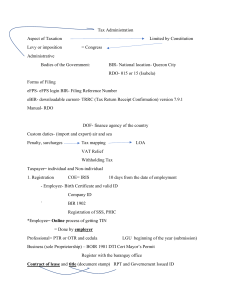

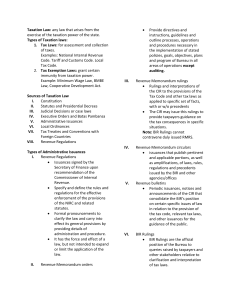

LESSON OBJECTIVES: To have an idea about the Bureau of Internal Revenue or BIR To have an idea of the acronyms commonly used in the BIR To know the purpose of the various regulations issued by the BIR THE BIR WHAT IS THE BUREAU OF INTERNAL REVENUE? BIR The government agency in charge of tax collection is known as the BIR or Bureau of Internal Revenue. The BIR is under the Department of Finance (DOF) and is headed by the Commissioner of Internal Revenue. The Commissioner is appointed by the President of the Philippines. The Commissioner for the past Aquino administration was Kim Henares while currently holding the position is Caesar Dulay under the Duterte administration. rst Filipino S as the Chief rved POSADAS ner except D when C y due to poor revenue B ector of Taft venue nBIR was he last A gs adopted through ) rofile orcement H ons of taxableG nce and tions, ees) and e- ues (CAATTs) were hensive lities easing tly hanresigned from F E DERS s) prescribe ivities, the L s, plans and K ept auditing. Os) ictly with the ecifically, the s and/or respons of authority, staf perfromances. J I ssed transfers the rofit s indirect. ing the The ness. P MENT. O of tax. be paid for the essen ofaid. the object. It ing and the r purchase. y law N M