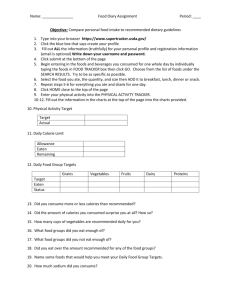

4.2 Attitudes towards functional foods

Market orientation for functional food industry

M.D. de Barcellos

1

, A.Hoppe

2

, L.M. Vieira

2

, G. Oliveira

2

1

UFRGS, Post-Graduate Programme in Management

Rua Washington Luis 855/409, Porto Alegre, RS, 90010-460, Brazil

Email: mdbarcellos@ea.ufrgs.br

2 UNISINOS Business School

Av. Unisinos, 950, São Leopoldo, RS, 930220-000, Brazil

Emails: alexiahoppe@gmail.com

; lmvieira@unisinos.br

; guilherme.expimp@gmail.com

Abstract

This study investigates the opportunities for functional foods in a developing country. An online survey with 318 consumers in South Brazil explores their attitudes towards functional foods, their background attitudes in regard to general health and natural product and specific perceptions and intention to buy locally produced functional food products. Respondents present positive attitudes towards functional foods and purchasing power to buy them. An exploratory factor analysis identified two main dimensions in regard reward ( Health and

Wellness and Preventive Medicine ). Yet, a cluster analysis further identified different consumers group that could be used for marketing oriented strategies by food companies.

Keywords: Functional Food, Consumer Behavior, Cluster Analysis, Market Orientation.

1 Introduction

Health has been named as the most significant trend and innovation driver in the global food and drinks market. The definition of health is no longer restricted to the absence of disease, but it includes physical as well as mental and psychological well-being. Eating functional food is not sufficient in itself to make us healthier, but functional food products are an important part of a sustainable and healthy diet. Nowadays, food is not only required for body development, growth and maintenance, but it is also recognised to play a key role in the quality of life (Ashwell, 2002).

The term “functional food” (FF) refers to a food that provides a health benefit as well as nutrients. The term can also refer to whole foods, to fortified, enriched or enhanced foods, and dietary supplements that have the potential to improve mental and physical well-being and reduce the risk of diseases. The ingredients responsible for this benefit can be naturally present or may have been added during processing. The concept was first introduced in Japan in the 1980s and further developed in the United States and in Europe, although nowadays there is a global (and growing) market for “functional foods” (De Barcellos and Lionello,

2011). According to Annunziata and Vecchio (2011) functional foods represent one of the most interesting areas of research and innovation in the food industry, and particularly for this industry, innovation is an important source of differentiation and a value-adding opportunity for managers to develop new products. Hence, innovation constitutes a competitive advantage in the globalised agri-food scenario (De Barcellos et al., 2009).

Nevertheless, the functional food product sector is subject to a multi-layered system of regulation. While functional foods are subject to the same controls on food safety as conventional food products, there are additional 'hoops' to be jumped through if projects are judged to be novel. Further, given that the chief basis on which these products are developed and commercialised is their purported health benefits, restrictions on health claims remain a

significant impediment to the exploitation of opportunities, especially in domestic markets

(Agriculture and Agri-food Canada, 2009). From the consumer’s viewpoint, the absence or existence of functional food legislation may not have a very crucial role in food choices as such. In turn, for authorities, marketers and manufacturers, the generally accepted guidelines would clearly facilitate the marketing efforts. Hence, the real challenge for functional food manufacturers is how to communicate the health effects unambiguously and reliably to the consumers (Urala, 2005).

Conversely, as consumers have become increasingly concerned about what they eat and how this affects their health, the food industry has responded by providing more detailed nutrition labeling and often making claims about the beneficial effects of certain foods (Lalor et al., 2011). While there can be professional skepticism (Lee et al., 2003) about the role of functional food products on the market place, it is clear that the consumer is showing increasing interest in the purchase of products which could provide solutions to dietary problems or go some way towards preventing problems before they arise (McNally, 2007).

Habit dictates many of our purchasing decisions. For new products however, such as functional foods, results of studies on consumer attitudes towards has gradually become established in the literature. In that sense, attitudes and lifestyle - other than demographic factors as gender, age or education – deeply affect the acceptance and consumption intention of functional food (Urala and Lahteenmaki, 2007) and, therefore consists in important elements on consumer’s segmentation. Functional foods, for having so many categories, are not perceived as a homogeneous group by consumers (Urala and Lahteenmaki, 2003).

Therefore, the purpose of this paper is to examine consumers’ attitudes towards functional food products in a developing country, considering the opportunities such products can represent to the local market. Specifically we aim to examine the existence of different segments and their profiling in terms of attitudes, general health interest, natural product interest and willingness to buy regional developed functional food products. We briefly discuss the role of regulation in the functional food sector in Brazil and how it can affect competitiveness.

The paper is organized as follows. Section 2 reviews the market and consumer behavior towards functional food, followed by regulation in Brazil and consumer attitudes towards functional foods. Section 3 presents the methodology applied in this study and section 4 summarizes the main findings. Finally, section 5 draws the conclusions and suggests a research agenda for future studies.

2 Theoretical Background

2.1

Market Orientation and Consumer Behavior towards Functional Food

The functional food market can be characterised as “technology-push”, which is predominately oriented by the research of new opportunities for innovative products by companies and, in a smaller proportion, by consumers’ demand (De Barcellos and Lionello,

2011). Research and development (R&D) activities are often accomplished experimentally, following the logic of attempt and error, with a very small effective use of applied research in consumer’s behaviour. Consequently, the failure rate of new products is high (Scholderer and

De Barcellos, 2008).

