Cadbury Schweppes PLC (CSG)

advertisement

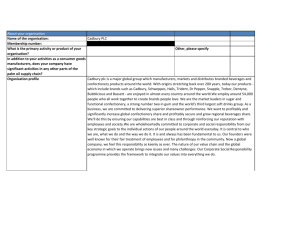

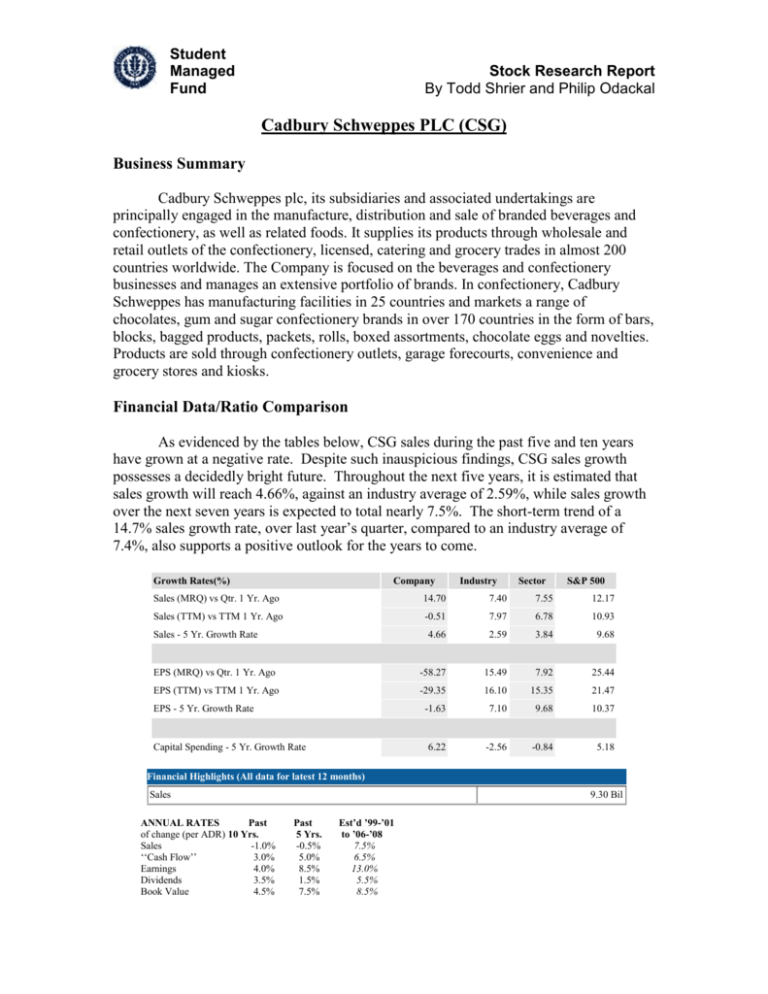

Student Managed Fund Stock Research Report By Todd Shrier and Philip Odackal Cadbury Schweppes PLC (CSG) Business Summary Cadbury Schweppes plc, its subsidiaries and associated undertakings are principally engaged in the manufacture, distribution and sale of branded beverages and confectionery, as well as related foods. It supplies its products through wholesale and retail outlets of the confectionery, licensed, catering and grocery trades in almost 200 countries worldwide. The Company is focused on the beverages and confectionery businesses and manages an extensive portfolio of brands. In confectionery, Cadbury Schweppes has manufacturing facilities in 25 countries and markets a range of chocolates, gum and sugar confectionery brands in over 170 countries in the form of bars, blocks, bagged products, packets, rolls, boxed assortments, chocolate eggs and novelties. Products are sold through confectionery outlets, garage forecourts, convenience and grocery stores and kiosks. Financial Data/Ratio Comparison As evidenced by the tables below, CSG sales during the past five and ten years have grown at a negative rate. Despite such inauspicious findings, CSG sales growth possesses a decidedly bright future. Throughout the next five years, it is estimated that sales growth will reach 4.66%, against an industry average of 2.59%, while sales growth over the next seven years is expected to total nearly 7.5%. The short-term trend of a 14.7% sales growth rate, over last year’s quarter, compared to an industry average of 7.4%, also supports a positive outlook for the years to come. Growth Rates(%) Company Industry Sector S&P 500 Sales (MRQ) vs Qtr. 1 Yr. Ago 14.70 7.40 7.55 12.17 Sales (TTM) vs TTM 1 Yr. Ago -0.51 7.97 6.78 10.93 4.66 2.59 3.84 9.68 EPS (MRQ) vs Qtr. 1 Yr. Ago -58.27 15.49 7.92 25.44 EPS (TTM) vs TTM 1 Yr. Ago -29.35 16.10 15.35 21.47 -1.63 7.10 9.68 10.37 6.22 -2.56 -0.84 5.18 Sales - 5 Yr. Growth Rate EPS - 5 Yr. Growth Rate Capital Spending - 5 Yr. Growth Rate Financial Highlights (All data for latest 12 months) Sales ANNUAL RATES Past of change (per ADR) 10 Yrs. Sales -1.0% ‘‘Cash Flow’’ 3.0% Earnings 4.0% Dividends 3.5% Book Value 4.5% 9.30 Bil Past 5 Yrs. -0.5% 5.0% 8.5% 1.5% 7.5% Est’d ’99-’01 to ’06-’08 7.5% 6.5% 13.0% 5.5% 8.5% Student Managed Fund Stock Research Report By Todd Shrier and Philip Odackal When evaluating the ratios below, it becomes apparent that the P/E ratio is significantly below both the industry and the S&P 500. Such a result suggests the stock may in fact be under-priced, especially when taking into consideration the fact that earnings estimates are expected to increase $0.19 per share in 2004. Favorable projected earnings estimates coupled with increased sales growth rate expectations, tend to favor price appreciation over the coming years. A potential source of price appreciation also stems from the diminished price to sales, price to book, price to tangible book and price to cash flow ratios, as compared to the industry. Another encouraging sign lies in each and every dividend ratio. A higher proportion of earnings in the hands of shareholders represents a strong commitment to increasing shareholder value. It is also significant to note that