Differences between the FIFO and LIFO Methods of

advertisement

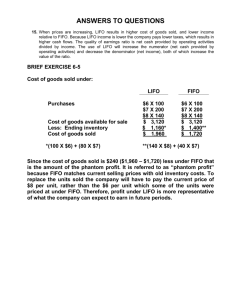

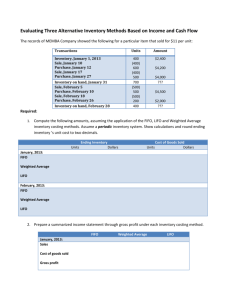

TERM PAPER OF ACT101 ON INVENTORIES MD.SHAFIUL AZAM SALMAN EAST WEST UNIVERSITY 1 Table of Content Page No 1.Introduction 2.First in First Out (FIFO) 2 3-5 3.Last in First Out 6-9 4.Weighted Average Cost (WAC) 10-13 5.Conclusion 14 2 Introduction: Inventories are asset. How a company classifies its inventory depends on whether the firm is a merchandiser or a manufacture. In a merchandising company inventor consists of many different items. For example, in a grocery store, canned goods, dairy products, meats, and produce are just a few of the inventory items on hand. These items have two common characteristics: 1) They are owned by the company and 2) They are in a form ready for sale to the customer in the ordinary course of business. Thus merchandisers need one one inventory classification, merchandise inventory, to describe the many different items that make up the total inventory. Manufactures usually classify inventory into three categories: 1) Finished goods 2) Work in process and 3) Raw materials Finished goods inventory is manufactured items that are completely and ready for sale. Work in process is that portion of manufactured inventory that has been placed into the production process but is not yet complete. Raw materials are the basic goods that will be used in the production but have not yet been placed into production. By observing the levels and changes in the levels these three inventory types, financial statement users can gain insight into management’s production plans. Cost flow assumptions There are three assumed cost flow methods: 1) First-in, first-out (FIFO) 2) Last-in, first-out (LIFO) 3) Average-cost There is no accounting requirement that the cost flow assumption be consistent with the physical movement of the goods. 3 First-In First- Out What is FIFO ? FIFO method is accounting techniques used in managing and financial matter involving the amount of money a company has tied up within inventory of produced goods. These methods are used to manage assumption of cost flow related to inventory, stock repurchases and various other accounting purposes. FIFO stands for first in-first-out, meaning that the oldest inventory item are recorded as sold first but do not necessarily mean that the exact oldest physical object has been thrashed and sold. First in First-out method assumes the items you have purchased or produced first are the first item you sold, Consumed or otherwise. Disposed of the item in inventory at the end of the tax year are matched with the costs of item of the same type that you most recently purchased or produced. An asset management and valuation method in which the assets produced or acquired first are sold, used or disposed of first. FIFO may be use by a individual or a corporation. 4 Differences between FIFO and LIFO : Period of rising Prices FIFO LIFO (+) Higher value of inventory. (-)Lower value of (-) Lower cost of goods sold inventory. (Inflation) (+) Higher cost of goods sold. Period of falling Prices (-)Lower value of (+) Higher value on inventory inventory. (-) Lower cost of goods sold (Deflation) (=) Higher cost of goods sold. Why would a company have to pick FIFO : In inventory Management, FIFO means that the oldest inventory items- the ones purchased. First are sold before newer items. companies must use FIFO for inventory if they are selling perishable good such as food companies selling products with relatively short demand cycles; such as designer fashion also may have to pick FIFO to ensure they are not stuck with outdated styles in inventory. Advantage of FIFO : Reduce obsolete inventory. Reduce impact of inflation. FIFO ensures current ending inventory value. FIFO method is simple to understand and easy to operate 5 It is logical Method because it takes into consideration the normal procedures of utilizing. first those materials which are received first. This method is useful when prices are falling are not too many and price of materials are fairly steady. Disadvantage of FIFO : This Methods increases the possibility of errors. Comparison between one job to another job will become difficult. For pricing rises, the issue price does not reflect the market price as materials are issued from the earliest consignment. 6 Last-In, First Out (LIFO) method for inventory accounting: The LIFO method assumes that the latest goods purchased are the first to be sold. LIFO seldom concidies with the actual physical flow of inventory. Only for goods in piles, such as hay, coal or, produce at the grocery store would LIFO match the physical flow of inventory. Under the LIFO method, the costs of the latest goods purchased are the first to be assigned to cost of goods sold. Here is how inventory cost is calculated using the LIFO method : Assume a product is made in three batches during the year. The costs and quantity of each batch are: Batch 1: Quantity 2,000 pieces, Cost to produce $8000 Batch 2: Quantity 1500 pieces, Cost to produce $7000 Batch 3: Quantity 1700 pieces, Cost to produce $7700 Let's say you sold 4000 units during the year, out of the 5200 produced. Then calculate the unit costs for each batch: Batch 1: 8000/2000 = 4 Batch 2: 7000/1500 = 4.667 Batch 3: 7700/1700 = 4.529 7 So, of the 4000 units sold, using LIFO The first 1700 units sold from the last batch cost $4.529 per unit The next 1500 units sold from the second batch cost $4.667 per unit And the last 800 units sold from the first batch cost $4. The cost of the remaining 1200 units from the first batch is $4 each. These units will start