the prudential code for capital finance

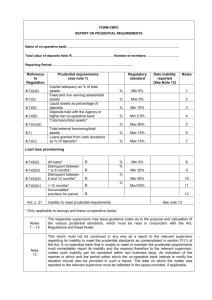

advertisement

APPENDIX B THE PRUDENTIAL CODE FOR CAPITAL FINANCE: PRUDENTIAL INDICATORS 1. Prudential Indicators: the actual position Actual Capital Expenditure for 2007/08 1.1 1.2 non-HRA HRA After the year-end, the actual capital expenditure incurred during the financial year will be recorded. This prudential indicator will be referred to as actual capital expenditure and shall be expressed as ‘actual capital expenditure for 0X/0Y’. The Code also requires separate identification of the actual HRA and non-HRA elements of this Prudential Indicator. (Prudential Code, paragraph 51 & 52). Actual capital expenditure for 07/08 2. non-HRA £X.Xm HRA £X.Xm Prudential Indicators for Affordability Prudential Indicators for Affordability: Estimates of the incremental impact of capital investment decisions on the Council Tax and on housing rents. 2.1 2.2 non-HRA HRA Blackpool is required to: (i) forecast the total non-HRA budgetary requirements for the authority based on no changes to the existing capital programme. (ii) forecast the total non-HRA budgetary requirements for the authority with the changes proposed to the capital programme included in the calculation. (iii) take the difference between (i) and (ii) and calculate the addition or reduction to Council tax that would result. (iv) forecast the total HRA budgetary requirements for the authority based on no changes to the existing capital programme. (v) forecast the total HRA budgetary requirements for the authority with the changes proposed to the capital programme included in the calculation. (vi) take the difference between (iv) and (v) and calculate the addition or reduction to average weekly housing rents that would result. These two Prudential Indicators (Prudential Code, paragraph 40) will be referred to as ‘estimates of the incremental impact of new capital investment decisions on the Council Tax/average weekly housing rents’ and shall be expressed in the following manner: £xx.xx. These indicators of the incremental impact of their capital investment decisions allow the effect of the totality of Blackpool Council’s plans to be considered at budget setting time. They also allow different options for the capital investment programme to be considered by comparing the different impact on council tax (and housing rents) that would result, holding all other things constant other than varying the capital programme. Moreover, these indicators take into consideration the effects of self-financing and the effects of government support. They also reflect the revenue impact of capital schemes other than financing costs, thus facilitating the consideration of revenue intensive vis-a-vis capital intensive options. Incremental impact of new capital investment decisions on the Council Tax on the average weekly housing rents £10.85 £12.58 £9.56 £0.00 £0.00 £0.00 2008/09 2009/10 2010/11 3. Prudential Indicators for Prudence Prudential Indicators for Prudence: Capital Expenditure (including capital commitments). 3.1 3.2 non-HRA HRA Local authorities are required to make reasonable estimates of the total of capital expenditure that they plan to incur during the forthcoming financial year and at least the following two financial years. These Prudential Indicators shall be referred to as the ‘estimate of total capital expenditure to be incurred in years 1, 2 and 3’. A local authority that has a Housing Revenue Account (HRA) will identify separately estimates of HRA capital expenditure and estimates of non-HRA capital expenditure. (Prudential Code, paragraphs 48 & 49). The Strategic Asset Management Group in conjunction with the capital finance team have completed the capital programme likely to be required over the next three years, together with the financial resources likely to be available for those schemes. This has taken into account new borrowing for which the government is providing resources to meet interest and debt repayment costs in the formula spending share, government grants, capital receipts, financial viability, and other funding (including s106 receipts). The current estimates of capital expenditure that should be funded is: 2008/09 2009/10 2010/11 Total schemes Non-HRA schemes HRA schemes £122.0M £119.6M £121.7M £104.4M £99.8M £101.8M £17.6M £19.8M £19.9M The above figures have to be approved in the January 2008 Capital Programme report. The Council may as part of its budget considerations in future years decide to approve a lower level of capital expenditure - thus reducing the costs of financing in the revenue budget - or a higher level of capital expenditure if there is scope. Making cost savings or generating income elsewhere, or by adjusting the level of council tax to achieve the desired balance of outcomes can achieve this flexibility. Capital expenditure remains higher than Blackpool’s historical levels because it is currently inflated by the gross costs of the Masterplan, the Coastal Protection schemes and the ALMO bid.