Question 1

advertisement

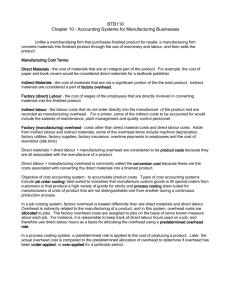

PRACTICE TEST FOR FINAL EXAM Question 1- -Chapter 16- Budgeting (18 Marks) Part A Discuss the following comment by the Manager of a small manufacturing company: “Budgeting is a waste of time. I’ve been running this business for fourty years. I don’t need to plan” Part B ABC Manufacturing sells widgets for $6.00 each. The marketing department has prepared the following second quarter sales forecast (in units) for 2009: April May June Total 15,000 23,000 20,000 58,000 Required: Prepare a sales budget for each month and the total for the quarter. Include all column and row headings. 1 Question 2-Chapter 13-Introduction to Management Accounting (8 marks) Presented below is a list of costs and expenses incurred in the factory by Eco Systems Ltd, a manufacturer of eco-friendly, hybrid vehicles. ____ 1. Property taxes on the factory land ____ 2. Metal used in manufacturing ____ 3. Cabinet maker's wages ____ 4. Nails and glue used in production ____ 5. Factory supervisors’ salaries ____ 6. Depreciation on factory machines ____ 7. Factory utilities ____ 8. Carpeting for the vehicles ____ 9. Property taxes on the factory building ____ 10. Insurance on factory equipment Required Classify the above items into the following categories: DM— Direct Materials DL— Direct Labour MO— Manufacturing Overhead 2 Question 3 –Chapter 14-Cost Accounting Systems-Job costing (14 marks) Wattle Ltd Manufactures make covers for outdoor spas. The company specialises in 3 types of covers. They make 1/Weatherproof, 2/Plastic and 3/Hard top. They have estimated the following for 2009; Expected Production 60,000 units Expected Direct Labour Hours 30,000 hours Expected Manufacturing Overhead $120,000 Manufacturing overhead is allocated on the basis of direct labour hours. At the end of 2009 the management of Wattle Ltd identified the following information. Manufacturing Overhead was $180,000 and the Direct Labour hours for each spa cover were are follows; Direct Labour Hours Weatherproof Cover Plastic Cover Hardtop covers 15,000 hours 7,000 hours 5,000 hours Required: (a) What was the predetermined manufacturing overhead rate calculated at the beginning of 2009 for Wattle Manufacturers? (b) What was the actual manufacturing overhead rate for 2009? (c) Outline the difference between the rates calculated in (a) and (b) above and provide ONE reason for the difference. (d) Determine the overhead to be allocated to the THREE products at the end of 2009. 3 Question 4 –Chapter 17-Capital Budgeting (16 marks) Part A ‘Net Present Value (NPV) should not be used for analysing projects that have strategic significance for the business, as this method cannot take strategic factors into account.’ (i) Provide an example that has strategic significance for the business (ii) Do you agree with the above statement? Part B Fresno Manufacturing Company specializes in the production of precision tools. Management is in the process of selecting a new drill press. The press under consideration will cost $92,000 plus necessary installation charges of $5,000. Experience indicates that the press will last for five years and should have a residual value at the end of that period of about $10,000. Expected annual cash revenues from the press should average $45,000, and related cash operating costs should be around $20,000. Management has decided on a minimum desired before-tax rate of return of 10 percent. Present value multipliers: 6 Percent 10 Percent Present value of $1 at end of five years .747 Present value of $1 received in each of the next4.212 five years .621 3.791 12 Percent .567 3.605 Required a. Using before-tax information and the net present value method to evaluate this capital investment, determine whether the company should purchase the drill press. Support your answer. b. If management has decided on a minimum desired before-tax rate of return of 12 percent, should the drill press be purchased? Show all computations to support your answer. 