VARDHMAN REPORT FINNNAAAL

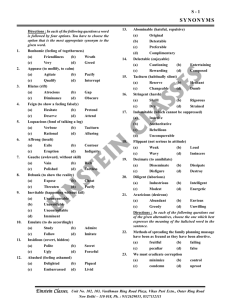

advertisement