the historical returns on capital have been below our optimal range of 15%, however, these values are expected to continually increase from 2003 through 20062008. Valuation Ratios Company P/E Ratio (TTM) Industry Sector S&P 500 18.95 24.07 21.12 25.65 P/E High - Last 5 Yrs. NA 70.72 46.34 47.62 P/E Low - Last 5 Yrs. NA 22.78 18.16 16.17 Beta 0.04 0.34 0.23 1.00 Price to Sales (TTM) 1.40 4.23 2.63 3.44 Price to Book (MRQ) 2.53 7.58 7.23 4.27 Price to Tangible Book (MRQ) NM 12.87 14.98 7.26 Price to Cash Flow (TTM) 13.98 18.92 16.25 18.83 Price to Free Cash Flow (TTM) 42.11 40.61 35.24 32.25 4.53 58.07 54.00 64.10 % Owned Institutions Dividends Company Industry Sector S&P 500 Dividend Yield 2.93 1.58 2.38 2.05 Dividend Yield - 5 Year Avg. 2.60 1.26 2.13 1.38 Dividend 5 Year Growth Rate 5.03 5.65 6.93 6.30 56.01 37.91 38.97 27.64 Payout Ratio (TTM) Earnings Estimates Average Estimate Qtr(9/03) NA Qtr(12/03) NA FY(12/03) 2.07 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 © VALUE LINE PUB., INC. 06-08 8.7% 9.3% 10.9% 8.0% 15.4% 14.4% 9.6% 10.6% 10.7% 12.5% 8.0% 8.5% Return on Total Cap’l 11.0% FY(12/04) 2.26 Student Managed Fund Stock Research Report By Todd Shrier and Philip Odackal Institutional Ownership As illustrated by the table below, there exists a clear trend of buying behavior. The three month net change in shares purchased exceeded the three-month change in net shares sold by 839,648. Furthermore, institutional buyers exceeded institutional sellers by 23. Each set of data indicates optimism in the productivity of CSG’s operations over the coming year in addition to the belief that CSG shares may in fact be undervalued over this time period as well. % Shares Owned: % Change in Ownership: # Institutions: Total Shares Held: 3 Mo. Shares Purchased: 3 Mo. Shares Sold: 3 Mo. Net Change: Ownership Summary 4.5 Price Range Quarter: 3.80 # New Buyers: 107 # Closed Positions: 22,950,759 2,558,308 # Buyers: (1,718,660) # Sellers 839,648 # Net Buyers: $19.76 - $25.61 21 13 64 41 23 Benchmark A chart comparison against PepsiCo, Coca-Cola and the S&P 500 clearly bodes unfavorably for CSG over the past year. However, we strongly feel that a turnaround is in store due, in large part, to the “Fuel for Growth” initiative announced in October. To clarify, CSG released nearly 5,500 employees, as a result of the $4.3 billion purchase of Dentyne, and is expected to realize over $640 million in cost savings through 2007. Press releases have also indicated that Cadbury plans to utilize a significant amount of these savings to strengthen marketing and new product development. Student Managed Fund Stock Research Report By Todd Shrier and Philip Odackal Recent News Dow Jones Business News Cadbury Schweppes Plans Job Cuts, Factory Closures Monday October 27, 3:40 am ET A Wall Street Journal Online News Roundup LONDON -- Cadbury Schweppes PLC (NYSE:CSG - News) , the world's third-largest soft-drink producer and a leading maker of sweets, said Monday it plans to cut 10% of its 55,000-strong global work force. The company also said it plans to close some 20% of the 133 factories it operates worldwide. Cadbury, which reported flat first-half earnings in June because of poor market conditions, said it expected the moves to yield savings of 400 million pounds ($678.2 million or 575.1 million euros) a year by 2007. The