Spring 2005 Exam #2

advertisement

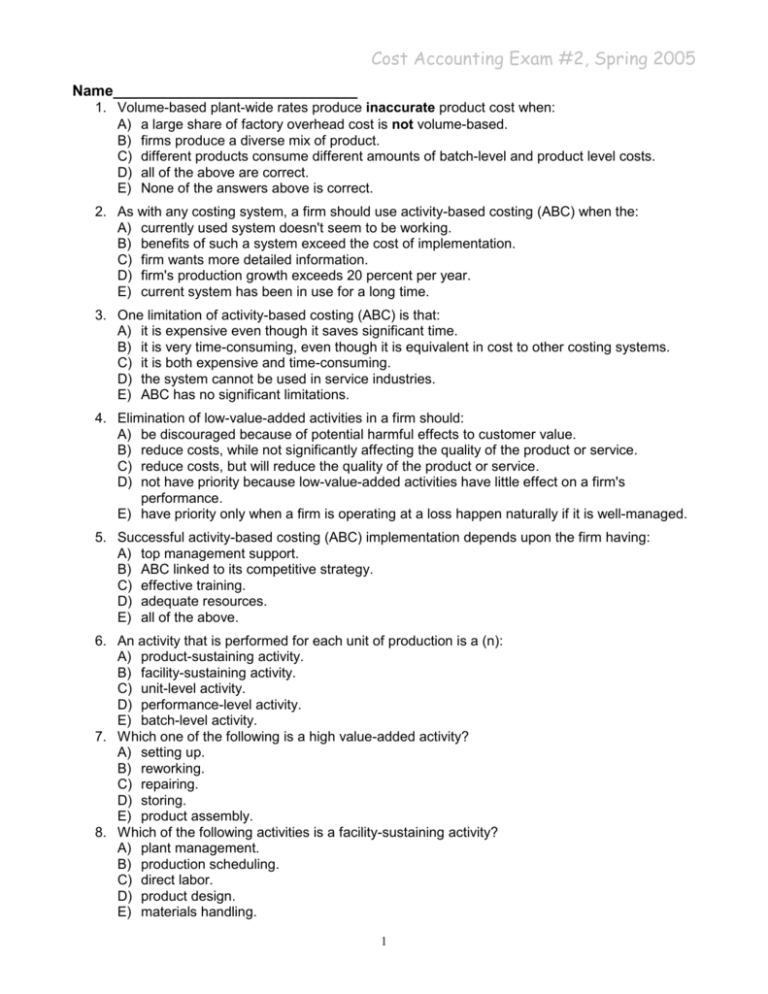

Cost Accounting Exam #2, Spring 2005 Name_____________________________ 1. Volume-based plant-wide rates produce inaccurate product cost when: A) a large share of factory overhead cost is not volume-based. B) firms produce a diverse mix of product. C) different products consume different amounts of batch-level and product level costs. D) all of the above are correct. E) None of the answers above is correct. 2. As with any costing system, a firm should use activity-based costing (ABC) when the: A) currently used system doesn't seem to be working. B) benefits of such a system exceed the cost of implementation. C) firm wants more detailed information. D) firm's production growth exceeds 20 percent per year. E) current system has been in use for a long time. 3. One limitation of activity-based costing (ABC) is that: A) it is expensive even though it saves significant time. B) it is very time-consuming, even though it is equivalent in cost to other costing systems. C) it is both expensive and time-consuming. D) the system cannot be used in service industries. E) ABC has no significant limitations. 4. Elimination of low-value-added activities in a firm should: A) be discouraged because of potential harmful effects to customer value. B) reduce costs, while not significantly affecting the quality of the product or service. C) reduce costs, but will reduce the quality of the product or service. D) not have priority because low-value-added activities have little effect on a firm's performance. E) have priority only when a firm is operating at a loss happen naturally if it is well-managed. 5. Successful activity-based costing (ABC) implementation depends upon the firm having: A) top management support. B) ABC linked to its competitive strategy. C) effective training. D) adequate resources. E) all of the above. 6. An activity that is performed for each unit of production is a (n): A) product-sustaining activity. B) facility-sustaining activity. C) unit-level activity. D) performance-level activity. E) batch-level activity. 7. Which one of the following is a high value-added activity? A) setting up. B) reworking. C) repairing. D) storing. E) product assembly. 8. Which of the following activities is a facility-sustaining activity? A) plant management. B) production scheduling. C) direct labor. D) product design. E) materials handling. 1 Cost Accounting Exam #2, Spring 2005 9. A company using a volume-based overhead assignment (allocation) method will tend to: A) overstate the cost of low volume and low complex products. B) understate the cost of low volume highly complex products. C) understate the cost of high volume simple products. D) understate the cost of all products. E) either understate or overstate the cost of high volume products depending on the specific manufacturing factors involved. 10. Using a plant-wide overhead rate based on machine hours to assign manufacturing overhead to a product line that uses relatively low machine hours is likely to: A) Overapply overhead to that product line. B) Underapply overhead to that product line. C) Understate direct labor costs. D) Overstate direct labor costs. E) Either over- or under-apply overhead to the product line depending on other factors. 11. Which of the following is a benefit of activity-based costing? A) Motivation to reduced cost drivers that cause overhead costs to be incurred. B) lower costs to implement than traditional systems. C) Facilitate better employee morale. D) Fewer cost drivers than volume-based costing systems. E) More streamlined manufacturing processes. 12. Regression analysis is better than the high low method of cost estimation because regression analysis: A) is mathematical. B) can provide greater precision and reliability C) fits its data into a mathematical equation. D) takes more time. E) seems more precise in its execution. 13. The independent variable in regression analyses is: A) the cost to be estimated. B) the cost driver used to estimate the value of the dependent variable. C) hard to define because of its independence. D) usually expressed as a range of values. E) not always necessary to perform regression analysis. 14. High-low and regression cost estimation methods are alike in that they both: A) have an intercept term and a slope term. B) have an intercept term but not a slope term. C) have a slope term but not an intercept term. D) use all data points. E) use only a few selected data points. 15. The learning curve in cost estimation is a good example of: A) non-linear cost behavior. B) machine-intensive production. C) simple regression. D) a random variable. E) inefficient labor. 