Chapter 20 - drgeorgefahmy.com

advertisement

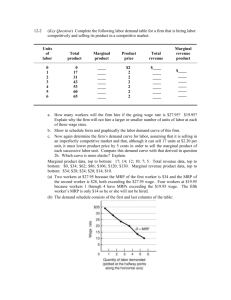

Chapter 20 Production and the Demand for Economic Resources Chapter Summary 1. Resource prices, such as wages, rents, interests, and profits, are determined by demand and supply. The demand for resources is derived from the demand for the commodities that require the resource in production. The greater the demand for the commodity and the more productive the resource, the greater the price that firms are willing to pay for the resource. 2. The marginal revenue product (MRP) measures the increase in the firm's total revenue from selling the extra product that results from employing one additional unit of the resource. As additional units of the variable resource are used with fixed inputs, the extra output, or marginal physical product (MPP), falls due to diminishing returns. 3. A firm that is a perfect competitor in the resource market maximizes profits when its marginal revenue product from the variable resource equals the resource price. Thus, the firm's marginal revenue product schedule is the firm's demand schedule for the variable resource. 4. If the firm is an imperfect competitor in the commodity market, its marginal revenue product declines both because the marginal physical product from the variable input declines and because the firm must lower the commodity price in order to sell more units of the commodity. 5. A firm's demand for a productive resource will increase if the demand for the product increases, if the productivity of the resource rises, if the price of a substitute resource rises, or if the price of a complementary resource falls. 6. If the firm is an imperfect competitor in resource markets, the firm maximizes total profits by hiring each resource until the marginal revenue product from each resource equals the marginal resource cost. The marginal resource cost is equal to the increase in the firm's total cost for hiring each additional unit of the resource. Important Terms Derived demand. The demand for productive resources which arises because resources are needed to produce final commodities that consumers demand. Firm's demand schedule for a resource. The MRP schedule of the resource (when the firm is a perfect competitor the resource market), reflecting the profitmaximization rule that the firm should continue to hire a resource until IRP equals the resource price. Marginal physical product (MPP). The change in total product that results from employing one additional unit of variable resource together with other fixed resources. Marginal revenue product (MRP). A measurement of the change in the firm's total revenue from selling the extra or marginal physical product that results from employing one additional unit of a resource together with other fixed sources. Perfectly competitive firm in the factor market. A firm that is too small to affect the price of the resource (factor) it purchases and can hire any quantity of the resource at the prevailing market price. Perfectly competitive firm in the product market. A firm that is too small to affect the price of the product (commodity) it sells and can sell any quantity of the product at the prevailing market price. Resource pricing. The manner in which wages for various kinds of labor, rents for various types of land and other natural resources, interests on capital assets, and profits on entrepreneurship are determined in a mixed economy such as that of the United States Total revenue (TR). The product price times the total product sold. Outline of Chapter 20: Production and the Demand for Economic Resources 20.1 20.2 20.3 20.4 20.5 20.6 Introduction to Resource Pricing Marginal Revenue Product under Perfect Competition Profit Maximization and Resource Demand under Perfect Competition Marginal Productivity and Resource Demand under Imperfect Competition Changes in Resource Demand and Elasticity A Firm's Demand fl)r Several Resources 20.1INTRODUCTION TO RESOURCE PRICING We now examine how the prices of productive resources such as wages, rents, interests, and profits are determined in a mixed economy such as that of the United States. Resource prices are a major determinant of money incomes and of the allocation of resources to various uses and firms. Broadly speaking, the price of a resource is determined by its market demand and supply. Firms demand resources in order to produce commodities. The demand for resources is a derived demand - derived from the demand for the commodities which require the resources in production. The greater the demand for the commodity and the more productive the resource, the greater the price that firms are willing to pay for the resource. EXAMPLE 20.1. As a result of consumers' demand for a final commodity, say shoes, firms hire labor and other resources in order to produce shoes. The greater the demand for shoes and the more productive labor in shoe production, the greater the firms' demands for labor. In the absence of market imperfections, minimum wage laws, union power, etc., the wage rate of labor is determined exclusively by the market demand and supply of labor. The wage rate is the major determinant of the money income of labor and of how labor is allocated to various firms and users in the economy. 