moves are part of a four-year plan for cutting costs and driving growth that Cadbury will embark on after admitting its cost base was "out of line." In addition to its flagship brand Dr Pepper, London-based Cadbury makes 7 UP, Mott's, Snapple and other beverages. Overall, Cadbury has a 16.6% share of the U.S. soft drink market, behind Coca-Cola and PepsiCo. The U.S. soft-drinks business accounts for about 25% of Cadbury's operating profits. Earlier this year, Cadbury announced it was consolidating its North American beverage business to cut costs and to improve its relationship with bottlers and retailers. LONDON MARKETS London stocks edge higher Cadbury among top gainers on broker upgrade By Emily Church & Steve Goldstein Last Update: 12:26 PM ET Oct. 17, 2003 LONDON (CBS.MW) - London stocks held onto gains on Friday behind defensive stocks, able to thwart the market downturn in the U.S. and Europe. The FTSE 100 index (UK:1805550: news, chart, profile) rose 0.1 percent to 4,344., while French and German markets declined. See story on European markets. U.S. stock markets dropped in a tech stock-led decline, with Sun Microsystems and Student Managed Fund Stock Research Report By Todd Shrier and Philip Odackal online auction house Ebay lower after giving a weaker 2004 projection than hoped. See story on U.S. markets. The U.S. losses did not impact London markets as much due to the dearth of tech exposure to the benchmark FTSE 100 index. Cadbury Schweppes (CSG: news, chart, profile) (UK:CBRY: news, chart, profile), the food and beverage maker, rose 4.3 percent and was among the biggest gainers in London. The stock was upgraded Friday by Goldman Sachs to outperform, which told clients it sees a potential 24 percent rise in share price over the next 12 months if it hits its targets. It said confectionery operations productivity is 45 percent below its peer group average, and new management "appears well placed to reduce costs and invest in better growth." Integration of its Adams unit should also provide lift to the shares, the broker said. Press Release Source: Cadbury Schweppes PLC Cadbury Schweppes in Successful $2BN Bond Issue Tuesday September 30, 12:14 pm ET LONDON, Sept. 30 /PRNewswire-FirstCall/ -- Cadbury Schweppes is pleased to announce that it has successfully completed the company's first bond issue in the US market, raising $2 billion, ahead of the company's $1 billion - $1.5 billion target. The size of the issue was increased in response to strong investor demand. The proceeds will be used to replace some of the financing arrangements put in place in December 2002 to fund the $4.2 billion acquisition of Adams confectionery business (which includes such major brands as Halls, Trident, Dentyne and Bubbas Bubblegum range). Cadbury Schweppes' brands (particularly Dr Pepper, 7 UP, Mott's, Snapple plus the Adams range) are well known in the US market. The bonds are split evenly between 5-year and 10-year maturities, with margins over the relevant US Treasuries of 80bps and 95bps respectively. After costs, this represents an average cost of funds of approximately 4.6% per annum. Proceeds from the sale were received on 29 September 2003. The lead arrangers were Bank of America, Deutsche and JP Morgan. David Kappler, CFO of Cadbury Schweppes said: "We are very pleased that US bond investors have recognised