ACC7500 – Bond Refinancing Example

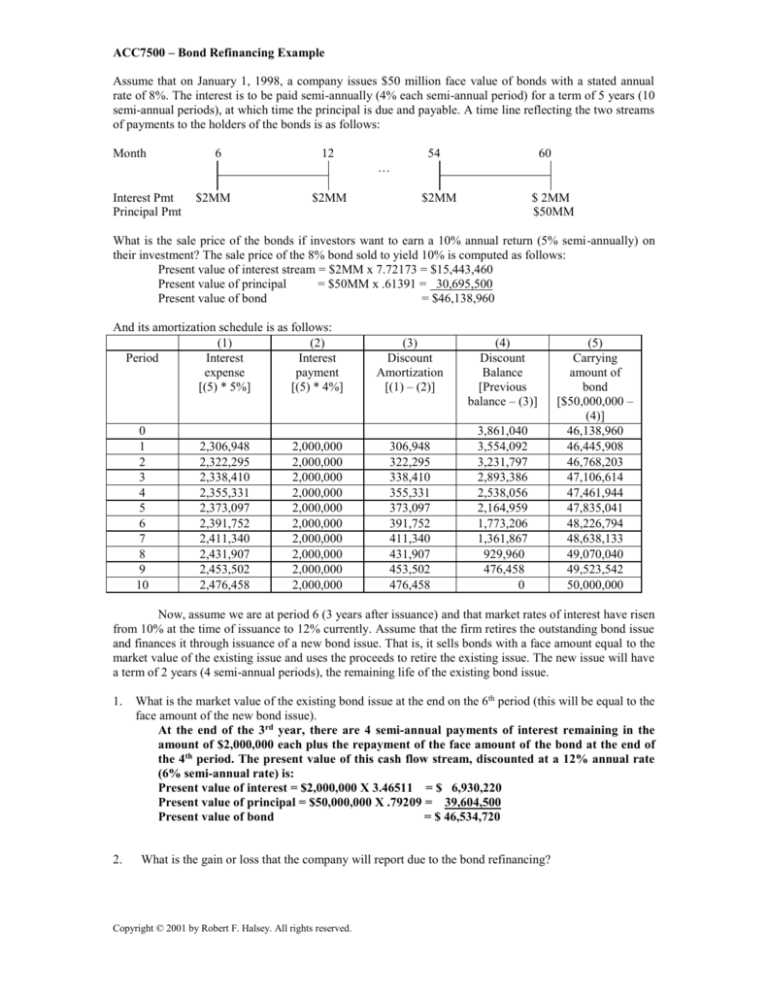

Assume that on January 1, 1998, a company issues $50 million face value of bonds with a stated annual

rate of 8%. The interest is to be paid semi-annually (4% each semi-annual period) for a term of 5 years (10

semi-annual periods), at which time the principal is due and payable. A time line reflecting the two streams

of payments to the holders of the bonds is as follows:

