1, 2, 7-11, Bridge Prob 1 - Faculty

advertisement

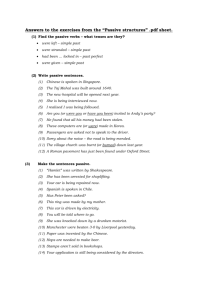

CHAPTER 5 LOSSES AND LOSS LIMITATIONS SOLUTIONS TO PROBLEM MATERIALS Question/ Problem 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Status: Present Edition Topic Bad debts: business Bad debts: tax benefit rule Bad debt and § 1244 stock § 1244 stock Issue recognition Transfer of § 1244 stock to another individual Casualty loss: amount of loss Casualty loss: disaster area loss Issue recognition Casualty loss: insurance recovery Net operating loss: calculation At-risk rules At-risk rules Issue recognition Passive loss rules: general application Passive loss rules: general application Sale of passive activity and suspended losses Sale of passive activity Passive losses of personal service corporation Passive losses of corporation Passive, active, portfolio income of non-PSC Groupings of two types of businesses Issue recognition Interaction of at-risk and passive loss rules Interaction of at risk and passive loss rules Interaction of at-risk and passive loss rules Modified Unchanged Modified Unchanged Unchanged Unchanged New Unchanged Unchanged Unchanged Modified New Unchanged Unchanged Unchanged Unchanged Modified Unchanged New Unchanged Unchanged Unchanged Unchanged Unchanged Unchanged New Q/P in Prior Edition 1 2 3 5 6 7 8 9 10 11 13 14 15 16 17 18 20 21 22 23 24 25 5-1 Status: Q/P 5-2 2003 Entities Volume/Solutions Manual Question/ Problem 27 28 29 30 31 Present Edition in Prior Edition Unchanged Unchanged New Unchanged Unchanged 27 28 Unchanged Unchanged Unchanged Unchanged Unchanged 32 33 34 35 36 Unchanged 37 Bad debt expense At-risk rules Passive activity loss rules: general application Unchanged Unchanged Unchanged 1 2 3 Casualty loss Offsetting rent income by passive losses Passive activity: amount of deductible loss Internet activity Internet activity Unchanged Unchanged New Unchanged Unchanged 1 2 Topic Interaction of at-risk and passive loss rules Issue recognition Passive loss deduction amounts Rental loss: active participation Active income and passive income: real estate activities Ethics problem Spousal participation in real estate activities Real estate rental exception Ethics problem Passive activity loss allowed, suspended losses and credits Rental real estate loss deduction 32 33 34 35 36 37 30 31 Bridge Discipline Problem 1 2 3 Research Problem 1 2 3 4 5 4 5 PROBLEM MATERIAL 1. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 January 29, 2002 Loon Finance Company 100 Tyler Lane Erie, PA 16563 Dear Sir: This letter is to inform you of the possibility of taking a bad debt deduction. Your loan to Sara is a business bad debt; therefore, you are allowed to take a bad debt deduction for partial worthlessness. You will be able to take a bad debt deduction in the current year of $26,000 ($30,000 - $4,000) based on partial worthlessness. Losses and Loss Limitations 5-3 Should you need more information or need to clarify anything, please contact me. Sincerely, John J. Jones, CPA Partner TAX FILE MEMORANDUM January 29, 2002 From: John J. Jones Subject: Bad Debt Deduction Loon Finance Company’s $30,000 loan to Sara is a business bad debt. Therefore, a bad debt deduction is allowed for partial worthlessness of $26,000 (i.e., Sara has filed for bankruptcy and Loon has been notified that the most the company can expect to receive is $4,000). Loon will be able to claim an additional bad debt deduction in the year when a final settlement has been reached with respect to the loan assuming the amount collected is less than $4,000. pp. 5-3 and 5-4 2. In 2001, Tom has a bad debt of $4,000. Because this is a nonbusiness bad debt, it is treated as a short-term capital loss. As such, Tom can use only $3,000 of the loss to offset ordinary income in 2001. In 2002, the collection of the debt increases Tom’s gross income. However, only $3,000 of the $4,000 received by Tom is included in his gross income in 2002 because this is the amount which produced a tax benefit in 2001. pp. 5-4 and 5-5 3. Salary § 1244 ordinary loss Short-term capital gain on § 1244 stock Short-term capital loss (nonbusiness bad debt) Net short-term capital gain Adjusted gross income pp. 5-4 to 5-7 $180,000 (95,000) $25,000 (7,000) 18,000 $103,000 5-4 4. 2003 Entities Volume/Solutions Manual Sell all of the stock in the current year: Current year’s AGI Salary Ordinary loss (§ 1244 limit) Long-term capital gain Long-term capital loss ($80,000 - $50,000) Long-term capital loss (limit) AGI Next year’s AGI Salary Long-term capital gain Long-term capital loss carryover ($22,000 - $3,000) Long-term capital loss (limit) AGI Total AGI Current year Next year Total $80,000 (50,000) $8,000 (30,000) ( 3,000) $27,000 $90,000 $10,000 (19,000) ( 3,000) $87,000 $ 27,000 87,000 $114,000 Sell half of the stock this year and half next year: Current year’s AGI Salary Ordinary loss (§ 1244 stock) Long-term capital gain AGI $80,000 (40,000) 8,000 $48,000 Next year’s AGI Salary Ordinary loss (§ 1244 stock) Long-term capital gain AGI $90,000 (40,000) 10,000 $60,000 Total AGI Current year Next year Total $ 48,000 60,000 $108,000 Mary’s combined AGI for the two years is lower if she sells half of her § 1244 stock this year and half next year. p. 5-7 5. John should be concerned with the following tax issues: Was there a bona fide debt? Business bad debt. Nonbusiness bad debt. Losses and Loss Limitations John’s basis in the debt. Date of worthlessness. Classification as capital or ordinary. Was there a § 1244 loss? Date of worthlessness. Amount of worthlessness. Classification as capital or ordinary. pp. 5-3 to 5-7 6. