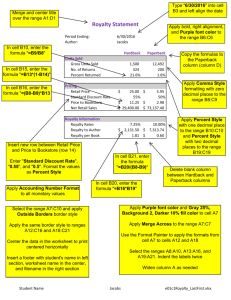

CHAPTER 14 : Royalty Processing

advertisement