Analyst Report

advertisement

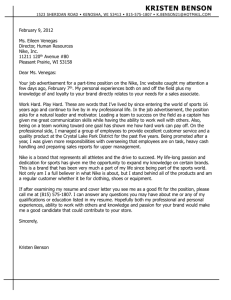

Jordan P. LaTendresse 1 Finance 305W ANALYST REPORT: NIKE Jordan P. LaTendresse 2 Finance 305W 1. After analyzing Nike, I believe it is far ahead of its competition. That being said, I believe to keep this edge Nike must begin to refocus on the younger population. Its financial metrics show it is extremely healthy and has room to grow. I believe its stock price will continue to increase in the present and far into the future. My analyst recommendation is a strong buy, 2. If I say athletic apparel, you say…? NIKE. Every athlete ranging from the PGA to the Olympic ski slopes have one thing in common. I would be willing to bet a large sum of money that they each own some type of Nike gear. Bill Bowerman and Phil Knight founded Nike on January 25th, 1964. Today the company is headquartered in Beaverton, Oregon, but employs about 44,000 people worldwide. In this past year Nike was valued at approximately $19 Billion, earning the corporation the title of most valuable brand in sports. On of the most attractive features of this sporting world giant is the fact that no sport is off limits. The company originally focused on the manufacturing of running shoes some 50 years ago; today Nike is on the forefront of equipment development for sports that are just beginning to become popular such as lacrosse. The broad range of apparel, equipment, and sports that Nike has become engaged in creates an extremely diverse revenue stream the company can draw from. According to the latest 10-k report, Nike has about 384 retail stores located in the U.S. and 442 International. This global presence allows for a broad market of consumers to be reached. Nike’s commitment to cutting edge innovation and quality allow it to generate substantial shareholder value. 3. Per the FY ’15 Q1 report revenue for Nike is up 15% to $8B. This increase was caused by growth across every product line less golf and extreme sports. Additionally, gross margin increased to 46.6% (170 basis points) as a result of focusing on higher margin products. An increase in input costs partially negated the improved gross margin. Overall there was an increase in SG&A to $2.5B mainly generated by demand creation expenses. Other contributors to this outcome were marketing investments in the world cup and a 19% increase in overhead costs. The effective tax rate declined from 25% to 21.7% when comparing FY ’14 Q1 to FY’15 Q1. The main cause was increase in foreign sales which are taxed at a much lower rate. Finally net income was reported at $962mm, an increase of approximately 23% and a 17% increase in quarterly dividends was implemented. In November Nike opened its second women’s only store in Shanghai. The facility is close to 5,000 square feet and features retail as well as an on-site group training center. The strategy behind this model is to connect with consumers on a deeper level. Additionally in November, Nike released its Vapor 360 fielding glove. This top of the line baseball glove inspired by Carlos Gonzalez features Nike’s Flywire technology giving it ultra-lightweight, flexibility, and the ability to be ready for game use without having to be broken in. Analysts forecasted Nike’s FY ’15 Q1 revenue to be approximately $7.15B and as previously discussed actual revenue was recorded at $8B. Surpassing forecasted Jordan P. LaTendresse 3 Finance 305W revenue by $0.85B is an extremely positive sign for Nike and its shareholders. Thus, I believe this is an indicator that Nike’s share price will continue to increase. 4. Nike’s Financial Indicators Employees Share P/E EPS Current Revenue Profit Market price ratio Margin Cap 56,500 $97.42 30.51 3.19 2.81 $28.82B 9.98% $83.93B 5. SWOT Analysis Strengths: -Product Innovation -Robust Cash Flow -Extremely Competitive Organization -Global Production/Sales -Brand Name/Loyalty Opportunities: -Product development -Expansion to Eyewear and Jewelry -Olympic Contracts -Emerging Market Growth Weaknesses: -Reliance on Footwear Market -Price Sensitivity -High Advertising Costs -Foreign Production Factory Conditions Threats: -Intensified Competition -Rising Input Costs -Environment of International Trade One of Nike’s main strengths is its continued product innovation. In the highly competitive world of athletics, having every possible advantage over an opponent is pivotal to victory. Success begins having the top of the line apparel and equipment that Nike manufactures. For example the Vapor 360 fielding glove discussed