Market orientation can be defined when two aspects are incorporated: a focus on the consumer and coordinated market. The first aspect means to carry out actions to understand consumers´needs, attitudes and values. The second aspect is to spread consumer knowledge in order to elaborate a strategy to respond to their needs. As the functional food is a very incipient industry in Brazil, the main analysis here is to understand consumers need to disseminate this information to the functional food industry development. Researches in consumer’s behaviour area (Verbeke, 2005; Frewer et al., 2003) indicate that successfully

established functional ingredients which have a more general health claim are more likely to be accepted than non-familiar ones or those just attractive to consumers with advanced medical and nutritional knowledge. Additionally, it is overall believed that consumers evaluate functional foods the same way they do with conventional food. It means that functional benefits can add value, but should not exceed the natural sensorial properties of food, such as flavor (Verbeke, 2006).

According to Solomon (2006), people buy a product for its meaning and not for what it is capable of doing. A product, such as food, represents more to the consumer than its physiological function. Consumers point as decisive factors for the consumption of functional products their family health, convenience, flavor and quality (Urala and Lähteenmäki, 2007).

Therefore, functional foods must simultaneously attend consumers’ desires for convenience, health and flavor (Gray et al., 2003).

In Europe, Germany, France, United Kingdom and the Netherlands represent the most important countries within the functional food market (Jago, 2009 apud Annunziata and

Vecchio, 2011). Nevertheless, the demand within the EU countries varies considerably mainly due to food traditions and cultural heritage, and in general the interest of consumers in FF in

Central and Northern countries is higher than in Mediterranean countries (van Trijp and van der Lans, 2007). A previous study found that attitudes towards functional foods were more positive in Finnish consumers compared to consumers in Denmark or the United States

(Bech-Larsen and Grunert, 2003) and Euromonitor data indicates that sales of FFs would rise moderately from 2005 to 2009 in the newly emerging markets of Hungary, Poland and Russia

(Benkouider, 2004).

In Brazil, a recent face-to-face survey applied to 450 consumers (De Barcellos and

Lionello, 2011) indicated that the market for functional food is incipient, but it is developing fast. There are few local functional food products in the market, but those are attractive to consumers and indicate promising opportunities. The survey showed that interviewed consumers presented positive attitudes towards functional foods. Life expectancy in Brazil has increased in past decades due mainly to an improvement in the quality of life and advances in medicine and health care. There is also an increasing the interest in more sophisticated and health-oriented products (Euromonitor, 2007), and as such, sales of functional foods in Brazil are expected to grow.

2.2

Functional Food Regulation in Brazil

The Brazilian regulation for functional and health claims for ingredients or food has been developed based on safety, efficacy and lays with the idea that functional foods are food products, not medicines. It means that functional foods have not been officially defined as a food classification in Brazil and the legislation basically asks for demonstration of safety of products and efficacy of claims (see Figure 1) (Lajolo and Miyazaki, 2007). There are four regulations for risk assessment, registering of novel products and for efficacy proof in Brazil, which were introduced in 1999. More recently, in 2002, another regulation was created and introduced a list of bioactive substances and probiotics with functional or health claims, aiming to distinguish functional food from nutraceuticals (Lajolo and Miyazaki, 2007). The

Brazilian regulatory agency responsible for the regulation of functional foods is the National

Sanitary Surveillance Agency (ANVISA). The Agency approves claims on a case-by-case basis (Toledo and Lajolo, 2008), all analyzed by the Technical Scientific Advisory

Commission on Functional Foods and New Foods (CTCAF), formed by experts from academia and research institutes (Lajolo and Miyazaki, 2007).

Novel food or ingredient

Functiona l or

Hea lth Cla im

Scientific

Demonstra tion

Risk a nd Sa fety

Eva lua tion

Effica cy Proofs

Registra tion Registra tion

Figure 1: Procedure to register a FF product or a health claim in Brazil

Source: Adapted from Lajolo and Miyazaki (2007)

Note: All regulations are available on the website: http://anvisa.gov.br/ing/legis/index.htm.

Finally, it is important to state that the successful introduction of functional food in the market do not only depends on consumers’ acceptance and food industry new product developments, but also depends from regulatory aspects. The regulatory issues regarding these categories are quite different among different countries. In Latin America, Brazil was the first country to issue legislation regarding functional food. Legislation asks for safety and efficacy demonstration of food products. Therefore proper regulation and consultation with health care providers is key challenge for these products at a global level (Kaushik and

Kaushik, 2010).

2.3

Attitudes toward functional food

From a consumers’ perspective, attitudes related to functional foods have been internationally studied and consistent research results have been described on literature (Urala and Lähteenmäki, 2003, 2004, 2007, Annunziata and Vecchio, 2011, Barcellos and Lionello,

2011). In 2007, Urala and Lähteenmäki validated a scale formed by 25 variables and four main dimensions were identified. According to the authors, the dimensions can be described as follows: (1) reward for the consumption of functional food (FF REW), where the main focus is that health, humor and welfare can be promoted by the consumption of functional foods. The pleasure resulted from the consumers´ perception of consuming functional food to take care of themselves is crucial to feel ‘reward’; (2) necessity of functional food (FF NEC), which describes this as the necessity for medicines (this dimension measures how necessary or unnecessary are the functional foods to society in general); (3) confidence in functional food (FF CON), that describes the confidence of consumers on functional foods as foods which promotes health and the reliability of research related to them and; (4) safety of functional food (FF SAF) – dimension (Urala and Lähteenmäki, 2004) with focus in the possible nutritional risks when functional foods are consumed.