20.2 MARGINAL REVENUE PRODUCT UNDER PERFECT COMPETITION In order to derive a firm's demand for a resource, we must first define the marginal revenue product (MRP). MRP measures tire increase in the firm’s total revenue from selling the extra product that results from employing one additional unit of the resource. If the firm is a perfect competitor in the commodity market, it can sell this extra output at the given market price for the commodity (see Section 17.3). However, as additional units of the variable resource are used together with fixed resources, after a point the extra output or marginal physical product (MPP) declines because of the operation of the law of diminishing returns (see Section 16.2). Because of the declining MPP, MRP also declines. EXAMPLE 20.2. In Table 20-1, column 1 refers to units of a variable resource, say, labor, employed in a given plant. Column 2 gives the total product produced. Column 3 gives the marginal physical product or the change in total product per unit change in the use of the resource. MPP declines because of the law of diminishing returns (assumed here for simplicity to begin operating with the first unit of resource hired). Column 4 shows the commodity price. It is constant because of perfect competition in the product market. Column 5 gives the total revenue obtained by multiplying the commodity price by the total product. Column 6 gives the marginal revenue product, measured as the increase in the total revenue in column 5. MRP declines because MPP declines. Table 20-1 (1) Units of Resources 0 1 2 3 4 5 (2) Total Product 0 5 9 12 14 15 (3) MPP or Δ(2) 5 4 3 2 1 (4) Product Price $10 10 10 10 10 10 (5) (6) Total Revenue MRP or Δ (5) (2) x (4) $0 $50 50 40 90 30 120 20 140 10 150 20.3 PROFIT MAXIMIZATION AND RESOURCE DEMAND UNDER PERFECT COMPETITION In order to maximize total profits, a firm should hire additional units of a resource as long as each adds more to the firm's total revenue than to its total costs. The increase in total revenue was defined in Section 20.2 as the marginal revenue product (MRP). The increase in total cost gives the marginal resource cost (MRC) of the resource. If the firm is a perfect competitor in the resource market, it can hire any quantity of the variable resource at the given resource price, and MRC equals the resource price. Thus to maximize total profits, the firm should hire the resource until MRP equals the resource price. The declining MRP schedule then represents the firm's demand schedule for the variable resource. EXAMPLE 20.3. If the firm represented in Table 20-1 is also a perfect competitor in the resource market and the resource price is $50, the firm will hire only one unit of the resource (say one worker) given where the MRP of $50 (column 6 in Table 20-1) equals the resource price of $50. If the resource price were $40, the firm would hire two units of the resource. At the price of $30, the firm would hire three units, and so on. The declining MRP schedule (columns 6 and 1 in Table 20-1) gives the firm's demand schedule for this resource and is graphed in Fig. 20-1. 20.4 MARGINAL PRODUCTIVITY AND RESOURCE DEMAND UNDER IMPERFECT COMPETITION If the firm is an imperfect competitor in the commodity market, the MRP declines both because the MPP declines and because the firm must lower the commodity price in order to sell more units. If the firm remains a perfect competitor in the resource market, the firm again maximizes total profits when it hires the resource until MRP equals the resource price. The declining MRP schedule then represents the firm's demand schedule for the variable resource. EXAMPLE 20.4. The first three columns of Table 20-2 are the same as in Table 201. Commodity price (column 4) declines because of imperfect competition in the commodity market. Total revenue (column 5) is obtained by multiplying commodity price by total product. Column 6 gives the MRP, measured as the change in total revenue in column 5. MRP declines both because MPP declines (column 3) and because the product price declines (column 4). A firm which is a perfect competitor in the resource market would maximize its total profits by employing the resource (say, workers) until their MRP equals the resource price. Table 20-2 (1) (2) Units of Total Resources Product 0 0 1 5 2 9 3 12 4 14 5 15 (3) MPP or Δ(2) 5 4 3 2 1 (4) Product Price $11 10 9 8 7 6 (5) Total Revenue (2) x (4) $0 50 81 96 98 90 (6) MRP or Δ (5) $50 31 15 2 -8 The MRP schedule of columns 6 and 1 in Table 20-2 is the firm's demand schedule for the resource and is graphed as din Fig. 20-2. At the resource price of $50, the firm will hire one unit of the resource. At the resource price of $31, the firm will hire two units of the resource, and so on. Note that d' is less elastic than d in Fig. 20-1. 