Statements and Ratio Analysis

advertisement

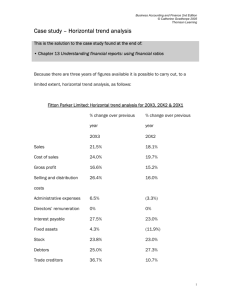

49

IX.

FINANCIAL STATEMENT ANALYSIS

Financial statements of a business must be analyzed and interpreted in order to

evaluate the financial condition of the company and the results of its operations.

Financial statement analysis provides information that is necessary to evaluate

the financial dimensions of management performance, detect emerging trends

and to help explain relationships contained in the basic financial statements. The

financial statements of Alamo Distributing Company will be analyzed in the

following sections. The analysis will concentrate on three major areas: A)

liquidity, B) profitability and C) capital structure.

A. Liquidity Ratios. Liquidity refers to the cash equivalence of assets and the firm's ability

to maintain sufficient near-cash resources to meet its obligations in a timely manner.

1. Current ratio: current assets

current liabilities

2. Quick Asset Ratio: cash + securities + A/R

current liabilities

3. Inventory turnover: cost of goods sold

inventory

4. Receivables turnover:

sales

accounts receivable

5. Working capital turnover:

sales

working capital

20X1

20X2

172,000

100,000

199,500

103,000

1.72

1.94

135,000

100,000

143,000

103,000

1.35

1.39

350,000

31,000

580,000

52,000

11.3

11.2

900,000

65,000

1,200,000

105,000

13.8

11.4

900,000

72,000

1,200,000

96,500

12.5

12.4

50

Overall Liquidity Evaluation

The ratios used to analyze liquidity must be evaluated as a group. The following

comparative ratios provide a composite basis for evaluating liquidity.

Alamo Distributing Company

Current ratio

Quick Asset ratio

Inventory turnover

Receivables turnover

Working Capital turnover

20X1

1.7

1.4

11.3

13.8

12.4

20X2

1.9

1.4

11.2

11.4

12.4

Change on Liquidity

Favorable impact

Essentially no change

Essentially no change

Negative impact

Essentially no change

The decrease in receivables turnover is the most negative factor in the liquidity evaluation.

The increase in receivables without a material change in current liabilities explains the

favorable trend in the current ratio. The decrease in receivables turnover will not cause a

major liquidity problem unless the firm must use short-term debt as a source of cash to

sustain operations in the next period. A projected cash flow analysis based on budgeted

sales for the next year would be necessary to evaluate this possible liquidity problem.

The increase in time required to collect receivables is shown by the alternative measure

(Days Sales Uncollected) which increased from 26.4 days to 32.0 days.

Alamo Distributing

Sales

÷ Accounts receivable

Receivables turnover

Days in a year

÷ Receivables turnover

Days Sales Uncollected

20X1

$900,000

÷ 65,000

13.8

====

365 days

÷ 13.8

26.4 days

=========

20X2

$1,200,000

÷105,000

11.4

====

365 days

÷ 11.4

32.0 days

=========

The longer collection period could indicate a problem with the collectability of receivables

or some change in credit policy. The liquidity effect of a decrease in receivables turnover

is that it takes a longer time period for the company to convert its receivables into cash.

51

B. Profitability Ratios - The principal objectives of profit- ability analysis are to evaluate

four critical factors related to profits: 1) operating efficiency; 2) asset productivity; 3)

rate of return on assets; and 4) rate of return on equity.

1. Operating Efficiency - A useful way to evaluate operating efficiency is to construct

a common sized income statement. In common size income statements, sales

are expressed as 100%, and all other items in the income statement are

expressed as a percentage of sales. Common size income statements for Alamo

Distributing Company are summarized in Exhibit 8.