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 July 30, 2002 Mr. Mike Sanders 2600 Riverview Drive Plank, MO 63701 Dear Mr. Sanders: This letter is in response to your question with respect to stock you held in a corporation that qualified as a small business corporation under § 1244. Our conclusion is based upon the facts you provided us. Any change in facts may cause our conclusion to be inaccurate. Your brother, Paul, gave you the stock a few months after he acquired the stock. Paul paid $30,000 for the stock three years ago. You sold the stock this tax year for $10,000. You may deduct the difference between the selling price of the stock, $10,000, and the cost of the stock to your brother Paul, $30,000. When property is given to another, there is a carryover of the basis the donor had in the property. Thus, your tax basis in the stock will be the $30,000 tax basis your brother, Paul, had in the stock. You will have a long-term capital loss of $20,000 on the sale of the stock. Because you were not the original holder of the stock, you may not take an ordinary loss deduction on the sale. Should you need more information or need to clarify our conclusion, do not hesitate to contact me. Sincerely yours, David C. Via, CPA Partner 5-5 5-6 2003 Entities Volume/Solutions Manual TAX FILE MEMORANDUM July 18, 2002 FROM: David C. Via SUBJECT: Mike Sanders Today I talked to Mike Sanders with respect to his sale of stock which was issued to his brother, Paul, pursuant to § 1244. Paul paid $30,000 for the stock three years ago and gave the stock to his brother, Mike, a few months after he acquired it. Mike sold the stock in the current tax year for $10,000. At issue: May a donee of stock in a corporation that qualified as a small business corporation under § 1244 take an ordinary loss deduction pursuant to § 1244? Conclusion: No. Only the original holder of § 1244 stock qualifies for ordinary loss treatment. pp. 5-6 and 5-7 7. The amount of the loss is limited to the adjusted basis in the road of $20,000. The fact that the adjusted basis in the land is more than $80,000 is irrelevant because the loss must be determined by reference to the single, identifiable property damaged (i.e., the road) and not the real property that surrounds it. The fact that Joe has been depreciating the road as a separate item is contrary to any argument that the road is part of the real property. p. 5-10 8. The loss is a business loss. Therefore, for the farm building and the farm equipment that were completely destroyed, the adjusted basis is used in calculating the amount of the casualty loss. For the barn that was damaged, the lower of the adjusted basis or the decline in value is used in calculating the amount of the casualty. Building ($90,000 - $70,000) Equipment ($40,000 - $25,000) Barn ($50,000 - $25,000) Total loss $20,000 15,000 25,000 $60,000 Because the President declared the area a disaster area, Grackle could claim the loss on last year's return or on the current year's tax return. If Grackle applies the loss to the prior year, the benefit of the loss will be at lower tax rates. If the loss is applied to the current year, the benefit will be at a tax rate of 39% and thus, provide a tax savings of $23,400 ($60,000 X 39%) rather than $14,350 [($15,000 X 34%) + (25,000 X 25%) + ($20,000 X 15%)]. Grackle should include the loss on the current year's tax return, since the tax savings is $9,050 ($23,400 - $14,350) greater. pp. 5-8 to 5-12 Losses and Loss Limitations 9. The tax issues for Toucan Corporation are as follows. Is this a casualty loss? What is the amount of the loss? The basis for computing the loss. The decline in fair market value. Replacement cost. pp. 5-7 to 5-12 10. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 January 26, 2002 Snipe Industries 450 Colonel’s Way Warrensburg, MO 64093 Gentlemen: This letter is to inform you of the tax consequences of filing a claim versus not filing a claim with your insurance company for reimbursement for damages to the car driven by Sam Smith. Because the claim is being made by a company and not an individual, you may deduct the casualty loss in full even if no claim for insurance is filed. Thus, your plan will work. The full $18,000 loss is deductible. Note that the result would have been different if the casualty loss were claimed by an individual. In such a circumstance, because the car was insured, the amount of the tax deduction would be determined as if a claim had been filed with the insurance company and the reimbursement was received. Consequently, the deduction would have been zero. The benefit of filing the claim, absent any tax consequences, is an expected cash inflow of $15,000 from the insurance company, while the tax savings from the casualty loss deduction if no claim is made is $2,700 (assuming a 15% tax rate). Thus, the expected cost of policy cancellation should be at least $12,300 ($15,000 - $2,700) to justify not filing a claim. Should you need more information or need to clarify anything, please contact me. Sincerely, John J. Jones, CPA Partner pp. 5-7 to 5-12 5-7 5-8 11. 