Transfer Pricing Solutions: International Tax & Cash Flow

advertisement

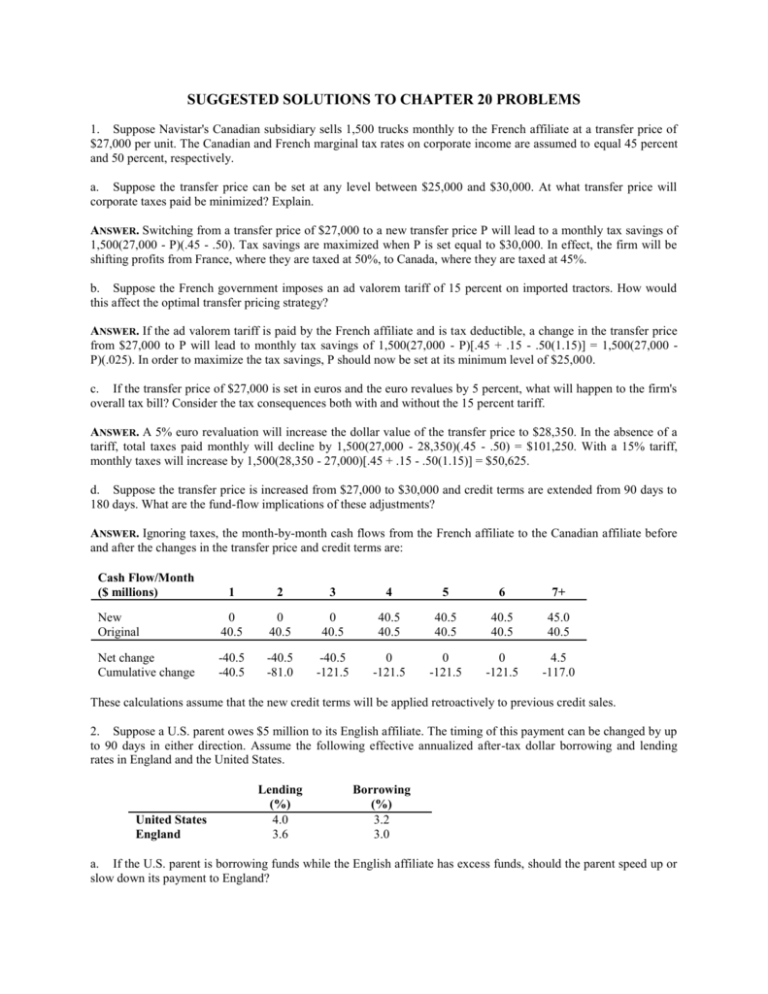

SUGGESTED SOLUTIONS TO CHAPTER 20 PROBLEMS 1. Suppose Navistar's Canadian subsidiary sells 1,500 trucks monthly to the French affiliate at a transfer price of $27,000 per unit. The Canadian and French marginal tax rates on corporate income are assumed to equal 45 percent and 50 percent, respectively. a. Suppose the transfer price can be set at any level between $25,000 and $30,000. At what transfer price will corporate taxes paid be minimized? Explain. ANSWER. Switching from a transfer price of $27,000 to a new transfer price P will lead to a monthly tax savings of 1,500(27,000 - P)(.45 - .50). Tax savings are maximized when P is set equal to $30,000. In effect, the firm will be shifting profits from France, where they are taxed at 50%, to Canada, where they are taxed at 45%. b. Suppose the French government imposes an ad valorem tariff of 15 percent on imported tractors. How would this affect the optimal transfer pricing strategy? ANSWER. If the ad valorem tariff is paid by the French affiliate and is tax deductible, a change in the transfer price from $27,000 to P will lead to monthly tax savings of 1,500(27,000 - P)[.45 + .15 - .50(1.15)] = 1,500(27,000 P)(.025). In order to maximize the tax savings, P should now be set at its minimum level of $25,000. c. If the transfer price of $27,000 is set in euros and the euro revalues by 5 percent, what will happen to the firm's overall tax bill? Consider the tax consequences both with and without the 15 percent tariff. ANSWER. A 5% euro revaluation will increase the dollar value of the transfer price to $28,350. In the absence of a tariff, total taxes paid monthly will decline by 1,500(27,000 - 28,350)(.45 - .50) = $101,250. With a 15% tariff, monthly taxes will increase by 1,500(28,350 - 27,000)[.45 + .15 - .50(1.15)] = $50,625. d. Suppose the transfer price is increased from $27,000 to $30,000 and credit terms are extended from 90 days to 180 days. What are the fund-flow implications of these adjustments? ANSWER. Ignoring taxes, the month-by-month cash flows from the French affiliate to the Canadian affiliate before and after the changes in the transfer price and credit terms are: Cash Flow/Month ($ millions) 1 2 3 4 5 6 7+ New Original 0 40.5 0 40.5 0 40.5 40.5 40.5 40.5 40.5 40.5 40.5 45.0 40.5 Net change Cumulative change -40.5 -40.5 -40.5 -81.0 -40.5 -121.5 0 -121.5 0 -121.5 0 -121.5 4.5 -117.0 These calculations assume that the new credit terms will be applied retroactively to previous credit sales. 2. Suppose a U.S. parent owes $5 million to its English affiliate. The timing of this payment can be changed by up to 90 days in either direction. Assume the following effective annualized after-tax dollar borrowing and lending rates in England and the United States. United States England Lending (%) 4.0 3.6 Borrowing (%) 3.2 3.0 a. If the U.S. parent is borrowing funds while the English affiliate has excess funds, should the parent speed up or slow down its payment to England? ANSWER. Under the circumstances, the parent's opportunity cost of funds is 3.2%, whereas the British unit's opportunity cost of funds is 3.6%. Since the British unit has the higher opportunity cost of funds, the U.S. parent should speed up its $5 million payment by 90 days. b. What is the net effect of the optimal payment activities in terms of changing the units' borrowing costs and/or interest income? ANSWER. The U.S. parent will borrow an additional $5 million for 90 days, adding $5,000,000 x .032 x .25 = $40,000 to its interest expense. At the same time, the British unit will invest an additional $5 million for 90 days, raising its interest income by $5,000,000 x .036 x .25 = $45,000. The net effect is to raise consolidated income by $5,000. 3. Suppose that DMR SA, located in Switzerland, sells $1 million worth of goods monthly to its affiliate DMR Gmbh, located in Germany. These sales are based on a unit transfer price of $100. Suppose the transfer price is raised to $130 at the same time that credit terms are lengthened from the current 30 days to 60 days. a. What is the net impact on cash flow for the first 90 days? Assume that the new credit terms apply only to new sales already booked but uncollected. ANSWER. This problem can best be worked by examining cash flows under the new setup and then subtracting cash flows under the old setup. Note that by changing credit terms to 60 days from 90 days, goods shipped in the first month are not paid for until the third month. The net effect during the first 90 days of