EXHIBIT 8

ALAMO DISTRIBUTING COMPANY

*COMMON SIZE INCOME STATEMENTS

For Years Ending December 31, 20X1 and 20X2

20X1

20X2

Sales

100%

100%

Cost of Goods Sold

(39)

(48)

Gross Profit on Sales

61%

52%

Selling Expenses

(12)

(11)

Administrative Expenses

(26)

(21)

Income from Operations

22%

20%

Interest Expense

(6)

(5)

Income before Taxes

16%

15%

Income Tax Expense

(6)

(6)

Net Income

10%

9%

General Reference Items

20X1

20X2

% Change

Sales

$900,000

$1,200,000

+33%

Net Income

$ 90,000

$ 108,000

+20%

10%

9%

Net Income to Sales

* Developed from the income statements presented in Exhibit 2

52

Evaluation of Operating Efficiency

A company should attempt to achieve a given sales volume with the minimum possible cost.

Operating efficiency results are measured by relating expense items in the income statement

to sales on a percentage basis. In the common size income statement, sales are expressed

as 100%, and all other items in the income statement are expressed as a percentage of

sales. By relating all income statement items to sales, the common size statements permit

comparison of expense levels and profit measures on a relative basis. With amounts

converted to a percentage basis, it is easier to pinpoint areas of improvement or deterioration

in profitability.

In Exhibit 8, it is apparent that cost of goods sold has increased significantly as a percentage

of sales (from 39% to 48%). This change is responsible for the decrease in gross profit

percentage (from 61% to 52%). This decrease in profitability was partially offset by selling

and administrative expenses which decreased as a percentage of sales (from 38% on a

combined basis to 32%). The decrease in gross profit percentage could have been caused

by an increase in the cost of inventory that the firm was unable to pass on to customers in

the form of higher selling prices. The change in gross profit percentage could also be caused

by a shift in product mix such that a higher proportion of total sales is derived from less

profitable product lines. An investor or creditor that analyzes the income statements of

Alamo Distributing Company would see only the effect of decreasing profitability without

knowing the exact causes. Management of the company would know or could determine the

causes underlying the decreased profitability.

On a comparative basis, any of the percentage relationships in the common size income

statement can be evaluated separately. To concentrate on operating efficiency, three ratios

are important indicators.

Ratio

How Computed

Alamo Distr.

20X1

20X2

Gross profit margin

Gross profit ÷ sales

61%

52%

Operating expense ratio

Selling and admin.

expenses ÷ sales

38%

32%

Operating Profit Margin

Operating Income/Sales

22%

20%

Net profit margin

Net income ÷ sales

10%

9%

As an overall evaluation, operating efficiency declined during 20X2 compared with 20X1.

Principal factors were the decrease in gross profit margin (a negative factor), the decrease in

the operating expense ratio (a positive result), and the decrease in net profit margin (a

negative factor). The evaluation of operating efficiency is negative even though sales and

net income increased in dollar amount. In 20X2, 9¢ of every sales dollar was retained as

profit, whereas 10¢ of every sales dollar was retained as profit in 20X1.

53

2. Asset Productivity. Sales divided by assets measures the revenue productivity of

resources employed by a company. The revenue productivity of total resources is

an important factor in evaluating profitability. Asset productivity is measured by a

ratio called asset turnover. This ratio is computed as sales divided by total assets.

Alamo Distributing

Sales

÷ Total Assets

Asset Turnover

20X1

$900,000

750,000

1.20

20X2

$1,200,000

929,500

1.29

Some analysts prefer to use a measure of average assets for a period instead of

the total assets at a balance sheet date as done here. The balance sheet date

approach is simpler and will be used throughout the financial statement ratio

material in this chapter. The asset turnover ratios indicate that each dollar of

assets produced $1.20 of sales in 20X1 and $1.29 of sales in 20X2. The basic

concept of asset productivity is that resources are used to generate or support

sales volume.

3. Return on Assets. Profitability is affected by operating efficiency and asset

productivity. A comprehensive measure of profitability that considers both profits

and resources employed to earn profits is the rate of return on assets. Rate of

return on assets is computed as net income divided by assets.

Alamo Distributing

Net Income

÷ Total Assets

Rate of return on assets

20X1

$ 90,000

750,000

12.0%

20X2

$108,000

929,500

11.6%

Rate of return on assets is influenced by net profit margin and asset turnover.