Month

6

12

54

60

…

Interest Pmt

Principal Pmt

$2MM

$2MM

$2MM

$ 2MM

$50MM

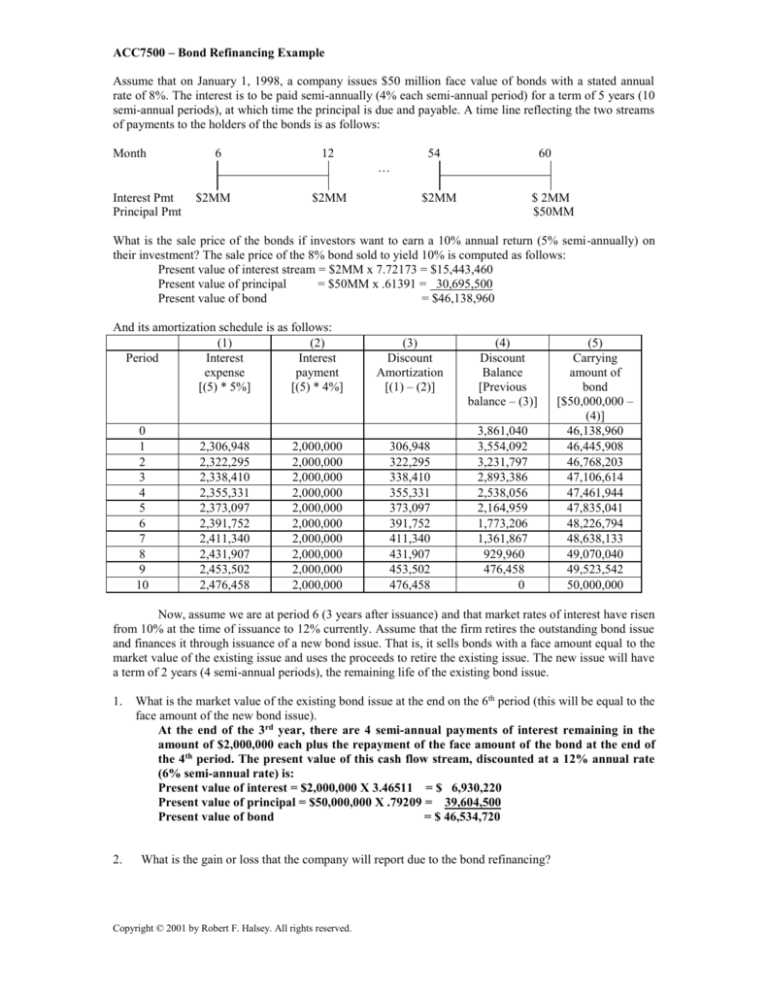

What is the sale price of the bonds if investors want to earn a 10% annual return (5% semi-annually) on

their investment? The sale price of the 8% bond sold to yield 10% is computed as follows:

Present value of interest stream = $2MM x 7.72173 = $15,443,460

Present value of principal

= $50MM x .61391 = 30,695,500

Present value of bond

= $46,138,960

And its amortization schedule is as follows:

(1)

(2)

Period

Interest

Interest

expense

payment

[(5) * 5%]

[(5) * 4%]

0

1

2

3

4

5

6

7

8

9

10

2,306,948

2,322,295

2,338,410

2,355,331

2,373,097

2,391,752

2,411,340

2,431,907

2,453,502

2,476,458

2,000,000

2,000,000

2,000,000

2,000,000

2,000,000

2,000,000

2,000,000

2,000,000

2,000,000

2,000,000

(3)

Discount

Amortization

[(1) – (2)]

306,948

322,295

338,410

355,331

373,097

391,752

411,340

431,907

453,502

476,458

(4)

Discount

Balance

[Previous

balance – (3)]

3,861,040

3,554,092

3,231,797

2,893,386

2,538,056

2,164,959

1,773,206

1,361,867

929,960

476,458

0

(5)

Carrying

amount of

bond

[$50,000,000 –

(4)]

46,138,960

46,445,908

46,768,203

47,106,614

47,461,944

47,835,041

48,226,794

48,638,133

49,070,040

49,523,542

50,000,000

Now, assume we are at period 6 (3 years after issuance) and that market rates of interest have risen

from 10% at the time of issuance to 12% currently. Assume that the firm retires the outstanding bond issue

and finances it through issuance of a new bond issue. That is, it sells bonds with a face amount equal to the

market value of the existing issue and uses the proceeds to retire the existing issue. The new issue will have

a term of 2 years (4 semi-annual periods), the remaining life of the existing bond issue.

1.

2.

What is the market value of the existing bond issue at the end on the 6th period (this will be equal to the

face amount of the new bond issue).

At the end of the 3rd year, there are 4 semi-annual payments of interest remaining in the

amount of $2,000,000 each plus the repayment of the face amount of the bond at the end of

the 4th period. The present value of this cash flow stream, discounted at a 12% annual rate

(6% semi-annual rate) is:

Present value of interest = $2,000,000 X 3.46511 = $ 6,930,220

Present value of principal = $50,000,000 X .79209 = 39,604,500

Present value of bond

= $ 46,534,720

What is the gain or loss that the company will report due to the bond refinancing?