2003 Entities Volume/Solutions Manual a. Business receipts Business expenses Net business loss Salary Interest income Adjusted gross income Less: Itemized deductions Personal exemption (1 X $3,000) Taxable income $72,000 (90,000) ($18,000) 11,000 6,000 ($ 1,000) (14,000) (3,000) ($18,000) b. Taxable income Add: Personal exemption Excess of nonbusiness deductions ($14,000) over nonbusiness income ($6,000) Net operating loss ($18,000) 3,000 8,000 ($ 7,000) p.5-14 12. Fran had $50,000 at risk last year (as none of the partnership level debt can be included in Fran’s at-risk basis). Consequently, she could deduct the $37,500 loss, and her at-risk amount was decreased to $12,500. Because her at-risk amount is only $12,500 at the end of the current year, she can deduct only this amount of the $20,000 loss. pp. 5-18 and 5-19 13. Smith, Raabe, and Maloney CPAs 5191 Natorp Boulevard Mason, OH 45040 February 5, 2002 Mr. Bill Parker 54 Oak Drive St. Paul, MN 55162 Dear Mr. Parker: This letter is in response to your inquiry regarding the tax treatment of losses that you could expect this year and next year from an investment in Best Choice Partnership. As I understand the facts, you would invest $60,000 in the partnership with the expectation that your share of the partnership losses in the current and succeeding years would be $40,000 and $25,000, respectively. Even though your investment would not be subject to the passive activity limitations, the amount of the deduction that you may claim in any one year is subject to the at-risk rules. Essentially, these rules provide that your deductions are limited to the amount that you have invested in the venture or the amount that you could lose if the investment were to be unsuccessful. Consequently, in your case, the initial amount that you would have at risk would be $60,000. Therefore, you would be able to deduct $40,000 in the current year, which would cause your at-risk basis to be lowered to $20,000 ($60,000 - $40,000). Because your at-risk basis at the end of next year would be only $20,000, your share of the partnership loss that would be deductible would be limited to $20,000. The amount not deducted under this scenario would be deductible later when your at-risk basis increases, for example by additional investments you may make in the partnership or because of income generated by the partnership. Losses and Loss Limitations 5-9 If you have additional questions or need further clarification, please call me. Sincerely, John J. Jones, CPA pp. 5-18 and 5-19 14. Whether the at-risk rules apply or whether Charles’s at-risk basis is sufficient to support any losses that may be attributed to him. pp. 5-18 and 5-19 How will these investments be grouped as activities (e.g., aggregating all businesses as one retail activity, treating the software, bagel, and rental businesses as three separate activities, or categorizing each location as a separate activity)? pp. 5-25 and 5-26 Will Charles’s involvement in any one or more of the activities be sufficient to support the classification of these businesses as active or will they be treated as passive? pp. 5-26 to 5-30 Will the mountain bike and ski rental shops be classified as rental activities or will they qualify for one of the exceptions involving rentals of personal property that are not treated as rental activities? p. 5-30 Assuming the passive activity rules apply, what is the best combination of grouping the ventures as one or more activities, given the projected profits and losses, and Charles’s willingness to stay with these investments without selling them for an extended period of time? pp. 5-25 and 5-26 15. Hazel can deduct none of the loss from either activity in the current year. Therefore, her suspended loss at the end of the current year is $16,000 ($10,000 loss from Activity A + $6,000 loss from Activity B). pp. 5-20 and 5-21 16. The $50,000 loss is suspended under the passive loss rules because Ray is not a material participant. AGI is $140,000. pp. 5-20 and 5-21 17. Last year, Saundra could deduct nothing against nonpassive income, and was required to allocate the $20,000 net loss among the three loss activities. Income (loss): Activity A Activity B Activity C Activity D Net passive loss $30,000 (30,000) (15,000) (5,000) ($20,000) Net passive loss allocated to: Activity B (30/50 X $20,000) Activity C (15/50 X $20,000) Activity D (5/50 X $20,000) Total suspended losses ($12,000) (6,000) (2,000) ($20,000) In the current year, Saundra has a net gain of $10,000 from the sale of Activity D. She can offset the $2,000 suspended loss from the activity and the current year's loss of $1,500 from 5-10 2003 Entities Volume/Solutions Manual the activity against the $10,000 gain. In addition, the remaining net gain of $6,500 ($10,000 - $2,000 - $1,500) from the sale may be used to absorb passive losses from the other activities. Examples 25 and 26 18. a. Net sales price Less: Adjusted basis Total gain Less: Suspended losses Taxable gain (passive) $100,000 ( 35,000) $ 65,000 ( 40,000) $ 25,000 b. Net sales price Less: Adjusted basis Total gain Less: Suspended losses Deductible loss $100,000 ( 75,000) $ 25,000 ( 40,000) ($ 15,000) c. Net sales price Less: Adjusted basis Total gain Less: Suspended losses Deductible loss $100,000 ( 75,000) $ 25,000 ( 40,000) ($ 15,000) The suspended passive losses are fully deductible. The suspended credits are lost forever because the sale of the activity did not generate any tax. pp. 5-20 to 5-22 and Example 28 19. A personal service corporation cannot offset passive losses against active or portfolio income. Oak’s income is $560,000 ($500,000 active income + $60,000 dividend income). pp. 5-24 and 5-25 20. a. A personal service corporation is not allowed to offset passive losses against ordinary income. Therefore, White's taxable income based on the facts given is $436,000 ($400,000 income from operations + $36,000 portfolio income). Example 30 b. A closely held, non-personal service corporation is allowed to offset passive losses against active income, but not against portfolio income. Therefore, White's taxable income based on the facts given is $396,000 ($400,000 income from operations $40,000 passive loss + $36,000 portfolio income). Example 31 21. A closely held, non-personal service corporation can offset passive losses against active income, but not against portfolio income. Green's income is $60,000 ($50,000 active income + $60,000 interest income - $50,000 passive loss deducted to extent of active income). Green will have a suspended passive loss of $30,000 ($80,000 - $50,000 used). Example 31 Losses and Loss Limitations 22. 5-11 Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 December 5, 2002 Mr. Greg Horne 431 Maple Avenue Cincinnati, OH 45229 Dear Greg: This letter is in response to your inquiry regarding the various strategies that are available concerning your movie theater and drugstore ventures in Cincinnati, Indianapolis, and Louisville. As you know, the basic issue relates to how the stores should be grouped or reported under the passive activity rules so as to maximize the tax benefit. As things currently stand and based on the projections that you have provided for the year, the $400,000 salary from your radio show is active income. If you do not participate any more in any of the movie theater or drugstore businesses, all profits and losses will be passive. As a result, you would have a net passive loss of $55,000 ($89,000 loss + $41,000 loss + $15,000 loss - $56,000 profit - $34,000 profit) that would be suspended and not available to offset your salary. To mitigate this result, three options are available. Option 1 is based on the significant participation activity rule. If all of the businesses were treated as separate activities, you would not be considered a material participant. Under the significant participation activity rules, the drugstores would be considered significant activities, but the movie theaters would not. Even with the drugstores, the total participation is not expected to exceed the more-than-500 hour threshold (140 + 170 + 180 = 490). Therefore, if you could participate 11 more hours in any of the drugstore businesses, they would be treated as active. You then could offset the net loss from the drugstores of $145,000 ($89,000 + $41,000 + $15,000) against your salary. Further, if you do not participate any more in the other theater businesses, their combined $90,000 of income will be reported as passive income. This characterization as passive could be helpful if you were to acquire additional passive businesses in the future that produce passive losses. Under option 2, both the movie theater and drugstore businesses could be combined as a “single activity” based on common ownership. Because you have participated more than 500 hours in the five businesses, the net loss of $55,000 would be considered active and could be used to offset the salary. Based on product, option 3 would combine the drugstores as one activity and the theaters would be treated as a separate activity. As with option 1, if you could participate 11 more hours in any of the drugstore businesses, they would be treated as active and you could offset the net loss of $145,000 ($89,000 + $41,000 + $15,000) against your salary. Also, you could treat the theaters as a single business and the net income would be passive. This could be helpful in the future if other passive ventures would be acquired. Other grouping possibilities exist, such as a grouping by location, but they do not appear to produce any tax advantages. 5-12 2003 Entities Volume/Solutions Manual Before making a decision on the above options, you should consider what is likely to happen in the future. For example, what is the likely profit and loss pattern of the existing businesses? Will you acquire additional businesses? If so, what types of businesses are likely to be acquired, and how will the new businesses fit into the grouping method that you adopt? Will you dispose of any of the existing businesses in the near future, and what impact will that have on the current grouping decisions? You will need to consider carefully all tax factors in deciding how to group your activities. This is so because once activities have been grouped, they cannot be regrouped unless the original grouping was clearly inappropriate or there has been a material change in facts and circumstances. Of course, our firm will be happy to assist you further in anyway we can concerning the choices you face. If we can answer or clarify any questions you may have, please call me. Sincerely, John J. Reswick, CPA Partner pp. 5-25 to 5-28 23. The amount of Rene’s at-risk basis in the hardware business and whether the losses flowing from the entity are limited by the at-risk rules. Whether the profits and losses from the public accounting firm are classified as passive or active. Whether Rene is a material participant in the hardware business. Whether Rene is subject to the passive loss rules. pp. 5-16 to 5-30 24. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 January 23, 2003 Ms. Kristin Bailey 123 Baskerville Mill Road Jamison, PA 18929 Dear Kristin: This letter is in response to your request for assistance in analyzing the tax consequences resulting from two investment alternatives. One alternative is to make an additional investment of $10,000 in Rocky Road Adventures in which you have an at-risk basis of $0, suspended losses under the at-risk rules of $7,000, and suspended passive losses of $1,000. If you were to make this investment, your share of the expected profits this year would be $8,000, while if your investment stayed at the same level, your share of profits would be $1,000. Your other choice is to invest $10,000 as a limited partner in the Ragged Mountain Losses and Loss Limitations 5-13 Winery, which would produce passive income of $9,000 this year. I have prepared the following analysis based on these facts. Invest $10,000 in Rocky Road Adventures: Expected profit from investment Beginning at-risk basis Increase due to profit Increase to at-risk basis due to investment Use of loss suspended by at-risk rules Ending at-risk basis Beginning suspended passive loss Reclassified suspended passive loss Use of suspended passive losses—revised Current taxable income Current tax liability $8,000 $ -08,000 10,000 $18,000 (7,000) $11,000 ($ 1,000) ( 7,000) Invest $10,000 in Ragged Mountain Winery: Expected profit from investment—Ragged Mountain Winery Expected profit from investment—Rocky Road Adventures Use of suspended passive losses from Rocky Road Adventures Current taxable income Current tax liability ($9,000 X 30%) (8,000) $ -0$ -0$9,000 1,000 (1,000) $9,000 $2,700 As you can see, the tax effects of the two options vary significantly and the differences relate to the interplay of the at-risk rules and the passive activity loss rules. I hope that this analysis will help you make a more informed investment decision. If you need any further explanation, please contact me. Sincerely, Libba Eanes, CPA Partner Examples 44 to 47 25. Lee’s share of ABC’s loss in 2002 is $80,000 ($400,000 X .20 ownership interest), and the entire loss is suspended under the passive loss rules. His share of the passive income in 2003 is $40,000 ($200,000 X .20 ownership interest). His at-risk amount is $80,000 ($120,000 - $80,000 passive loss in 2002 + $40,000 share of income in 2003). In 2003, he may deduct $40,000 of his $80,000 suspended loss against the passive income. This leaves a $40,000 suspended loss at the end of 2003. pp. 5-31 and 5-32 26. Ann is allowed a $40,000 deduction. Because her at-risk basis is only $40,000, $10,000 of the $50,000 loss is suspended. The available $40,000 loss is not subject to the passive activity loss rules because she was a material participant. The loss is treated as an active loss. Therefore, Ann’s AGI is $100,000 ($140,000 - $40,000). pp. 5-18 and 5-19 27. a. Initially the remaining $15,000 is disallowed by the at-risk limits. Since Soong is not a material participant, $45,000 of his $60,000 loss is reclassified as a passive loss and disallowed under the passive loss limits. Therefore, Soong's AGI is $218,000 ($200,000 salary + $18,000 portfolio income). 5-14 2003 Entities Volume/Solutions Manual b. Initially the remaining $15,000 is disallowed by the at-risk limits. Since Soong is a material participant, $45,000 of his $60,000 loss is deductible as an active loss. Therefore, Soong's AGI is $173,000 ($200,000 salary + $18,000 portfolio income $45,000 active loss). Examples 44 to 47 28. The fundamental issue is how can the time that Alan devotes to his business best be allocated across the various businesses in order to minimize the negative impact of the material participation rules as set out in the Regulations. Related to this issue are several points that need to be identified and resolved. How are the various businesses grouped together to form activities and how many hours does Alan spend working in each activity? How many employees are working at each of the businesses and how many hours have they worked? What type of work can Alan’s wife do to ensure that her participation will be treated as being his? Whether Alan is a limited partner in any of the businesses (which would allow for applying the rules in a different way). pp. 5-25 to 5-29 29. If losses were limited only by the at-risk rules, Gerald would be able to deduct the following amounts in 2001 and 2002. Year Loss Allowed* Disallowed 2001 2002 $40,000 30,000 $30,000 -0- $10,000 30,000 *Allowed under the at-risk rules, reclassified as a passive loss subject to the passive loss limitations. However, the losses also are limited by the passive loss rules as follows: Year Passive Deductible Suspended 2001 2002 $30,000 -0- $-0-0- $30,000 -0- In 2003, the $50,000 income increases Gerald’s at-risk amount to $50,000 enabling him to deduct the $40,000 of disallowed losses. The $50,000 is passive income that can be offset by $50,000 of suspended losses, leaving a suspended loss of $20,000. At the end of 2003, Gerald has no unused losses under the at-risk rules, $20,000 of suspended passive losses, and a $10,000 adjusted basis in the activity [$30,000 (adjusted basis on 1/1/2001) - $40,000 (loss in 2001) - $30,000 (loss in 2002) + $50,000 (income in 2003)]. pp. 5-25 to 5-29 Losses and Loss Limitations 30. 