The following equations show this relationship.

Return on Assets = (Profit Margin) X (Asset Turnover)

{Net Income} / {Assets} = ({Net Income} /{Sales}) X ({Sales}/{Assets})

({Net Income} / {Assets}) = {Net Income} / {Assets}

54

For Alamo Distributing Company, this relationship can be used to examine

the decline in rate of return on assets.

Alamo Distributing

For year 20X1

For year 20X2

Profit

Asset

Margin X Turnover

10%

1.20

9%

1.29

=

Return

on Assets

12.0%

11.6%

On a comparative basis, the rate of return on assets in 20X2 is not

significantly below the 20X1 ratio of 12.0%. The 11.6% rate of return on

assets in 20X2 is partly attributable to the improvement in asset turnover, or

otherwise rate of return on assets would have decreased significantly. In

general, the overall profitability of Alamo Distributing deteriorated in 20X2.

4. Return on Equity. Another rate of return measure that is significant to the

financial management of a company is rate of return on owners' equity. This

ratio is computed as net income divided by owners' equity.

Alamo Distributing

Net Income

÷ Owners' equity

Return on owners' equity

20X1

$ 90,000

338,000

26.6%

20X2

$108,000

426,000

25.4%

Return on owners’ equity measures the profitability of the owners' interest in

total assets. Return on equity is influenced by profit margin, asset turnover

and the relationship between total debt and owners' equity. If a firm

increases its assets with debt financing, then the owners' equity would

represent a smaller percentage of total resources. As profits increase in this

case, the return on owners' equity would also increase.

C. Capital Structure Ratios. The capital structure of a company refers to the

sources of financing used to acquire assets and is shown by the liabilities and

55

owners' equity section of the balance sheet. In analyzing capital structure, there

are two primary concerns: the amount of debt relative to the owners' equity; the

ability to service the principal and the interest requirements on debt. The

following ratios are useful in evaluating these considerations:

Capital Structure Ratios

Debt to Equity

How Computed

Total liabilities ÷ Total owners' equity

Times interest earned

Operating Income ÷ interest expense

Debt service margin

(Cash provided by operations) ÷

(installments due on long-term debt)

1. Debt to Equity Ratio. The proportion of total debt relative to equity is an

important indicator of the credit risk to which a company is exposed. Credit

risk is the possibility that interest and debt repayment cannot be satisfied with

available cash flows.

Alamo Distributing

Total liabilities

÷ Total owners' equity

Debt to equity ratio

20X1

$412,000

338,000

1.22

20X2

$503,500

426,000

1.18

For Alamo Distributing, the debt to equity ratio for 20X2 indicates that the firm

has $1.18 of liabilities for every $1.00 of owners' equity. The decrease in the

debt to equity ratio indicates that debt has become a smaller proportion of

total financing, as shown by the following percentage relationships.

Alamo Distributing

20X1

20X2

Total liabilities

Total owners' equity

Total Sources of Assets

55%

45

100%

54%

46

100%

2. Times Interest Earned. Interest on current and long-term liabilities is

reported in the income statement as an expense that is subtracted from

56

operating income. Income from operations must be sufficient to cover the

required interest expense before there can be profits to the stock- holders of

a corporation. "Times interest earned" is a ratio that indicates the adequacy

of income from operations to cover required interest charges.

Alamo Distributing

Income from operations

÷ Interest expense

Times interest earned

20X1

$202,000

52,000

3.88

20X2

$236,500

65,000

3.64

3. Debt Service Margin. This ratio measures the adequacy of cash provided by

operations to cover required annual installment payments on the principal

amount of long-term liabilities. As indicated in the earlier cash flow discussion, cash provided by operations should be viewed as a major source of

cash used to retire long-term debt. Long-term debt scheduled to mature in

annual installments will be classified as a current liability to the extent that

payments are due within one year from a given balance sheet date.