20.5 CHANGES IN RESOURCE DEMAND AND ELASTICITY A firm's demand for a productive resource will increase (i.e., shift up) if (1) the product demand increases, ((2) The productivity of the resource rises, (3) the prices of substitute resources rise, or (4) the prices of complementary resources fall. On the other hand, the elasticity of the resource's demand is greater (1) the greater the elasticity of the product demand, (2) the smaller the rate of decline of the resource's MPP, (3) the easier it is to substitute this resource for other resources in production (as the resource price falls), and (4) the larger the proportion of the cost of this resource to the total costs of production. EXAMPLE 20.5. If the market demand for shoes rises and if the firm provides each worker with better but more expensive equipment, the firm's demand for labor will also rise (i.e., shift up). That is, to produce more shoes requires more labor; better equipment makes labor more productive and so the demand for labor increases; an increase in the price of capital equipment encourages the substitution of labor for capital in production. On the other hand, the firm's demand for labor is very elastic if consumers' demand for shoes is very elastic, if the MPP of labor in shoe production falls very slowly, if the firm can easily substitute labor for capital equipment when the price of labor falls, or if the cost of labor in relation to total costs is high. 20.6 A FIRM'S DEMAND FOR SEVERAL RESOURCES If a firm uses more than one variable resource, say labor (L) and capital (K), the firm will maximize total profits when it uses labor and capital until the marginal revenue product of each resource equals the source price (if the firm is a perfect competitor in the resource markets). That is, the firm will maximize total profits when MRP L = PL or wage rate, and MRPK= PK or the rate of interest. This can be rewritten as MRP L/PL = MRPK/PK = 1 and can be generalized to any number of resources. If the firm is an imperfect competitor in the resource markets, the profit maximization condition is generalized to MPPL = MRCL and MPPK = MRCK or MPPL/MRCL = MPPK/MRCK = 1 (where MRC refers to the marginal resource cost-see Sections 20.3 and 21.3). Solved Problems INTRODUCTION TO RESOURCE PRICING 20.1. (a) What is resource pricing? (b) Why is it important? (c) How is the price of resources determined in a mixed economy such as that of the United States? (a) Resource pricing examines or studies the determination of (l) the wages of various kinds of labor, (2) the rents of various types of land and other natural resources, (3) the interest rates on capital assets, and (4) profits from various forms of entrepreneurial activity. This chapter deals with resource pricing in general. Chapter 21 deals with wage determination, and Chapter 22 covers the determination of rents, interests. and profits. (b) Wages, rents, interests, and profits are major determinants of the money income of resource owners and of the inequality in the personal distribution of income. Thus. the prices of resources help determine the answer to the fundamental economic question of for whom to produce (see Section 2.1) and refer to the bottom loop in Fig. 2-2. The prices of resources also help to determine which commodities will be produced and how firms will combine various resources to minimize the costs of production and to maximize profits. (c) Broadly speaking, the price of a resource is determined, just as the price of a final commodity is determined, by the interaction of the market supply and demand. The interaction of the forces of market demand and supply for each kind of labor time determines the wage rate of various kinds of labor. The interaction of the forces of market demand and supply for each type of land or other natural resource determines the rent of each of these natural resources. The same is true for interest on various kinds of capital and profit on various forms of entrepreneurship. However, in a mixed economy, the operation of the forces of market demand and supply is often modified by such market imperfections as union power and minimum wage legislation (see Section 21.3). 