New Diocesan Building Procedures

SECTION 7

Section 7.1

Section 7.2

Section 7.3

Section 7.4

VOLUNTARY AIDED SCHOOLS –

BUILDINGS AND CAPITAL

- Diocesan Policy on Buildings

- New Diocesan Building Procedures for

Voluntary Aided Schools

- Capital Framework for Voluntary Aided

Schools

- Gift Aid

SECTION 7.1

DIOCESAN POLICY ON BUILDINGS

1. The Diocesan Board of Education will represent the interests of all

Church of England schools, regardless of their status, in the statutory

Asset Management Planning process with LEAs.

2. Reflecting the requirement of the 1991 Diocesan Board of Education

Measure that governing bodies of Voluntary Aided schools must obtain the permission of the Board of Education before carrying out work on their school buildings, the Board will ensure the provision of specialist advice to consider all such requests before approval is granted. The

Board will work with governing bodies to ensure that Church schools remain fit for purpose in the provision of a high quality education for the

21 st Century and will encourage strongly the use of professional consultants by governors in undertaking their buildings responsibilities.

3. The Diocesan Board of Education will expect governing bodies and

1 where appropriate, the local church to raise the 10% contribution towards the cost of maintaining and improving the premises of

Voluntary Aided schools. It is recognised, however, that under certain circumstances, especially with a major capital building project, the costs involved may prevent this, in which case the Board will seek to provide financial support as far as possible from its own reserves, or help to facilitate support from other sources.

4.

The Diocesan Board of Education will, in line with the Church’s national policy, support the use of Private Finance Initiative (PFI) arrangements where these represent the most appropriate and cost effective means of achieving a major capital project at a Church of England school.

1 Section 7, p1

SECTION 7.2

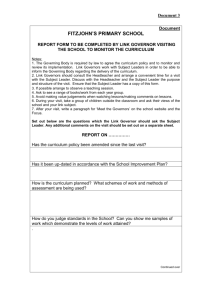

NEW DIOCESAN BUILDING PROCEDURES FOR VA SCHOOLS

This guidance has also been issued to all Diocesan approved consultants. It is part of the approved consultants role to undertake this process on behalf of the governing body.

Step1

Any alteration or repair of school premises costing more than £2,000

(excluding fees and VAT) may only be undertaken once the Governing Body have obtained written consent from the Diocesan Education Department. In order to avoid unnecessary preparatory work on any given scheme this approval should be sought prior to DfES approval.

The attached pro-forma should minimise any inconvenience caused by this additional requirement. School Consultants will normally complete this on the

Governor’s behalf although the Headteacher and Chair of Governors must authorise it by signing. It is essential that Governors agree to make their 10% contribution to each project. If governors are unable to do this then the

Diocesan Education Department should be notified.

Every effort will be made to ensure that Governing Bodies who are genuinely unable to afford their contribution are not excluded from accessing grant.

Step 2

Once Diocesan approval has been received the ‘VA/Approval’ application to proceed should be completed by School Consultants, signed by the Chair of

Governors and submitted to the DFES in the normal way.

Step 3

The Approval to Proceed (ATP) confirmation letter from the DfES should be copied and along with the relevant Claim Forms sent to: Stuart Harrison,

Assistant Director of Education, Education Department, Church House,

1 Hanover Street, Liverpool L1 3DW.

The Diocese will now make all claims on behalf of the Governing Body

Costs relating to Planning Applications and Building Regulations can be paid by the Consultant or directly by the Governing Body.

2

2 Section 7, p2

Step 4

All other invoices, which must be accompanied by a Payment Certificate, should be made out to the Governing Body of the School and forwarded to

Liverpool Diocesan Board of Education, PO Box 1092, Liverpool, L69

1ZT.

The Diocese will now pay all these invoices on behalf of the Governing

Body.

A batch payment will be made once a month. Invoices/Certificates received on or before the 15 th day of the month will be paid at the end of the following month.

3

3 Section 7, p3

SECTION 7.3

CAPITAL FRAMEWORK FOR VOLUNTARY AIDED SCHOOLS

SUMMARY OF THE CURRENT SYSTEM

1. The Regulatory Reform Order provides for a package of changes, which were introduced in 2002 and are summarised below

The policy on liabilities

2. The outcome of the consultation process supported the DfES of introducing arrangements which:

Are simple to administer

empower schools to take decisions at a local level:

place more of the funding in delegated school budgets: and

are more consistent with the allocation systems for other categories of maintained schools, whilst protecting the essential characteristics of the VA sector.

3. The detailed policies are designed to reflect those key principles, and to reduce the bureaucratic burdens for schools, governing bodies,

Dioceses, LEAs, other advisers, and the Department.

