МИССИЯ

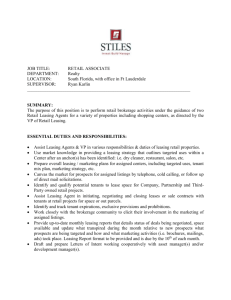

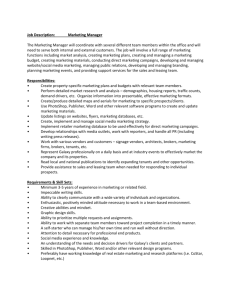

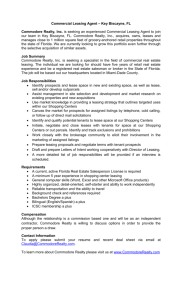

advertisement

LEASING COMPANY “LEASINGFINANCE” 1 LEASING COMPANY “LEASINGFINANCE” THE COMPANY DESCRIPTION The name Creation date Work date started The share capital (at the moment of formation) Leasing company "LEASINGFINANCE" 10.2007 09.2008 420 000 US dollars Shareholders Attivita Holding Ltd (Cyprus) – 98,56 % Physical persons – 1,44 % Management - Financial Company "GRANDINVEST" Management Company’s tasks: Company "LEASINGFINANCE" adjusts steady partner relations with many official dealers of cars and special equipment, suppliers of the equipment for different industries. It allows us to offer clients the whole complex of services in search and selection of subjects of the leasing which is meeting the requirements of the client on functionality and, at the same time, representing optimal variant from the point of view of the price and terms of delivery. Expansion of a spectrum of the offered services connected with preparation and realization of leasing projects; Territorial diversification leasing projects; Increase in volumes of operations of financial/operating leasing; Growth of actives of the company; Increase of competitiveness and appeal of the products offered by the company in the market; Strengthening of positions of the company as reliable and competent partner in the regional financial market. We provide insurance of leasing property in the most reliable insurance companies possessing a wide range of branches in Ukraine, and we incur all work with insurers. Clients need to choose the most optimum variant of the leasing offer only. For an operating time the company saves up the rich practical experience allowing successfully realize leasing projects in the most different branches of economy of Ukraine. Further we can to develop advantages available for us and to improve the work, and also are ready to offer our clients new interesting programs. 2 LEASING COMPANY “LEASINGFINANCE” MISSION AND STRATEGY 3 LEASING COMPANY “LEASINGFINANCE” Now the grocery offer of leasing business develops in several directions: Small business: The wide spectrum of the accessible standardized products of retail leasing is developed for the small-scale business enterprises («Express leasing of automobile and commercial cars», «Leasing of equipments », «Leasing of the building equipments») with high speed of decisionmaking and minimal requirements to client. Products of retail leasing assume presence of the standardized parameters and requirements to client, financing within the limits of strictly established limits without passage of credit committees. Average business: Complex decisions are developed for average business on a turn-key basis on the basis of products of retail leasing. Within the limits of products of retail leasing further it is planned to organize granting of a full spectrum of the most demanded additional services. Large business: Complex branch decisions are developed for corporate clients with individual adjustment. Presence of individual options allows to consider as much as possible requirements of clients and to offer them modern and innovative leasing decisions. Within the limits of corporate leasing financing of acquisition of the equipment, cargo cars including with use of technology of the international leasing is carried out. PARTNERS Development of mutual relations with manufacturers and suppliers of subjects of leasing, dealers, the insurance companies is one of key directions of development of the company. Leasing company "LEASINGFINANCE" plans to increase quantity of joint programs with manufacturers of subjects of leasing for their key clients and offers complex decisions on financing for suppliers and their dealers. The basic directions of development of mutual ■ increase in quantity of joint programs with manufacturers of subjects of leasing for their key clients; ■ formation of complex decisions on financing for suppliers and their dealers; ■ placing of employees of the Leasing company in territory of vendors; ■ increase in quantity of agreements with vendors regional level; ■ formation of joint ventures with manufacturers. Cooperation with partners will allow Leasing 4 LEASING COMPANY “LEASINGFINANCE” relations with partners: company "LEASINGFINANCE" to increase a sales volume of leasing products, that considerably raises competitiveness of the company and reduces cost of leasing services for clients. EXTERNAL BORROWING Leasing company "LEASINGFINANCE" plans to act in the Ukrainian and international markets of the capital as the independent borrower. Within the limits of the organization of attraction of financing by the company it is planned to use such tools, as the direct credits, the syndicated credits, bonded loans, CLN, trading financing. For increase of the investment appeal Leasing company "LEASINGFINANCE" supervises sufficiency of own capital