FINRA REQUEST EXAMPLES doc

advertisement

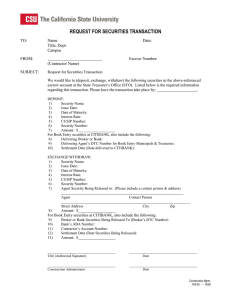

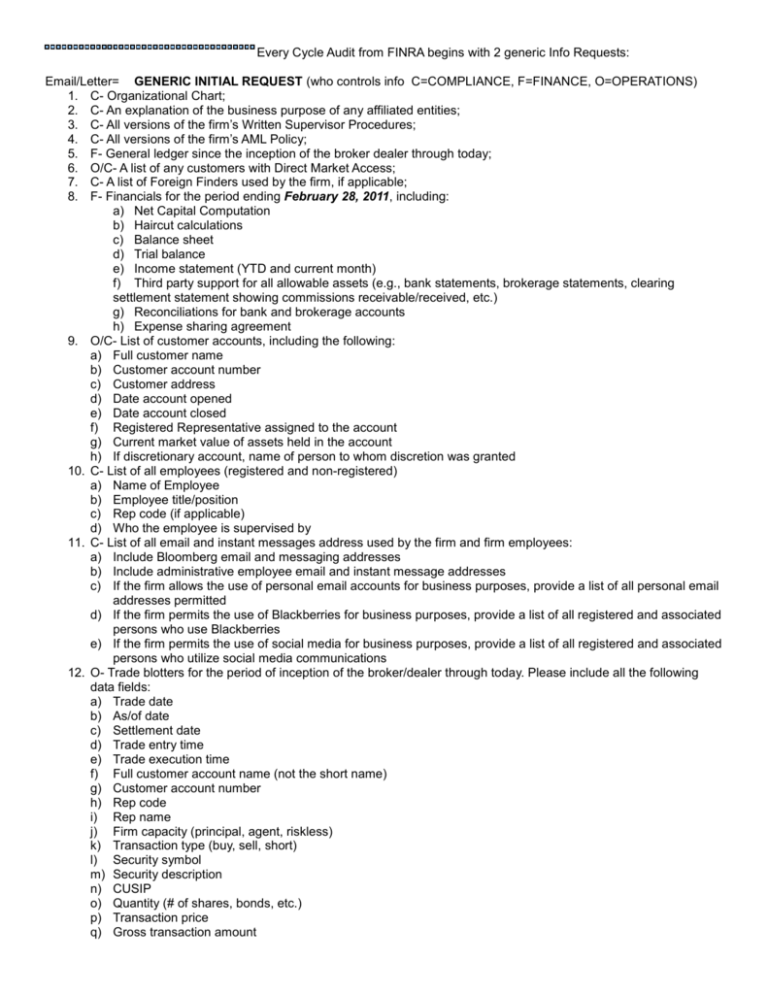

Every Cycle Audit from FINRA begins with 2 generic Info Requests: Email/Letter= GENERIC INITIAL REQUEST (who controls info C=COMPLIANCE, F=FINANCE, O=OPERATIONS) 1. C- Organizational Chart; 2. C- An explanation of the business purpose of any affiliated entities; 3. C- All versions of the firm’s Written Supervisor Procedures; 4. C- All versions of the firm’s AML Policy; 5. F- General ledger since the inception of the broker dealer through today; 6. O/C- A list of any customers with Direct Market Access; 7. C- A list of Foreign Finders used by the firm, if applicable; 8. F- Financials for the period ending February 28, 2011, including: a) Net Capital Computation b) Haircut calculations c) Balance sheet d) Trial balance e) Income statement (YTD and current month) f) Third party support for all allowable assets (e.g., bank statements, brokerage statements, clearing settlement statement showing commissions receivable/received, etc.) g) Reconciliations for bank and brokerage accounts h) Expense sharing agreement 9. O/C- List of customer accounts, including the following: a) Full customer name b) Customer account number c) Customer address d) Date account opened e) Date account closed f) Registered Representative assigned to the account g) Current market value of assets held in the account h) If discretionary account, name of person to whom discretion was granted 10. C- List of all employees (registered and non-registered) a) Name of Employee b) Employee title/position c) Rep code (if applicable) d) Who the employee is supervised by 11. C- List of all email and instant messages address used by the firm and firm employees: a) Include Bloomberg email and messaging addresses b) Include administrative employee email and instant message addresses c) If the firm allows the use of personal email accounts for business purposes, provide a list of all personal email addresses permitted d) If the firm permits the use of Blackberries for business purposes, provide a list of all registered and associated persons who use Blackberries e) If the firm permits the use of social media for business purposes, provide a list of all registered and associated persons who utilize social media communications 12. O- Trade blotters for the period of inception of the broker/dealer through today. Please include all the following data fields: a) Trade date b) As/of date c) Settlement date d) Trade entry time e) Trade execution time f) Full customer account name (not the short name) g) Customer account number h) Rep code i) Rep name j) Firm capacity (principal, agent, riskless) k) Transaction type (buy, sell, short) l) Security symbol m) Security description n) CUSIP o) Quantity (# of shares, bonds, etc.) p) Transaction price q) Gross transaction amount r) Dollar amount of commission s) Dollar amount of markup/markdown t) Net transaction amount u) An indicator whether the transaction was cancelled or rebilled v) Identity of contra party (by MPID) 13. O/C- Wire Transfer Blotter a) Date of wire b) Full customer account name c) Customer account number d) Rep code e) Dollar amount of wire f) Identity of receiving party (bank name and beneficiary name) 14. O- A securities movement blotter, including all stock certificates deposited, stock certificates delivered, DWAC transfers received, journals of securities and DTC transfers, including the following data fields: a) Date of event b) Full customer account name c) Customer account number d) Rep code e) Type of event (Certificate received, DWAC received, DTC transfer received, securities journal, DTC transfer sent, certificate delivered) f) Security symbol g) Security description h) CUSIP number. i) Quantity (# of shares, bonds, etc.) j) If a journal or a DTC transfer, include the contra party to the transaction. k) For securities journals, include the account number and the full name of the customer sending/receiving the securities. l) For DTC transfers, include the receiving institution’s name and the beneficiary’s name; and 15. C- A list of all exception reports available to the firm, including a description of the purpose of the exception report. Online with FINRA “Information Request Form”. The form a)reviews the information maintained in the Finra System for each firm b)requests some manual information After the initial/automatic 2 Initial Requests they begin: *Following this year’s audit focus paths *Begin looking further into details depending on what they see with the info received. An example of additional requested items: SEE EXCEL SHEET