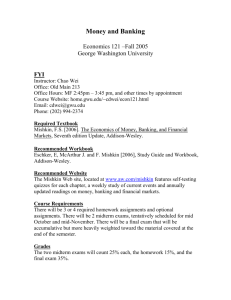

Money and Banking - gwu.edu - George Washington University

advertisement

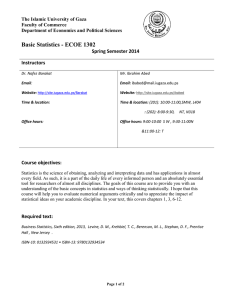

Money and Banking Economics 121 –Fall 2009 George Washington University FYI Instructor: Chao Wei Office: Monroe 317 Office Hours: Thursdays 2:15-3:15 pm, and other times by appointment Course Website: home.gwu.edu/~cdwei/econ121.html Email: cdwei@gwu.edu Phone: (202) 994-2374 Required Textbook Mishkin, F.S. [2009]. The Economics of Money, Banking, and Financial Markets, 9th edition, Addison-Wesley. Recommended Workbook Eschker, E, McArthur J. and F. Mishkin [2009], Study Guide and Workbook, Addison-Wesley. Course Requirements There will be 3 required homework assignments and multiple optional assignments. There will be 2 midterm exams, tentatively scheduled for Mid October and Mid-Late November. There will be a final exam that will cover all the materials after the first midterm, but more heavily weighted toward the materials covered after the second midterm. Grades The two midterm exams will count 25% each, the homework 15%, and the final exam 35%. Course Outline and Tentative Schedule At the end of the first 1/3 of the semester, you will be able to: Compute the yield to maturity and present value of various bonds; Understand the determination of interest rates; Understand the risk and term structure of interest rates. Compute the price of stocks; Understand the efficient market hypothesis. Week 1: Chapter 1 and 2 Week 2: Chapter 2 and 4 Week 3: Chapter 4 Week 4: Chapter 5 Week 5: Chapter 5 and 6 Week 6: Chapter 6 Week 7: Chapter 7 Week 8: Chapter 7 and the first midterm exam At the end of the second 1/3 of the semester, you will be able to: Conduct an economic analysis of the features of financial structure; Understand the reasons behind the subprime meltdown; Read the bank balance sheet; Understand general principles of bank management; Understand the reasons and drawbacks of bank regulation. Week 10: Chapter 8 Week 11: Chapter 9 Week 12: Chapters 10 Week 13: Chapters 11-12, the second midterm exam At the end of the semester, you will be able to: Understand the creation and determination of money supply; Understand the determination of the federal fund rate; Understand the pros and cons of monetary policy tools. Week 14: Chapter 3, Chapter 14 Week 15: Chapter 14 Week 16: Chapter 15 Course Policy Academic dishonesty is defined as cheating of any kind, including misrepresenting one’s own work, taking credit for the work of others without crediting them and without appropriate authorization, and the fabrication of information. 1. To be fair to all students, I do NOT give extra credit for any work which is not a requirement for all students in class. Please do NOT request differential treatment as a way to boost your grades. 2. I allow rescheduling of exams only under EXTRAODINARY circumstances. Any request to reschedule the midterm exams must be made within one week of the announcement of the exam date. In case of rescheduling the exam, you must take the exam before the scheduled date. 3. If severe medical conditions or any catastrophic events prevent you from taking the exam on the exam date, you must provide me with documentation confirming your illness or proving the occurrence of those events to qualify for a makeup exam. You must take the makeup exam within one week of the original exam date, or receive a 0 for the exam. 4. Students may work together but each must submit his or her own homework. By own homework, I mean you must use your own words to answer questions. If two sets of identical homework are submitted, each will be given only half of the credit. 5. All late homework assignments are subject to a 10% penalty, with the exception that those late for more than 24 hours are subject to a 50% penalty. Late homework will not be accepted after the answer key to the assignment is made available to the class.