and other financial indicators. Strategy in the field of external attraction is directed on increase in average terms of attraction, depreciation and диверсификацию sources (including increase in a share of trading financing). REGIONAL STRATEGY Corporate governance Regional strategy of Leasing company "LEASINGFINANCE" is directed on formation of a network of branches in all regions of Ukraine. For maintenance stable and efficient control in Leasing company "LEASINGFINANCE" the considerable attention is given to formation of system of a corporate governance, perfection of corporate procedures and internal standard base, formation of system of the analysis and management of risks. The board of directors, system of committees and Board allow to carry out a corporate governance according to the advanced international standards. 5 LEASING COMPANY “LEASINGFINANCE” For maintenance stable and efficient control in Leasing company "LEASINGFINANC E" the considerable attention is given to formation of system of a corporate management, perfection of the corporate Procedures and internal standard base, to formation of system of the analysis and management of risks. Board of directors FC "GRAND INVEST", system of committees allow to carry out a corporate management according to the advanced international standards. 6 LEASING COMPANY “LEASINGFINANCE” The Ukrainian market of leasing and positioning The leasing company 7 LEASING COMPANY “LEASINGFINANCE” On many indicators growth of the Ukrainian market of leasing is an excellent example of potential of the developing European countries in the field of adaptation of various schemes of financing of operations on acquisitions of a fixed capital. Growth of a leasing portfolio proceeds, though has considerably slowed down the rates. This year (2009) Ukrainian leasing portfolio has grown on 41 % - an amazing indicator for a current situation, but not so amazing in comparison with 485 % growth of the market from the end of 2006 year till the end of 2007. Regarded as one of the basic Central European leasing markets at level with the leasing markets of Slovakia, the Czech Republic and Hungary which were considerably narrowed in 2008, the Ukrainian market of leasing has continued growth and during general global recession, partially thanks to the big share of leasing business serving proof agricultural sector. But in some cases, growth was possible only thanks to wonderful growth in 2007 which has caused activity of the market all next years. Activity of the market for last years was so low, that business at all did not consider leasing as a financing variant, preferring to solve questions of financing at the expense of bank credits, are spoken by analysts. Progress of 2007 also has created for the leasing companies a necessary infrastructure for financing attraction at level which has allowed the leasing companies to adapt for more severe credit conditions. For last year lessors have financed at the expense of own means about a quarter of all transactions in comparison with 10 % in 2007. Besides falling of rates of growth, pressure of recession has affected Ukraine and in other directions. The economic instability supported by the political disorder, has increased for lessors price risks about leasing that has caused reduction of average terms of the leasing transaction. Also, the financing average index has fallen to 45 % from a total cost of a subject of leasing. The proportion of making leasing payments also has considerably changed for a year, having increased a share of the commissions lessor`s, indemnifications for risk and percentage payments to 30 % from the general leasing payment, in comparison with 20 % year before. According to the terms defining business environment, dominating players in the Ukrainian market are large foreign bank networks led by the Unicredit Leasing and Raiffeisen Leasing, taking the second and third place on volume of a leasing portfolio and volume of the conclusion of new leasing contracts accordingly. Heads the table about ranks the Russian colossus – VTB Leasing exceeding three times indicators of volume of leasing portfolio of the nearest competitor. Leasing in Ukraine – the key statistics. Details Changes in 2009 29 from 208 which represent 80 Growth in comparison with 7 Quantity of the companies % of the leasing market companies in 4 quarter 2007 Cars, the agricultural technician, Falling in the field of cars leasing, the building equipment, the growth in the agricultural technician In the lead actives computer equipments, the and the building equipment polygraphic equipment Growth of 5 % in comparison with 9 Q-ty the signed contracts of 9 766 275 last year leasing Falling on 41 % in comparison with 0,95 billion Euro Cost of new contracts 1,16 billion Euro last year 8 LEASING COMPANY “LEASINGFINANCE” Growth of 41 % in comparison with 1,93 billion Euro last year Growth of 16,4 % in comparison with 17 568 Operating contracts 15 102 last year Falling on 