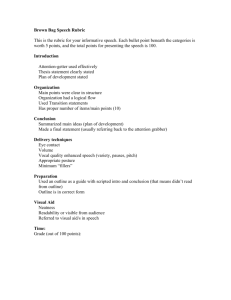

Budget Project Overview

advertisement

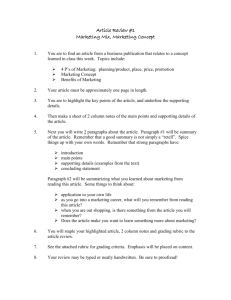

Government/Economics Mrs. Eugster Personal Budget Assignment Your assignment is to plan a monthly budget (for 3 months in a row) to see how expensive life is. Many of you have bought a car or made several personal purchases, but few of you have had to pay for shelter or bought the boring necessities, such as laundry detergent or light bulbs, and thus you probably have little understanding how these purchases add up. This assignment will hopefully give you a better understanding of how much money is needed to survive as well as giving you practice budgeting your money. I have had students in the past who have changed life plans after completing this project; I promise you, completing this project will be an eye-opener. This is a 200-point assignment and will have benchmark due dates throughout both semesters of Government and Economics. You will need to document the price of just about everything you purchase. Your grade depends largely on the breadth, thoughtfulness and frugality of your purchases and the documentation of your Internet shopping cart from different sites. The Scenario: You have just graduated from high school and now you are ready to go earn a living. You are absolutely on your own and you are starting with nothing except your clothes, good credit, and a job. Occupation: You need a job. We are going to imagine that you have found yourself a well paying job. It pays $16.50 per hour. Figure out how much you will make per year if you worked full time (40 hours) for 52 weeks. First deduct $1,200 from this amount to cover your health insurance at $100 a month for a year. The Wage Calculation Form is posted online; you must complete this form in order to receive credit for this portion, we will be going over it in class or you can work on it in advance if you like. Taxes: You may consider the amount of money you earn during a calendar year as one discrete sum that you call plain old income. But the 1RS looks at income in a different way: it charges you different tax rates for different levels of taxable income. That's because the U.S. income tax is a graduated tax, designed so that people pay an increasing percentage rate as their income rises through various tax brackets. In this tiered system, known as a progressive tax, you pay 10 percent on the first tier of taxable income — for a single person in 2007, the first $7,825 in earnings. Then you pay 15 percent on the next tier — for a single person, income between $7,825 and $31,850 plus the $782.50 from the first tier. You pay increasing percentages as your income rises, topping out at 35 percent on all income over $349,700 plus all amounts from the lower tiers. You also have to pay Social Security Tax of 6.2% on your earnings up to $97,500. California has one of the highest state income tax rates in the nation. Figure your rate will be 8%. After state and Federal income tax are calculated for this project you will end up paying approximately 20% of your income. In this project we will be ignoring other various taxes, such as, Workers Compensation and Medicare that you would pay in real life. The money leftover should be divided by 12 to find out how much money you will clear per month. This figure will be how much you really will have to spend. For your hourly rate this will work out to $_______ per month. Except for the first month your monthly expenses cannot exceed the amount of money you make per month Car: You need to get a car, other methods of transportation like mopeds, motorcycles, etc., are not acceptable. I would suggest a used vehicle since payments on a new one would probably be too expensive. How expensive will the upkeep of your car be? What is the cost of gasoline per month for your car? You need to consider the cost of maintenance. Therefore the lowest price acceptable for a car is $3,500, but if you wish you may go above that amount. Insurance: You will also need to get car insurance. For the car insurance part you need an actual written estimate (or a downloaded one from an Internet auto insurance site) from an insurer on the car you “purchased” for this assignment. If you have a family member who sells insurance you will still need to get an official quote. What type of insurance will you get? You do not have to get medical insurance – you already paid for it before you got your check. Apartment or House: Find a place to live IN FREMONT. You can have some roommates but you are not to share a room with anyone or have people living in a room other than a bedroom. For example, you and two others must find a three-bedroom house. You can split the rent but must do all your own shopping for the rooms in the apartment. Utilities: Most apartments will include some utilities, for example, water, garbage, or PG&E in the rent. You are expected to determine which, if any, are included with the rent for your apartment. If not included you are to assume your PG&E costs will be $75 per month. Cable television and Internet are optional, but phone service is not, although you may use cellular only if you like. You must include a copy of the ads for the services you decide on.. Food: First you need to make a menu for a week (breakfast, lunch and dinner) and list the cost of each item. A meal must consist of at least two food items and a beverage. The menu does not have to broken down in terms of the cost of each item for each meal. Just calculate the total cost of providing yourself with the items in the menu for a week. You may use the