Alamo Distributing

Cash provided by operations

÷ Installment due on long-term debt

Debt service margin

20X1

*$285,000

60,000

4.75

20X2

$177,500

32,000

5.55

*(cash flow for 20X1 is an assumed amount)

For Alamo Distributing Company, the debt service margin for 20X2 indicates

that $5.55 of cash provided by operations was generated to service each $1

of long-term debt that will mature in the next year. This increase in debt

service margin from 4.74 to 5.55 indicates less pressure to use operating

cash flows for debt service purposes.

Comparative Evaluation in Statement Analysis

57

The analysis and interpretation of financial statements involve a process of

comparative evaluation. Measures of profitability, liquidity and capital structure

are studied to determine the existence of potential financial problems or failure to

achieve desired performance levels. One form of comparative evaluation is to

relate ratios for the current period to the same ratios for one or more past

periods. Most analysts believe that from three to five accounting periods are

required to provide an adequate comparative base. Reviews of past financial

performance should involve the current year (or interim period) and at least the

two preceding accounting periods of a comparable duration. For internal

analysis purposes, management will also compare actual financial results with

budgeted amounts to evaluate performance.

Financial statement ratios for a particular company may also be comparatively

evaluated in terms of industry standards. Industry standards are representative

measures for firms in the same line of business or industry. Industry standards

are available from trade associations and groups which compile financial

statement ratios for many industries. Financial statement studies for several

types of industry and business activity are published by Dun and Bradstreet and

Robert Morris Associates. For any given line of business, these studies will

report a median ratio for the survey group. The median ratio is usually

accompanied by two other measures showing the median of the upper 50% and

the median of the lower 50%. Financial statement ratios for manufacturing

companies in numerous industries are provided by the recent Dun and

Bradstreet summary in the supplementary section of the text.

For management purposes, the most relevant evaluation is to compare the most

recent financial results of the company with its past performance or planned

results. Comparison of actual results with past performance is a control

procedure designed to detect emerging problems or areas of company

operations requiring further investigation. Comparison of actual results with

budget amounts is also a control procedure that indicates relative accuracy of

planning systems and gives feedback that can improve future plans. Financial

analysis with the ratios illustrated in this chapter expands the information content

of the basic financial statements. Investors, creditors and other external users of

financial statements can use the same form of statement analysis to serve their

own information needs. Management uses the tools of financial statement

analysis to evaluate cash flows, liquidity, profitability and capital structure. The

primary difference is that management uses the information to control operations,

make decisions and develop future plans. Thus, financial statement analysis is

an integral part of management accounting.

Review Problem - Ratio Analysis

58

Refer to the Vann Corporation financial statements on the next page. Using the

budgeted financial statements for 20X3, compute the ratios listed below and

designate the comparative change in each ratio as favorable, unfavorable, or

essentially no change in relation to actual results for 20X2.

Ratio

20X2

1. Current Ratio

1.8

2. Quick asset ratio

.9

3. Accounts receivable

turnover (and Days)

20X3

Calculations Evaluation

16.0

4. Inventory turnover

(And Days Supply)

8.0

5. Working Capital turnover

8.7

6. Gross profit margin

17.0%

7. Operating profit margin

3.7%

8. Net profit margin

2.7%

9. Asset turnover

2.0

10.

Return on assets

5.4%

11.

Return on equity

10.9%

12.

Debt to equity ratio

1.0

13.

Times interest earned

3.7

14.

Debt service margin

1.7

VANN CORPORATION

COMPARATIVE FINANCIAL STATEMENTS

59

December 31, 20X2 and 20X3

Balance Sheets

20X2 20X3

(Actual) (Budget)

Cash

Accounts Receivable (net)

Inventory (at FIFO cost)

Prepaid Expenses

Increase

(Decrease)

$130,000

120,000

200,000

40,000

-----------$490,000

600,000

(140,000)

$950,000

$ 60,000

158,000

240,000

35,000

-----------$493,000

690,000

(185,000)

$998,000

($ 70,000)

38,000

40,000

(5,000)

-----------$ 3,000

90,000

(45,000)