Thus, Urala and Lähteenmäki (2007) correlates attitudes toward functional foods with background attitudes, aiming a deeper comprehension about the consumption behaviour of this kind of food. For this purpose, the authors used scales of General Health Interest (GHI) and the Natural Product Interest (NPI) scale from the Roininen et al. (1999) study, which showed positive and moderate correlation for GHI itself and negative correlation of NPI with attitudes toward functional food in their study.

According to Urala and Lähteenmäki (2007), through the understanding of consumers’ attitudes, it is possible to predict the intention about the consumption of functional food.

Consumers’ attitudes can also be strategically used in the initial stages of the new products development, as a support tool in the selection of alternatives for further progress.

3 Methodology

We applied an online survey, descriptive in nature, to investigate the potential market for functional foods. The objective was to map consumers’ attitudes towards functional foods in a sample of this population, as well as their background attitudes, perceptions and intention to buy locally produced functional foods. As previously discussed, little is known about functional food consumers in developing countries. In specific, South Brazil represents one of the most affluent regions of the country, and therefore characterizes itself as a potential market for differentiated products such as functional food.

In this research, the attitude scales towards functional foods were based on the studies from Urala and Lähteenmäki (2004, 2007), recently replicated by De Barcellos and Lionello

(2011). In this study, we expand results to gather a sample from Rio Grande do Sul (state level), contributing to a better understanding of the market from South Brazil.

3.1

Survey: Data Collection

An online survey was conducted with 509 consumers within the country, resulting in

381 valid questionnaires from Rio Grande do Sul, the southernmost State of Brazil. Churchill and Gilbert (1999) and Malhotra (2001) comment that the method of cross-sectional survey is the most popular and widely used in descriptive research, and it is characterized by collecting information from a sample of the population only once. The method provides a "snapshot" of the variables of interest at a given moment in time.

Consumers were interviewed through an online questionnaire, and the link was distributed via “snowball” technique, using researchers’ e-mail list, social networks and access to more than 20 virtual Brazilian communities related to “food” (those listed in Orkut and Facebook in November 2011). The use of this technique in social networks has been largely applied in exploratory studies. To assure the understanding of the “functional food” concept, a written definition was provided to the respondents at the beginning of the interview, along with examples of real products. The questionnaire was based on European studies of Urala and Lähteenmäki (2004, 2007), who developed a scale to measure attitudes specifically in relation to functional foods, and on a study from Roininen et al. (1999), who developed two scales to measure background attitudes related to the interest to natural products (NPI) and general health interest (GHI). General attitudes towards functional food were additionally measured using the classic semantic differential scale proposed by Ajzen and Fishbein (1980).

In our questionnaire, effective consumption (past behavior) was measured by asking consumers who consumed different functional food categories within the last week.

Frequency of consumption of functional foods in general was also assessed, followed by a set of questions related to attitudes towards functional foods and respondents’ the general health interest in food products and the interest in natural food product. Next, we investigate consumers’ perception (familiarity, healthiness, attractiveness, beneficial) and willingness to buy local functional food products. Finally, in the last section of the questionnaire sociodemographic questions about the respondents were asked.

3.2

Survey: Data Analysis

Data were initially treated aiming to detect possible non-random missing data and outliers. Normality and multicolinearity checks were also applied aiming to reduce any

“noise” that could negatively interfere with further analysis. Following this stage, univariate and multivariate statistics analysis were performed using the software SPSS v18.0.

A general attitude scale (Ajzen and Fishbein, 1980) was first used to assess attitudes towards functional food products. Next, we applied the scale developed by Urala and

Lähteenmäki (2004, 2007). Factor analysis (Maximum likelihood, Varimax rotation) was

used to explore the dimensional structure of functional food related attitude statements. The original scale comprising 26-items (Urala and Lähteenmäki, 2004, 2007) and four dimensions

( Reward from using functional food, Necessity for functional foods, Confidence in functional foods and Safety in function al) was reduced to 10 items (and only the Reward dimension ) in order fit web survey purposes and to test the stability of this dimension in Brazil. A recent study Brazil confirmed that Reward from using functional food was the strongest dimension in Brazil (Barcellos and Lionello, 2011).

In this study, the Reward dimension was confirmed, although fractioned in two new dimensions: (1) Reward from using functional food as Health and Wellness; (2) Reward from using functional food as Preventive Medicine. Results and factor loadings can be seen in

Table 2. As indicated in the rotated matrix, the two generated factors explain 61.03% of the phenomenon. Besides the clear dense factor loadings (a factor loading is the correlation between a variable and a factor that has been extracted from the data, and loadings above 0.4 are good indicators of this fit), the Kaiser-Meyer-Olkin (KMO) and Bartlett’s test indicated significant results in 0.887 (p = 0.000). The KMO measures the sampling adequacy which should be greater than 0.5 for a satisfactory factor analysis to proceed. The Bartlett's test of sphericity is significant at p=0.000 indicating that the correlation matrix is not an identity matrix. Reliability was tested using Cronbach's alpha measures and we can say that the obtained factors are reliable, since the alphas were higher than 0.8, a highly satisfactory result.

In terms of the dimensional structure of the background attitudes related to the interest to natural products (NPI) and general health interest (GHI) (Roininen et al., 1999), factor analysis has confirmed their one-dimensional character.