45 % in comparison with Average volume of the 95 000 Euros 175 000 Euros last year contract Repayment of cost of a subject Repayment of cost of a subject of Average component of leasing of leasing – 68,78 %, the leasing leasing – 78,3 %, the leasing payments commissions – 24,32 % commissions – 19,5 % 47 % - bank credits, 22 % - own 29 % - bank credits, 11 % - means of Sources of financing of the capital, 7 % - means of legal legal bodies leasing companies bodies Total cost of contracts 2,7 billion Euro Rating of the Ukrainian leasing companies on volume of a leasing portfolio Position in a rating The company name Portfolio on 31.12.08 (million Euro) 1 VTB Leasing Ukraine 546 2 Raiffeisen Leasing Ukraine 179 3 UniCredit Leasing 156 4 Hypo Alpe-Adria Group 68 5 ING Leasing Ukraine 59 6 Euro Leasing 55 7 Lasca Leasing 49 8 SG Equipment Leasing Ukraine 46 9 ALD Automotive (the First leasing company) 41 10 VAB Leasing 40 Rating of the Ukrainian leasing companies on volume of the concluded new transactions Position in a rating 1 2 3 4 5 6 7 8 9 10 The company name VTB Leasing Ukraine UniCredit Leasing Raiffeisen Leasing Ukraine ING Leasing Ukraine SG Equipment Leasing Ukraine Hypo Alpe-Adria Group VAB Leasing Euro Leasing Lasca Leasing ALD Automotive (the First leasing company) New transactions in 2008 г (million Euro) 229 121 99 71 62 51 44 30 29 29 9 LEASING COMPANY “LEASINGFINANCE” DYNAMICS OF SALES OF LEASING COMPANY "LEASINGFINANCE" IN SUBJECTS OF LEASING 2008-2009. Dynamics of sales. YEAR Quantity of contracts 2008 2009 5 25 Cost of contracts (thousand USD.) 114,3 474,3 LEASING PORTFOLIO IN LEASING SUBJECTS Contract cost (thousand USD.) % The special technics 69,4 9,1 Cars Cargo cars Buses TOTAL 137,2 Commercial cars 161,3 184,1 36,4 588,6 30,5 25,0 27,4 8,1 100 Strategy leasing company of AUTOMOBILE LEASING In the market of leasing of automobile Leasing company "LEASINGFINANCE" plans to offer products of retail leasing («Express leasing of automobile and commercial cars»), products of corporate leasing on acquisition of vehicles, a product of "Financing of dealers of equipment» for official dealers of manufacturers of cars. Key initiatives: ■ conclusion of cooperation agreements with leading car manufacturers and working out of joint programs; ■ introduction of system of granting of additional services within the limits of corporate and retail products (statement on the account, insurance, maintenance service and so forth); ■ realization of transactions on leasing of cars with application of technology of the international leasing; ■ realization of complex programs on financing of suppliers and dealers (inventory finance + leasing); ■ placing of employees of Leasing company "LEASINGFINANCE" in points of sales of dealers. 10 LEASING COMPANY “LEASINGFINANCE” The number of clients of Leasing company "LEASINGFINANCE " continuously grows. Growth of number of clients is caused first of all by sales volume growth in 2009-2010 y. of a retail product «Express leasing of automobile and commercial cars» through a regional network of the company By strategy of Leasing company "LEASINGFINANCE " it is provided diversification client`s base at the expense of increase in a share of sales of the leasing products focused on the enterprises of small and average business, through a filial network. 11 LEASING COMPANY “LEASINGFINANCE” Strategic targets: ■ Increase in a share of the market by 2014 to ■ Quantity of branches of Leasing company "LEASINGFINANCE" ■ Leasing portfolio DEVELOPMENT PROSPECTS Prospects of development of the leasing company are connected with potential of growth of economy. Company strategic targets are position strengthening in the leasing market of Ukraine and the further increase in a leasing portfolio. Leasing Company "LEASINGFINANCE" plans to develop work with the enterprises of small and average business and to expand a spectrum of directions of leasing activity. 15% 20 120 mln. USD. With a view of increase of appeal of leasing of motor transport the separate leasing product «Express leasing of automobile and commercial cars» has been developed. The given product allows to give a full spectrum of services in the market of leasing automobile and commercial cars, and also minibuses. The method of work of the company is a complex approach to the leasing transaction: - The help in a car choice; - Insurance; - Statement on the account in motor licensing and inspection department bodies; - Car service at station; - Seasonal replacement and rubber storage. For today there are some programs on leasing of cars – The preliminary decision on the transaction conclusion is accepted within 1 hour, car payment is made in day of reception of advance payment; – Work with guarantors; – Possibility of scheduling of leasing payments taking into account seasonal prevalence of activity lessee; – Financing of projects and again created companies; – Insurance, registration in motor licensing and inspection department; VENDOR`S - PROGRAMS Within the limits of realization of the strategy directed on development of mutual relations with partners-vendor`s, the Leasing company in 20082009 had been concluded a number of agreements with such car manufacturers, as: GENERAL MOTORS (SAAB, OPEL, CHEVROLET, CADILLAC, HUMMER), LAND ROVER and JAGUAR, MERCEDES-BENZ, BMW. In immediate prospects the leasing company intending spare special attention to following directions of the work: Increase in quantity and the size of leasing transactions; Increase in efficiency of the 12 LEASING COMPANY “LEASINGFINANCE” conclusion of leasing transactions; Expansion of assortment of given services. For the decision of tasks in view the company plans to involve the extensive contacts to suppliers of various kinds of the equipment and transport and faultless reputation for maintenance of as much as possible favourable conditions of financing for the clients. Financial strategy of the company the next years is realized with application of management methods by liquidity, managements of risks, диверсификации investment directions, optimization of structure of a leasing portfolio, expansion of stable sources of the income and high-grade protection of interests of founders and investors. CLIENT BASE The personnel-one from the major competitive advantages of Leasing company "LEASINGFINANCE", therefore in the company is paid the big attention to development of the personnel and formation of corporate culture. Formation of the uniform corporate culture stimulating an all-around development of employees and promoting achievement of strategic targets of Leasing company "LEASINGFINANCE", is based on following initiatives: Personnel selection. The policy in the field of management of the personnel is directed on granting to each employee of possibilities for full disclosing of skills, knowledge and talents and urged to provide stability of the company as the business organizations. Motivation. The motivational program of Leasing company "LEASINGFINANCE" is constructed on a combination corporate and the individual purposes and urged to form culture of awarding by result. In the company non-material methods of motivation are widely used, competitions on a rank of the best head of branch, the best seller of products of retail leasing are monthly held. Development. Leasing company "LEASINGFINANCE" actively uses both remote, and internal forms of training of employees. In the company training programs on products of retail and corporate leasing, risk- 13 LEASING COMPANY “LEASINGFINANCE” management are specially developed. The special attention is given to formation professional competition in the field of sales of leasing products and to formation of administrative skills. 14 LEASING COMPANY “LEASINGFINANCE” CAPITAL BORROWING One of priority problems of Leasing company "LEASINGFINANCE" is realization of the scale program of loans for financing of new leasing transactions. It is planned to use such financial tools, as the direct loans, the syndicated credits, release CLN (credit notes) and securities. Key initiatives: Performance of the plan of external borrowing for the account: ■ organizations of accomodation on an open bond market, CLN, Eurobonds (under condition of a good situation in the market); ■ borrowing of the syndicated credits, including address financing; ■ borrowing of the connected financing from foreign banks, including through credit agencies; ■ borrowing of credits from the Ukrainian banks; 15 LEASING COMPANY “LEASINGFINANCE” RISKMANAGE MENT 16 LEASING COMPANY “LEASINGFINANCE” MANAGEMENT OF CREDIT RISK The control system of credit risks of Leasing company "LEASINGFINANCE" includes two levels: The first level - planning and methodology level management of risks by working out of a credit policy, a regulation of the business processes connected with granting of leasing products with credit risk, workings out of techniques of an estimation of credit risks on corporate both retail leasing products and the further control of their realization and execution. The second level – at decision-making level on separate leasing products with credit risk, within the limits of work of System of decision-making on leasing products which includes system of credit committees FC "GRAND - INVEST", in that number credit committee of Leasing company "LEASINGFINANCE", system of personal powers of managers on decision-making and system of delegation to managers of individual powers on decision-making on retail leasing products. The control of credit, financial and not financial risks is a key problem of Leasing company "LEASINGFINANCE" THE CREDIT POLICY The credit policy of the company for 2009-2014 is focused on creation and maintenance liquid and diversification the leasing portfolio providing profitableness of leasing operations, adequate to level of accepted credit risk, for the purpose of achievement of planned targets of cost, volumes and efficiency of the company. For the decision of