Beneficiary: Polish Financial Supervision Authority (KNF)

advertisement

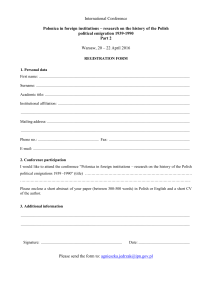

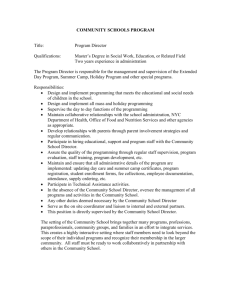

Project type: Twinning Light Project name: Strengthening the supervising capacities of the Polish Financial Supervision Authority in the field of capital market. Beneficiary: Polish Financial Supervision Authority (KNF) Description of the beneficiary institution: On 19 September 2006, i.e. on the day when the Act of 21 July 2006 on supervision of the financial market entered into force, the Polish Financial Supervision Authority (PFSA) initiated its activity. The new supervisory body took over the tasks of the Insurance and Pension Funds Supervisory Commission and of the Securities and Exchange Commission, which were abolished pursuant to the provisions of the said Act. The President of the Council of Ministers appointed the Chairperson of the new Authority, Stanisław Kluza. The Chairperson of the PFSA shall perform his functions for five years. Tasks of the Polish Financial Supervision Authority cover capital market supervision, insurance supervision, pension scheme supervision and complementary supervision of financial conglomerates whereof the supervised entities constitute the part. Moreover, the tasks of the PFSA shall include the following: a. undertaking measures aimed at ensuring regular operation of the financial market; b. undertaking measures aimed at development of financial market and its competitiveness; c. undertaking educational and information measures related to financial market operation; d. participation in the drafting of legal acts related to financial market supervision; e. creation the opportunities for amicable and conciliatory settlement of disputes which may arise between financial market actors, in particular disputes resulting from contractual relations between entities covered by PFSA supervision and recipients of services provided by those entities; f. carrying out other activities provided for by acts of law. The aim of financial market supervision is to ensure regular operation of this market, its stability, security and transparency, confidence in the financial market, as well as to ensure that the interests of market actors are protected. Since 1 January 2008, the scope of financial supervision of the Polish Financial Supervision Authority also includes banking supervision and supervision of electronic money institutions, which till the end of 2007 were performed by the Banking Supervisory Commission. PFSA activity shall be supervised by the President of the Council of Ministers. Foreseen start of project activities: IV quarter 2008 Project duration: 3 months Overall objectives Component 1 Strengthening the institutional and operational capacity of the public administration institution in order to properly function in the structures of the European Union and proper enforcement of the EU regulations concerning financial market. Project purpose 1 Component 1 - Training with other national authorities in the scope of: methods of detection of abuse, proceedings of enforcement and enforcement actions in light of defendant’s rights according to the powers stipulated in the Market Abuse Directive (MAD). - Training with other national authorities in the scope of cooperation with the public prosecutor office and the police. - Identification of the methods of investigation not only on a capital market but on a financial market as a whole, in which there is a ground for possible abuses. Background and Justification Component 1 For the effective applying of acquis communautaire in the field of the Market Abuse Directive it is necessary for supervisors to explore through the dialogue how their institutions set strategy to regulate financial markets, how they identify and monitor this market. The Polish Authority and supervised markets would benefit from the dialogue with authorities that regulate large, well developed markets with long history, identifying the best solutions. PFSA faces the problem of the financial advising by non-regulated entities. Their activity may fall in the scope of the Market Abuse Directive. The additional goal of the project is to learn the methodology of monitoring activities of a.m. advisers, protecting investors from fraudulent activity of such entities. After implementing the Market Abuse Directive it is important for PFSA to learn how to exploit its powers in the most effective way. Results Component 1 The level of knowledge of the Beneficiary regarding the relevant methodology of the Market Abuse Directive in other Member States of European Union and practical solutions in the following subjects is improved: - effective applying of acquis communautaire - MAD; - administrative capacity in specific areas of the MAD; - greater efficiency of the personnel of the competent authority. The results of the activity in Component 1 are enclosed in one document – guidebook. The Twinning Light partner with the assistance of the beneficiary experts develop the guidebook comprising knowledge and information obtained from foreign supervisory authorities. The text of the guidebook covers issues concerning activity on financial market done by non-regulated entities and guidelines how to protect individuals from fraudulent activities. It includes some features on proceedings of enforcement and scope of