GNP/GDP - M Anwar Jalil

advertisement

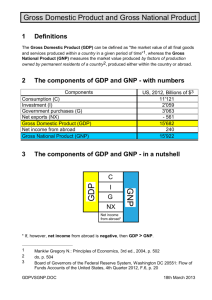

Gross National Product (GNP): An economic statistic that includes GDP, plus any income earned by citizens (importantly companies) of a country in foreign land, minus income earned within the domestic economy by overseas residents. GNP measures total production of resources owned by citizens of a country. Some citizens own resources that do their production in the foreign sector. Total value of Goods and Services produced by all nationals of a country whether within or outside the country in given time. GNP records income produced (e.g. sales). GNP is the total value of all final goods and services produced within a nation in a particular year, plus income earned by its citizens (including income of those located abroad), minus income of non-residents located in that country. Basically, GNP measures the value of goods and services that the country's citizens produced regardless of their location. GNP is one measure of the economic condition of a country, under the assumption that a higher GNP leads to a higher quality of living of a country, all other things being equal. National Income There three methods of measuring National Income are; 1. The income method 2. The output method 3. The expenditure method All three methods should equal each other as output (production) pays for wages (incomes) which are spent (expenditure) on output. However there can by stastistical discrepancies (small differences) due to the different methods used. Three methods are used to ensure that there is; 1. Accuracy: using three methods gives a more accurate result. 2. A cross-check: estimates under one method can be cross-checked under the other two methods. 3. Each method brings valuable information lacking in the other two and the government uses this to make decisions relating to the three sectors of the economy. 1. The Income Method Is a supply-side analysis which focuses on all factor payments made to households; planners need to know this information in order to assess the levels of taxes and transfers that are appropriate for given families. It involves adding up the incomes received by each of the factors: land, labour, capital and enterprise in each of the three sectors agriculture, industry and services. Precautions for the Income Method Income-in-kind/benefit in kind Payment received in a form other than in cash/non-monetary form. Payment in the form of goods and services. They are included in National Income statistics. Eg. Company car Transfer payment/earnings Is money received without the supply of goods/services. Payment for which no factor of production is supplied. They are not included in National Income statistics. Eg. Job-seekers allowance Imputed rent If you own a house, you are assumed to be receiving an income equal to the amount you could get if you let it out for rent. This is included in National Income Statistics. 2. The Output Method Is also a supply-side analysis which focuses on the payments received from the supply of goods and services. Understanding the outputs of different sectors is vital for infrastructural advancement, research and development (R&D) clusters, export competitiveness. It involves adding up the output produced by each of the factors: land, labour, capital and enterprise in each of the three sectors agriculture, industry and services. Precautions Double counting When using the output method, care must be taken to avoid “double counting”. If a dressmaker buys material for €100 and makes a dress worth €00, their output is only €200. This is known as the value added of the business. Only goods & services for which payment is made are included so the efforts of charity workers and home- makers are excluded. 3. The expenditure method Is often associated with the writings of Keynes and unlike the other two, focuses on the levels of demand in the economy and it allows planners to assess the balance between investment and consumption, public and private activity, imports and exports (the balance of trade) etc. It involves adding up the spending by each of the factors: land, labour, capital and enterprise on the goods and services on the economy. Relationship between GDP @ CMP and NNP @ FC GDP at current market prices ± Net Factor Income from abroad (ROW) = GNP at current market prices Less indirect taxes Plus subsidies = GNP at Factor Cost Less Depreciation = Net National Product at Factor Cost (NI) Relationship between NNP @ FC and GDP @ CMP Net National Product at Factor Cost (NI) Plus Depreciation =GDP at Factor Cost +/- Net Factor Income from abroad (ROW) = G.N. P. at Factor Cost Plus indirect taxes -Less subsidies = GNP at Market Prices Explanation of terms Gross Domestic Product at Current Market Prices Is the output produced in one year in by the factors of production in the domestic economy irrespective of whether the factors are owned by Irish nationals or foreigners at current market prices. +/_Net Factor Income from the Rest of the World Is the difference between incomes earned by foreign factors of production in Ireland and send abroad and income earned by Irish factors of production abroad and returned to Ireland. Gross National Product at Current Market Prices Is the value of the total goods and services produced in one year in an economy by Irish owned factors of production valued at current market prices (excluding subsidies and including taxes). It includes earnings of Irish factors abroad but excludes earnings/profits of foreign factors in Ireland that are sent home (repatriated). GNP is less than GDP when; Net Factor Income from the Rest of the World is negative. This is due to: • Repatriation (sending home) of profits by foreign companies resident in Ireland. Eg. Intel • Repayments on the foreign element of our National Debt. • Remittances (earnings) of immigrants in Ireland sent abroad. Therefore: GDP is a better guide to the level of economic activity in a country whereas GNP is a better guide to the standard of living in a country. GNP @ current market prices – indirect tax + subsidies = GNP @ factor cost Indirect tax Is a tax on pending such as VAT. Subsidy Is a sum of money paid by the government to a producer in order to decrease costs of production or a payment to exporters to allow them to sell goods more cheaply. Eg. Factor Cost Is the cost of a factor of production producing a good/service (includes subsidies by excludes taxes). Gross National Product at Factor Cost Is the value of the total goods and services produced in one year in an economy by Irish owned factors of production (including subsidies and excluding taxes) before depreciation is deducted. . Depreciation Is the capital used up in production. It is the loss in value of capital goods (fixed assets in the prodution of goods and services in the economy. Net National Product at Factor Cost (National Income) Is the total of all incomes earned by the permanent residents of a country whether earned in that country or abroad after depreciation has been deducted.