20.2. (a) Why do firms demand resources? In what way is a firm's demand for a resource a derived demand? How does this differ from consumers' demand for final commodities? (b) What determines the strength of a firm's demand for a productive resource? (a) Firms demand resources in order to produce final commodities. However, resources may first be utilized to produce capital equipment that would then facilitate the production of final commodities. It is the consumers' demand for final commodities that ultimately gives rise to the firm's demand for productive resources. Because of this, the demand for a resource is referred to as a derived demand. It is derived from the demand for the final commodities which require the resource in production. While consumers demand final commodities because of the direct utility or satisfaction that they get from consuming commodities, producers demand resources only because the resource can be used to produce the commodities that consumers demand. (b) The strength of a firm's demand for a resource depends on (2) the strength of the demand for the commodity that the resource is used to produce, (2) the productivity of the resource in producing the final commodity, and (3) the prices of other related (i.e., substitute and complementary) resources. The higher the demand for the final commodity, the more productive is the resource; the higher the price of substitute resources and the lower the price of complementary resources, the greater the firm's demand for resource. MARGINAL REVENUE PRODUCT UNDER PERFECT COMPETITION 20.3. (a) When is a firm a perfect competitor in the product market? (b) When is a firm a perfect competitor in the resource market? (a) A firm is a perfect competitor in the product market if it is one of a large number of sellers of a homogeneous commodity and can sell any quantity of the commodity without affecting the market price. The perfectly competitive firm is a price taker. That is, it faces an infinitely elastic demand for the commodity it sells at the prevailing market price (see Sections 17.1 and 17.3). (b) A firm is a perfect competitor in the resource market if it is one of a large number of buyers of the resource, each too small to affect the resource price. Thus, the firm faces an infinitely elastic supply of the resource and can purchase any quantity of the resource at its prevailing market price. 20.4. From Table 20-3, Table 20-3 Units of Resource 0 1 2 3 4 5 Total Product 0 10 18 24 28 30 Product Price $1 1 1 1 1 (a) find the marginal physical product (MPP), total revenue, and the marginal revenue product (MRP) schedules. (b) Why does the MPP decline? Why does the MRP decline? How can you tell that this firm is a perfect competitor in the product market? (a) Column 3 in Table 20-4 gives the MPP. It is obtained from the change in total product per unit change in the use of the variable resource. Columns gives the total revenue of the firm. It is obtained by multiplying the product price (column 4) by the total product (column 2). Column 6 gives the marginal revenue product. It is obtained from the increase in the total revenue in column 5. Table 20-4 (1) Units of Resources 0 1 2 3 4 5 (2) Total Product 0 10 18 24 28 30 (3) MPP or Δ(2) 10 8 6 4 2 (4) Product Price $1 1 1 1 1 (5) (6) Total Revenue MRP or Δ (5) (2) x (4) $ 0 $10 10 8 18 6 24 4 28 2 30 (b) The MPP that results from employing each additional unit of the variable resource (together with fixed amounts of other resources) declines because of the law of diminishing returns (see Section 16.2). For simplicity, it is here assumed that the law of diminishing returns begins to operate with the first unit of the variable resource hired. The marginal revenue product declines because MPP declines. We know that this firm is a perfect competitor in the product market because product price remains constant at $1 per unit regardless of the quantity of the product sold by the firm. PROFIT MAXIMIZATION AND RESOURCE DEMAND UNDER PERFECT COMPETITION 20.5. (a) What general rule should a firm follow in hiring a resource in order to maximize total profits? Explain mammal resource cost (MRC). (b) What is MRC when the firm is a perfect competitor in the resource market? How does this affect the rule that the firm should follow in hiring a resource in order to maximize its total profits? (a) In order to maximize total profits. a firm should hire additional units of a resource as long as each adds more to the firm’s total revenue than to its total costs. The increase in total revenue is called the marginal revenue product (MRP). The increase in total costs (from hiring one additional unit of a resource to be used with other fixed resources) is called the marginal resource cost (MRC). Thus, to maximize total profits a firm should hire a resource as long as MRP exceeds MRC and until MRP MRC. Note the similarity between this and the condition for profit maximization (MR = MC) in Section 17.3. The only difference is that our main focus is now the resource market rather than the product market. (b) If the firm is a perfect competitor in the resource market (so that it can hire any quantity of the resource at the prevailing market price of the resource), the change in its total costs in hiring one more unit of the resource (i.e., its MRC) equals the resource price. The rule for profit maximization when the firm is a perfect competitor in the resource market is to hire a resource as long as MRP exceeds the resource price and up to the point when they are equal. (The ease where the firm is an imperfect competitor in the resource market is discussed in detail in Section 21.3.) 