The next phase of the analysis was the implementation of a two-stage sample segmentation task through cluster analysis. Respondents’ grouping criteria were the attitudes towards functional foods. After initial implementation of hierarchical cluster analysis (stage

I), the k-means procedure implemented on the hierarchical clusters’ centroids followed, with the option of identifying 3–5 clusters (stage II). The 3-cluster solution was finally selected as the one with the highest correlation between the hierarchical and the k-means cluster membership variables (Pearson correlation 0.701, P < 0.001). The profile of each of the three clusters was developed by cross-tabulating the cluster membership variable and the sociodemographic, attitudinal and pork consumption frequency variables. Chi-square and Duncan and Scheffe post hoc ANOVA tests substantiated statistically significant differences among the three clusters.

4 Results

4.1

Demographic profile of the sample

Table 1 presents the demographic profile of the sample. The sample is predominantly feminine (64.8%), corresponding to 247 of the 381 interviewed individuals. Males therefore represent 35.2% of the total. In terms of age, most respondents are adults from 25 to 44 year old (58.8%) and younger than 24 years old constituted 25.5% of the sample. The smallest group was composed by respondents above 65 years old (1.3%), been followed by respondents between 45 to 64 years old (14.4%). Respondents with post-graduate degree represent the majority of the sample (47% of individuals) and those who have completed a

University degree level represented 45.7% of the sample. Respondents with primary school were minority with 0.3% of the surveyed sample, and 4.2% had technical education degree.

Respondents with Secondary (High School) degree represented only 2.9% of the total. Such bias toward high degree of education was expected when applying this online survey in

Brazil, since we acknowledge that only 45% of the Brazilian population had access to the

Internet in 2009 (CETIC, 2010). Yet, for the purpose of this research and assuming that

functional foods are differentiated food products in the Brazilian market, the sampling was considered adequate.

Table 1. Distribution frequency of the socio-demographic profile and number of respondents interviewed

Variable

Gender Female

Male

Total

Categories Frequency (%) Number (n)

64.8

35.2

100.0

247

134

381

Age 25-44 years old

Less than 24 years old

45-64 years old

More than 65 years old

Total

Highest Education Attained

Post-Graduate Degree

Superior (University degree)

Secondary (High school)

Certificate Program (Technical)

Primary (Basic education)

Total

Household situation

I live with one/both of my parents

I live with my partner, spouse

I live with my spouse and children

I live alone

Other

I live with my son/daughter

Total

Number of people living at your residence

2

4

3

1

5

More than 5

Total

Monthly household income

From US$ 2.701 to US$ 5.400

From US$ 1.621 to US$ 2.700

From US$ 601 to US$ 1.620

More than US$ 5.401

Less than US$ 600

Total

58.8

25.5

14.4

1.3

100.0

47.0

45.7

2.9

4.2

0.3

100.0

32.3

22.3

17.6

13.9

8.7

5.2

100.0

34.1

22.8

21.0

13.9

5.8

2.4

100,0

30.7

23.6

21.5

19.7

4.5

100.0

224

97

55

5

381

179

174

11

16

1

381

124

85

67

53

33

20

381

117

90

82

75

17

381

130

87

80

53

22

9

381

A question about household situation helped us to understand respondents’ familiar structure. 32.3% of the sample lived with their parents, while 22.3% lived with their spouse/husband. 17.6% lived with their spouse and children, and 13.9% lived alone. Only

5.2% lived with their sons/daughters and 8.7% lived with other people, such as friends and other relatives. These results indicate a predominantly family structure of the sample. In terms of the number of people residing in a household, the same indicates that respondents in households with 2 to 4 residents made up 77.9% of the cases, of which 34.1% was inhabited by only 2 persons. These results indicate small family units. Such information, combined with monthly household income reinforces the indicative notion of high per capita income and consequent high purchasing power. People living alone represented significant 13.9% of the sample, and respondents living with 5 or more people were only 8.2%. Finally, as regard to

the monthly household income, 30.7% of the respondents has an income from US$ 2.701 to

US$ 5.400. Following, household income between US$ 1.621 and 2.700 made up 23.6% of the sample. Above US$ 5.401 made up 19.7%. This indicates that more than 70% of the sample has the disposable income to buy food products with added higher value. However, the remaining respondents declared to have a low monthly income between US$ 601 and

1.620 (21.5% of the total). The lowest grade (up to US$ 600) was made up by only 4.5% of the sample.

4.2

Attitudes towards functional foods

From the 10 items of the dimension “Reward from using functional foods” (Urala and

Lähteenmäki, 2007) one was excluded due to its low factor loading (“ It is great that modern technology allows the development of functional foods

”). The remaining items generated two factors. Factor 1, which was called as “Health and Wellbeing” is the strongest, linked to the benefits of wellness and health coming from functional foods consumption, as found in the original studies. Factor 2 “Preventive Medicine” combined the reward items that more related to the prevention of disease like conditions (see Table 2).

One possible explanation for the split of this dimension into two factors in relation to the original study may be the early stage of market development. Urala and Lähteenmaki recognize that the dimensions found in their 2004 and 2007 studies were not stable and they highly recommend assuring the factorial structure before using the scales as predictors or grouping variables in statistical analysis, as we performed here. Crobach’s alpha were satisfactory for both factors.

