CHAPTER 2

FINANCIAL STATEMENTS AND ACCOUNTING

TRANSACTIONS

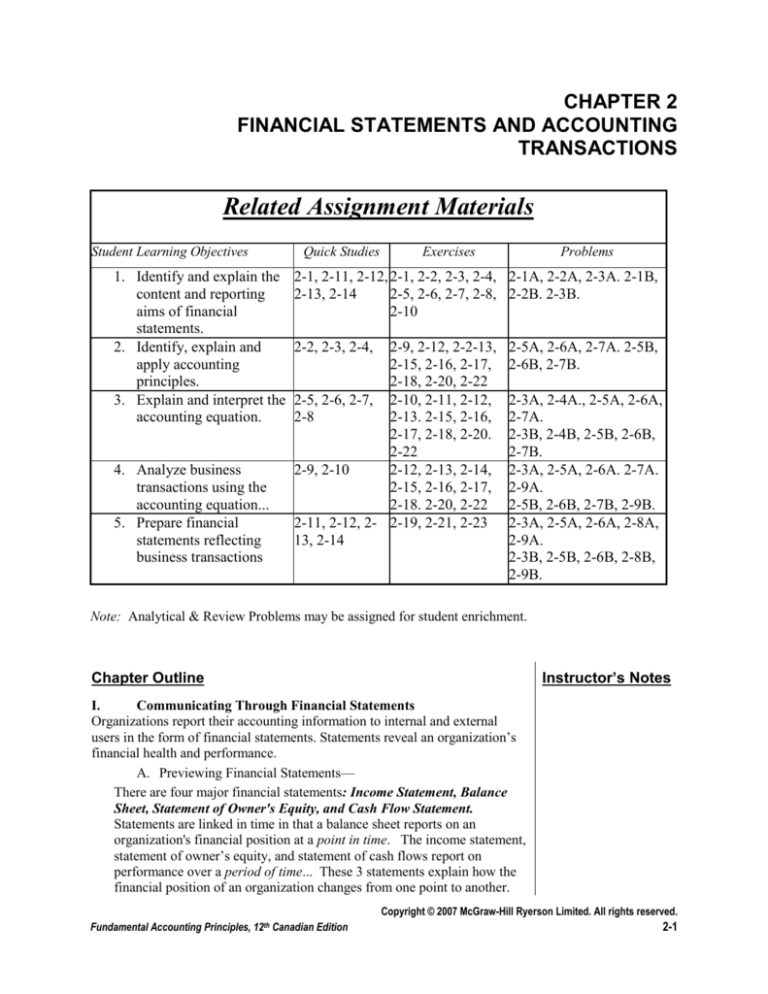

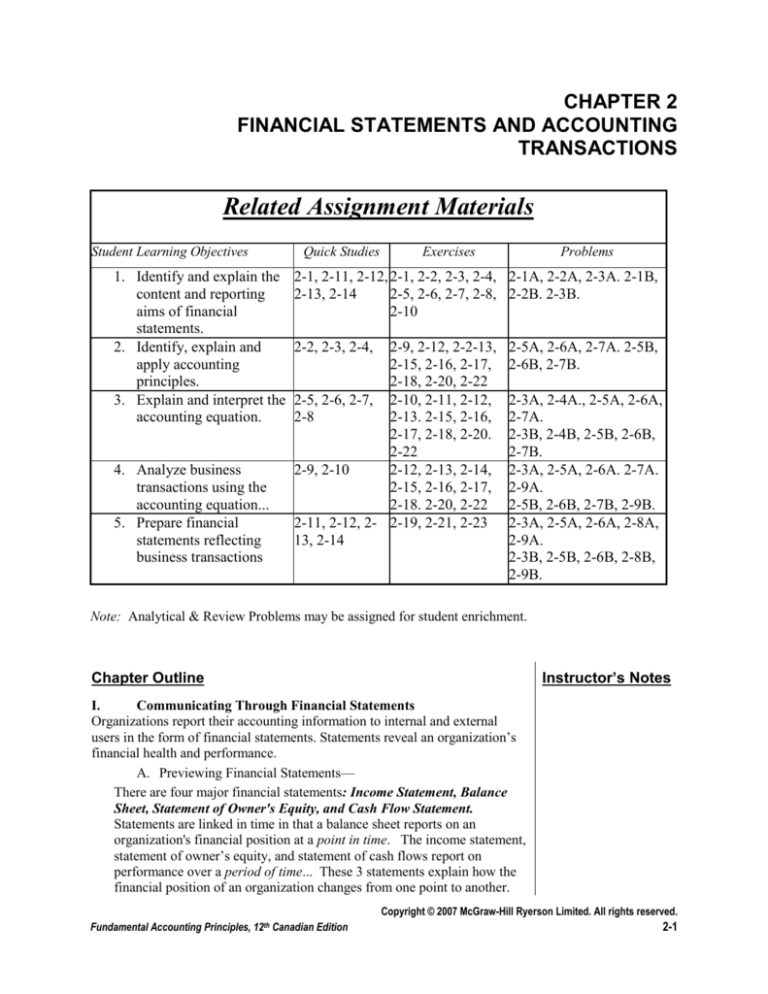

Related Assignment Materials

Student Learning Objectives

1. Identify and explain the

content and reporting

aims of financial

statements.

