Week15-2

advertisement

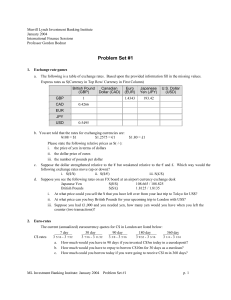

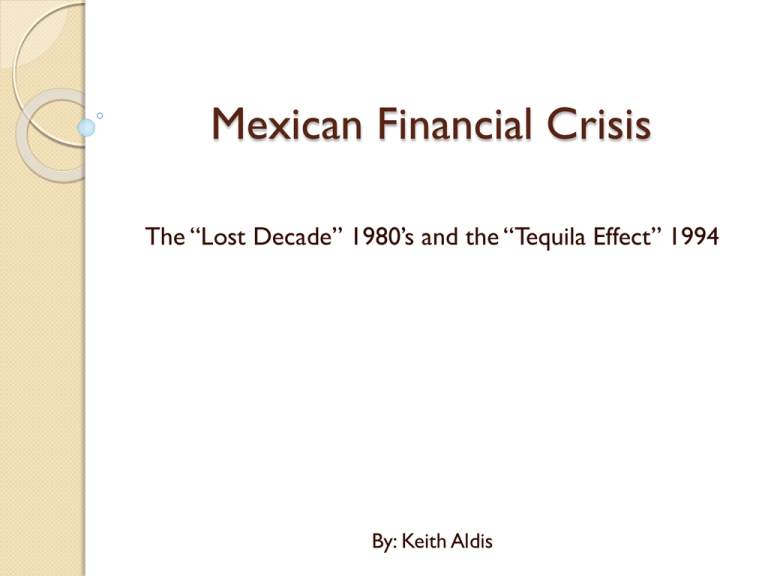

Mexican Financial Crisis The “Lost Decade” 1980’s and the “Tequila Effect” 1994 By: Keith Aldis 1982 – 1986 Causes Current Account deficit Heavy government borrowing of short term loans Depletion of government foreign reserves Higher U.S. interest rates due to Volcker's anti-inflation policies Falling oil-prices Large capital outflows Peso devaluation Gross Domestic Product GDP (millions) 700000 600000 500000 400000 GDP (millions) 300000 200000 100000 0 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 Solutions and lessons IMF injection of $4.55 billion to keep from defaulting $3.625 billion from United States to be repaid in 1 year Long process of stagnation and slow growth for years Crisis spread throughout most of Latin world 1994 - Causes Political upheaval, assassination, and loss of confidence Current account deficit and Capital flight Peso devaluation Large amounts of credit flow domestic and foreign Liberalization of the then privatized financial sector Peso Devaluation Mexican Import and Export 12000 10000 8000 6000 Exports Imports 4000 2000 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 Solutions and lessons $48.8 billion from IMF $20 billion from U.S. Loans were repaid rapidly Mexico quickly recovered and returned to global markets Spread to other Latin countries did not occur to a great extent End of crawling pegged exchange rate policy and beginning of floating system Conclusion Mexico learned to not get itself that position again with a current account deficit and easily retractable capital in-flows. They learned not to overvalue their currency for fear of another great devaluation and start floating exchange rate policy Privatized many industries opening them up to foreign markets and reaping the rewards of FDI