problems of management liquidity of a leasing portfolio and it диверсификации, a credit policy establishes target indicators of a leasing portfolio, including limits on the maximum sizes of credit risk, restriction on conditions of granting of products and their concentration. Also in the document the list obligatory for an estimation and the analysis of the credit and design risks arising at realization of leasing projects is given, and recommended values on the size of own participation by the client in acquisition of a subject of leasing, depending on an estimation of its market cost and liquidity are resulted. Within the limits of the Credit policy segmentation of clients depending on volume indicators on small, CORPORATE LEASING The estimation of credit risks within the limits of realization of marketing strategy «Corporate leasing» is carried out with use методологий, developed with the assistance of the international consulting company and adapted taking into account the best world practice and recommendations of Basel committee (including Basel II). The decision on granting of products within the limits of strategy of "Corporate leasing» is accepted by joint body. The size of the brave price depends on quality of a financial condition of the client, liquidity of a subject of leasing, the size of a share of participation of the client in the project, presence of additional maintenance under the leasing project. 17 LEASING COMPANY “LEASINGFINANCE” average and large business is spent and taking into account an available grocery ruler two marketing strategy are realized: ■ strategy «Corporate leasing» for large and average business; ■ strategy «Retail leasing» for small and average business. RETAIL LEASING The estimation of credit risks within the limits of realization of marketing strategy «Retail leasing» is based on scoring model adapted under features of each group of retail products («Express leasing of automobile and commercial cars»). The technology of authorization of granting of products within the limits of strategy «Retail leasing» provides decision-making on financing on the simplified procedure. Within the limits of positions about a product restrictions on the maximum size of credit risk on the client and to financing term are established. MONITORING OF THE SUBJECT OF LEASING The recommended values fixed by a credit policy on the size of own participation in acquisition of a subject of leasing depending on an estimation of its market cost and liquidity are directed by the client on formation of a leasing portfolio with sufficient maintenance. Necessary requirements to a leasing subject are: The liquidity requirement. The property considered as a subject of leasing, without fail should possess liquidity (i.e. liquidity of offered property should not be hopeless) under condition of its preservation in that quality in which it is considered for the leasing transaction. Possibility of a cost estimation. The property considered as a subject of leasing, should be subject to cost estimation under condition of its preservation in that quality in which it is considered for the leasing transaction. . Realization possibility. The property considered as a subject of leasing, should be turned in the market, i.e. is not withdrawn from a turn and not limited in a turn, under condition of its preservation in that quality in which it is considered for the leasing transaction. Alienation possibility. The property considered as a subject of leasing, without fail should be alienated under condition of its preservation in that quality in which it is considered for the leasing transaction Appropriate registration. The property considered as a subject of leasing, should be properly 18 LEASING COMPANY “LEASINGFINANCE” It is issued, i.e. the company should have an order right offered property under condition of preservation of its (property) in that quality in which it is considered for the leasing transaction. In the company the following procedure of monitoring of a condition of subjects of leasing and additional maintenance under leasing transactions operates: Monitoring of a condition of objects of leasing and the additional maintenance issued at realization of the leasing transaction, can be carried out: ■ the employee of the company; ■ the employee of division of an estimation and work with corporation pledges; ■ the accredited insurance company; Check of a condition of subjects of leasing and additional maintenance is carried out not less often than 1 time a year. Responsibility for realization of actions for monitoring of a condition of objects of leasing and the additional pledge issued at realization of the leasing transaction, is assigned to the manager of the company. MANAGEMENT OF RESERVES The order of creation of reserves under depreciation of actives in Leasing company "LEASINGFINANCE" is realized according to recommendations of auditor company Ernst and Young. The reserve under depreciation of actives is