2. Identify, explain and

apply accounting

principles.

3. Explain and interpret the

accounting equation.

4. Analyze business

transactions using the

accounting equation...

5. Prepare financial

statements reflecting

business transactions

Quick Studies

Exercises

Problems

2-1, 2-11, 2-12, 2-1, 2-2, 2-3, 2-4, 2-1A, 2-2A, 2-3A. 2-1B,

2-13, 2-14

2-5, 2-6, 2-7, 2-8, 2-2B. 2-3B.

2-10

2-2, 2-3, 2-4,

2-9, 2-12, 2-2-13,

2-15, 2-16, 2-17,

2-18, 2-20, 2-22

2-5, 2-6, 2-7, 2-10, 2-11, 2-12,

2-8

2-13. 2-15, 2-16,

2-17, 2-18, 2-20.

2-22

2-9, 2-10

2-12, 2-13, 2-14,

2-15, 2-16, 2-17,

2-18. 2-20, 2-22

2-11, 2-12, 2- 2-19, 2-21, 2-23

13, 2-14

2-5A, 2-6A, 2-7A. 2-5B,

2-6B, 2-7B.

2-3A, 2-4A., 2-5A, 2-6A,

2-7A.

2-3B, 2-4B, 2-5B, 2-6B,

2-7B.

2-3A, 2-5A, 2-6A. 2-7A.

2-9A.

2-5B, 2-6B, 2-7B, 2-9B.

2-3A, 2-5A, 2-6A, 2-8A,

2-9A.

2-3B, 2-5B, 2-6B, 2-8B,

2-9B.

Note: Analytical & Review Problems may be assigned for student enrichment.

Instructor’s Notes

Chapter Outline

I.

Communicating Through Financial Statements

Organizations report their accounting information to internal and external

users in the form of financial statements. Statements reveal an organization’s

financial health and performance.

A. Previewing Financial Statements—

There are four major financial statements: Income Statement, Balance

Sheet, Statement of Owner's Equity, and Cash Flow Statement.

Statements are linked in time in that a balance sheet reports on an

organization's financial position at a point in time. The income statement,

statement of owner’s equity, and statement of cash flows report on

performance over a period of time... These 3 statements explain how the

financial position of an organization changes from one point to another.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

Fundamental Accounting Principles, 12th Canadian Edition

2-1

Instructor’s Notes

Chapter Outline

1. The income statement reports revenues earned and

expenses incurred by a business during a given period Net

income results when revenues are greater than expenses. Net

loss occurs when expenses are greater than revenues for a

period.

Revenues—value of assets exchanged for products or services

provided to customers.

Expenses—costs incurred or the using up of assets from

generating revenue..

II.

2. The statement owner's equity shows the beginning and

ending balances of owner's equity for a period, and the items

that caused the net change, including: Owner’s equity

represents how much of the assets belong to the owner.

Increases due to investments by the owner and/or net income.

Decreases due to withdrawals by the owner and/or a net loss.

3. The balance sheet reports the financial position of the

business at a point in time, usually at the end of a month or a

year.

Assets—properties or economic resources owned by the

business. Common characteristic is the ability to provide

probable future economic benefits to the business.

Liabilities—debts or obligations of a business or claims

against assets. A common characteristic is capacity to reduce

future assets or to require future services or products.

Equity—is the owner’s claim to the assets or the residual

interest in the assets of an entity after deducting liabilities;

also called net assets.

4. The Cash Flow Statement - describes the sources and uses

of cash for a reporting period. The cash flows are classified as

being caused by operating, investing, and financing activities.

The statement also reports the beginning, ending and change

in cash.

B. Financial Statements and Forms of Organizations

The focus of the early chapters of this book is on proprietorships.

Exhibit 2-7 gives a brief outline of differences business organization.

Generally Accepted Accounting Principles (GAAP)

A. The rules that make acceptable accounting practices are referred to

as Generally Accepted Accounting Principles (GAAP). Information

presented using these principles are considered to be relevant, reliable,

consistent and comparable.

Fundamental Principles of Accounting

Include both general and specific principles and are discussed

throughout the book. The principles discussed in this chapter are:

1. Business entity principle—every business is to be accounted

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

2-2

Fundamental Accounting Principles, 12th Canadian Edition

Instructor’s Notes

Chapter Outline

III.

