Amazon mini-case

(deferred taxes)

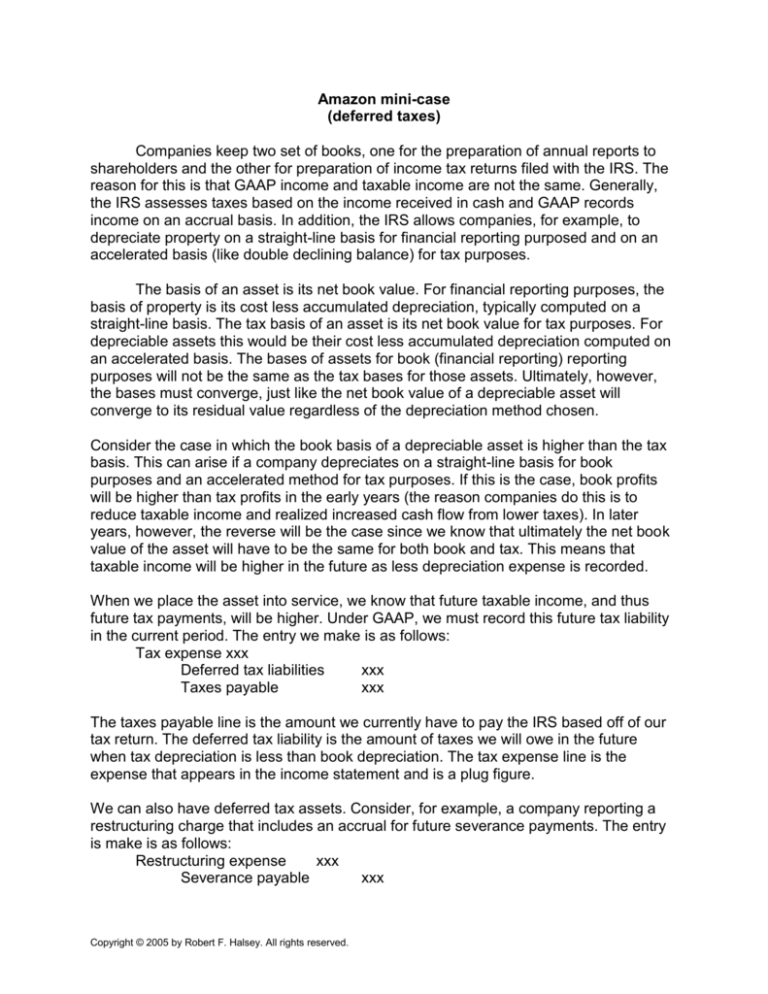

Companies keep two set of books, one for the preparation of annual reports to

shareholders and the other for preparation of income tax returns filed with the IRS. The

reason for this is that GAAP income and taxable income are not the same. Generally,

the IRS assesses taxes based on the income received in cash and GAAP records

income on an accrual basis. In addition, the IRS allows companies, for example, to

depreciate property on a straight-line basis for financial reporting purposed and on an

accelerated basis (like double declining balance) for tax purposes.

The basis of an asset is its net book value. For financial reporting purposes, the

basis of property is its cost less accumulated depreciation, typically computed on a

straight-line basis. The tax basis of an asset is its net book value for tax purposes. For

depreciable assets this would be their cost less accumulated depreciation computed on

an accelerated basis. The bases of assets for book (financial reporting) reporting

purposes will not be the same as the tax bases for those assets. Ultimately, however,

the bases must converge, just like the net book value of a depreciable asset will

converge to its residual value regardless of the depreciation method chosen.

Consider the case in which the book basis of a depreciable asset is higher than the tax

basis. This can arise if a company depreciates on a straight-line basis for book

purposes and an accelerated method for tax purposes. If this is the case, book profits

will be higher than tax profits in the early years (the reason companies do this is to

reduce taxable income and realized increased cash flow from lower taxes). In later

years, however, the reverse will be the case since we know that ultimately the net book

value of the asset will have to be the same for both book and tax. This means that

taxable income will be higher in the future as less depreciation expense is recorded.