Table 2: Exploratory Factor Analysis of the Attitude Dimension “Reward of using Functional Food” in South

Brazil: Factors and Loadings

Factors

(1) Health

Wellbeing

(2) Prev

Med

Functional foods make it easier to follow a healthy lifestyle 0,831

I can prevent disease by eating functional foods regularly 0,805

The idea that I can take care of my health by eating functional foods gives me pleasure 0,740

Functional foods promote my welfare

Functional foods help to improve my mood

My performance improves when I eat functional foods

I actively seek out information about functional food

0,701

0,820

0,776

0,638

I am prepared to compromise on the taste of a food if the product is functional

Functional foods can repair the damage caused by an unhealthy diet

0,510

0,461

Reliability of the FF attitudes’ factors (Cronbach’a alpha) 0,906 0,723

Note: (1) Attitudes towards Health and Wellness; (2) Attitudes towards functional food as Preventive Medicine

Our analysis showed the key role played by the perception of healthiness and wellbeing in determining South Brazilian consumers’ attitudes towards functional. Apparently the approval of functional foods has also a strong utilitarian connotation as their usage should entail expectations of consequences, as indicated by Factor 2 (Preventive Medicine). Such results highlight the key role of available information for the consumer in order to truly assess the healthiness and wellbeing provided by the products.

4.3 Cluster Analysis

In terms of statistical difference, no difference has been found between groups regarding age, household status, education and monthly income, indicating similar positive attitudes between all clusters. However, significant statistical difference has been found within the three clusters for frequency of consumption, consumption within the last week

(effective behavior) and gender, indicating distinct attitudes for female and male functional food consumers. Table 3 presents these results.

Table 3: Cluster profiles in terms statistically significant socio-demographic characteristics (percentages)

Socio-demographic profile

Frequency of consumption

Consumption (Eff Behavior)

Gender

Note: ANOVA testes with **: p <0.01

Daily

Last Week

Female

Sig.

**

**

**

Cluster 1

N

1

= 137

36.0 %

24.0%

33.5%

30.8%

Cluster 2

N

2

=215

56.4%

74.0%

60.5%

62.3%

Cluster 3

N

3

= 29

7.6%

2.0%

6.0%

6.9%

Sample

N = 381

100%

26.2%

87.7%

64.8%

In terms of general attitudes towards functional foods (see Table 4), results indicate that consumers are overall positive about it (considering it mainly to be beneficial, good, enjoyable, necessary and pleasant), although respondents from clusters 2 and 1 are respectively more positive. In terms of specific attitudes towards functional food (Reward from its use), the Health and Wellness factor was the main one for respondents from Clusters

2 and 1, whilst respondents from Cluster 3 mostly disagree with its statements. The same happens with the attitudes towards Reward from using functional food as “Preventive

Medicine”.

Interestingly, consumers from Cluster 2 “do not seek out for information” and “are not willing to compromise taste if the food is functional” (different from cluster 1, that is willing to compromise and seeking out for information).

The general health interest (GHI) scale presented high means, especially for consumers from Cluster 1 and 2. The natural product interest (NPI) scale presented lower means if compared to the GHI, although with means above 3.5 for all clusters.

In general terms, respondents from Cluster 2 represent the majority of the sample

(54.6%) and the group is mainly formed by women (62.3%). They have the highest frequency of consumption (74% consume it daily) and effective behavior measured by consumption of functional food performed “last week” (60.5%). They also present the highest means in terms of general attitudes (6.56 out of 7.0), Reward from health and wellness (6.44) and Reward as

Preventive Medicine (4.84). This segment is therefore called “Functional food consumers”.

Cluster 1 represents the next segment, formed by 36% of the sample and also presenting overall positive attitudes towards functional food (5.55 out of 7.0). This group is mainly formed by males (69.2%), who are not willing to compromise taste and are not seeking out for information. Consumption is not so regular, as only 25% within this cluster consume functional food daily and 33.5% consumed it “last week”. They are therefore called

“Functional food sympathizers” and represent an interesting segment to be developed by the food industry. Finally, cluster 3 represents the smallest segment (7.6% of the sample), but the one with negative attitudes towards functional foods. This group sees no reward at all in consuming functional foods (all means items are negative in factor Health and Wellness as well as in Preventive Medicine), although their general attitude is still positive, what implies an open door to marketing and communication strategies. This group, although not favorable towards functional food is interested in general health issues as well as in natural products.

They favour low fat, organics and food with no additives. This segment is therefore called

“Natural food supporters”. Table 4 presents the results in details.

Table 4: Cluster profiles in terms of attitudes towards functional foods and background attitudes

Scales

General Attitudes towards FF (Alpha=0.866)

Good

Enjoyable

Beneficial

Pleasant

Necessary

Attitude FF (Factor 1 Rew Health and Wellness)

(Alpha=0.906)

Functional foods make it easier to follow a healthy lifestyle

I can prevent disease by eating functional foods regularly

The idea that I can take care of my health by eating functional foods gives me pleasure

Functional foods promote my welfare

Attitude FF (Rew Preventive Medicine) (Alpha=0.723)

Functional foods help to improve my mood

My performance improves when I eat functional foods

I actively seek out information about functional food

I am prepared to compromise on the taste of a food if the product is functional

Functional foods can repair the damage caused by an unhealthy diet

General Health Interest scale (GHI)(Roininen et al., 1999)

(Alpha=0.908)

It is important for me that my diet is low in fat

I am very particular about the healthiness of food

The healthiness of snacks makes difference to me

I do avoid foods if they may raise my cholesterol

I always follow a healthy and balanced diet

It is important to me that my daily diet contains a lot of vitamins and minerals

The healthiness of food has strong impact on my food choices

Not always I eat what I like because I do worry about the healthiness of food

The Natural Product Interest Scale (NPI) (Roininen et al.,

1999) (Alpha=0.856)

I try to eat foods that do not contain additives.

