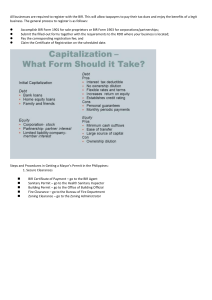

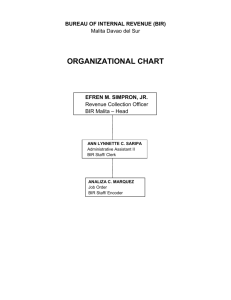

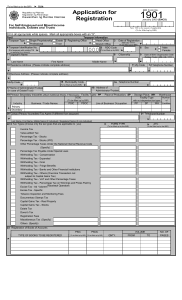

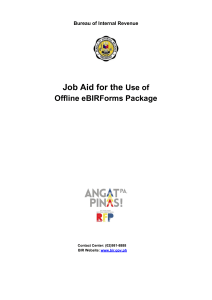

Tax Administration Aspect of Taxation Levy or imposition Limited by Constitution = Congress Administrative Bodies of the Government: BIR- National location- Quezon City RDO- 015 or 15 (Isabela) Forms of Filing eFPS- eFPS login BIR- Filing Reference Number eBIR- downloadable current- TRRC (Tax Return Receipt Confirmation) version 7.9.1 Manual- RDO DOF- finance agency of the country Custom duties- (import and export) air and sea Penalty, surcharges Tax mapping LOA VAT Relief Withholding Tax Taxpayer= individual and Non-individual 1. Registration COE= IRIS 10 days from the date of employment - Employee- Birth Certificate and valid ID Company ID ` BIR 1902 Registration of SSS, PHIC *Employee= Online process of getting TIN = Done by employer Professional= PTR or OTR and cedula LGU beginning of the year (submission) Business (sole Proprietorship) – BOIR 1901 DTI Cert Mayor’s Permit Register with the barangay office Contract of lease and title (document stamp) RPT and Governement Issued ID Payment for 0605 Registration period- on or before commencement of business DTI registereddate of registration (w/in 30 days) ✓ BIR Forms= 1901-1905 RDO- Location of Business Permanent address if professional ✓ BIR Form 0605- 500 registration fee (renewed every year on or before January 31) ✓ BIR Form 2000-OT- Doc stamp on the lease (every 5th of the following month beginning on the contract) ✓ Document stamp for the COR Validity of Receipt- 5 years payment ✓ BIR 1906- authority to print receipt Services (OR) Trading (SI and DR;CR) Income Tax- Quarterly and annual - 1700- Individual 1701 and 1701A 1702 earning purely compensation income Employer = withholding tax = 1601C monthly = consolidation1604C- annually SAWT Sched 1 = Taxable = 2316 -- Employee Sched 2 = MWE Receiving with BIR= employee February 28 REGISTRATION Books of Accounts = Journal, ledger, CR, CD Sales Journal and PL Renewal- January 15 (BIR 1905)- looseleaf books Manual books- pag naubos- January 15 (before the end of the year)