IV.

for separately and distinctly from its owner or owners.

2. Cost principle—all transactions are recorded based on actual

cash amount received. A cash-equivalent amount may be

given in exchange.

3. Objectivity principle—financial statement information is to be

supported by independent, unbiased and verifiable evidence.

4. Going-concern principle—financial statements are to reflect

the assumption that the business will continue operating

instead of being closed or sold, unless evidence shows that it

will not continue.

5. Monetary Unit—transactions and events must be expressed in

monetary, or money, units which is generally the currency in

which it operates. Accounting assumes a stable monetary unit,

which means we do not account for change in the value of

currency.

6. Revenue recognition principle—revenue should be recognized

at the time it is earned. The inflow of assets associated with

revenue may be in a form other than cash. The amount of

revenue should be measured as the cash plus the cash

equivalent (market value) of any other assets received.

The Accounting Equation

Investing=Financing, Equal amounts of investment and financing

have to occur in order for the accounting equation to remain balanced.

Transactions and the Accounting Equation

Business activities are described as transactions or events. Some

economic consideration (something of value) is exchanged for

something else in a transaction. These transactions cause changes

to the accounting equation. Source documents identify and

describe the transactions. The source documents provide the data

to be entered into the accounting system. Business events do not

involve exchange of economic consideration. Assets will always

equal liabilities plus owner’s equity.

A. Transaction Analysis

1. Investment by owner

+Asset (Cash) = + Owner’s Equity (Owner’s Name,

Capital)

reason: investment

Increase on both sides of equation keeps equation in

balance.

2. Purchase supplies for cash

+Asset (Supplies) = -Asset (Cash)

Increase and decrease on one side of the equation keeps

the equation in balance.

3. Purchase furniture and supplies on credit =

+Asset (Supplies)+Asset(Furniture) = + Liability

(Accounts Payable)

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

Fundamental Accounting Principles, 12th Canadian Edition

2-3

Instructor’s Notes

Chapter Outline

V.

Increase on both sides of equation keeps equation in

balance.

4. Services rendered for cash =

+ Asset (Cash) = + Owner’s Equity(Owner’s Name,

Capital)

reason: revenue earned

Increase on both sides of equation keeps equation in

balance.

5. Payment of expenses in cash

- Asset (Cash) = - Owner’s Equity(Owner’s Name,

Capital)

( rent) reason: expense incurred

Decrease on both sides of equation keeps equation in

balance.

6. Payment of expenses in cash

- Asset (Cash) = - Owner’s Equity (Owner’s Name,

Capital)

(Salary) reason: expense incurred

Decrease on both sides of equation keeps equation in

balance.

Revenue Recognition Principle--requires revenues be

recorded to be reported in the period it is earned.

7. Service contract signed, no effect on accounting equation

as no transactions has yet occurred.

8. Services and rental revenues rendered services for credit =

+ Asset (Accts Rec.) = + O E (Owner’s Name, Capital)

Reason revenue earned

Increase on both sides of equation keeps equation in balance.

9. Receipt of cash on account =

+ Asset (Cash) = - Asset (Accounts Receivable)

Increase and decrease on one side of the equation keeps the

equation in balance.

10. Payment of an accounts payable =

- Asset (Cash) = - Liability (Accounts Payable)

Decrease on both sides of equation keeps equation in

balance.

11. Withdrawal of cash by Owner =

- Asset (Cash) = - O E (Owner’s Name, Capital)

reason: withdrawal

Decrease on both sides of equation keeps equation in

balance.

Summary of transactions is shown in Exhibit 2-10.

Financial Statements

Financial Statements are prepared from transaction analysis in the

following order using the procedure indicated:

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

2-4

Fundamental Accounting Principles, 12th Canadian Edition

Instructor’s Notes

Chapter Outline

A. Income Statement – information about revenues and expenses is

taken from the owner's equity column. Total revenues minus total

expenses equals net income or loss. Notice withdrawals and

investments are not part of measuring income or loss.(This is a very

common mistake for students at this point.)

B. Statement of Owner’s Equity -- the beginning owner’ equity is

taken from the owner’s equity column and any investments of owner

showed in this column are added. The net income, from the income

statement is added ( or the net loss is subtracted) and finally the

owner’s withdrawals, which are found in the owner’s equity column,

are subtracted to arrive at the ending capital. (Point out that balance is

already known from the transaction sheet.)

C. Balance Sheet -- the ending balance of each asset is listed and the

total of this listing equals total assets. The ending balance of each

liability is listed and the total of this listing equals total liabilities. The

ending capital, taken from the statement of changes in owner’s equity,

is listed and added to total liabilities to get total liabilities and owner’s

equity. Both sides must equal.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

Fundamental Accounting Principles, 12th Canadian Edition

2-5