$ 48,000

Total Liabilities

Common Stock

Retained Earnings

TOTAL LIABILITIES & EQUITY

$190,000

30,000

50,000

-----------$270,000

210,000

-----------$480,000

300,000

170,000

$950,000

$ 205,000

75,000

40,000

-----------$320,000

185,000

-----------$505,000

310,000

183,000

$998,000

$ 15,000

45,000

(10,000)

-----------$ 50,000

(25,000)

-----------$ 25,000

10,000

13,000

$ 48,000

Income Statements

Sales

Cost of Goods Sold

Gross Profit on Sales

Operating Expenses

Operating Income

Interest Expense

Net Income

20X2

$1,920,000

(1,593,600)

$ 326,400

(256,400)

$ 70,000

(19,000)

$ 51,000

Total Current Assets

Fixed Assets (at cost)

Accumulated Depreciation

TOTAL ASSETS

Accounts Payable

Notes Payable - current

Accrued Liabilities

Total Current Liabilities

Notes Payable - long-term

Retained Earnings

20X2

Balance, January 1

Net Income for year

Cash Dividends

Balance, December 31

$134,000

51,000

(15,000)

$170,000

20X3

$2,300,000

(1,955,000)

$ 345,000

(289,000)

$ 56,000

(21,000)

$ 35,000

20X3

$170,000

35,000

(22,000)

$183,000

VANN CORPORATION

CASH FLOW ANALYSIS

$380,000

(361,400)

$ 18,600

(32,000)

($14,000)

(2,000)

($16,000)

60

For Budget Year 20X3

Sources of Cash

Net income for 20X3

Adjustments to net income:

Depreciation expense

Increase in accounts receivable

Increase in inventory

Decrease in prepaid expenses

Increase in accounts payable

Decrease in accrued liabilities

Cash Provided by Operations

$35,000

45,000

(38,000)

(40,000)

5,000

15,000

(10,000)

$12,000

Other Sources of Cash:

Increase in notes payable - current

Increase in common stock

Total Sources of Cash

45,000

10,000

$67,000

Uses of Cash

Acquire fixed assets

Reduce notes payable - long-term

Cash dividends

Total Uses of Cash

Decrease in Cash Balance

$90,000

25,000

22,000

(137,000)

($70,000)

Summary of Cash Flow Analysis

Cash provided by operations

Less: Reductions in notes payable - long-term

Cash dividends

Balance available for investment

External financing: short-term debt

common stock

Cash available for investment

Cash invested: acquire equipment

Decrease in Cash Balance

$12,000

(25,000)

(22,000)

($35,000)

45,000

10,000

$20,000

(90,000)

($70,000)

FINANCIAL STATEMENT RATIO ANALYSIS

61

LIQUIDITY ANALYSIS

COMPUTATIONAL GUIDELINE

1) Current ratio

Current assets ÷ Current liabilities

T

2) Quick asset ratio

Quick assets ÷ Current liabilities

T

3)Accounts receivable

turnover

Sales ÷ Accounts

receivable

T

3a)

Days supply of receivables

(Days Sales Outstanding)

4) Inventory turnover

4a)

RESULT

365 ÷ ratio #3 =

(collection period)

days

Cost of goods sold ÷ Inventory

T

Days supply of inventory

5) Working capital turnover

365 ÷ ratio #4 (holding period)

days

Sales ÷ Working capital

T

PROFITABILITY ANALYSIS

6)

Gross profit margin

Gross profit ÷ Sales

%

7)

Operating profit margin

Operating income ÷

Sales

%

8)

Net profit margin

Net Income ÷ Sales

%

9)

Asset turnover

Sales ÷ Total Assets

T

10)

Return on assets

Net Income ÷Total Assets

%

11)

Return on equity

Net Income ÷ Equity

%

CAPITAL STRUCTURE ANALYSIS

12)

13)

14)

**

Debt to equity ratio

Times interest earned

Debt service margin

Total liabilities ÷

Owners' equity

T

NIBIT** ÷ Interest

expense

T

Operating Cash Flow ÷

Notes Payable (Current)

T

NIBIT stands for Net Income Before Interest and Taxes