Statement of Financial Accounting Standards issued by FASB

advertisement

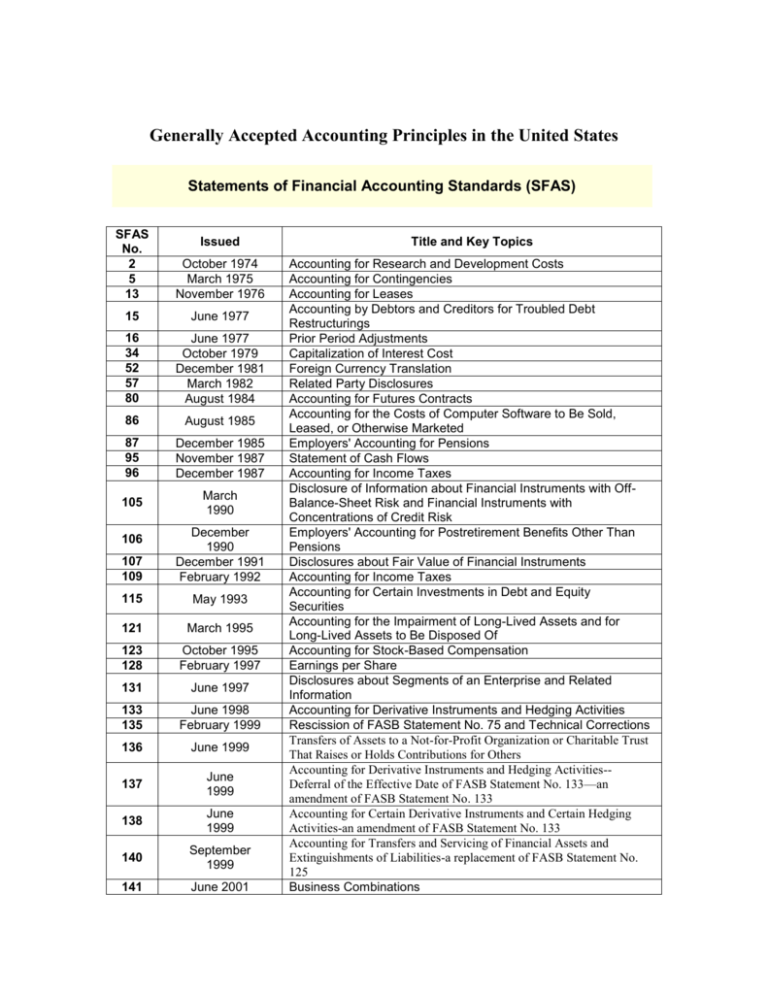

Generally Accepted Accounting Principles in the United States Statements of Financial Accounting Standards (SFAS) SFAS No. 2 5 13 Issued Title and Key Topics October 1974 March 1975 November 1976 15 June 1977 16 34 52 57 80 June 1977 October 1979 December 1981 March 1982 August 1984 86 August 1985 87 95 96 December 1985 November 1987 December 1987 105 March 1990 Accounting for Research and Development Costs Accounting for Contingencies Accounting for Leases Accounting by Debtors and Creditors for Troubled Debt Restructurings Prior Period Adjustments Capitalization of Interest Cost Foreign Currency Translation Related Party Disclosures Accounting for Futures Contracts Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise Marketed Employers' Accounting for Pensions Statement of Cash Flows Accounting for Income Taxes Disclosure of Information about Financial Instruments with OffBalance-Sheet Risk and Financial Instruments with Concentrations of Credit Risk Employers' Accounting for Postretirement Benefits Other Than Pensions Disclosures about Fair Value of Financial Instruments Accounting for Income Taxes Accounting for Certain Investments in Debt and Equity Securities Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of Accounting for Stock-Based Compensation Earnings per Share Disclosures about Segments of an Enterprise and Related Information Accounting for Derivative Instruments and Hedging Activities Rescission of FASB Statement No. 75 and Technical Corrections Transfers of Assets to a Not-for-Profit Organization or Charitable Trust That Raises or Holds Contributions for Others Accounting for Derivative Instruments and Hedging Activities-Deferral of the Effective Date of FASB Statement No. 133—an amendment of FASB Statement No. 133 Accounting for Certain Derivative Instruments and Certain Hedging Activities-an amendment of FASB Statement No. 133 Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities-a replacement of FASB Statement No. 125 Business Combinations 107 109 December 1990 December 1991 February 1992 115 May 1993 121 March 1995 123 128 October 1995 February 1997 131 June 1997 133 135 June 1998 February 1999 136 June 1999 137 June 1999 138 June 1999 140 September 1999 141 June 2001 106 142 143 144 June 2001 June 2001 August 2001 145 April 2002 146 June 2002 147 October 2002 148 December 2002 Goodwill and Other Intangible Assets Accounting for Asset Retirement Obligations Accounting for the Impairment or Disposal of Long-Lived Assets Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB Statement No. 13, and Technical Corrections Accounting for Costs Associated with Exit or Disposal Activities Acquisitions of Certain Financial Institutions —an amendment of FASB Statements No. 72 and 144 and FASB Interpretation No. 9 Accounting for Stock-Based Compensation—Transition and Disclosure— an amendment of FASB Statement No. 123 © Deepak Softworks