Copyright © 2001 by Robert F. Halsey. All rights reserved.

The company will pay $46,534,720 to redeem a bond that is on its books at a carrying

amount of $48,226,794. The difference of $1,692,074 is reported as a gain on redemption, an

extraordinary item (net of tax).

3.

Although our firm reports an accounting gain on the redemption of bonds, has the company actually

realized a true economic gain?

In this case, the firm will issue bonds with a coupon rate of 12% (6% semi-annually) in the

amount of $46,534,720. Since we assume that the bonds are sold with a coupon rate equal to

the market rate, they will sell at par (no discount or premium). The interest expense per sixmonth period, therefore, will be equal to the interest paid in the amount of $2,792,083

($46,534,720 * 6%). Total expense for the 4 period life of the bond will be $2,792,083 X 4 =

$11,168,333. That amount, plus the $46,534,720 face amount of the bonds the firm will repay

at maturity, results in total bond payments of $57,703,053. Had the firm not redeemed the

bonds, it would have paid 4 additional interest payments of $2,000,000 each plus retirement

of the face amount of $50,000,000 at maturity, for total bond payments of $58,00,000. On the

surface, then, it appears that the firm is able to save $296,947 by redeeming the bonds and

has realized a true economic gain.1

This is, however, misleading. The firm’s “gain” consists of two parts. First, its

interest payments increase by $792,083 per year ($2,792,083 - $2,000,000). And second, the

face amount of the bond that must be repaid in 4 years decreases by $3,465,280 ($50,000,000

- $46,534,720). In order to evaluate whether a true gain has been realized, we must consider

the present value of these cash outflows and savings.

The present value of the increased interest outflow, a 4 period annuity of $792,083

discounted at 6% per period, is,

Present value cost of increased interest outflow = $792,083 * 3.46511 = $2,744,655

The present value of the reduced face amount the firm must repay at maturity, $3,465,280 4

periods hence, is

Present value benefit of decreased bond repayment = $3,465,280 * .79209 =

$2,744,814

So, has the firm realized a true economic gain? The answer is no. The present value of the

increased interest payments offsets the present value of the decreased amount that must be

paid at maturity and the present value of the net savings is zero. 2

Why, then, does application of current accounting principles result in the

recognition of a gain? The answer lies in our use of historical costing. Bonds are reported at

amortized cost, that is, the face amount less any applicable discount or plus any outstanding

premium. These amounts are a function of the selling price of the bond, its market value at

the time of sale, and are fixed for the duration of the bond. Market prices for bonds,

however, vary continuously with changes in market rates of interest. Firms do not adjust the

carrying amount of their bond liabilities for these changes in market value. As a result, when

bonds are redeemed, their carrying amount will differ from their market value and GAAP

requires the recognition of a gain or loss equal to this difference to be recorded upon

redemption of the bonds.

Although marketable securities accounted for as “trading” or “available-for-sale”

are reported on the balance sheet at current market values, the same is not true for bonds

and other long-term liabilities. This information might be relevant, however, for investors

and creditors in their analysis of the firm as it would provide an indication of unrealized

gains and losses similar to that reported for marketable securities. Fortunately, GAAP does

require companies to provide information about the current market values of their longterm liabilities in footnote disclosures. 3 Remember, however, that these current market

values are not reported on the balance sheet and changes in these market values are not

1

Notice, also, that the total interest expense on the new issue will be $3,168,333 ($11,168,333 $8,000,000) more than it would have recorded under the old bond issue. So, it is recording a present gain

but will also incur future higher interest costs.

2

The two amounts differ by $158, which is due to rounding errors in the use of 5 significant digits.

3

SFAS No. 107, “Disclosures About Fair Values of Financial Instruments,” Norwalk, CT: FASB, 1991.

Copyright © 2001 by Robert F. Halsey. All rights reserved.

reflected in net profit. Analysts must make their own adjustments to the balance sheet and

income statement based information contained in the notes.

Copyright © 2001 by Robert F. Halsey. All rights reserved.