Capital work

4. VA governing bodies are liable for:

the existing buildings (internal and external);

those buildings previously known as ‘excepted’ (kitchens, dining areas, medical/dental rooms, swimming pools

, caretakers’ dwelling houses);

perimeter walls and fences, even if they are around the playing fields;

playgrounds;

furniture, fixtures and fittings;

other capital items (which can include boiler replacements and replacement of services).

4

4 Section 7, p4

5. LEAs are liable for:

playing fields

buildings on those fields and related to their use.

6. These liabilities are not specifically related to ownership. For example, governing bodies of those VA schools which were previously Grant

Maintained may now own the playing fields and associated buildings, but the LEA will be responsible for any work to them.

7.

Even if the LEA owns any of the ‘excepted’ buildings referred to above, the VA governing body is responsible for any capital work to them. To protect any such investment (in the event of the building being sold at some future point), the school will need to notify the LEA of any related capital expenditure. We would expect there to be an independent valuation of the building at the time of any disposal, and the Secretary of State would have the power to intervene if agreement on sharing the proceeds could not be reached.

8. Teachers’ dwelling houses remain the liability of the trustees (not the

VA governing body or the LEA).

Revenue work

9. All revenue work to the premises is LEA liability, but the funding is normally delegated to schools in Fair Funding budgets. There is, therefore, no statutory governing body contribution to revenue work, and there is no need to continue the Formula Repair grant which was previously paid to VA schools for revenue expenditure on their liabilities. An adjusting payment is being made to LEAs, through the

Department’s Standards Fund, in recognition of the additional revenue commitment for Authorities.

The policy on funding

10. The standard rate of grant support to VA school governing bodies from the Department has increased to 90%. This is intended to help meet the ongoing costs of the additional liabilities which are being taken on by VA governing bodies.

11. The DfES will pay grant at 100% of the agreed costs of any conditionrelated backlog work required in excepted buildings at the point of transfer of liability (1 April 2002); any capital work arising thereafter would be funded at the 90% rate in the usual way. This funding programme will be available for a maximum of 5 years, to enable all work to be assessed, agreed and funding approved.

5

5 Section 7, p5

12. The Department has the power to pay grant at up to 100% in exceptional circumstances. The power for LEAs to assist with governing body contributions has been retained.

Other changes

13. The DfES have introduced three other significant improvements:

grant can be paid on receipt of approved invoices or equivalent documentation, rather than having to be paid by the school (or

Diocese/LEA) and then reimbursed by the Department. We will, however, need to see all receipts at final costs stage;

providing a broad definition of capital expenditure, removing the previous prescriptive list, giving more local decision-making and flexibility in the choice of funding to be used;

there is a ‘de minimis’, or minimum, level of £2,000, below which any expenditure, even if it would otherwise be regarded as being of a capital nature within the broad definition, cannot be met from capital funds.

14. The legislation will provide for future revision, if required, of the definition of capital and the de minimis level.

6

6 Section 7, p6

DEFINITION OF CAPITAL EXPENDITURE

“Capital expenditure” means expenditure on :

(a) the acquisition, reclamation, enhancement or laying out of any land;

(b) the acquisition, construction, preparation, enhancement, replacement or demolition of any building or part of a

7 building (including any fixtures and fittings affixed to a building), wall, fence or other structure, or any playground or other hard-standing;

(c) the acquisition, installation or replacement of any moveable or immovable, plant, machinery, apparatus or furniture; used or intended to be used for the purposes of the school.

“enhancement”, in relation to any asset, means the carrying out of works which are intended:

(a) to lengthen substantially the useful life of the asset; or

(b) to increase substantially the open market value of the asset; or

(c) to increase substantially the extend to which the asset can or will be used for the purposes of or in connection with the school concerned.

7 Section 7, p7

TARGETED CAPITAL FUND

Outline

Bids for additional funding can be made for support under the Targeted

Capital fund (TCF). TCF is a relatively limited programme and is intended to support projects which contribute directly to meeting the Government’s educational priorities, and which might not otherwise be supported through formulaic allocations to LEAs and schools. Guidance relating to an allocation round is issued to LEAs and Dioceses at the appropriate point each year.

LEA CO-ORDINATED VA PROGRAMME (LCVAP

)

Outline

This is the main funding programme available to the VA sector in financial year 2004/05. There are no limits on the size of a project that can be supported via LCVAP, nor any restrictions on the type of capital project, as long as the capital work is g overnors’ liability.