subtracted from balance cost of corresponding actives. For calculation of the sum of a reserve the following technique is used: ■ the reservation rate as the relation of problem debts to a total sum of payments (a leasing portfolio) Is defined. The problem debts consider debts The client on leasing payments over 30 days. The reserve rate pays off in a cut of the integrated fields of activity лизингополучателей. ■ the reserve Sum pays off as product of the sum of pure investments in leasing and reservation rates. ■ In case of regular delays under the contract of leasing and presence of the delayed debts over 60 days the active is classified as problem. Reserve formation under the problem Actives pays off starting with 100 % of the sum of pure investments in leasing. Besides, in the company in addition internal design procedure of reserves for the administrative account (on the basis of the brave prices) is realized. As a whole the leasing portfolio is generated for the account liquid assets of property, such as automobile and cargo transport, the building equipment. The company pursues a policy of obligatory insurance of all subjects of leasing upon property risks. Practice of the conclusion with 19 LEASING COMPANY “LEASINGFINANCE” suppliers/manufacturers of contracts remarketing and the return repayment is actively used. 20 LEASING COMPANY “LEASINGFINANCE” MANAGEMENT OF FINANCIAL RISK Leasing company "LEASINGFINANCE" has the accurate strategy directed on the maximum lengthening and reduction in price of extra means. RISK OF LIQUIDITY The important problem in the field of management of liquidity is alignment of structure of actives and passives on promptness. Leasing company "LEASINGFINANCE" has the accurate strategy directed on the maximum lengthening and reduction in price of extra means. Thus the greatest attention is given to structuring of loans under concrete leasing contracts or pools of contracts. Ability to service of a debt of Leasing company "LEASINGFINANCE" is balanced by that receipts of leasing payments always advance payments on debt service. The established internal limit on cumulative GAP assumes the general size дисбаланса actives and passives with within 1 year at level no more than 30 % from volume of operational passives, with more rigid restriction of rupture on short terms. Observance of limits on liquidity rupture is carried out through change of structure of passives, and also placing of money resources in various financial tools. MARKET RISKS The main principle of Leasing company "LEASINGFINANCE" in the field of management of currency and percentage risk consists in risk carrying over on the client (lessee). Thus management of currency and percentage risk of the company and the control of their level are carried out at two stages: 1 stage. At a stage of opening of leasing transactions for the account: ■ financings of transactions in bank-counterpart on mirror conditions; ■ uses by divisions of sales at structuring of schedules of leasing payments of uniform base rates фондирования leasing transactions, obligatory for all divisions Sales of the leasing company; ■ uses in the contracts of leasing financed at the expense of credits with the floating rate, an option obliging лизингополучателей to make out by additional agreements to contracts of leasing revision of a total sum of the contract and size of leasing payments according to change of rate Libor/Euribor concerning the rate for date of 21 LEASING COMPANY “LEASINGFINANCE” signing of the contract. 2 stage. At a stage of the quarterly analysis of reports on structure of balance and dynamics of rates Libor/Euribor, by which results in case of presence of imbalance of actives and passives decisions on change of structure of actives and passives (through change of target reference points on external loans, through the statement of limits on operation in this or that currency, through change of uniform rates financing of leasing operations) are made. Matrix of management of risks of Leasing company "LEASINGFINANCE" ■ types of risks ■ the components of risks which are subject to regulation ■ management tools CREDIT RISK Risk of occurrence of non-payments from clients. Quality of actives-minimization of the losses connected with deterioration of a financial condition of the client. ■ System of authorization of credit decisions ■ the Credit policy ■ reservation System (on the basis of an estimation of credit risks) ■ Methods of an estimation and forecasting of credit risk Risk of loss or damage of subjects of leasing. Minimization of the losses connected with loss and damage of property Risk of depreciation and decrease in liquidity of a subject of leasing Minimization of the losses connected with possible realization of a subject of leasing ■ Monitoring of a current condition of a subject of leasing ■ Insurance of a subject of leasing ■ Estimation and the forecast of change of market cost and liquidity of a subject of leasing ■ Conclusion of