4 Question 5-Chapter 17-Incremental Analysis (12 Marks) Part A Explain how the existence of spare production capacity can affect the choice of whether to accept or reject a special order. Part B Northern Star Limited produces 10,000 units of Gadgets each year with the following production costs. Cost Direct material Direct labour Variable manufacturing overhead costs Electricity Fixed manufacturing overhead costs Factory space rental Other manufacturing overhead Amount ($) 2.00 0.50 0.20 20,000 30,000 Southern Star Limited, who is a reliable vendor of Northern Star Limited has offered to supply the 10,000 units at a price of $4. Required: (i) Assume that the capacity freed up from purchasing the 10,000 units from Southern Star Limited is idle. Should Northern Star Limited purchase the 10,000 units from Southern Star Limited? (ii) Assume that the capacity freed up from the purchase could be used by the Northern Star to produce a different product, Badges. If Northern Star was able to sell all the badges produced with the freed up capacity for $60,000 at a cost of $45,000, would your answer change from part (i) ? 5 Question 6-Chapter 15-Cost Volume Profit Analysis (16 Marks) Part A In a strategy meeting, the manufacturing director said, ‘if we raise the price of our product, the company’s breakeven point will be lower. The finance director responded by saying, ‘then we should raise the price. The company will be less likely to incur a loss’. Do you agree with the manufacturing director? Give reasons. Do you agree with the finance director? Explain your answer. Part B The Item Opener Company manufactures and sells three products, details of which are as follows: Unit selling price Unit variable costs Contribution margin Ratio of sales Can opener $1.25 $0.75 $0.50 30% Bottle opener $2.00 $1.30 $0.70 40% Corkscrew $2.50 $1.75 $0.75 30% Total annual fixed cost are $32,750 Required a) Calculated break even point in units for each product b) Calculate the sales required for each product if a desired after tax profit of $6,000 is to be earned. Tax rate is $40%. c) Prove your answer with an itemised income statement showing profit by product and in total. 6 Question 7-Chapter 14-Cost Accounting Systems-ABC (16 Marks) Rolex Company manufactures two models of watches, the “Classic” and “Modern”. The “Classic” model has been produced since 2005 and the “Modern”, was introduced in early 2008. Rolex Company currently uses a traditional costing system. Manufacturing overhead costs were estimated at 2,400,200 and were allocated on the basis of machine hours. The following cost information has been used as a basis for pricing decisions over the past year. Per-unit data Direct materials Direct labour hours Machine hours Units produced Direct labour cost per hour Machine usage cost per hour Classic Modern $105 $290 1.5 3.5 6 3 12,500 3,250 $12 $12 $16 $16 Rolex CEO, Harry Clarke, suggested that the company should concentrate its marketing resources on the “Modern” and begin to phase out the “Classic” model.Tony Martin, the new accountant,suggested that an activity based costing analysis firrst be run to get a better picture of the true manufacturing cost. The following data were collected: Activity center Cost driver Soldering Number of solder joints Shipments Number of shipments Quality control Number of inspections Purchase orders Number of orders Machining Machine hours Machine set-ups Number of set-ups Total traceable costs Activity Soldering Shipments Quality control Purchase orders Machining Machine setup Number of Events Classic 592,500 8,100 28,100 40,050 88,000 8,000 Traceable costs $ 471,000 430,000 620,000 475,400 28,800 375,000 2,400,200 Modern 192,500 1,900 10,650 54,990 8,000 7,000 Total 785,000 10,000 38,750 95,040 96,000 15,000 Required: (a) Calculate the manufacturing cost per unit for Classic and Modern under a traditional costing system (b) Calculate the manufacturing cost per unit for Classic and Modern under the ABC system (c) Explain the diffrences in manufacturing cost per unit calculated in part (a) and part (b) (d) How are non manufacturing costs treated under conventional costing systems?Is this approach useful for management? 