The DfES have announced indicative levels of LCVAP in 2004-05 and 2005-

06. This will assist with the planning of capital projects, to ensure that the available grant is fully spent by the VA sector for the next three years.

Detail

Each LEA is asked to co-ordinate, in consultation with local partners (eg dioceses, schools not associated with a diocese), the allocation of the programme according to local needs and priorities. This allocation process should take account of priorities identified in each LEAs Asset Management

Plan (AMP).

Co-ordination of the programme should also take into account those projects that have slipped expenditure into 2004/5.

When deciding which new projects should be funded through LCVAP, local partners will consider the amount of Devolved Formula Capital (DFC) held by schools. It may be appropriate to ask those schools to contribute some, or all, of their allocation towards the costs of the LCVAP projects. This will ensure that schools do not hold large amounts of unallocated DFC, and that the

LCVAP programme funds as much work as possible.

8

8 Section 7, p8

Things to Remember

LCVAP funding must be spent in the year it is allocated otherwise it becomes a commitment in the following year. The impact of this is that fewer new projects can be supported in the following year.

Consider phasing projects over two years if that best suits the projects built period. In this way, additional projects can be supported in both years.

LCVAP can support all types of c apital work as long as it is governors’ responsibility. There is a minimum project cost of £2,000 but no maximum project cost.

9

9 Section 7, p9

DEVOLVED FORMULA CAPITAL (DFC)

10

Outline

DFC is a formula based grant available to most VA schools. Exceptions are as follows:

schools that open in, or move into, completely new buildings will have their DFC withdrawn in the first three years;

schools that enter into a PFI contract will have their DFC withdrawn from the year following the contract signing, and is resumed in the third year after the service is started, but at 50% of the formulaic rate.

The only limit on the size of a project that can be supported by DFC relates to the amount of DFC that can be accumulated by a school. There are no restrictions on the type of capital project that can be supported by DFC, as long as the capital work is governors liability. Decisions should also take account of priorities identified for the school in the LEA’s AMP.

2003/2004 Standard

Amount

£11,300

+ 17.5% for

VAT = VA

100%

£13,277

90% grant

£11,950

Governing

Body 10% contribution

£1,328 Lump Sum

Per Pupil

Amount

Primary

Secondary

SEN (all schools)

£42.40

£63.60

£127.20

£49.82

£74.73

£149.46

£44.84

£67.26

£134.50

£4.98

£7.47

£14.95

2004/2005 Standard

Amount

£12,750

+ 17.5% for

VAT = VA

100%

£14,981

90% grant

£13,483

Governing

Body 10% contribution

£1,498

Lump Sum

Per Pupil

Amount

Primary

Secondary

SEN (all schools)

£48.00

£72.00

£144.00

£56.40

£84.60

£169.20

£50.76

£76.14

£152.28

£5.64

£8.46

£16.92

10 Section 7, p10

2005/2006

Lump Sum

Per Pupil

Amount

Primary

Secondary

SEN (all schools)

11

Standard

Amount

£13,150

£49.40

£74.10

£148.20

+ 17.5% for

VAT = VA

100%

£15451

£58.05

£87.07

£174.14

90% grant

£13,906

£52.24

£78.36

£156.72

Governing

Body 10% contribution

£1,545

£5.80

£8.71

£17.41

11 Section 7, p11

Features

Roll forward – it is possible to roll forward your allocation into the following financial year. You can roll forward a year allocation for a maximum of three financial years. For example, any grant rolled forward from the 2001/02 allocation must be claimed by March 2004, grant rolled forward from the

2003-04 allocation must be claimed by March 2006.

If you do not spend your allocation within the three year period, it will be lost.

Anticipate

– it is possible to anticipate some or all of your 2004-05 and 2005-

06 allocations into 2003-04. The calculation will be based on the formula parameters outlined in the table above, using Jan 2002 Annual Census Data.

However, if you do anticipate, it will be added to your initial allocation for

2003-04. You must therefore spend it all by the March of the three year period; e.g.

£10,000 initial 2003-04 anticipate £5000 from 2004-05, therefore

£15,000 must be spent by march 2006.

Clustering – it is possible for a number of schools to decide to pool some, or all, of their 2003-04 DFC. Donating schools would be giving up an amount of their DFC and passporting this to the receiving school. The receiving school must spend all this clustered funding in the year it has been received.

If you do decide to cluster, you will need to let the DfES and the Diocese know. It is the responsibility of the recipient school to ensure that the necessary form VA/FC (cluster) are completed and sent to us. We would

12 advise that you send these forms, along with form VA/Approval for the work that is to be undertaken with the pooled funding.

Detail

DFC can be used for small-sca le capital work that exceeds £2,000. It can also be used as a contribution towards a larger project funded through another programme.