contracts of the return repayment and re-marketing with suppliers/manufacturers 22 LEASING COMPANY “LEASINGFINANCE” FINANCIAL RISK Currency risk Sensitivity of actives and passives to change of rates of exchange ■ Control of currency risk ■ financing borrowings in currency of contracts of leasing Risk of liquidity Structure of actives and passives on promptness ■ Monitoring of a daily payment position on the basis of Cash-plan ■ Control of intermediate term and long-term liquidity on the basis of GAP-report ■ Financing of transactions in bank-counterpart on "mirror" conditions (an emphasis on trade export finance) Risk of residual cost Minimization of the losses connected with the accounting and tax account ■ Control of calculation of schedules of leasing payments at a stage of the conclusion of the contract of leasing Percentage risk Sensitivity of actives and passives to change of interest rates ■ Control of observance of a percentage policy on active operations at an input stage in the transaction ■ Financing of transactions in bank-counterpart on "mirror" conditions (an emphasis on trade export finance) ■ Variable sums of contracts of leasing in case of financing under the floating rate ■ Regular analysis of dynamics of rates Libor/Euribor ■ Hedging NON FINANCIAL RISK Operational risk Conformity of methods of a corporate governance to business scales ■ Regulated business processes and system of duty regulations ■ System of granting of powers ■ Control of operations by division of operational support ■ Monitoring system of costs service of budgetary controllers ■ translation System Strategic risk 23 LEASING COMPANY “LEASINGFINANCE” Conformity of offered leasing products and services to expectations and requirements the market Achievement KPI of business ■ Working out of the operative (annual) business plan and the strategic plan for development ■ System KPI 24 LEASING COMPANY “LEASINGFINANCE” THE ANALYSIS OF RESULTS OF ACTIVITY. The intermediate reporting on 31.12.2009 25 LEASING COMPANY “LEASINGFINANCE” Assets Noncurrent Intangible assets Intangible assets - cost Intangible assets - accumulated depreciation (0,1) Loans granted Property and equipment Loans granted (0,0) (0,1) - 10,2 - (9,6) (5,1) 1,2 Construction in progress 13,8 - - - - - Prepayments for CIP 32,3 1,6 101,4 Receivables from finance lease - NIL (noncurrent) 25,2 44,0 51,8 VAT receivable VAT receivable 3,3 15,1 6,0 85,9 79,9 174,5 Cash and cash equivalents 80,8 11,0 39,3 Amounts due from credit institutions 0,0 40,2 59,0 100,0 11,2 - 0,4 0,3 0,2 - - - Insuarance prepaid 2,6 11,0 12,3 Other current assets 6,3 76,7 11,7 - - - Receivables from finance lease - NIL (current) Impairment provision against Receivables from finance lease 20,9 112,2 151,0 - - - VAT receivable 14,1 32,9 42,5 225,1 295,5 316,0 311,0 375,3 490,5 (265,5) (473,2) (473,2) Cash and cash equivalents Inventories Inventories Loans granted Prepayments and other current assets Loans granted VAT receivable Current Assets Share capital Share capital Reserves Retained earnings Reserves - (1,2) (1,2) Retained earnings - (17,3) (18,5) Unpaid capital Unpaid capital - 164,9 162,6 (265,5) (326,8) (330,3) (265,5) (326,8) (330,3) Loans and borrowings - - (92,0) Other payables - - - (8,3) (5,4) (5,4) (8,3) (5,4) (97,4) - (34,3) (42,7) Equity Equity Interest-bearing loans Advances and other liabilities Deferred tax Deferred tax Non-urrent Current 0,4 Receivables from finance lease Receivables from finance lease Liabilities 0,4 13,9 Impairment provision against other current assets Noncurrent 0,4 13,8 Restricted cash in UAH Equity 2010 20,4 Noncurrent Equity 2009 Property and equipment - cost Property and equipment - accumulated depreciation Investments in financial lease objects Current 2008 Interest-bearing loans Loans and borrowings 26 LEASING COMPANY “LEASINGFINANCE” Advances and other liabilities Other current liabilities (1,4) (0,0) (0,0) - - (7,8) Payables to employees (4,8) (1,0) (1,1) Other payables (6,8) (5,7) (2,2) Payables for CIP (2,2) - - Taxes payable, other than income tax (3,2) (0,6) (0,5) Current income tax payable (0,3) (0,3) (0,1) (18,7) (41,9) (54,5) (27,1) (47,3) (151,9) Amounts due from credit institutions (0,0) (6,6) (1,5) Finance income from finance lease (2,9) (74,6) (35,5) Amounts due to credit institutions - 1,5 3,3 Depreciation 9,6 2,5 1,4 Other payables Trade and other payables Taxes payable, other than income tax Current income tax payable Current Liabilities PL PL Finance income Finance expenses General and admin expenses General and admin expenses 60,1 91,8 21,2 Selling and distribution costs Selling and distribution costs 0,7 8,6 3,8 Other income Other expenses - 1,6 - (6,8) (24,1) (1,5) Other income Other expenses Bed debt expenses Other expenses Other income/expenses Other income Other income/expenses, net Income tax expense PL PL Income tax expense - 0,1 - 6,1 6,3 0,4 (286,5) (152,8) (11,6) 191,8 146,8 11,8 9,5 (2,4) 0,1 (18,5) (1,3) (8,2) (18,5) (1,3) (8,2) 27