Accounting 30S - Pembina Trails School Division

advertisement

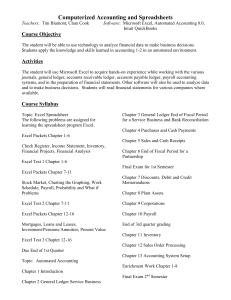

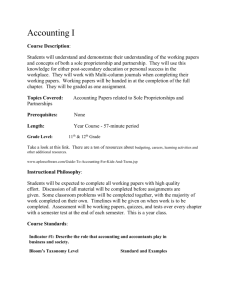

Accounting Principles 30S Course Outline Teacher: Mr. Doyle Room: 236 Textbook: Principles of Accounting 2nd edition (D’Amico) Software: Excel The students will also use the Intranet for material. Accounting 30S is a very practical course which develops work skills that you can take with you after leaving school. This course has a lot of content and some math involved. We will also be using Excel spreadsheets in the class. This is an introductory-level course for students who want to learn about manual and computerized accounting systems. General Learning Outcomes: Upon completion of the Accounting Principles 30S course, students will: Understand the nature of accounting and the accounting cycle. Demonstrate accounting-related skills, including analysis and interpretation. Use the processes of accounting for problem solving and decision making. Demonstrate knowledge about the integration of accounting and technology. Use technology to enhance accounting procedures. (Excel) Pursue interests that lead to an enriched lifestyle and life-long learning. Expectations: All students must attend class regularly and be on time. Use of cell phones is prohibited. Use of music players is at the discretion of the teacher. All assignments must be submitted on time. Proper use of computer equipment is mandatory at all times. Any test or quiz that is missed without proper justification will result in a mark of zero. Evaluation: Projects, quizzes and tests are 70% of the final grade. A final exam is held during exam week that is 30% of the final grade. If a student has a mark of 75% or more, he or she will be exempt from the exam. NOTE: There is one exception to this rule—if a student has cheated in any way, he or she will write the exam, regardless of their mark. Tests and quizzes account for about 60% of the mark. Assignments saved in their respective computer folder account for about 40% of the mark. 1 Specific Outcomes for Accounting 30S: Students will be introduced to manual accounting procedures to provide an understanding of the accounting concepts, principles and processes. These manual accounting procedures are used in a computerized accounting environment on an ongoing basis using Microsoft Excel. Simply Accounting may be introduced in a progressive way towards the end of the course. Unit 1: Accounting Principles (5 weeks) Students will demonstrate the skills necessary to: 1.1. 1.2. 1.3. 1.4. 1.5. 1.6. 1.7. 1.8. 1.9. Determine & calculate the accounting equation. Define & explain the purpose of a balance sheet. Prepare a balance sheet. Analyze changes in the Accounting Equation Record changes in the financial position of a business. Record transactions into t-accounts using the debit and credit rules for assets, liabilities and owner’s equity. Calculate new balances in the ledger. Prepare a trial balance. Prepare an updated balance sheet after changes in the financial position has changed. Unit 2: The Income Statement (3 weeks) Students will demonstrate the skills necessary to: 2.1 2.2 2.3 2.4 2.5 2.6 Define the profit and loss of a business. Prepare an income statement. Understand the debit and credit rules for income statement accounts. Record changes in revenue and expense accounts. Prepare an updated trial balance and income statement. Prepare a balance sheet in report form. Unit 3: Journals & Ledgers (3 weeks) Students will demonstrate the skills necessary to: 3.1 3.2 3.3 Utilize the general journal. Post to the ledger from the journal. Identify and utilize the subsidiary ledgers. 2 Unit 4: The Worksheet (3 weeks) Students will demonstrate the skills necessary to: 4.1 4.2 4.3 4.4 4.5 4.6 Prepare a six column worksheet. Prepare financial statements from a six column worksheet. Analyze financial statements. Journalize adjusting closing entries. Post closing entries to the ledger. Prepare a post closing trial balance. Unit 5: Cash Control (2 weeks) Students will demonstrate the skills necessary to: 5.1 5.2 5.3 5.4 5.5 5.6 5.7 5.8 Understand how to manage cash receipts. Understand sales and goods and services tax. Calculate sales and goods and services tax. Prepare a multicolumn journal. Establish and replenish a petty cash account. Understand the principles of banking at financial institutions. Understand a bank reconciliation statement. Prepare a bank reconciliation statement. Unit 7: Payroll (3 weeks) Students will demonstrate the skills necessary to: 7.1 7.2 7.3 7.4 Define and understand the fundamentals of the payroll system. Understand how to pay employees of a business. Determine payroll deductions. Prepare payroll liabilities and expenses. 3