the strengths of the company's strategy, portfolio of brands and cash flow to enable us to raise money at such competitive margins. The relatively low interest rate environment may present further refinancing opportunities, although we do not envisage tapping this US Market again in the foreseeable future." Student Managed Fund Stock Research Report By Todd Shrier and Philip Odackal Risk Factors The first risk factor confronting CSG’s management team is the distribution chain of the U.S. beverage market. Over the years, CSG has had to rely heavily on bottlers owned by Pepsi and Coke due primarily to their superior breadth of coverage. Such a trend has continued throughout 2003 and it is believed that new brand offerings by Pepsi and Coke, such as Pepsi Vanilla, have taken priority of CSG’s leading brand Dr. Pepper, for distribution. CSG must attempt to negotiate an agreement that would allow distribution of its core brands regardless of the product offerings of both Coke and Pepsi. The second risk factor centers on the implications of substantial debt holdings. Valueline reports CSG possesses 6.2 billion dollars worth of long-term debt against only 9.02 billion in sales. Such a high proportion of debt translates into diminished managerial flexibility in the years to come. Although much of the debt is due to their recent acquisition spree (Adams and Dentyne), this is a situation that will have to be monitored in the upcoming years. The third risk factor relates to globalization. Pepsi and Coke have already entered and grasped significant market share in emerging markets around the world. Over the next ten years, CSG will be challenged to compete on a similar basis. Furthermore, with the saturation of soft drink consumption in the U.S. market, Pepsi and Coke have looked to non-carbonated beverages as a solution to stagnant growth. CSG will once again be challenged to stimulate growth by fortifying their non-carbonated product line beyond Snapple and Hawaiian Punch. Models 1. Earnings Yield -2003 EPS: $2.07 -Current price: $25.99 -Current yield: 7.96% -Projected sales growth rate: 6.5% Result: Buy *Nearly an 8% current yield provides a significant gap against the longbond over the next ten years even if CSG was to under-perform its earnings estimates and the long-bond approaches its historical average of 6%. 2. Valueline: -Return on total capital: 10% -Sales: 6.5% -P/E: 20 -Dividend yield: 2.9% -Ten-year future value: $92.93 -Buy price: $29.66 for 15% return -Current price: $25.99 Student Managed Fund Stock Research Report By Todd Shrier and Philip Odackal Result: Potential Buy *Sales estimates and return on total capital estimates used in this model were conservative (6.5% against projected 7.5%; 10% against projected 11%). 3. Valuepro: -Growth Rate: 6.5% -Risk Free Rate: 6% -Beta: 1 -WACC: 8.37 -Intrinsic Value: $22.91 Result: Observe *Intrinsic value slightly under current price of $25.99 Trade Details Stock Name: Cadbury Schweppes PLC Ticker: CSG Presentation Date: November 9, 2003 Covering Managers: Todd Shrier & Philip Odackal Vote: For: 7; Against: 1; Absent: 3 Decision: Buy Current Price: $25.99 Number of Shares: 578 Cash Value: $15,022.22 Stop Loss Limit: $22.09 (15%) Appreciation Review Target: 31.18 (20%) Anticipated Date of Trade: November 13, 2003 Trade Executed by: Professor Chinmoy Ghosh