same item for a meal, e.g., lunch no more than 3 times in a week. You must prove the price of each item with an ad (hard copy or Internet site print out of your shopping cart) or receipt. An imaginative, different meal everyday is expected for full credit. Remember if you cook real food you will save money! You are allowed to go out to eat twice a week but you must include the price of the meal in your budget. Other Market Necessities: Soap, toilet paper, detergent, shampoo, etc. This is just the tip of the iceberg. Also you will need kitchen supplies like a drain board, dishes, glasses, pots and pans etc. You need to provide the prices, with ads, of these items as well. Recreation: How much do you have left to go out and have fun with? Think of creative and inexpensive ways to entertain yourself and document the costs. Be realistic…you will spend money even if it is just getting a slurpee with friends. Emergency Money: After the first month your emergency funds must be at least $100. LOAN: You will be required to take out a loan to cover the first months' one-time expenses (all the big expenses such as sofa and dining room table), to purchase your car, and to pay deposits and installation fees. DO NOT GET A SEPARATE AUTO LOAN. Your loan is to be used to buy your one time purchases and nothing else. Paying off the loan will be a monthly budget item. We will go over the amount you need to borrow and how to calculate the monthly loan payment in class. I will provide you with the address of the web site you can use to calculate your payments. In the real world, would I ever recommend getting a loan to purchase a used car and one-time move-in expenses? NOOOOO!!!! This is for practice applying for and working interest on loans. Additional Information: Only the housing cost may be shared. This may include the rent, first and last and/or security deposit. If you have a roommate or roommates you cannot submit (copied or identical) versions of any work. This includes ads, menus, calculations, or anything else. It you do submit copied work it will cost you at least, at my discretion, a full letter grade. Conclusion: The conclusion should be comprehensive and explain what you have learned from the project. A large portion of your total grade on this project will be determined by the quality and insight of your conclusion. Do not write ‘I learned it is expensive to live in Fremont,” unless it is part of a more developed theme. Also stay away from statements such as, “I learned money doesn’t grow on trees.” Format: Posted online is a sample budget project format you can use, but please feel free to create your own, as long as all the documentation as well as rubric and additional forms are attached or pasted into the PowerPoint. It is the first time I am using PowerPoint as an acceptable submission, but do look at the binder versions to understand exactly what I am looking for in grading. I have sample budget projects from past students that give you an idea of the format needed for this project. Grading Rubric: A copy of the grading rubric needs to be turned in with your project. It is posted online. Your project should be tabbed in the exact order of the grading rubric. Each section within each tab should be in the order of the rubric. If you are creating a PowerPoint, it should also be in the exact order of the rubric to earn full credit. INSURANCE Information Automobile Insurance – A type of insurance that protects against losses involving automobiles. Auto policies contain a variety of coverages that can be purchased depending upon the needs and wants of the policyholder. Liability for bodily injury and property damage, medical payments, uninsured motorist, comprehensive, and collision are some of the common coverages offered under an auto insurance policy. Comprehensive Coverage – Pays for damage to your car caused by reason other than collision, such as fire, theft, vandalism, windstorm, flood, et cetera. Collision – Pays for damage to your car caused by physical contact with another vehicle or with another object, such as a tree, boulder, guardrail, structure, or person. Deductible – The amount of the loss that the policyholder is responsible to pay up-front before covered benefits from the insurance company are payable. This is applicable to comprehensive or collision coverage only. Liability Insurance – Coverage for a policyholder’s legal liability resulting from injuries to other persons or damage to their property. Limits – The maximum amount of benefits the insurance company agrees to pay in the event of a loss. Medical Payments Coverage – Covers the medical costs (up to the specified limit) resulting from an auto accident for you, your family, or others in your car. This coverage pays regardless of fault. How Much Insurance Must You Carry? State law says you must be financially responsible for your actions whenever you drive and for all motor vehicles you own. It is illegal to drive without being financially responsible. Most drivers choose to have a liability insurance policy as proof of financial responsibility. If you have an accident not covered by your insurance, your driver license will be suspended. If the driver is not identified, the owner of the motor vehicle involved, if not insured, will have his or her driver license suspended. The minimum amount your insurance must cover per accident is: $15,000 for a single death or injury. $30,000 for death or injury to more than one person. $5,000 for property damage. This amount of coverage is very minimal if you are at fault and you cause damage to another car or person.