previously is the first of its kind, this innovation places both athletes and Nike ahead of their respective competitors. This company’s ability to produce large amounts of free cash flow results in an increase of shareholder value. This is achieved by a focus on research and development which allows Nike to stay on the cutting edge of innovation. Next in the strength category is Nike’s competitive organizational nature. Nike’s CEO was quoted saying that, “business is war without bullets.” This competitive mindset is embodied by the company as a whole by making this feature a candidate requirement when hiring employees. Next, the fact that Nike has 384 retail stores located in the U.S. and 442 International gives the company the ability to generate profit around the world. Finally, its greatest strength is derived from brand name and brand loyalty. The women’s only facility in Shanghai highlights this concept, by offering in store group training sessions consumers build personal relationships with employees and continue to buy their merchandise. One of Nike’s greatest weaknesses is its dependency on the footwear market. Using the FY ’15 Q1 10-Q, I calculated that footwear generated approximately 63% of Nike’s revenue that period. This large percentage combined with the fact that the retail sector is very price sensitive creates a concerning weakness. Next in this category is Nike’s high advertising costs or what they call “demand creation.” One of the main pillars of the Jordan P. LaTendresse 4 Finance 305W companies advertising strategy is using high profile sports icons to endorse their products. This strategy is very useful but carries lengthy and expensive contacts. Also the fact that this industry is becoming increasingly competitive will continue to raise advertising costs. Finally Nike’s last weakness is foreign labor conditions. Dangerous working conditions, long hours, and low wages in overseas production have been exposed by the media numerous times. In today’s world, the public demands corporate social responsibility from companies and Nike’s accountability in this subject could be a red flag for some consumers. One of the various opportunities available to Nike is product development. Nike is mainly focused on the functionality of their product, but the younger population derives a lot of value from how things look. By improving their fashion sense, Nike could increase sales and also reach consumers who are not athletes but like the way their products look. Taking this fashion subject farther, Nike could expand into sporting eyewear and jewelry. Its competitors have certainly not pushed far into this frontier, this market segment is wide open and would generate large profit margins. Currently Nike has a contract with the US Olympic Committee that expires after 2020, extending this contract further would create a massive opportunity. Nike would inevitable increase revenue with this move but more importantly it would generate free advertising from the massive Olympic audience. This move would contribute to nullifying Nike’s weakness of high advertising costs inherently. One final opportunity Nike could explore are emerging markets. China, with its enormous population and Brazil, with its fanatic passion for sports could produce increases in sales. Nike’s largest threat is created by its competitors. Companies like sketchers and Under Armor have been successfully focusing on young consumers. The younger generation’s purchasing power will inevitably increase with age and if their brand loyalty is not captured by Nike, issues will surface. Next, the inputs needed for Nike’s products have increased in price. This is a threat because if Nike wants to continue generating profit they will have to raise the prices of their products which is a dangerous move in such a price sensitive sector. A final threat Nike faces is one that all global companies are confronted by. The buying and selling of goods in multiple currencies causes instability in margins or costs over an extended amount of time. 6. Financial Nike Adidas Puma Under Armor Indicator Share Price $97.42 $40.55 $228.00 $69.30 Revenue $28.82B $18.31B $3.7B $2.87B Profit Margin 9.98% 4.26% -1.6% 6.42% Diluted 3.19 1.86 -3.9 0.84 Earnings Per Share P/E Ratio 30.51 21.86 N/A 82.60 Current Ratio 2.81 1.51 2.09 2.99 Market Cap $83.93B $16.97B $3.41B $14.81B Net Income $593.8mm $209.79mm $25.7mm $29.6mm Quarterly 5 Year Avg. Jordan P. LaTendresse 5 Finance 305W After analyzing the chart above it is quite evident that