7 Suggested solutions Question 1 Part A This comment is occasionally heard from people who have started and run their own small business for a long period of time. These individuals have great knowledge in their minds about running their business.They feel they do not need to spend a great deal of time on the budget process, because they can essentially run the business by gut feel. This approach can result in several problems. First, if the person who is running the business is sick or absent, he or she is not available to implement plans that could have been clarified by a budget. Second, the purposes of budgeting are important to the effective running of an organisation.Budgets facilitate communication and co-ordination, are useful in resource allocation and help in evaluating performance and providing incentives to employees. It is difficult to achieve these benefits without a budgeting process. Part B ABC Manufacturing Sales Budget Quarter ending June 30, 2009 Estimated sales (units) Sales price per unit Total budgeted sales April 15,000 $ 6.00 $90,000 May 23,000 $ 6.00 $138,000 June 20,000 $ 6.00 $120,000 Total 58,000 $ 6.00 $348,000 Question 2 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. MO DM DL MO MO MO MO DM MO MO 8 Question 3 (a) What was the predetermined manufacturing overhead rate calculated at the beginning of 2009 for Capri Manufacturers. Formula = Estimated O/H cost / estimated quantity of alloc bases $120,000 / 30,000 hrs = $4 per hour (3 marks) (b) What was the actual manufacturing overhead rate for 2009? $180,000 / 27,000 hrs = $6.66 per hour (3 marks) (c) Outline the difference between the rates calculated in (a) and (b) above and provide ONE reason for the difference. The rate difference is due to underestimation (2 marks) Budget O/H cost Alloc Base 120,000 30,000 Actual 180,000 27,000 Diff 60,000 3000 (3marks) (d) Determine the overhead to be allocated to the THREE products at the end of 2009. Machine hours used on job x budgeted overhead rate (calculated in part Weatherproof Cover = 15000 hrs x $6.66 = $99,900 Plastic Cover = 7,000 hrs x $6.66 = $46,620 Hard Top Cover = 5,000 hrs x $6.66 = $33,300 QUESTION 4 Part A i) Any example for one of the following categories will be correct – – – – – – – – 1. Operational capital investment decisions (eg factory buys a forklift) 2. Strategic capital investment decisions (eg Hugo Boss new building offices in Richmond) 3.Investment decisions to comply with regulatory, safety, health and environmental requirements (eg equipment to minimise pollution 9 ii) NPV is still a valid method for evaluating projects of strategic significance. However, attempts should be made to include seemingly ‘non-quantifiable’ factors into the analysis, or greater weight should be placed on strategic aspects of the investment. Note: You may give marks for any other logical explanations a. Decision on purchase of drill press, using a 10 percent before-tax rate of return: Purchase price of drill press Installation costs Desired before-tax rate of return Cash flows from drill press Useful life Residual value Present value of net cash inflow ($25,000 3.791) Residual ($10,000 .621) Total present value Less purchase price of drill press ($92,000 + $5,000) Positive (negative) net present value $92,000 $5,000 10 percent $25,000 5 years $10,000 $ 94,775 6,210 $100,985 97,000 $ 3,985 The drill press will yield more than a 10 percent before-tax return, so an affirmative decision should be made. b. Decision on purchase of drill press, using a 12 percent before-tax rate of return: Purchase price of drill press Installation costs Desired before-tax rate of return $92,000 $5,000 12 percent Cash flows from drill press Useful life Residual value $25,000 5 years $10,000 Present value of net cash inflow ($25,000 3.605) Residual ($10,000 .567) Total present value Less purchase price of drill press Positive (negative) net present value $90,125 5,670 $95,795 97,000 ($1,205) The drill press should not be purchased because of the negative net present value. 10 QUESTION 5 Part A If a firm has spare production capacity, there is no opportunity cost to the acceptance of a special order. On the other hand, if the firm is already operating at capacity and there is no spare production capacity, the opportunity cost associated with accepting a special order includes the contribution margin foregone from the products that would have been manufactured with the resources now devoted to the special order. Answer-Part B i) Total cost analysis Make option ($) Cost of purchase from Southern Star Variable costs Direct material Direct Labour Electricity Buy option ($) 10,000x $4 = 40,000 2.00 x 10,000 = 20,000 0.50 x 10,000 = 5,000 0.20 x 10,000 = 2,000 Less: Fixed costs Factory space rental Other manufacturing overhead 20,000 