Ch 13-1: Preparing Payroll Time Cards - Coach Tarpley

advertisement

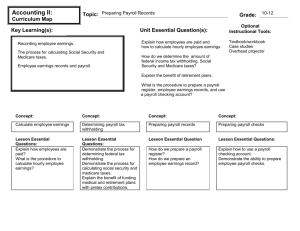

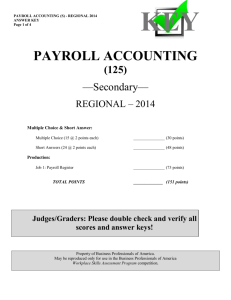

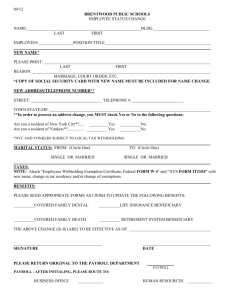

Ch 12-1: Preparing Payroll Time Cards The money paid for employee services (work) is called a salary The period covered by a salary payment is called a pay period - decided by business (weekly, bimonthly, monthly) - usually twice a month (15th and 30/31st) Total amount earned by all employees for a pay period is the payroll - reduced by state and federal taxes & deductions (health insurance) Time cards most frequently used method of tracking employee time worked (see handout) - Employee number, name, and ending pay date - Morning / Afternoon / Overtime = Total Daily Hours - Times rounded to nearest quarter hour (15 mins) - Total all Regular Hours & Overtime Hours The total pay due for a pay period before deductions is called total earnings (GROSS PAY) To find Gross Pay amount: - Multiply your Total Regular Hours & Regular Rate - Multiply your Total Overtime Hours & Overtime Rate o Overtime Rate = 1 ½ x Regular rate - Add amount columns to find total earnings HOWEVER…taxes and other deductions must be subtracted from total earnings to determine actual amount employee is paid 12-1 Work Together Ch 12-2: Determining Payroll Tax Withholding Payroll taxes are taxes based on the payroll of a business - business is required to withhold certain taxes from employee salaries - based on employee total earnings - liability for employer until payment is made to government Employers also required to withhold state, city, or county income taxes from employee earnings Information used to determine amount of income tax withheld is on W-4 - employers required to have current W-4 for all employees Amount of tax withheld is based: - employee martial status - number of withholding allowances Withholding allowance is deduction from total earnings for each person legally supported by a taxpayer, including the employee… (spouse & kids) *Exemption from withholding available for certain low-income & part time employees* Employee Income Tax Withholding Tables – See Handout Tables prepared by Internal Revenue Service (IRS) - revised each year - prepared for various payroll periods (monthly, semimonthly, weekly) - Single vs. Married are taxed at different levels Example: Mr. Tarpley makes $1450/2 weeks – has wife & 2 children At least $1440 / But less than $1460 & 4 allowances = FICA (Federal Insurance Contributions Act) provides for a federal system of old-age, survivors, disability, and hospital insurance - Federal tax to pay for these is social security tax - Federal tax paid for hospital insurance is Medicare tax o Each of these are accounted for and reported separately - Paid by BOTH employees and employer Social Security tax is calculated on employee earnings up to a maximum paid in a calendar year (tax base) - SS tax rate (for this book) is 6.5% of earnings - MAX of $64,500 each calendar year Total Earnings x SS Tax Rate (6.2%) = SS Tax Deduction Medicare has NO tax base - rate (for this book) is 1.5% of total earnings Total Earnings x Medicare Tax Rate (1.45%) = 12-2 Work Together Medicare Tax Deduct. Ch 12-3: Preparing Payroll Records: Business form used to record payroll information called payroll register - summarizes payroll for one pay period - shows total earnings, withholdings, and net pay - information taken from time cards - deductions calculated from GROSS PAY - shows payroll of ALL employees Total earnings paid to employee after payroll taxes and other deductions is called net pay. (amount of check employee takes home) Gross Pay - Total Deductions = Net Pay Payroll checks are written after payroll calculations are verified and partner approves - write payroll check number in Check No. column Employee earnings record is form used to record details affecting payments made to each employee - business sends quarterly (3 months) reports to federal & state gov’t. - shows employee taxable earnings and taxes withheld Accumulated Earnings: - keeps track of accumulation of GROSS PAY (NOT net pay) 12-3 Work Together Ch 12-4: Preparing Payroll Checks: Employees are paid with checks written on a special payroll checking account 1) Check is written from the general checking account to payroll acct. 2) That check is deposited into payroll checking acct. 3) Employee checks are written from payroll checking acct. Check from General Checking Account Payroll Checking Account Employee A Employee B Employee C Electronic Funds Transfer (Direct Deposit) - payroll still must be calculated, but no individual checks written - employee receives a statement of earnings and deductions 12-4 Work Together

![[Product Name]](http://s2.studylib.net/store/data/005238235_1-ad193c18a3c3c1520cb3a408c054adb7-300x300.png)