Sell More Equipment

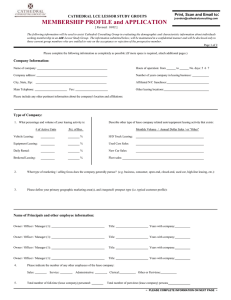

advertisement

Benefits of Leasing How Leasing Benefits You Leasing can enable you to sell more equipment, more often, to more customers, all while improving your cash flow. The ability to offer leasing is a valuable sales and retention tool. Sell More Equipment Offer low monthly payments and make equipment acquisition easy for your customers Enable your customers to order additional equipment that they may not have purchased due to cash constraints Increase transaction size and profit margins by presenting your customers with more purchasing power Sell More Often Make it easier for your customers to acquire new equipment, upgrade current equipment, or add on to existing equipment as their needs change Develop follow-up selling opportunities and build a long-term footprint for repeat business Sell to More Customers Close sales faster by offering leasing options, and spend more time in front of potential prospects Control the sale by offering "one-stop shopping" - equipment, technology, servicing and financing - all in one package Increase customer loyalty by being a single, convenient source for quality products and flexible, affordable financing Improve Your Cash Flow Get paid fast with rapid funding on documented and installed systems Reduce your "day’s sales outstanding" from net-30 sales and eliminate fees paid to credit card companies How Leasing Benefits Your Customers Leasing is a fast and easy way for your customers to obtain technology and office equipment. It offers flexibility that an outright purchase does not. Protection Against Advancing Technology Your customers may be able to add on or upgrade during the lease term At the end of the lease, they can choose to return or purchase the equipment - ensuring they stay on top of technological advances while minimizing financial impact or risk Predictable, Low Monthly Payments Enable your customers to pay over time, rather than invest a lump sum up front Lease payments can be tailored to budget levels or revenue streams and may be taxdeductible (subject to customer's independent tax advisor) Reduction of Upfront Costs Enable your customers to obtain the technology and office equipment they need now without impacting cash flow Preserve working capital and existing credit lines, freeing up cash for other operational expenses Flexible Pay Structures Offer your customers the flexibility of 100% financing with no money down Allow payment structures that match cash flows or business cycles Provide customers with a variety of end-of-lease options Ability to Bundle Transactions Offer your customers the ability to finance hardware, software and upfront services in one transaction The convenience of one-stop shopping offers an immediate, affordable way for customers to meet their technology and office equipment needs and support their business