Once a school has decided on how DFC will be spent, the school/diocese will then need to proceed with the project in line with the DfES handling arrangements.

12 Section 7, p12

Things to remember

DFC can be rolled forward but it must be spent within three years of when it was allocated e.g. 2002-03 allocation must be spent by March 2006.

DFC can be anticipated from a future year, but it must be spent in line with the three year period to which it was added.

DFC can support all types of capital work a s long as it governors’ responsibility. There is a minimum project cost of £2,000 but not maximum project cost.

VASIS can be used to monitor your DFC allocation and to warn you if you are about loose any DFC because of the three year rule deduction.

13

13 Section 7, p13

FUNDING IN EXCEPTIONAL CIRCUMSTANCES

Outline

With the changes introduced in April 2002, the DfES now has the power to pay VA capital grant at up to 100% in exceptional circumstances. LEAs will continue to have a power to assist VA school governing bodies with their contributions towards normal capital projects. The following suggest what might be regarded as exceptional circumstances in which up to 100% grant support might be appropriate.

Suggested circumstances

The LEA makes a strong case for a major reorganisation across the whole, or a significant part, of the Authority (e.g. changing from 3 tier to 2 tier school system).

DfES Ministers introduce a top-down initiative which applies to VA schools in the same way as other categories of schools.

A complete and unpredicted failure of a major service in the first two years of operation of the new liabilities and funding arrangements.

A statutory proposal, prepared on the basis of the funding and liabilities arrangements pre April 2002 that is approved by the School

Organisation Committee and involves a major element of LEA liability.

The DfES would not regard the following as exceptional;

When a governing body cannot afford its contribution towards a conventional capital project;

A one-off reorganisation affecting only a small number of schools which is not part of a larger reorganisation initiated by the LEA or Diocese;

A Surplus place removal project at an individual school;

Any projects where the contribution is less than £10,000 for a primary school, or £20,000 for a secondary school.

14

14 Section 7, p14

EXCEPTED BUILDINGS PROGRAMME

Outline

The DfES arranged for a survey of all schools that were VA on 31st March

2002 and which have what were previously referred to as ‘excepted’ buildings, to assess any backlog of condition work relating to the change in liability for these buildings from LEA’s to the schools governing body. These buildings are

School kitchens;

School dining halls

Swimming pools

Medical/dental inspection rooms and

Caretaker’s houses

These condition surveys were carried out to an agreed DfES specification and all schools will have received a copy of the survey results. Key features of the survey were;

The funding is to bring the specified buildings up to an acceptable condition;

It is not to provide facilities which currently do not exist;

The funding will be paid at 100% of the assessed costs, so there is no need for the statutory 10% governors contribution.

You will have received an allocation letter along with the survey results. This letter outlines the amount of funding that is allocated to the school to deal with the identified work.

Process

You may decide that an alternative solution to straightforward repair or renewal could offer better value for money. With projects of this type, any shortfall in funding would need to be found from a suitable alternative source.

For example, if the LCVAP programme is used, grant support for that part of the project would be at 90%.

For projects where the funding stream is not solely excepted buildings, and the majority of funding is from an alternative funding stream, the project must be submitted in line with the existing guidance and category limits.

Where the work identi fied has a net total below the £2,000 de minimis, you can complete the work and claim grant support direct from the Capital Team using VAEB/Small Claim.

15

15 Section 7, p15

Swimming pools have formed part of the survey. The summary report will provide details of the costs associated with the condition backlog and, where appropriate, demolition costs. Before investing what might be large sums of money in repairing swimming pools, VA governing bodies should ensure that they can provide the necessary level of on-going specialist maintenance.

Things to Remember

Funding under this programme is cash limited. If after allowing for any quarterly increase in the public sector price index, tenders exceed cash limits, any difference should be met from an alternative funding stream.

Use form VAEB/Approval to obtain approval for the work, if the majority of the funding is from the excepted building programme. Alternatively, use form

VA/Approval to obtain approval for work, if the majority of the funding is from other funding streams.

Your school consultant will undertake this work on the Governing

Body ’s behalf.

16

16 Section 7, p16

SCHOOLS ACCESS INITIATIVE (SAI)

Outline

For new projects starting in 2004-5, these will be administered through

LCVAP as the funding has been joined with other formulaic funding streams to provide a single pot to assist local decision making.

Existing SAI projects that have work carried forward into the 2003-04 financial year do not need to be funded from LCVAP and therefore grant can still be claimed in the normal way. Please ensure you progress these projects as quickly as possible.