20.6. (a) Following the profit-maximization rule for the firm of Problem 20.4, how many units of the variable resource should the firm hire if the resource price is $10. $8.56 54, $2? (b) Draw this firm's demand curve for the variable resource. (a) Since the firm is a perfect competitor in the resource market. it will maximize its total profits by hiring the variable resource as long as MRP exceeds the resource price and until they are equal. Thus. at the resource price of $10, the firm will hire one unit of the resource. At the resource price of $8, the firm will hire two units of the resource. The firm will hire three units of the resource at the price of $6, four units at the price of $4, and five at the price of $2. Thus columns 6 and I of Table 20-4 give the firm's demand schedule for the variable resource. (b) See Fig. 20-3. Graphing the firm's demand schedule. we get the firm's demand curve (d) for the resource. Note that the MRP is plotted at the midpoint of each resource unit. MARGINAL PRODUCTIVITY AND RESOURCE DEMAND UNDER IMPERFECT COMPETITION 20.7. Suppose that the product price in Table 20-3, instead of remaining at $1, declined to $0.90 when two units of the product sold, to $0.80 for three units sold, $0.70 for four, and to $0.60 for five units of the product sold. (a) Find the MPP, the total revenue, and the MRP schedules. (b) Why does the MRP decline? Row can you tell that this firm is an imperfect competitor in the product market? (a) Column 3 in Table 20-5 gives the MPP (the same as in Table 20-4). Column 5 gives the total revenue of the firm (obtained by multiplying the total product by product price). Column 6 gives the MRP, measured as the change in total revenue. Table 20-5 (1) (2) (3) (4) (5) (6) Units of Total MPP Product Total Revenue MRP or Δ (5) Resources Product or Δ(2) Price (2) x (4) 0 0 $ 0.00 10 $10.00 1 10 $1.00 10.00 8 6.20 2 18 0.90 16.20 6 3.00 3 24 0.80 19.20 4 0.40 4 28 0.70 19.60 2 –1.60 5 30 0.60 18.00 (b) The MRP declines because both (1) MPP declines (due to the operation of the law of diminishing returns) and (2) product price declines. The firm represented in Table 20-5 is an imperfect competitor in the product market because it must lower the product price in order to sell more units of the product. (In order to distinguish it from this case, the MRP when the firm is a perfect competitor in the product market is sometimes referred to as "the value of the marginal product." or the VMP.) 20.8. If the firm in Problem 20.7 is a perfect competitor in the resource market. (a) how many units of the variable resource should this firm hire at the resource price of $10, S6.20, $3.00, and $0.40? Why will the firm not hire the fifth unit of the resource even if it were free? (b) Draw this firm's demand curve for the variable resource. (a) The firm will hire one unit of the variable resource at the resource price of $10 (where MRP equals the resource price), two units at the resource price of $6.20: three at the price of $3, and four at the resource price of $0.40 per unit. The firm would not employ the fifth unit of the resource even if it were free because the MRP of this fifth unit is negative (-$1.60). That is, by lowering the product price in order to sell the MPP of the fifth unit of the variable resource, the total revenue of the firm will decline. Because the firm hires a resource up to the point where MRP equals the resource price, this is referred to as the marginal productivity theory. (b) Columns 6 and 1 of Table 20-5 give the firm's demand schedule for the variable resource. This is plotted as din Fig. 20-4. Note that d' is less elastic than d in Fig. 20-2. CHANGES IN RESOURCE DEMAND AND ELASTICITY 20.9. Explain what can cause an increase or upward shift in a firm's demand for a productive resource. When the market demand for a product increases, firms will purchase more resources in order to increase their output of the product. For example, when the demand for housing rises, construction firms tend to hire more electricians, plumbers, and construction workers and to purchase or rent more construction equipment and land in order to build more homes. As workers are supplied with better equipment, the productivity and demand for labor increase still further. If the price of capital equipment subsequently rose in relation to wages, firms would increase their demand for labor as they substituted labor for capital in production. On the other hand, when the wage rate of electricians falls (so that more electricians are employed), the demand for plumbers (the complementary labor to build houses) also increases. 