off the next year. Differences between the FIFO and LIFO Methods of Inventory: FIFO Basics and Benefits: FIFO is an acronym that stands for "first-in, first-out." With this inventory valuation approach, the company accounts for the value of inventory received first when sales are made. One of the more common reasons a company chooses FIFO is because it is a more natural straight-line approach since you account for your first inventory in as the first items sold. This makes it especially useful when tracking inventory items is simple. LIFO Basics and Benefits: LIFO is an acronym that stands for "last-in, first-out." Thus, you are accounting for your most recently received inventory with first items sold. This actually gives a more realistic look at the market costs of the inventory you sell since it is sold shortly after received. A main reason companies choose LIFO during periods of inflation, though, is that it helps keep current taxable income low since your more recent purchases typically have a higher cost basis. 8 Advantages of Last in First Out (LIFO) Method: 1. The cost of materials issued will be either nearer to and or will reflect the current market price. Thus, the cost of goods produced will be related to the trend of the market price of materials. Such a trend in price of materials enables the matching of cost of production with current sales revenues. 2. The use of the method during the period of rising prices does not reflect undue high profit in the income statement as it was under the first-in-first-out or average method. In fact, the profit shown here is relatively lower because the cost of production takes into account the rising trend of material prices. 3. In the case of falling prices profit tends to rise due to lower material cost, yet the finished products appear to be more competitive and are at market price. 4. Over a period, the use of LIFO helps to iron out the fluctuations in profits. 5. In the period of inflation LIFO will tend to show the correct profit and thus avoid paying undue taxes to some extent. 9 Disadvantages of Last in First Out (LIFO) method: 1. Calculation under LIFO system becomes complicated and cumbersome when frequent purchases are made at highly fluctuating rates. 2. Costs of different similar batches of production carried on at the same time may differ a great deal. 3. In time of falling prices, there will be need for writing off stock value considerably to stick to the principle of stock valuation, i.e., the cost or the market price whichever is lower. 4. This method of valuation of material is not acceptable to the income tax authorities. The problems with LIFO: The LIFO method can result in an ending inventory cost value that’s seriously out of date, especially if the business sells products that have very long lives. Unscrupulous managers can use the LIFO method to manipulate their profit figures if business isn’t going well. They let their inventory drop to abnormally low levels, with the result that old, lower product costs are taken out of inventory to record cost of goods sold expense. 10 4. The Weighted Average Cost method for inventory accounting The weighted average cost method is one of the three methods used in inventory accounting. It considers all costs incurred to acquire the inventory and spreads those costs to all units. The inventory costs include the beginning inventory along with purchases made during the period. This method assumes that we sell all our inventories simultaneously. The units include the beginning inventory count and the quantity of units purchased during the period. The accountant adds the total costs and the total units, and then divides the total costs by the total units to determine the unit cost. This gives a weighted-average unit cost that is applied to the units in the ending inventory. Consider this example. Let's say one has a furniture store and purchases 200 chairs for $10 and then 300 chairs for $20. At the end of an accounting period, 100 chairs have been sold. 200 chairs @ $10 = $2,000 300 chairs @ $20 = $6,000 Total number of chairs = 500 Under Weighted Average Cost method: Cost of a chair: $8,000 divided by 500 = $16 per chair Cost of Goods Sold: $16 x 100 = $1,600 Remaining Inventory: $16 x 400 = $6,400 Difference from LIFO and FIFO methods The main difference between weighted average cost accounting, LIFO, and FIFO methods of accounting is the difference in which each method calculates inventory and cost of goods sold. The weighted average cost method uses the average of the costs of the goods to assign costs. In other words, weighted average uses the formula: Total cost of items in inventory available for sale divided by total number of units available for sale. The costs of goods under weighted average will be between the cost levels determined by FIFO and LIFO. 11 In contrast, FIFO (first in, first out) accounting means that the costs assigned to goods are the costs for the first goods bought. In other words, the company assumes that the first goods sold are the oldest or the first goods bought. On the other hand, LIFO (last in first out) assumes that the last or latest items bought are the first items to be sold. Use of Weighted Average Cost method The weighted average cost method is most commonly used in manufacturing businesses where inventories are piled or mixed together and cannot be differentiated, such as chemicals, oils, etc. Chemicals bought two months ago cannot be differentiated from those bought yesterday, as they are all mixed together. So we work out an average cost for all chemicals that we have in our possession. The method specifically involves working out an