5-15 Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 March 5, 2002 Mr. Joe Cook 125 Hill Street Charleston, WV 25311 Dear Mr. Cook: This letter is in response to your inquiry regarding the $50,000 loss you incurred this year in conjunction with your investment in the apartment building, which I have assumed is not low-income housing given that it is located in an exclusive part of the city. As I understand your situation, you anticipate that your current AGI, exclusive of the loss flowing from the real estate rental activity, will be $140,000 and you wish to determine whether the loss is either partially or fully deductible. As you are aware, the apartment rental activity is considered a passive activity, and, in general, is subject to the passive activity rules. However, because you are an active participant in the investment, you will be able to deduct $5,000 under a real estate rental exception to the passive activity rules. More specifically, the law allows losses of up to $25,000 from certain real estate rental activities to be deducted each year. However, if a taxpayer's AGI exceeds $100,000, the amount deductible in the current year is reduced by 50% of every dollar of AGI over $100,000. Once a taxpayer's AGI reaches $150,000, no current loss deduction is allowed. Because your AGI is expected to be $140,000, the maximum allowable loss of $25,000 is reduced as follows: [$25,000 (maximum allowable) - .50($140,000 AGI - $100,000)]. Therefore, your AGI would be $135,000 after the allowable $5,000 loss ($140,000 - $5,000). The remaining $45,000 loss that would not be deductible in the current year is suspended under the passive loss rules and would be available in future years. If you do not actively participate in this activity next year, and a loss is generated, none of it will be deductible under the real estate rental exception. Joe, if you have any additional questions or would like further clarification of this matter, please call me. Sincerely, John J. Jones, CPA pp. 5-32 to 5-34 31. Donald does not satisfy both requirements for certain real estate professionals that allow nonpassive treatment for losses. Of the 2,300 hours Donald worked during the year, only 1,100 hours, or less than half, involved real estate trades or businesses in which he materially participated. Therefore, his real estate rental activities are passive activities. However, the 600 hours Donald devoted to his real estate development business satisfies the 500-hour material participation requirement. Therefore, the $18,000 loss is fully deductible. 5-16 2003 Entities Volume/Solutions Manual Under the rental real estate exception, Donald can deduct $25,000 of his $26,000 of losses. The remaining $1,000 of losses are suspended passive losses. pp. 5-32 to 5-34 32. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 December 15, 2002 Scott Myers 603 Pittsfield Dr. Champaign, IL 61821 Dear Scott, Based on our discussion, I understand that you are attempting to qualify under the special rules for real estate professionals as a material participant in order to deduct against your nonpassive income any losses generated by this rental activity. Consequently, you should document a sufficient number of hours so that you will meet the material participation standard. Your activities to date appear to be within the bounds of the tax law as it is written, but you also appear to be stretching its limits. You need to be careful to avoid any appearance of or taking any actual fraudulent actions on you or your wife’s part. Essentially, the issue is whether the participation hours generated are of substance or merely of form. Another issue is whether one of the principal purposes of the tasks being performed is to avoid the disallowance of passive losses or credits. Should you need more information or need me to clarify anything, please call. Sincerely, Jake Smith, CPA pp. 5-32 and 5-33 33. Maria and Jorge do not qualify to use the exception for real estate professionals in re-characterizing their loss from the real estate development business because they cannot combine their services to meet the 750-hour requirement. Therefore, the $18,000 loss is a passive loss and cannot be offset against active or portfolio income and must be carried forward to next year. Of the real estate rental passive loss, $25,000 can be deducted under the real estate rental exception. The remaining $1,000 loss is suspended. pp. 5-32 to 5-34 Losses and Loss Limitations 5-17 34. Gene is considered a material participant in the tax practice but not in the apartment leasing operation. However, because he actively participates in the real estate rental activity and owns at least 10% in the activity, $25,000 of the $30,000 loss is deductible in the current year against his tax practice income. The remaining $5,000 loss from the rental activity is suspended as a passive activity loss. pp. 5-32 to 5-34 35. How Active is Active? Under the real estate rental activities exception, George and Louise qualify to deduct a loss of up to $25,000 from the real estate rental activity if they actively participate in the activity and own a 10 percent or more interest in the activity. Here the issue is whether their involvement has reached the level of active participation for the year. In general, being an active participant requires the owner to make management decisions in a significant and bona fide sense. The facts revealed in the scenario suggest that they have taken a “hands off” approach and have left most, if not all, of the management decisions to the property manager. Nonetheless, the