20.10.Explain what determines the elasticity of demand for a resource. The elasticity of resource demand depends on several conditions: (1) The greater the elasticity of the product demand, the greater the elasticity of resource demand. When the firm is a perfect competitor in the product market and faces an infinitely elastic product demand, the firm's resource demand is more elastic than when the firm is an imperfect competitor in the product market (compare d in Fig. 20-3 to d' in Fig. 20-4). (2) Since a resource demand schedule is given by its MRP schedule and the MRP depends on the resource MPP schedule (and the commodity price), the smaller the rate of decline in the resource MPP schedule, the more elastic the MRP or the resource demand curve (everything else being held constant). (3) If a resource can easily be substituted for others as the resource's price falls, the percentage increase in the quantity demanded of the resource will be large in relation to the percentage decline in the resource's price and result in an elastic resource demand. (4) If the resource's cost is large in relation to the firm's total costs, an increase in the resource's price will cause a relatively large increase in costs of production, leading to a relatively large decline in production and, hence, in the quantity of the resource demanded. 20.11.(a) How do we get the total market demand for a resource? (b) Why is this important? (a) The total market demand (i.e., the demand of all firms) for a resource is obtained by summing the quantity demanded of the resource by each firm at each resource price. In a more advanced course, you will see that this is not as straightforward and simple as obtaining the market demand for a product by totaling individual demands for the product (see Section 3.1). This happens because as a resource price falls, firms will hire more of the resource and produce more of the commodities which require that resource in production. This increase in the product-market supplies will reduce product prices and cause a downward shift in the resource MRP and the demand curve. (b) The resource-market demand is important because, together with the resource-market supply, it determines the resource-market equilibrium price. This is the price which the perfectly competitive firm in the resource market uses to determine how much of the resource to employ (see Section 21.1). A FIRM'S DEMAND FOR SEVERAL RESOURCES 20.12.Explain how much of each variable resource a firm should hire in order to maximize total profits, if the firm is a perfect competitor in the resource markets. We saw in Section 20.3 that in order to maximize total profits. a firm which is a perfect competitor in the resource market should hire the variable resource as long as its MRP exceeds its price and until they are equal. In the usual case, the firm employs more than one variable resource, say labor (L) and capital (K) but the same rule applies. That is. in order to maximize total profits. the firm should hire labor and capital as long as the MRPL exceeds PL or wage rate (W) and until MRPL = PL or W. Similarly, the firm should employ capital as long as the MRPK exceeds PK or rate of interest and until MRPK = PK. When MRPL = PL, MRPL / PL = 1. Similarly, when MRPK = PK , MRPK / PK = 1. Thus, the condition for profit maximization for a firm employing labor and capital can be rewritten as MRPL / PL = MRPK / PK = 1. This is a special rule for the firm which is a perfect competitor in the resource markets. and can be extended to any number of variable resources. See Problem 20.13. 20.13.Explain how much of each variable resource a firm should hire in order to maximize total profits. if the firm is an imperfect competitor in the resource markets. When a firm which is an imperfect competitor in the resource markets wants to hire more of a resource, it will have to pay a higher price. not only on the additional units of the resource but also on all previous units of the resource hired. Thus, the increase in the total costs of hiring an additional unit of the resource or marginal resource cost (MRC) exceeds the resource price (see Section 21.2). The firm will maximize total profits when it hires variable resources as long as each resource MRP exceeds its MRC and until they are equal. With variable resources labor (L) and capital (K), the firm maximizes total profits when MRPL = MRCL and MRPK = MRCK or MRPL / MRCL = MRPK / MRCK = 1. This is the general rule of which MRPL / PL = MRPK / PK = 1 is the special case for the firm in a perfectly competitive resource market. Another way of stating the profit-maximization condition is to say that a firm should hire resources until the MRP per dollar spent on each resource is the same and equal to 1. Once again. this rule can be extended to any number of variable resources. Multiple Choice Questions 1. 2. 3. 4. 5. 