OCR PREVIEW FILE

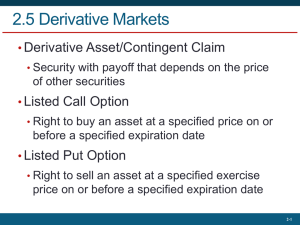

advertisement