I would like to eat only organically grown vegetables

I do not eat processed foods, because I do not know what they contain

I do care about additives in my daily diet

In my opinion, artificially flavoured foods are harmful for my health.

In my opinion organically grown foods are better for my health than those grown conventionally

Sig.

**

**

**

**

**

**

**

**

**

**

**

**

**

**

**

**

**

**

**

**

**

*

**

**

**

*

** n.s.

** n.s. n.s.

**

**

Cluster 1

N

1

= 137

36.0 %

5.55

5.82

5.49

6.12

5.07

5.24

5.00

5.42

4.96

4.74

4.88

3.47

3.77

4.38

2.79

2.92

3.50

4.81

5.63

4.97

4.86

4.72

3.83

4.78

4.91

3.88

4.54

4.38

4.59

3.84

4.39

4.80

5.24

Cluster 2

N

2

=215

54.6%

6.56

6.76

6.40

6.91

6.16

6.58

6.44

6.68

6.46

6.29

6.35

4.84

4.98

5.64

4.31

4.45

4.82

5.35

5.95

5.42

5.55

4.96

4.49

5.54

5.59

4.22

4.88

4.53

5.17

4.07

4.56

5.18

5.78

Cluster 3

N

3

= 29

7.6 %

5.00

5.35

5.28

5.38

4.72

4.28

1.98

2.21

2.00

1.62

2.10

2.21

2.14

2.24

2.45

2.00

2.23

3.74

4.07

4.03

3.69

3.62

3.41

3.76

3.64

2.90

3.83

3.73

3.52

3.62

4.10

3.59

4.41

Sample

N = 381

100%

6.08

6.31

5.99

6.51

5.66

5.92

5.58

5.88

5.58

5.38

5.50

4.15

4.33

4.93

3.62

3.72

4.15

5.04

5.69

5.15

5.16

4.77

4.17

5.13

5.20

4.00

4.68

4.42

4.84

3.95

4.46

4.92

5.48

Note: ANOVA tests with *: p <0.05; **: p <0.01; n.s.: not significant.

All items measured on a 7-point scale with end points 1 = “strongly disagree” to 7 “strongly agree”.

Finally, in order to investigate segments’ perceptions about functional food products available in South Brazil, we added to the questionnaire some items and pictorial information about three locally produced FF products, produced and commercialized by three large food industries from Rio Grande do Sul. The questionnaire was composed by five questions, as described: (1) How familiar is this product for you?; (2) How attractive is this product for you?; (3) How beneficial this product would be for you personally?; (4) How healthy is this product? and finally, (5) If this product was available in stores that you normally attend, how you would be predisposed to buy it? The results are presented per cluster inTable 5.

Table 5: Perceptions of three regional functional food products per cluster

Functional Product

Multigrain Bread

(vitamins and collagen)

Fruit Yogurt

(with probiotics)

Fresh Cheese (with probiotics)

Scales

Familiarity

Attractiveness

Beneficial

Healthiness

Willingness to buy

Familiarity

Attractiveness

Beneficial

Healthiness

Willingness to buy

Familiarity

Attractiveness

Beneficial

Healthiness

Sig.

*

**

**

**

**

*

**

**

**

** n.s.

**

**

**

Cluster 1

N

1

= 137

36.0 %

2.44

4.38

4.74

5.00

4.30

2.78

4.36

4.79

4.98

4.26

2.09

3.81

4.23

4.77

Cluster 2

N

2

=215

54.6%

2.83

4.94

5.41

5.47

4.83

3.12

5.11

5.37

5.62

4.88

2.34

4.65

5.13

5.44

Cluster 3

N

3

= 29

7.6 %

2.10

3.55

3.76

4.40

3.33

2.38

3.55

3.62

4.02

2.86

2.45

3.34

4.00

4.53

Sample

N = 381

100%

2.63

4.63

5.04

5.22

4.53

2.94

4.72

5.03

5.27

4.50

2.26

4.25

4.72

5.13

Willingness to buy ** 3.78 4.50 3.24 4.14

Note: ANOVA tests with *: p <0.05; **: p <0.01; n.s.: not significant. Familiarity item measured on a 5-point scale, with end points 1 = “I do not recognize this product” and 5 = “I consume it regularly”. All others items measured on a 7-point scale with end points to 1 = “not (...) at all” to 7 “extremely (...)”, regarding to each answered characteristic.

Results indicate that most of consumers are not familiar with the products, with the exception of the fruit yogurt by Cluster 2. The three products are widely distributed within main retail chains in Rio Grande do Sul and other states of the country. Perceptions regarding attractiveness, benefit and healthiness are overall positive, even for consumers from Cluster 3.

For this group, especially the healthiness of the multigrain bread and of the fresh cheese is highlighted, although their willingness to buy the fruit yogurt is still negative. Individuals from Cluster 2 are again the ones seeing most of the benefits and with the highest willingness to buy.

It is interesting to highlight that between those three FF products, the bread has no official claim registered by the Brazilian regulatory agency ANVISA. Therefore, the producer can inform in the product’s package that it contains a functional ingredient, but cannot specify their functional claims and benefits. It is also the newest product in the market. In the other hand, both yogurt and cheese have their functional claims (probiotics) registered by ANVISA.

Surprisingly, those conditions did not appear to have affected the way consumers evaluate their choices. These results should be consider when functional food companies develop new products facing the risk and length of time to receive the health claim.