tax preparer servicing George and Louise should inquire more about the role that they actually played in the operations of the rental unit to be certain about their level of participation. For example, perhaps they actually were involved in making key management decisions such as approving new tenants, deciding on rental terms, and approving capital or repair expenditures. Such involvement would be enough for them to be considered active participants. However, given that George and Louise are surprised that a loss resulted from the operations, they may not have envisioned the need to actively participate. Therefore, unless additional supporting evidence comes to light, claiming a deduction under the real estate rental activities exception does not appear to be supported by the facts of the scenario by virtue of their lack of participation. pp. 5-33 and 5-34 36. Ida can utilize $20,000 of losses and $1,350 of credits as follows: Income (Loss): Activity A Activity B Activity C Net loss Utilized loss Suspended loss Utilized credit Suspended credit ($12,000) (18,000) 10,000 ($20,000) 20,000 $ -0$ 1,350 $ 750 After deducting the loss of $20,000, Ida has available a deduction equivalent of $5,000 [$25,000 (maximum loss allowed) - $20,000 (utilized loss)]. Therefore, the maximum amount of credits Ida may claim is $1,350 [$5,000 (deduction equivalent) X 27% (marginal tax bracket)]. Examples 49 and 50 37. Rental loss Rental income Other passive income Net passive rental loss Deductible against other income Suspended rental loss Example 49 ($105,000) 25,000 32,000 ($ 48,000) 25,000 ($ 23,000) 5-18 2003 Entities Volume/Solutions Manual BRIDGE DISCIPLINE PROBLEMS 1. a. Beginning allowance for bad debts Bad debt expense Bad debts written off during the year Ending allowance for bad debts $120,000 36,000 ( 33,000) $123,000 Given the $33,000 write-off and the $3,000 increase in the allowance for bad debts, the bad debt expense for financial accounting purposes is $36,000. b. The bad debt expense for tax purposes is $33,000, the amount of accounts receivable written off during the current year. c. The sole book/tax difference for Marketplace relates to the treatment for bad debts. Bad debt expenses per books Bad debt expense per tax Excess of book expense over tax expense $ 36,000 ( 33,000) $ 3,000 Therefore, the taxable income for Marketplace is computed as follows: Before-tax net income for financial accounting purposes Excess of book expense over tax expense Taxable income 2. $545,000 3,000 $548,000 Based on the following, Alternative 2's benefit exceeds Alternative 1's by $1,917 ($55,059 - $53,142), primarily because of the flow of the benefits and the effect of the at-risk rules on those benefits. Alternative 1 Income Yr. 1 ($24,000) Yr. 2 (24,000) Yr. 3 72,000 Total present value Tax cost/ benefit After-tax benefit 8% PV factor Present value $ 6,480 1 4,320 2 (17,280) $ 6,480 4,320 54,720 0.92593 0.85734 0.79383 $ 6,000 3,704 43,438 $53,142 Losses and Loss Limitations 5-19 Alternative 2 Income Tax cost/ benefit Yr. 1 ($48,000) Yr. 2 32,000 Yr. 3 40,000 Total present value $10,800 4 (6,480) 10,800 3 After-tax benefit 8% PV factor Present value $10,800 25,520 29,200 0.92593 0.85734 0.79383 $10,000 21,879 23,180 $55,059 1 Because of the at-risk rules, Amanda's tax deduction in year 2 is limited to her remaining at-risk basis of $16,000. The $8,000 loss that is not deductible in year 2 is suspended until her at-risk basis increases. Therefore, her tax benefit from the deduction is $4,320 ($16,000 X 27%). 2 Amanda's $72,000 share of income increases her at-risk basis and provides the opportunity to claim the $8,000 suspended loss from the previous year. Therefore, her taxable income for year 3 from this investment is $64,000 ($72,000 - $8,000) and the tax cost is $17,280 ($64,000 X 27%). 3 Because of the at-risk rules, Amanda's tax deduction in year 1 is limited to her at-risk basis of $40,000. The $8,000 loss that is not deductible in year 1 is suspended until her at-risk basis increases. Therefore, her tax benefit from the deduction is $10,800 ($40,000 X 27%). 4 Amanda's $32,000 share of income increases her at-risk basis and provides the opportunity to claim the $8,000 suspended loss from the previous year. Therefore, her taxable income from this investment in year 2 is $24,000 ($32,000 - $8,000) and the tax cost is $6,480 ($24,000 X 27%). pp. 5-18 and 5-19 3. Option B's benefit exceeds Option A's by $7,198 ($21,629 - $14,431), primarily because of the flow of the benefits and the ability to benefit from the passive loss deductions in years 1 and 2. Option A Income Yr. 1 $8,000 Yr. 2 8,000 Yr. 3 8,000 Total present value Tax cost/ benefit After-tax benefit 8% PV factor Present value ($2,400) (2,400) (2,400) $5,600 5,600 5,600 0.92593 0.85734 0.79383 $ 5,185 4,801 4,445 $14,431 Tax cost/ benefit After-tax benefit 8% PV factor Present value $ 2,400 600 23,800 0.92593 0.85734 0.79383 $ 2,222 514 18,893 $21,629 Option B Income Yr. 1 ($ 8,000) Yr. 2 (2,000) Yr. 3 34,000 Total present value $ 2,400 600 (10,200) 5-20 2003 Entities Volume/Solutions Manual RESEARCH PROBLEMS 1. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 February 2, 2002 Mr. George Johnson 100 Apple Lane St. Paul, Minnesota 55123 Dear Mr. Johnson: This letter is in response to your request concerning whether you can claim a casualty loss for the damage your automobile sustained when it fell through the ice as you were watching an iceboat race. Based on our research, we believe that the event constitutes a casualty and as such, you are entitled to claim a casualty loss for the damage to your car. Should you need more information or need further clarification on any matter, do not hesitate to contact me. Sincerely yours, John J. Jones, CPA Partner TAX FILE MEMORANDUM January 29, 2002 FROM: John J. Jones SUBJECT: George Johnson’s Casualty Loss Today I talked with George Johnson concerning an incident involving his car. Several weeks ago, George parked his car on a lake while he was watching an iceboat race. During the race, the ice beneath his car unexpectedly gave way, and the car sank to the bottom of Losses and Loss Limitations 5-21 the lake. George wants to know whether he will be entitled to claim a casualty loss for the damage to his car. The facts of George’s case are similar to Rev. Rul. 69-88, 1969-1 C.B. 58. In the ruling, the taxpayer’s automobile was parked on the ice while he was ice fishing. A casualty loss was allowed for the purpose of claiming a deduction under § 165. Based on this ruling, I have advised George that he will be entitled to claim a casualty loss for the damage to his car. 2. John and Samantha’s plan to generate rent income that would then be offset by otherwise suspended passive losses is very creative. Unfortunately for John and Samantha, however, Reg. § 1.469-2(f)(6) holds otherwise. If property is rented to a nonpassive activity, such as John’s medical practice, then such gross rent income generated is treated as though it is not from a passive activity if the property is used in a trade or business activity in which the taxpayer materially participates. This Regulation would essentially eliminate the benefits that John and Samantha desire by treating the rent income as active income rather than passive. In a case involving an attorney whose law practice rented a building owned by the attorney and his wife, the validity of Reg. § 1.469-2(f)(6) was reviewed by a court. [Fransen v. U.S., 98-2 USTC ¶50,776, 82 AFTR 2d 98-6621 (D.Ct. La., 1998), affd. in 99-2 USTC ¶50,882, 84 AFTR 2d 99-6360, 191 F.3d. 599 (CA-5, 1999)]. The Court concluded that the Regulation is valid, in a fact pattern that is similar to John and Samantha’s. The IRS properly recharacterized as non-passive the attorney and wife's income from the rental activity. The income was treated as nonpassive because the building was rented by a trade or business (i.e., his law firm) in which he materially participated. The statute, legislative history, and the Regulation’s rationale showed that the Regulation did not arbitrarily negate § 469’s classification of rental activity as passive. 3. Smith, Raabe, and Maloney, CPAs 5191 Natorp Boulevard Mason, OH 45040 January 13, 2003 Mr. Lane Mitchell 77 Lakeview Drive Salt Lake City, Utah 84109 Dear Mr. Mitchell: I am responding to your inquiry regarding the current tax treatment of the investment in the minor league baseball team. As you have been unable to devote any time to the baseball 5-22 2003 Entities Volume/Solutions Manual club because of your full-time job, the activity will be characterized as passive. Consequently, the passive loss flowing from this investment will not be deductible since you have no passive income. But does this result change because your wife worked as an office receptionist in connection with the activity for about 20 hours a week during the year? Normally, participation by a taxpayer’s spouse is treated as participation by the taxpayer. [Temp. Reg. § 1.469-5T(f)(3)] Further, participation generally includes any work done by an individual in an activity that he or she owns. However, it does not include work if it is of a type not customarily done by owners and if one of its principal purposes is to avoid the disallowance of passive losses. [Temp. Reg. § 1.469-5T(f)(2)(i)] Under these circumstances, it appears that the work performed by your wife would not be counted in determining whether you are a material participant. [Temp. Reg. § 1.469-5T(k), Example 7] Consequently, you have not materially participated, either directly or through your wife’s efforts, and will not be considered to be a material participant. As a result, you unfortunately will not be allowed to deduct your share of the loss from the activity. If you have any questions regarding our conclusion or would like to discuss this further, please do not hesitate to call me. Sincerely, Joyce Guthrie, CPA 4. The Internet Activity research problems require that the student access various sites on the Internet. Thus, each student’s solution likely will vary from that of the others. You should determine the skill and experience levels of the students before making the assignment, coaching them where necessary so as to broaden the scope of the exercise to the entire available electronic world. Make certain that you encourage students to explore all parts of the World Wide Web in this process, including the key tax sites, but also information found through the web sites of newspapers, magazines, businesses, tax professionals, government agencies, political outlets, and so on. They should work with Internet resources other than the Web as well, including newsgroups and other interest-oriented lists. Build interaction into the exercise wherever possible, asking the student to send and receive e-mail in a professional and responsible manner. 5. See the Internet Activity comment above.