enforcement actions as a regulatory tool to protect market integrity. Due to the fact that the guidebook includes non-public information about the methods of investigation or detecting market misconduct applied by foreign supervisory authorities, some information is restricted and not presented in it. The guidebook will be prepared in Polish and English A4 format version. The Beneficiary will also receive the electronic version. The accomplished document will be published in 20 copies each language version. The achieved guidebook will be regularly up-dated by the beneficiary experts within the scope of the sustainability of the developed knowledge and guidelines. Objectively verifiable indicators: 1) Number of trained people – approximately 30 people; 2) Post-seminar documents and training materials; 3) Guidebook, comprising knowledge and information obtained from foreign supervisory authorities. Implementation schedule: 2 Component 1 Activity 1.1 IV quarter 2008 in Warsaw, preferably 4 calendar days, approximately 2 - 4 short term experts, 30 participants, seminar and workshop: Surveillance and enforcement of the market abuse cases. Participants: employees of respective departments of PFSA. All seminar participants will be supported with the training materials in Polish. Institutional Framework, including beneficiary Component 1 Direct Beneficiaries: Polish Financial Supervision Authority. Component 1 Final Beneficiaries: Polish Financial Supervision Authority (Law and Legislation Pillar). BC Project Leader and contact for the project: Mr Adam Płociński, Managing Director of the Financial Market Development and Cross – Sector Policy Pillar, Polish Financial Supervision Authority, tel.: +48 22 33 26 634, e: mail: adam.plocinski@knf.gov.pl BC Project implementation manager: Mr Bogusław Budziński, Director of the International Cooperation Department, Polish Financial Supervision Authority, tel.: +48 22 33 26 802, e: mail: boguslaw.budzinski@knf.gov.pl MS Project Leader: - Overall co-ordination of the project implementation; - Leading the project activities; Profile: - Civil servant from an EU Member State administration responsible for capital market supervision and regulation; - Experienced in the field of management and organization; - Approximately 2 - 3 years working experience in a leading management; - In a position to operate at the appropriate political level; - Good leadership skills; - Knowledge in the processes related to the implementation of EU-funded projects; - Knowledge in the processes related to the implementation of the methodology of capital market supervision and EU regulations; - Fluent English; - Good computer skills. Profile of the Short Term Experts: - Public sector experts; - Approximately 2 - 3 years of professional experience in the field of capital market regulation 3 and supervision; - Familiar with EU regulatory system, legislative process (app. 2 - 3 years experience with acquis); - Fluent English. Budget including national co-financing See attached. Basic Implementation Arrangement There will be a start – up report covering the first month of the contract (submitted during the first month), plus final report (Templates and requirements as for standard Twinning). For the purpose of effective coordination of the project the Steering Committee (StC) shall be formed by the Polish Financial Supervision Authority (KNF). StC consists of the representatives from Polish Financial Supervision Authority (Enforcement Department, International Cooperation Department), Central Financing and Contracting Unit and MS partner. The responsibility for the organization of the Project Steering Committee meeting lies with both Project Leaders. Steering Committee will meet app. two times during the project implementation period in order to discuss and approve the reports presented by the MS PL and decide on the timetable of the project and achievement of project results. Three weeks before the project event BC Project implementation manager and BC Project Leader will receive a detailed sketch of material that would be presented during the event for approval and modification. After the project event a report will be written. It will assess the achievement of the event objective. The working language of the project will be English. Translation and interpretation services will be provided in all activities in which non-English speaking experts participate. The Polish FSA Project Implementation Unit (PIU) will be the main contact point for all official communications between the Twinning partner and the Polish FSA concerning the implementation and management of the project. In this particular case, the International Cooperation Department at the Polish FSA will play the role of PIU, which shall also be assisted by experts from the specialized administration. The contact person for the project are: Mr Bogusław Budziński – Director of the International Cooperation Department in the Polish FSA, Pl. Powstańców Warszawy 1, 00-950, Warsaw, Poland, tel: (+48 22) 33 26 802, fax: (+48 22) 33 26 763, email: Boguslaw.Budzinski@knf.gov.pl Ms Joanna Lipowczan – Individual Post for the EU Projects Implementation in the International Cooperation Department in the Polish FSA, Pl. Powstańców Warszawy 1, 00-950, Warsaw, Poland, tel: (+48 22) 33 26 703, fax: (+48 22) 33 26 763, e-mail: Joanna.Lipowczan@knf.gov.pl 4