Nike’s market cap of $83.93B is much larger than its competitors. This measure is generated by multiplying shares outstanding by the market price of one share, it indicates that Nike is heavily traded and significantly larger than its competition. The next metric that catches the eye is revenue. Nike’s revenue is $10B greater Adidas and about 5 times greater than Under Armor and Puma combined. Thus Nike’s sales were greater than these three competitors combined. This trend is reflected when comparing net income between these four companies. Again, Nike absolutely dominates this metric showing it is much more profitable than Adidas, Puma, and Under Armor. The profit margin percentage shows how much of profit a company makes off of $100. Here we see Nike has edged out the competition once again, this metric is important because it shows that if each company had the same amount of revenue, Nike would still have the greatest profit. The current ratio is obtained by dividing current assets by current liabilities, it shows a company’s ability to pay back short term debt. When referencing the chart we see that Nike is second in this category by a slim margin to Under Armor. Next, the P/E ratio is found by dividing the market value per share price by earning per share this shows how much investors are willing to pay for each dollar of earnings. The sector average for P/E is 25, a firm higher than that average is expected to do very well in the future. Under Armor’s P/E of 82.6 reflects its strong connection to the younger generation, Nike needs to refocus its advertising to that generation to have a more competitive P/E. On the bright side for Nike, I high P/E means higher risk, this makes Nike more attractive to risk-averse investors. Earnings per share is calculated by the following equation: (net income-dividends on preferred stock)/average outstanding shares. This ratio is one of the most important metrics to investors and the fact that Nike’s EPS is significantly higher than its competition makes it extremely attractive. 7. When comparing industries with in this sector inventory turnover and profit margin are important metrics. The inventory turnover ratios for Nike, Under Armor, Puma, and Adidas were 4.2, 2.6, 2.7, and 2.9 respectively. Next, the respective profit margins are 9.98%, 6.42%, -3.9%, and 1.86%. Nike’s major advantage is summed up in these two ratios and can be explained in two steps. The turnover ratio is calculated by dividing sales by inventory, a high ratio indicates large sales and low inventory which equates to lower holding costs. As discussed previously profit margin shows our profit from sales generated. In summation, it is evident that Nike nets much more profit than its competitors 8. One of the largest difference between these companies is target segments. Nike and Under Armor are extremely broad in the fact that they target all sports globally. Adidas and Puma mainly focus on soccer in Europe. The diversity that Nike and Under Armor have in their products/markets give them a large advantage over their competitors in the profit category. Reflecting back over the information analyzed, Nike is far ahead of its competition. If the company begins focus more on the younger population this advantage will continue to increase far into the future. Jordan P. LaTendresse 6 Finance 305W References "Adidas Net Income (Quarterly):." Adidas Net Income (Quarterly) (ADDDF). Web. 1 Dec. 2014. <http://ycharts.com/companies/ADDDF/net_income>. "Equities." Puma SE, PUMX:GER Financials. Web. 1 Dec. 2014. <http://markets.ft.com/research/Markets/Tearsheets/Financials?s=PUMX:GER>. “Investors” Web. 1 Dec. 2014. <http://investors.nike.com/files/doc_financials/2015/q1/NIKEInc-Q115-Press-Release-FINAL_v001_q1avi0.pdf>. "News, Events & Reports." NIKE, Inc. Web. 1 Dec. 2014. <http://investors.nike.com/investors/news-events-and-reports/?toggle=earnings>. "Nike SWOT - Marketing Teacher." Marketing Teacher. Web. 1 Dec. 2014. <http://www.marketingteacher.com/nike-swot/>. "Olympics-USOC and Nike Extend Partnership Through 2020." Fortune OlympicsUSOC and Nike Extend Partnership Through2020 Comments. Web. 1 Dec. 2014. <http://fortune.com/2014/11/24/olympics-usoc-and-nike-extend-partnership-through2020/?xid=yahoo_fortune>. "Profitability - Adidas Ag-sponsored Adr (ADDYY)." Businessweek.com. Web. 1 Dec. 2014. <http://investing.businessweek.com/research/stocks/financials/ratios.asp?ticker=ADD YY>. “Yahoo! Finance” Web. 1 Dec. 2014. <http://finance.yahoo.com/q/ks?s=NKE Key Statistics>.