXES: SURCHARGE: 25 % INTEREST: 20% PER ANNUM COMPROMISE PENALTY: Exceeds xxx 500.00 1,000.00 2,000.00 5,000.00 7,500.00 10,000.00 15,000.00 2,000.00 30,000.00 50,000.00 100,000.00 500,000.00 1,000,000.00 But Does Not Exceed 500.00 1,000.00 2,000.00 5,000.00 7,500.00 10,000.00 15,000.00 20,000.00 30,000.00 50,000.00 100,000.00 500,000.00 1,000,000.00 xxx Compromise Is 200.00 400.00 700.00 1,000.00 1,500.00 2,000.00 3,000.00 4,000.00 6,000.00 8,500.00 12,000.00 16,000.00 20,000.00 25,000.00 “YOUR TAXES IS THE LIFEBLOOD OF LGU-MALITA” BUREAU OF INTERNAL REVENUE (BIR) Malita Davao del Sur The powers and duties of the Bureau of Internal Revenue shall comprehend the assessment and collection of all national internal revenue taxes, fees, and charges and the enforcement of all forfeitures, penalties, and fines connected therewith including the execution of judgments in all cases decided in its favor by the Court of Tax Appeals and the ordinary courts. It shall also give effect to and administer the supervisory and police power conferred to it by the national internal revenue code of the Philippines or other laws. MISSION The BIR raise revenues for the government through effective and efficient collection of taxes, quality service to taxpayers, and impartial and uniform enforcement of tax laws. VISION Taxpayers is satisfied with BIR services An agency that is taxpayer-focused, efficient and transparent An organization that is stream-lined, productive and has fiscal and administrative flexibility A workforce that is professional, competent, morally upright and motivated A model of good governance in the public sector GUIDING PRINCIPLE “Service Excellence With Integrity and Professionalism” VALUES God-fearing Consistency Competency Innovativeness Accountability Synergy Respect Fairness Transparency