FASB on Subprime We Warned You

advertisement

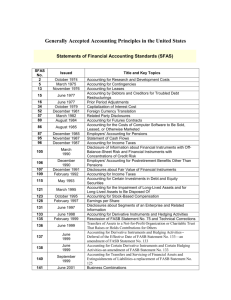

FASB on Subprime: "We Warned You" The chairman of the accounting standards board notes that his staff sent up a warning flare about subprime mortgages in 2005. Tim Reason and Marie Leone, CFO.com | US CFO.com May 1, 2008 If only the financial world had paid more attention to FSP SOP 94-6-1, there might not have been a subprime mortgage crisis. It is safe to say that many preparers of financial statements, not to mention the large majority of investors, pay little attention to the deliberations of the Financial Accounting Standards Board — at least, that is, until they result in rules that directly affect financial results. Yet at a conference Thursday morning, FASB chairman Robert Herz reminded both investors and preparers that his staff issued an unusual six-page "reminder" back in December 2005 that warned that investments in subprime mortgages were risky. Unfortunately, the title of the document was not "Investments in Subprime Mortgages are Risky." Still, by FASB standards, it was pretty darn close. "Terms of Loan Products That May Give Rise to a Concentration of Credit Risk," also known as FASB Staff Position SOP 94-6-1, warned investors and financial preparers alike that FASB's staff "is aware of loan products whose contractual features may increase the exposure of the originator, holder, investor, guarantor, or servicer to the risk of nonpayment or realization." In that paper, FASB's staff warned specifically about types and features of subprime mortgages that have since become household phrases: negative amortization, option adjustable-rate mortgages, interest-only loans. The paper also warned that some of these features, such as low introductory interest rates that set higher after several years, "may delay defaults" even as they ultimately "affect a borrower's ability to repay the loan and lead to increased defaults and losses." The financial vehicles into which those features were packaged became "ticking time-bombs," Herz said earlier this month at a joint meeting of FASB and the International Accounting Standards Board in London. "And the bombs started to explode," he added. At that meeting, Herz added that the securitization of those loans had made improper use of an accounting mechanism known as a qualified special purpose entity, or QSPE. Both U.S. and international accounting standards setters are now looking to eliminate QSPEs. Eliminating QSPEs will be "like taking the punch bowl away" from banks and other firms that have enjoyed the off-balance sheet treatment it afforded them, said Herz, who spoke Thursday morning at the annual Financial Reporting Conference Thursday morning in New York at Baruch College's Zicklin School of Business. If QSPEs are eliminated, companies will be required to review whether all special purpose entities — the trusts that are used to hold securitized assets — need to be consolidated under the accounting rules laid out by Fin 46R. However, Fin 46R is also currently under review at FASB. At the time it released its position paper, FASB's staff noted that it had done so to emphasize the need for financial statement preparers to consider whether they had disclosed enough information about the risks involved in such loans, and whether changes in market conditions required additional disclosure. The paper strongly suggested that additional disclosure was required — by a variety of accounting standards — for many of the subprime scenarios it described. Under one of those rules, FAS 107, additional disclosures are required for significant concentrations of risk, although the staff added that "Judgment is required to determine whether loan products have terms that give rise to a concentration of credit risk." As it happens, the question of judgment will be addressed in another conference this week, to be held Friday, in which the Securities and Exchange Commission's Committee on Improvements to Financial Reporting will discuss, among other things, the question of what constitutes "a reasonable judgment" by a financial statement preparer. The CIFR committee is also expected to address securitization