17

17 Section 7, p17

LEA Notification on AMP Implications

After the project is completed the Local Authority must be informed of the following so that they can update the Schools Asset Management Plan.

Update Floor Area (Increase/Decrease) Original New

Update Sufficiency Data

Update AMP Condition Survey

Update Asbestos Register

Comments

Signed Headteacher

School Consultant

Original

Date

Date

New

VAT

TOTAL

Education

Department

School Building Capital Work proposals requiring Diocesan Board of Education approval.

SCHOOL

NAME:

DESCRIPTION OF PROPOSED PROJECT:

ESTIMATED COST: PROPOSED FUNDING SOURCES:

Financial

Years

Buildings Work

Furniture & Equipment

Professional Fees

£

Formula Capital

School Reserves

Seed Challenge

LCVAP

Access Initiative

Private Funding

Others (State)

TOTAL

03/04 04/05 05/06

Do the Governing Body agree to meet their 10% liability on this scheme ? Yes/No

Proposed Start Date: Proposed Completion Date:

Consultant:

Fire Officers Report Requested

Planning Permission Required

Asbestos Implications

YES/NO

YES/NO

YES/NO

EXISTING

(m ) (sq.m)

Teaching Area:

Non-Teaching Area:

Gross Floor Area:

Reasons for Project/Current Problems/Evidence of Need

PROPOSED

(sq.m)

Outputs/How Building Improvements Will Assist in Raising Standards

Do the proposed works resolve premises-related issues identified by the Asset Management

Plan assessments regarding:

(i) Condition ie physical state of the premises

(ii) Suitability ie "fitness for purpose" of internal spaces/external areas

(iii) Sufficiency ie area of building and grounds

Signed Headteacher

YES/NO

YES/NO

YES/NO

Date

Chair of Governors

School Consultant

PLEASE RETURN TO :

Stuart Harrison,

Assistant Director of Education,

Church House,

1 Hanover Street,

Liverpool.

L1 3DW.

For office use:

Diocesan Board of Education Approval

Notification of Approval posted

Date

Date

Date

Date

SECTION 7.4

GIFT AID

School Consultant

Example Inland Revenue Registration Letter

IR (Charities)

Titles Section

St John’s House

Merton Road

Bootle

Merseyside

L69 9BB

Date

Dear

Re: Name of School

The above Church School within the Diocese of Liverpool would like to take advantage of the Gift Aid legislation with regard to charitiable donations made to the school. The school should have exempted status as it is both religious and educational.

I would be grateful if you could register the school, and allocate an appropriate reference number. I can send a copy of the Instruments of

Government and the Articles for the school if required.

Please contact me if you require any documentation concerning the registration.

I look forward to hearing from you in due course.

Yours sincerely

Name

Example thank you letter

Dear

I am writing on behalf of the school to thank you for your donations over the past year, which has been made under Gift Aid. The amount on which we will cl aim tax from the Inland Revenue on your behalf is £ … I am also writing to ask if you could let me know if your taxable status has changed over the past year, or will change during the next, as I would not wish to claim anything to which we were not entitled. Once again, many thanks for your giving under Gift Aid. The school children really benefit from the additional facilities parent’s support enables us to provide, the tax we receive from the Inland Revenue is a very welcome benefit.

Draft letter to parents

Dear

I am writing to you as a parent to tell you about Gift Aid and to ask you to consider making a commitment to Gift Aid to our school. There have been tax changes introduced by the Chancellor that allow tax to be claimed back under Gift Aid for any donations by tax payers.

So I am writing to invite you to complete a Gift Aid Declaration, as I know that you support the school with regular donations. If you would like to take advantage of the new relaxed arrangements for tax efficient giving that allow us to claim an additional 28 pence for every pound you give, then please complete the Declaration. The only additional requirement of you will be to make your donations either by cheque or in an envelope with your name and the date marked on the outside. This will cost you nothing and will help us a great deal, in order that we can help your children.

Thanking you in anticipation of your assistance.

Yours sincerely

MODEL GIFT AID DECLARATION

Gift Aid declaration

Name of Charity…………………………………………………………………….

Details of donor

Title…….Forename(s)…………………………………Surname……………………………

Address…………………………………………………………………………………………

…………………………………………………………………………………………

…………………………………………Post Code………………………………….

I want the charity to treat

* the enclosed donation of £………………….

* the donation(s) of £……………..which I made on ……/……/……

* all donations I make from the date of this declaration until I notify you

otherwise

*all donations I have made since 6 April 2000, and all donations I make

from the date of this declaration until I notify you otherwise as Gift Aid donations.

*delete as appropriate

Signature…………………………………..Date……/……/……

See overleaf for notes