Content Map of Unit

advertisement

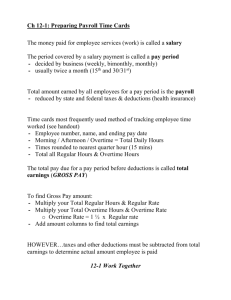

Accounting II: Curriculum Map Topic: Preparing Payroll Records Key Learning(s): Grade: 10-12 Optional Instructional Tools: Unit Essential Question(s): Explain how employees are paid and how to calculate hourly employee earnings. Recording employee earnings. The process for calculating Social Security and Medicare taxes. Employee earnings records and payroll. Textbook/workbook Case studies Overhead projector How do we determine the amount of federal income tax withholding, Social Security and Medicare taxes? Explain the benefit of retirement plans. What is the procedure to prepare a payroll register, employee earnings records, and use a payroll checking account? Concept: Concept: Concept: Concept: Calculate employee earnings Determining payroll tax withholding Preparing payroll records Preparing payroll checks Lesson Essential Questions: Explain how employees are paid? What is the procedure to calculate hourly employee earnings? Lesson Essential Questions: Demonstrate the process for determining federal tax withholding. Demonstrate the process for calculating social security and medicare taxes. Explain the benefit of funding medical and retirement plans with pretax contributions. Lesson Essential Question Lesson Essential Questions: How do we prepare a payroll register? How do we prepare an employee earnings record? Explain how to use a payroll checking account. Demonstrate the ability to prepare employee payroll checks. Vocabulary: Wage Salary Commission Total earnings Pay period Payroll Payroll clerk Time clock Other Information: Vocabulary: Payroll taxes Withholding allowance Payroll deduction Social security tax Medicare tax Accumulated earnings Tax base Qualified retirement plan 401(k) Individual retirement account Roth individual retirement account Vocabulary: Payroll register Employee earnings record Vocabulary: Voucher check Direct deposit

![[Product Name]](http://s2.studylib.net/store/data/005238235_1-ad193c18a3c3c1520cb3a408c054adb7-300x300.png)