simultaneously switching credit terms and changing the transfer price is to shift $700,000 from the Swiss affiliate to the German affiliate. This can be seen in the following exhibit, which traces out the cash flow effects of these changes. Cash Inflows for Swiss Unit and Cash Outflows for German Unit Month 1 2 3 New Terms $1,000,000 0 $1,300,000 Old Terms 1,000,000 1,000,000 1,000,000 Change 0 -$1,000,000 +$300,000 Cumulative 0 -$1,000,000 -$700,000 b. Assume the tax rate is 25 percent in Switzerland and 50 percent in Germany and that revenues are taxed and costs deducted upon sale or purchase of goods, not upon collection. What is the impact on after-tax cash flows for the first 90 days? ANSWER. This problem is more complex because the tax effects occur prior to settling interaffiliate accounts with cash. The Swiss unit's taxes are now $325,000/month (.25 x $1,300,000) as compared with $250,000 previously, while the German unit's monthly tax write-off has risen to $650,000 (.5 x $1,300,000) as compared to $500,000 before. Cash Flows for Swiss Affiliate Month New Terms Collection of receivables Tax payments Net cash inflow 1 2 3 $100,000 -325,000 $675,000 0 -325,000 -$325,000 $1,300,000 -325,000 $975,000 Old terms Collection of receivables Tax payments Net cash inflow 1,000,000 -250,000 $750,000 1,000,000 -250,000 $750,000 1,000,000 -250,000 $750,000 Change in net cash inflow Cumulative change -$75,000 -$75,000 -$1,075,000 -$1,150,000 $225,000 -$925,000 Cash Flows for German Affiliate Month New Terms Payment of payables Value of tax write-offs Net cash outflow Old terms Payment of payables Value of tax write-offs Net cash outflow Change in net cash outflow Cumulative change 1 $1,000,000 -650,000 2 0 -650,000 3 $1,300,000 -650,000 $350,000 -$650,000 $650,000 $1,000,000 -500,000 $1,000,000 -500,000 $1,000,000 -500,000 $500,000 $500,000 $500,000 -$150,000 -$150,000 -$1,150,000 -$1,300,000 $150,000 -$1,150,000 The net result of the simultaneous change in credit terms and transfer price is that for the first 90 days the Swiss unit's after-tax cash inflow drops by $925,000 and the German unit's after-tax cash outflow falls by $1,150,000. The $225,000 gain in net cash flow is attributable to the change in transfer price which leads to a shift of $300,000 in reported monthly income from Germany to Switzerland, or a shift of $900,000 over the first 90 days. Because income in Switzerland is taxed at a rate of 25%, while German income is taxed at 50%, the net effect of this income shift for the first three months is to save an amount of taxes equal to $900,000 x (.50 - .25) = $225,000. 4. Suppose a firm earns $1 million before tax in Spain. It pays Spanish tax of $0.52 million and remits the remaining $0.48 million as a dividend to its U.S. parent. Under current U.S. tax law, how much U.S. tax will the parent owe on this dividend? ANSWER. Under current U.S. tax law, the firm's U.S. tax owed on the dividend is calculated as follows: Dividend Spanish tax paid Included in U.S. taxable income U.S. tax @ 35% Less: U.S. indirect tax credit Net U.S. tax owed $480,000 520,000 $1,000,000 350,000 520,000 ($170,000) As a result of paying Spanish tax at a rate that exceeds the U.S. tax rate of 35%, the company receives a $170,000 FTC that can be used to offset U.S. taxes owed on other foreign source income. 5. Suppose a French affiliate repatriates as dividends all the after-tax profits it earns. If the French income tax rate is 50 percent and the dividend withholding tax is 10 percent, what is the effective tax rate on the French affiliate's before-tax profits, from the standpoint of its U.S. parent? ANSWER. Assume the French affiliate earns $1 million before tax. It then pays $500,000 in French income tax and remits the remaining $500,000 as a dividend to its U.S. parent. Only $450,000 gets through because of the 10% French dividend withholding tax. It appears as if the effective tax rate on this affiliate's earnings from the parent's standpoint is 55%. However, the parent will receive a foreign tax credit of $210,000, the difference between the $550,000 total tax payments to the French government and the $340,000 in U.S. tax owed on the $1 million in pre-tax earnings. If the full FTC can be used, then the parent's effective tax rate declines to 34%. If the FTC is unusable, the parent's effective tax rate on the affiliate's earnings is 55%. If part, but not all, of the tax credit is usable, the parent's effective tax rate on its French unit's earnings will lie between 34% and 55%. The higher the fraction of the FTC that is usable, the lower the parent's effective tax rate.