1. Summary of Significant Accounting Policies (continued) Income

advertisement

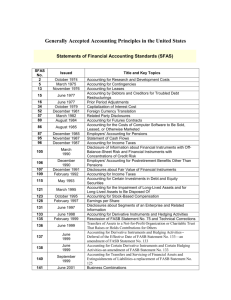

Panhandle Oil and Gas Inc. Notes to Consolidated Financial Statements (continued) 1. Summary of Significant Accounting Policies (continued) Income Taxes The estimation of the amounts of income tax to be recorded by the Company involves interpretation of complex tax laws and regulations as well as the completion of complex calculations, including the determination of the Company’s percentage depletion deduction. Although the Company’s management believes its tax accruals are adequate, differences may occur in the future depending on the resolution of pending and new tax matters. New Accounting Pronouncements In June 2006, the FASB issued FIN 48, “Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement 109,” which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with FAS 109, “Accounting for Income Taxes.” FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 is effective for fiscal years beginning after December 15, 2006, which will be our fiscal year beginning October 1, 2007. The adoption of this statement is not expected to have a material impact on the Company’s financial position or results of operations or cash flows. On September 13, 2006, the Securities and Exchange Commission (“SEC”) issued Staff Accounting Bulletin No. 108 (“SAB 108”), which provides interpretive guidance on how the effects of the carryover or reversal of prior year misstatements should be considered in quantifying a current year misstatement. SAB 108 was effective for the Company in fiscal year 2007. The adoption of this statement did not have a material impact on the Company’s financial position, results of operations or cash flows. In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. This statement is effective for financial statements issued for fiscal years beginning after November 15, 2007. The Company is still assessing the impact of this statement, but the adoption of this statement is not expected to have a material effect on the Company’s financial position, results of operations or cash flows. In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities. This statement permits entities to choose to measure many financial instruments and certain other items at fair value. This statement is effective for financial statements issued for fiscal years beginning after November 15, 2007. The adoption of this statement is not expected to have a material effect on the Company’s financial position, results of operations or cash flows. Other accounting standards that have been issued or proposed by the FASB or other standardssetting bodies that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption. (45)