5 Conclusions

The present exploratory study employed a quantitative method in order to obtain insights into consumers’ attitudes towards functional foods and how they differentiate between three different consumer clusters. The objective of the study was to investigate those issues, bringing to light market orientation for innovative food chains. Consumers are generally positive towards functional foods, although the examined clusters do differentiate in their attitudes, signaling to food companies that specific marketing strategies must be applied to the market of functional foods. This study shows that the understanding of consumers in developing countries is fundamental to enhance food chains competitiveness and their market orientation. It also contributes theoretically when integrating concepts from consumer

behavior theory (specifically attitudes) to market orientation strategies for innovative food products.

It is important to consider what consumers know today about foods and beverages that promote health and learn about the actions they are taking to make improvements to their diet.

This understanding of consumer attitudes, perceptions, and behaviors can help food and health communicators tailor information that resonates with and motivates consumers to achieve optimal health through diet and lifestyle (Kapsak et al, 2011).

Consumer’s increased knowledge about links between diet and health, awareness of quality characteristics, and access to information about new production and processing technologies have resulted in a constantly increasing demand for improved quality foods

(Fotopoulos and Krystallis, 2003).

Many multinational and local food, beverage, and agricultural companies have dedicated their growth strategies and research budgets to developing and marketing foods with benefits that promote health. All of this is fueled by consumer demographics expanding the demand for functional foods, especially among growing and developing populations, like the Brazilian one.

Information concerning the health effects and the means of communicating them are the key factors behind the success of the functional food product because the health effect cannot be perceived directly from the product itself, since healthiness is a credence attribute. Health effects may offer the food manufacturers a way of differentiation and promoting new food products with added value, but it may be extremely challenging to design credible marketing messages that differentiate one’s own product from that of the competitors without providing any advantage to the competing products (Urala, 2005).

Urala and Lähteenmaki (2007) suggest that as functional foods become more familiar, more regular consumers’ monitoring is needed to ascertain how the attitudes towards functional foods are developing in emerging markets such as Brazil. In this regard, we recommend further studies to keep monitoring consumer attitudes towards functional food in

Brazil and other emerging countries in Latin America and elsewhere.

According to De Barcellos and Lionello (2011), the functional food industry in Brazil has a market size estimated at over US$ 6 billion and a growth rate of 11% in the period 2006 and 2007 (Euromonitor, 2007). There is much potential for growth, which is increased by an aging and more educated population, attentive to information about nutrition and health. For instance, sales of health and wellness food and beverages are expected to record a good performance in the 2009-2014 period driven by better economic indicators, such as low unemployment, low inflation and higher disposable income. It is expected that improvement in purchasing power amongst the middle classes will also have a major impact on the performance of better for you, naturally healthy and fortified/functional products in the near future as the penetration of these kinds of products is currently still low among lower-income demographics (Euromonitor, 2010).

In order to become market oriented, functional foods need to be promoted with the aim of making them much more visible and recognizable to final consumers, in order to avoid confusion with other generic health foods, such as light or diet products. Regulation of the functional food and natural health product sector is critical to the successful development and commercialisation of new products and to the successful exploitation of market opportunities

Based on the existing regulation in Brazil, functional foods can be considered as foods bearing health claims, approved by the health authority. In that sense, a pre-market approval is mandatory (Lajolo and Miyazaki, 2009). The role of ANVISA also represents a risk for innovative products when it needs to have the health claim recognized. If a functional food company invest time and money to develop a new functional food product and it does not get

a health claim, it can still have a interesting market to large number of consumers willing to buy health and wellness products.

Finally, for the food industry, functional foods offer significant opportunities to add value to primary commodities and to exploit sizeable latent demand on the part of consumers, while bringing about significant public health benefits (Agriculture and agri-food Canada,

2009). Yet, the complex issues faced by the sector call for public and business policies to provide an appropriate environment in which firms can innovate and commercialise. Overly strict controls will slow down the pace of innovation, while negatively affecting competitiveness and the potential flow of public health benefits. It is uttermost the need to understand and respond to consumer attitudes towards functional foods, and to communicate the potential health benefits, engaging in dialogue over concerns in order to promote its acceptance and use. Further research could use qualitative techniques to have a better understanding of the lifestyle of the three consumers groups identified in this study (clusters) to propose more detailed marketing strategies for food industry.

6 Acknowledgments

The authors acknowledge the financial support of the National Council for Development and Research (CNPq) from the Brazilian Ministry for Science and Technology (MCT) and the

PhD scholarship by CAPES – Prosup Cursos Novos (Brazilian Ministry of Education).

7 References

Agriculture and Agri-food Canada. 2009. Regulation of functional foods and natural health products. http://www4.agr.gc.ca/AAFC-AAC/displayafficher.do?id=1239641986095&lang=eng Acessed 09 December 2011.

Ajzen, I. and M. Fishbein, 1980. Understanding attitudes and predicting social behavior.

Prentice-Hall, England, 278 pp.

Annunziatta, A. and R. Vecchio, 2011. Functional foods development in the European market: A consumer perspective. Journal of Functional Foods, 3, 223-228.

Ashwell, M. 2002. Concepts of Functional Foods. ILSI Europe Concise Monograph Series.

Ed. Walker, R. http://www.ilsina.org

Accessed 10 October 2008.

Bech-Larsen, T., and K.G. Grunert, 2003. The perceived healthiness of functional foods: conjoint study of Danish, Finnish and American consumers’ perception of functional foods.

Appetite, 40, 9–14.

Benkouider, C., 2004. Functional foods: A global overview. International Food Ingredients, 5,

66–68.

Bhaskaran, S., and F. Hardley, 2002. Buyer beliefs, attitudes and behaviour: Foods with therapeutic claims. The J. of Cons. Mark. 19, 591-606.