6. Wages, rents, interests, and profits are a major determinant of (a) the money incomes of resource owners, (b) the relative shares of national income going to various kinds of resource owners. (c) how resources are allocated to various uses and firms. (d) all of the above. Which of the following statements is incorrect? (a) Consumers demand final commodities because of the utility or satisfaction they get from them. (b) Firms demand resources in order to produce goods and services demanded by consumers. (c) Firms demand resources because of the utility or satisfaction they get from them. (d) The more productive a resource in producing a commodity, the greater the resource price. The extra product generated by adding one unit of a resource to the other fixed resources is called (a) marginal physical product (MPP), (b) marginal revenue product (MRP), (c) marginal resource cost (MRC), (d) marginal revenue (MR). When the firm is a perfect competitor in the product market, its MRP declines because of declining (a) MPP only, (b) commodity price only, (c) marginal revenue only, (d) MPP and the commodity price. Which of the following statements is incorrect? (a) The increase in the firm's total costs in hiring one more unit of the variable resource is called the marginal resource cost (MRC). (b) When the firm is a perfect competitor in the resource market. the marginal resource cost equals the resource price. (c) Total revenue equals product price times MPP. (d) To maximize total profits, a firm should hire the variable resource until MRP = MRC. When the firm is a perfect competitor in the resource market. its demand for the variable resource is the schedule of 7. 8. 9. 10. (a) MRP, (b) MPP, (c) MRC. (d) MR. When the firm is an imperfect competitor in the product market. its MRP declines because of declining (a) MPP only, (b) commodity price only, (c) marginal revenue only. (d) MPP and commodity price. When the firm is an imperfect competitor rather than a perfect competitor in the product market. its demand for the variable resource (other things being equal) is (a) more elastic, (b) less elastic, (c) infinitely elastic. (d) unitary elastic. A firm's demand for a productive resource increases (i.e.. shifts up) when (a) the product demand increases, (b) the productivity of the resource rises, (c) the prices of substitute resources rise or the prices of complementary resources fall. (d) all of the above. Which of the following is incorrect? A firm's demand for a resource is more elastic, (a) the more elastic the product demand. (b) the greater the rate of decline of the resource's MPP, (c) the easier it is to substitute this for other resources in production when the price of the resource falls. (d) the larger the proportion of the resource's cost to total production costs. 11. 12. When a perfectly competitive firm in the labor and capital markets is maximizing its total profits, (a) MRPL = PL , (b) MRPK = PK , (c) MRPL / PL = MRPK / PK = 1, (d) all of the above. When an imperfectly competitive firm in the labor and capital markets is maximizing profits, (a) MRPL = PL, and MRPK = PK , (b) MRPL / PL = MRPK / PK = I, (c) MRPL / MRCL = MRPK / MRCK = 1, (d) none of the above. True or False Questions 13. The demand for resources is derived from the goods that require the resource in production. 14. The price of a resource is determined by the demand for the resource. 15. The marginal revenue product measures the increase in total costs in hiring each additional unit of the variable input. 16. If the firm is a perfect competitor in the product market. its marginal revenue product curve is downward-sloping only because the marginal physical product curve of the resource is downward-sloping. 17. A firm's marginal revenue product curve is steeper if the firm is an imperfect rather than a perfect competitor in the product market. 18. Marginal resource cost refers to the increase in the firm's total costs in hiring each additional unit of the resource. 19. To maximize profits, a firm should hire resources as long as each additional unit of the resource adds more to the firm's total costs than to its total revenue. 20. A firm's demand for a resource is its marginal revenue product curve if the firm is a perfect competitor in the product market. 21. A firm's demand for a resource shifts up if the productivity of the resource increases. 22. A firm's demand for a resource shifts up if the price of a substitute resource increases. 23. A firm's demand for a resource shifts down if the price of a complementary resource declines. 24. To maximize profits a firm must hire a resource until the marginal revenue product from the resource is equal to the marginal resource cost. Answers to Multiple Choice and True or False Questions 1. (d) 7. (d) 13. (T) 19. (F) 2. (c) 8. (b) 14. (F) 20. (F) 3. (a) 9. (d) 15. (F) 21. (T) 4. (a) 10. (b) 16. (T) 22. (T) 5. (c) 11. (d) 17. (T) 23. (F) 6. (a) 12. (c) 18. (T) 24. (T)