Week 1 Reading Assignment

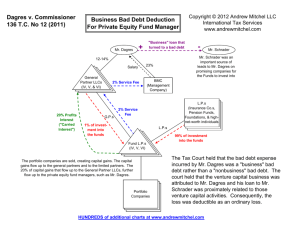

advertisement