When we place the asset into service, we know that future taxable income, and thus

future tax payments, will be higher. Under GAAP, we must record this future tax liability

in the current period. The entry we make is as follows:

Tax expense xxx

Deferred tax liabilities

xxx

Taxes payable

xxx

The taxes payable line is the amount we currently have to pay the IRS based off of our

tax return. The deferred tax liability is the amount of taxes we will owe in the future

when tax depreciation is less than book depreciation. The tax expense line is the

expense that appears in the income statement and is a plug figure.

We can also have deferred tax assets. Consider, for example, a company reporting a

restructuring charge that includes an accrual for future severance payments. The entry

is make is as follows:

Restructuring expense

xxx

Severance payable

xxx

Copyright © 2005 by Robert F. Halsey. All rights reserved.

The company, thus, reports the expense for book purposes currently when the liability is

incurred. For tax purposes, however, the expense is not a deduction until the severance

payments are actually paid. In this case, book income is less than tax income. We

know, however, that we will have a future deduction when the payments are made. This

is a future tax benefit and meets the test of an asset. So, we record a deferred tax

asset. Deferred tax assets reduce current the tax expense reported for book purposes

with the following entry:

Tax expense

xxx

Deferred tax asset xxx

Tax payable

xxx

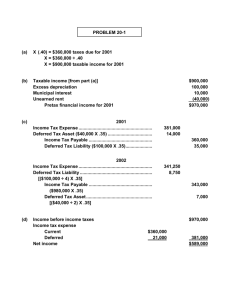

Companies can have both deferred tax assets and deferred tax liabilities. The amount

of expense reported in the company’s income statement will depend on 1. the amount

of tax payable (current portion) and the changes in deterred tax assets and liabilities

(deferred portion). This mini-case is designed to give you an introduction into deferred

taxes. We will use the Amazon 2004 annual report for this exercise, portions of which

follow. Please answer the following questions:

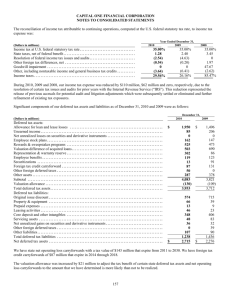

1. How much pre-tax profit, tax expense, and net income did the company report

for 2004?

2. For its tax expense, how much is currently payable and how much is due to

changes in deferred tax assets and liabilities?

3. What deferred tax assets and liabilities does the company report in total? Are

the assets and liabilities reported separately or netted on the balance sheet?

4. What are the major categories of deferred tax assets and liabilities? How might

these arise?

5. The company reports net operating loss carry forwards. Generally, these relate

to taxable losses that, under the IRS code, can be carried forward to future

years to reduce taxable income in those years. If it is unlikely that the NOL’s will

be used before they expire, the company must set up a valuation allowance to

reduce the deferred tax asset, just like the allowance for doubtful accounts.

What will be the effect on current profitability if a company establishes a deferred

tax asset valuation allowance?

6. What changes does Amazon report in its deferred tax valuation allowance

account for 2004? Describe what prompted the change and the effect the

change had on its reported income?

7. As an analyst, how should you view deferred tax asset valuation accounts?

8. In general, for growing manufacturing companies that typically report a large

deferred tax liability, how should you view the deferred tax asset or liability? That

is, does the liability represent a future cash outflow? Under what circumstances?

Copyright © 2005 by Robert F. Halsey. All rights reserved.

Copyright © 2005 by Robert F. Halsey. All rights reserved.

Copyright © 2005 by Robert F. Halsey. All rights reserved.

Copyright © 2005 by Robert F. Halsey. All rights reserved.

Copyright © 2005 by Robert F. Halsey. All rights reserved.

Copyright © 2005 by Robert F. Halsey. All rights reserved.

Copyright © 2005 by Robert F. Halsey. All rights reserved.