CETIC 2010. Pesquisa sobre uso das tecnologias da informação e comunicação no Brasil

2010. http://www.cetic.br/tic/2010/index.htm

Accessed 20 June 2010.

Churchill, J. and A. Gilbert, 1999. Marketing research: methodological foundation. The

Dryden Press, United States of America, 720 pp.

De Barcellos, M.D., L.K. Aguiar, G.C. Ferreira and L.M. Vieira, 2009. Willingness to Try

Innovative Food Products: a Comparison between British and Brazilian Consumers. Braz.

Adm. Rev. 6(1), 50-61.

De Barcellos, M.D. and R.L. Lionello. 2011. Consumer markets for functional food in South

Brazil. International Journal on Food System Dynamics, 2(2), 126-144.

Euromonitor (2007). Demographic transformation in Brazil. Country Sector Briefing

(November 2007)

Euromonitor (2007) State of the Market: Global Health & Wellness Products. London:

Euromonitor, (May 2007), 24p.

Euromonitor (2010). New health and wellness sales fuelled by developing markets of China,

Mexico, and Brazil (April 2010).

Frewer, L., J. Scholderer and N. Lambert, 2003. Consumer acceptance of functional foods: issues for the future. Brit. Food J.

10, 714-731 .

Fotopoulos, C. and A. Krystallis, A., 2003. Quality labels as a marketing advantage: The case of the “PDO Zagora” apples in the Greek market. European Journal of Marketing, 37(10),

1350-1374.

Gray, J., Armstrong, G. and Farley, H. (2003). Opportunities and constrains in the functional food market. Nutr. & Food Sc.

33, 213-218.

Kapsak, W.R., Rahavi, E.B., Childs, N.M., and C. White. 2011. Functional Foods: Consumer

Attitudes, Perceptions, and Behaviors in a Growing Market. Journal of the American Dietetic

Association, 111(6), 804-810.

Kaushik, N. and D. Kaushik, 2010. Functional Foods: Overview and Global Regulation. Int.

J. of Phar. Rec. Res. 2(2), 47-52.

Kwak, No-Seong, and D.J. Jukes, 2001. Functional foods. Part 2: The impact on current regulatory terminology. Food Control, 12, 109-117.

Lajolo, F.M. and E. Miyazaki, 2009. Functional foods legislation in Brazil. In: J.N. Losso, F.

Shahidi and D. Bagchi (editors), Anti-angiogenic functional and medicinal foods. CRC

Press, United States of America, pp. 275-311.

Lalor, F., Madden, C., McKenzie, K., and P.G. Wall. 2011. Health claims on foodstuffs: A focus group study of consumer attitudes. Journal of Functional Foods, 3, 56-59.

Lee, Y.-K., Georgiou, C., and C. Raab, 2003. The knowledge, attitudes and practices of dietitians licensed in Oregon regarding functional foods, nutrient supplements and herbs

as complementary medicine. American Journal of Clinical Nutrition, 77, 1089S–1092S.

Malhotra, N., 2001. Marketing research: an applied orientation. Prentice Hall, United States of America, 719 pp.

McNally, A., 2007. Products offering more than one health claim are more attractive to consumers and this could translate into a 20 percent sales boost, a study in Germany has found. Available in: <http://www.nutraingredients.com/news/ng.asp?id=78440-nationalstarch-health-claims-fibre-prebiotics/>.

Roininen, K., L. Lähteenmäki, and H. Tuorila, 1999. Quantification of consumer attitudes to health and hedonic characteristics of foods. Appetite, 33, 71-88.

Scholderer, J., and De Barcellos, M. 2008. Feasibility study for meat ‐ derived functional

ingredients (Restricted). MAPP, Aarhus School of Business, Denmark.

Silveira, T. F. V. da; Vianna, C. M. de M., and Mosegui, G.B.G., 2009. Brazilian legislation

for functional foods and the interface with the legislation for other food and medicine

classes: contradictions and omissions.

Physis [online], 19, 4, 1189-1202.

Siró, I., E. Kapolna, B. Kapolna and A. Lugasi, 2008. Functional food. Product development, marketing and consumer acceptance. A review. Appetite, 51, 456-467.

Solomon, M.R. 2006. Consumer behavior: buying, having, and being. Prentice Hall, United

States of America, 446 pp.

Toledo, M.C.F. and F.M. Lajolo, 2008. Supplements and Functional Foods Legislation in

Brazil. In: D. Bagch (editor), Nutraceutical and Functional Food Regulations. Academic

Press, United States of America, pp. 349-364.

Urala, N. and L. Lähteenmäki, 2003. Reasons behind consumers functional food choices.

Nutr. & Food Sci. 33, 148-158.

Urala, N. and L. Lähteenmäki, 2007. Consumers changing attitudes towards functional foods.

Food Quality and Preference, 18, 1-12.

Urala, N. and L. Lahteenmaki, 2004. Attitudes behind consumers’ willingness to use functional foods. Food Qua. and Pref. 15, 793-803.

Van Trijp, H.C.M. and IA van der Lans, 2007. Consumer perceptions of nutrition and health claims. Appetite 48, 305-324.

Verbeke, W., 2005. Consumer acceptance of functional foods: socio-demographic, cognitive and attitudinal determinants. Food Qua. and Pref. 16, 45-57, 2005.

Verbeke, W., 2006. Functional foods: Consumer willingness to compromise on taste for health? Food Qua. and Pref. 17(1,2), 126-131.