30,000 77,000 20,000 30,000 90,000 It is cheaper to make internally. Northern Star Limited will save $13,000 ($90,000-$77,000) (6 Marks) ii) Make option ($) Cost of purchase from Southern Star Cost of making internally Buy option ($) 90,000 77,000 Less: Opportunity cost of producing badges 77,000 (60,000-45,000)=$15,000 75,000 Now it is cheaper to purchase from Southern Star. Northern Start can save $2000 (77,000-75,000), if purchase from Southern Star. 11 QUESTION 6 Part A The manufacturing director is correct. A price increase results in a higher unit contribution margin. An increase in the unit contribution margin causes the break-even point to decline. The financial director’s reasoning is flawed. Even though the break-even point will be lower, the price increase will not necessarily reduce the likelihood of a loss. Customers will probably be less likely to buy the product at a higher price. Thus, the firm may be less likely to meet the lower breakeven point (at a high price) than the higher break-even point (at a low price). Part B Average CM=(30%0.5)+(40%x070)+(30%x0.75)=$0.655 BEP(units) = Fixed cost/Average contribution margin=32,750/0.655 =50,000 units BEP (by product) = Can opener Bottle opener Corkscrew 50,000x0.3 =15,000 50,000x0.4 =20,000 50,000x0.3 =15,000 b) BEP Sales (Units) = Fixed cost + Target profit before tax Weighted av.Contribution margin = 32,750+10,000 0.655 = 65,267 SALES BY PRODUCT Can opener Bottle opener Corkscrew 65,267x0.3 =19,580 65,267x0.4 =26,107 65,267x0.3 =19,580 c) Can opener ($) Sales Less :Variable costs Contribution margin Less: Fixed cost Profit before tax Tax (@40%) Net profit after tax Ratio of sales 24,475 14,685 9,750 30% PRODUCTS Bottle Corkscre opener ($) w ($) 52,214 48,950 33,939 34,265 18,275 14,685 40% TOTAL ($) 125,639 82,889 42,750 32,750 10,000 4,000 6,000 30% 12 Question 7-Answer (a) Manufacturing cost per unit under traditional cost accounting In the traditional cost accounting system, overhead is allocated to products based on machine hours. The rate per hour is calculated as follows: Total estimated overhead Estimated machine hours: Classic (6.0 hours × 12500 units) Regal (3.0 hours × 3250 units) Total estimated machine hours $2 400 200 75 000 9750 84 750 Estimated allocation rate per machine hour ($2 400 200/84750) = $28.32 The total manufacturing cost per unit is the sum of per unit direct material, direct labour, machine usage and allocated overhead as follows: Classic Direct material $105.00 Direct labour 1.5 DL hrs × $12 18.00 Machine usage 6 mach hrs × $16 96.00 Overhead 6 mach hrs × $28.32 169.92 Total $388.92 Modern $290.00 3.5 DL hrs × $12 42.00 3 mach hrs × $16 48.00 84.96 464.96 (b) Using the ABC system calculate the allocation rate for each of the ABC pools. Soldering Shipments Quality control Purchase orders Machining Machine set-ups 471,000 430,000 620,000 475,400 28,800 375,000 785,000 10,000 38,750 95,040 96,000 15,000 0.60 43.00 16.00 5.00 0.30 25.00 13 Activity Soldering Shipments Quality control Purchase orders Machining Machine setup Manuf O/H p/u Direct Materials Direct Labour Machine Usage Total Manufacturing Cost p/u (c) 592,500 8,100 28,100 40,050 88,000 8,000 0.60 43.00 16.00 5.00 0.30 25.00 (1.5*12) (6*16) Classic $ 355,500.00 348,300.00 449,600.00 200,250.00 26,400.00 200,000.00 192,500 1,900 10,650 54,990 8,000 7,000 Modern $ 115,500.00 81,700.00 170,400.00 274,950.00 2,400.00 175,000.00 0.60 43.00 16.00 5.00 0.30 25.00 1,580,050.00 819,950.00 Classic 126.40 105.00 18.00 96.00 Modern 252.29 290.00 42.00 48.00 (3.5 *12) (3*16) 345.40 632.29 The conventional costing system allocates a lump sum of overhead based only on machine hours, while the ABC system uses six cost pools to allocate the overhead. Allocations using these cost pools and cost drivers more accurately reflect the flow of resources. (d) Over time, both upstream and downstream non-manufacturing costs have grown and many of them, such as product design, development and advertising costs, are related to particular products. Yet, conventional costing systems usually expense all non-manufacturing costs in the period in which they are incurred. Ignoring these costs means that management has an incomplete picture of a product’s costs. This may make it difficult for managers to decide which products to produce and what prices to set. 14