average cost per unit at each point in time after a purchase. This can also be used in industries that have a lot of price change because it will average the prices out to keep the overall price of the cost of goods sold down. Advantages of WAC method Businesses that use the weighted average method enjoy several advantages over the use of LIFO and FIFO methods. Consistency One advantage of using the weighted average method involves the consistent product cost used. After the accountant calculates the product cost, he uses that cost for all units. This includes the cost used for the ending inventory value as well as the cost of goods sold. Thus, it does not lend itself to manipulation. Alternative methods require the accountant to use a variety of costs, depending on the individual costs incurred with each transaction. Less Paperwork Another advantage of using this method is the level of paperwork required. The weighted average method requires the accountant to calculate one cost and to use this cost for all calculations. The accountant maintains only a few sheets of paper documenting the calculation. 12 The accountant does not need to maintain detailed records for each purchase. Instead, the accountant only needs to maintain records for the totals. Simple Calculation The calculation used to determine the unit cost under the weighted average method is simpler than that of alternative methods. The calculation only requires the accountant to complete three steps. Alternative methods require the accountant to perform multiple steps in order to calculate the inventory value or cost of goods sold. Disadvantages of WAC method This method has some disadvantages of using it as well. Less Accurate The value of inventory costs and cost of goods sold that is provided through this method is not accurate so it does not give the proper information about these values. Changes in current replacement cost of inventories are concealed in this method because these costs are averaged with older costs. It also often provides less accurate information to Income Statement since the cost of goods sold calculated in this method is averaged rather than the actual cost. Slow or False Reflect in Change Neither the valuation of ending inventory nor the cost of goods sold quickly reflect the changes in the current replacement value of goods, purchased or sold, if weighted average cost method is followed. Effects on the Financial Statements Different inventory accounting methods have different effects on the financial statements. We assume the natural scenario of rising price of goods. Effects on the Income Statement 13 FIFO gives the highest amount of gross profit, hence net income, because the lower unit costs of the first units purchased are matched as cost of goods sold against revenues. LIFO method gives the opposite scenario. WAC method shows average results between LIFO and FIFO results so that the profit is neither overstated like in FIFO method nor understated like in LIFO method. Effects on the Balance Sheet Under FIFO method, ending inventories are reported at the same rate as the current replacement costs. Therefore, current assets hence total assets; hence the stockholder’s equity will be overstated. In case of LIFO method, all these will be understated since older inventories will be reported as ending inventories. Weighted average cost method shows an average result in between the results from LIFO and FIFO methods showing closer information to actual total assets and stockholder’s equity value. Effects on the Cash Flow Statement Even though there is no direct effect on cash flow statements for using different inventory accounting methods, there is an indirect effect since cash flow statements consider taxes. Therefore, using FIFO method would lead to paying higher tax for showing higher income and using LIFO method would lead to paying lower tax. Weighted average method would result in paying an average tax amount compared to other two methods. 14 5. Conclusion: Perpetual inventory: In perpetual inventory system, companies keep detailed record of each inventory purchase and sale. These records continuously –perpetually show the inventory that should be on hand for every item. E:g: Ford dealership has separate inventory records for each automobile, truck and van on its lot and showroom floor. Similarly, A Kroger grocery store uses bar codes and optical scanners to keep a daily running record of every box of real and every jar of jelly that it buys and sells. Under a perpetual inventory system, a company determines the cost of goods sold each time a sale occurs. Periodic system: In a periodic inventory system, companies do not keep detailed inventory records of the goods on hand throughout the period. Instead, they determine the cost of goods sold only at the end of the accounting period that is periodically. At that point, the company takes a physical inventory count to determine the cost of goods on hand. This is use by most merchandising companies: Companies that sell merchandise with high unit values, such as automobile, furniture and major home appliances, have traditionally used perpetual systems. The growing use of computers and electronic scanners has enabled many more companies to install Perpetual system. The Perpetual inventory system is so named because the accounting records continuously, perpetually show the quantity and cost of the inventory that should be on hand any time. For all that reason Perpetual inventory system is use in most of the merchandising companies. Much of Wal-Mart’s success is attributes to its sophisticated Inventory system.(perpetual inventory system use by Wal-Mart). 15