2 Cost Accounting Exam #2, Spring 2005 Problem 1 The controller for Catherine’s Cooking Oil Co. established the following overhead cost pools and cost drivers: Budgeted Estimated Overhead Cost Pool Overhead Cost Driver Cost Driver Level Machine setups $143,000 #of setups 110 setups Material handling 124,800 # of barrels 7,800 barrels Quality control 316,200 # of inspections 1,020 inspections Other overhead cost 172,500 # of machine hrs 11,500 machine hrs Total $756,500 An order of 800 barrels of cooking oil used: Direct materials costs Direct labor costs Machine setups Material Handling Quality inspections Machine hours $30,000 $20,000 10 setups 780 barrels 104 inspections 980 machine hours Required: (A) What is the overhead rate per machine hour if the number of machine hours is used as a single cost driver under a traditional costing system? (B) Utilizing traditional costing, how much overhead is assigned to the order based on machine hours as a single cost driver? (C) Utilizing ABC, how much total overhead is assigned to the order? (D) Utilizing ABC, how much is the total cost for this order? (E) Which method do you prefer and why? 3 Cost Accounting Exam #2, Spring 2005 Problem 2 Jessica's Compact Disc Store expanded the size of its store in Westfield, NJ two months ago. The owner, Jessica, has asked you to develop an analysis of the cost structure in her store, but you only have two months of data. She provides you with account data for the two months, which she explains is representative of what these costs are in most months of the year. She sold 1,100 CDs in September and 890 CDs in October. This month (November) Jessica expects to sell 1,000 CDs. Total Costs September (1,100 CDs) October (890 CDs) $13,652 $11,653 Required: (A) Develop the cost equation for total costs of Jessica’s store, using the high-low method, assuming that the cost driver is the individual compact disc. (B) What are the predicted total costs for November? 4 Cost Accounting Exam #2, Spring 2005 Problem 3 Dean G’s Manufacturing recently completed and sold their first order. The order included 50 units that had the following costs. Direct materials Direct labor (1,000 hours @ $8.50) Variable overhead (1,000 hrs. @ $4.00)* Fixed overhead* 1,500 8,500 4,000 2,400 $16,400 * Applied on the basis of direct labor hours Dean G’s Manufacturing has now been requested to prepare a bid for 150 units of the same product. Required: A. If an 80 percent learning curve is applicable, estimate Dean G’s total cost on this order. B. What is the cost per unit on the first 50 units? C. What is the cost per unit for the order of 150 units? 5 Cost Accounting Exam #2, Spring 2005 Problem 4 Diploma Mill University (DMU) is a 5,000 student state-supported, four-year institution located in the middle of nowhere. Physical facilities can accommodate another 1,000 students, and the college administration is attempting to estimate the added yearly cost of educating the 1,000 additional students. The Business Manager of DMU has asked you to evaluate two linear regressions given below, and recommend the better one to her. Regression A is based on a students being the cost driver and Regression B is based on the number of sections being the cost driver. The Business Manager estimates that 1,000 additional students would require 200 additional sections to be added per year. DMU currently offers 1,000 sections per year. Regression A (students) Regression B (sections) a (intercept) 4,303,000 a (intercept) 3,800,000 b coefficient 143.50 b coefficient 750.00 Standard error of the estimate 133,000 Standard error of the estimate 117,000 R-squared 0.594 R-squared 0.707 t-value for b 2.03 2.83 Required: A. Based on the data derived from regression A, 1,000 additional students would increase total costs by how much? How much should be budgeted for total costs if enrollment is increased to 6,000 students? B. Based on the data derived from regression B, 1,000 additional students would increase total costs by how much? How much should be budgeted for total costs if enrollment increased to 6,000 students? C. What is the percent of the total variance that can be explained by each of the regression equations? D. Which regression equation should DMU use? Defend your choice of cost function (regression A or regression B) for predicting added student educational costs per year. E. Using the equation selected in part D, what range of costs should DMU expect to incur approximately two-thirds of the time (at 6,000 student level of activity)? 6