Automated Accounting 3-4

Computerized Accounting and Spreadsheets

Teachers : Tim Biamont, Clara Cook Software : Microsoft Excel, Automated Accounting 8.0,

Intuit QuickBooks

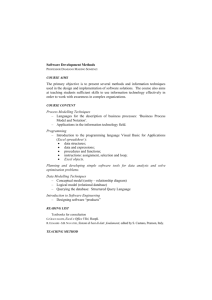

Course Objective

The student will be able to use technology to analyze financial data to make business decisions.

Students apply the knowledge and skills learned in accounting 1-2 in an automated environment.

Activities

The student will use Microsoft Excel to acquire hands-on experience while working with the various journals, general ledger, accounts receivable ledger, accounts payable ledger, payroll accounting systems, and in the preparation of financial statements. Other software will also be used to analyze data and to make business decisions. Students will read financial statements for various companies where available.

Course Syllabus

Topic: Excel Spreadsheet

The following problems are assigned for learning the spreadsheet program Excel.

Excel Packets Chapter 1-6

Check Register, Income Statement, Inventory,

Financial Projects, Financial Analysis

Excel Test 1 Chapter 1-6

Excel Packets Chapter 7-11

Stock Market, Charting the Graphing, Work

Schedule, Payroll, Probability and What if

Problems

Excel Test 2 Chapter 7-11

Excel Packets Chapter 12-16

Mortgages, Loans and Leases,

Investment/Pensions/Annuities, Present Value

Excel Test 3 Chapter 12-16

Due End of 1st Quarter

Topic: Automated Accounting

Chapter 1 Introduction

Chapter 2 General Ledger Service Business

Chapter 3 General Ledger End of Fiscal Period for a Service Business and Bank Reconciliation

Chapter 4 Purchases and Cash Payments

Chapter 5 Sales and Cash Receipts

Chapter 6 End of Fiscal Period for a

Partnership

Final Exam for 1st Semester

Chapter 7 Discounts, Debit and Credit

Memorandums

Chapter 8 Plant Assets

Chapter 9 Corporations

Chapter 10 Payroll

End of 3rd quarter grading

Chapter 11 Inventory

Chapter 12 Sales Order Processing

Chapter 13 Accounting System Setup

Enrichment Work Chapter 1-8

Final Exam 2 nd Semester

Course Goals

1.

Students will learn to build basic accounting worksheets entering text, numbers and formulas using Microsoft excel.

2.

Students will maintain the accounting records related to the recording, summarizing and reporting phases of the accounting cycle, and interpret the resulting financial information using worksheets and various types of charts.

3.

Students will use vocabulary associated with spreadsheets, accounting principles and the types of computerized software they are using.

4.

Students will maintain accounting records related to taxes, bad debts, debts and depreciation.

5.

Students will maintain accounting records related to inventory control, notes prepaid expenses, unearned revenue, accrued revenue and expenses.

6.

Students will acquire knowledge of the partnership and corporation forms of business ownership and procedures used for income distribution applied to each type.

7.

Students will identify the differences between manual and computerized accounting and understand the differences in software operation.

8.

Students will work with a computerized accounting system to complete general ledger, accounts receivable, and accounts payable ad payroll problems.

9.

Students will acquire a foundation for further study and recognize training and employment opportunities for all cultural/ethnic groups in business and industry.

Evaluation

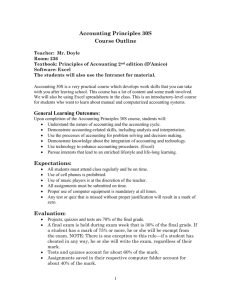

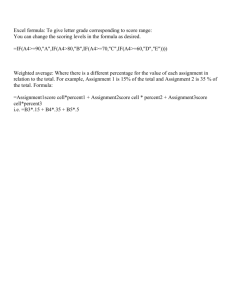

Students will be graded on the completion of assignments, class participation, and test results. Some assignments will be completed outside of class.

Comments

The course prepares students for entry-level positions in accounting and/or continued education at the post-secondary level. Students are qualified to enroll in the Cooperative Work Experience Program.

Successful achievement in this course can qualify for college credit.