Unit 5.

advertisement

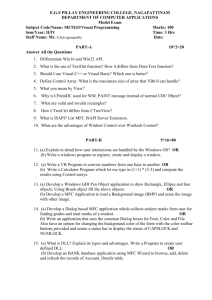

Unit 5. Production or Manufacturing of output, revenues, costs, and profits as functions of input level (Ch. 5) GM Labor Issues GM (General Motors) officials are about to begin labor contract renewal negotiations with the UAW (United Auto Workers Union). GM officials are concerned about lagging worker productivity in their plants vis-à-vis the competition. For example, Ford workers produced an average of 33.2 vehicles per year and were paid an average wage of $43 per hour, while the corresponding figures for GM were 27.9 cars at $45 per hour. Based on this information, how much higher are GM’s labor costs per car than Ford’s? What GM labor output would result in GM’s labor costs per car being equal to Ford’s with current wages? Managing Office Space Global Technologies is currently leasing the office space used by staff at corporate headquarters in Seattle. Other than a change in the price or cost of office space, what economic factors might explain management’s decision to increase leased office space by 10%? Suppose in the geographic area of Global’s Corporate headquarters (i.e. Seattle) management has reason to believe that other companies may be cutting back on their needs for office space. Based on this information, what advice do you have for Global Technologies management regarding the future purchase of office space in Seattle? How Many Workers to Hire? A concession stand owner/operator hires workers (= L) at a daily wage (= W) of $40 to sell pop (= q) at $2.00 (= P = price) per bottle. If q = 200L1/2 and total fixed costs = $100, how many workers should be hired? For simplicity, assume labor costs are the only variable costs. Who’s To Blame? The salaries of professional athletes in major sports often are above $1 million per year. Who or what is the main economic explanation as to why this happens? Is the main cause the athletes themselves, the owners, television networks, sports clothing companies, and/or the fans? Production-Related Qs of Interest to Firm Managers (Examples) How does output Q change as input Q changes? Can output Q be increased w/o increasing input Q? To what extent can one input be substituted for another in the production process? What input Q would minimize costs? Maximize profits? How should inputs be acquired? Revenues & Costs (Input side relationships) 1. Graphical $ Q of input 2. Mathematical $ concepts = f(Q of input) Demand Economics: D factors Consumer utility Elasticities of D etc. PxQ Mgmt Concerns ______________ = Revenues - Cost ============ = Supply Economics: S factors Production processes Input productivity etc. Profits Production Analysis Production Function Q = F(K,L) The maximum amount of output that can be produced with K units of capital and L units of labor. Short-Run vs. Long-Run Decisions Fixed vs. Variable Inputs Assume q = f( K ,L) = a short-run production function where: Q = K = L = r = w = physical units of output physical units of fixed capital physical units of variable labor per unit cost (rental rate) of capital per unit cost (wage rate) of labor SR Production Concepts Concept/Definition Math Calculation q=linear fn of L q=nonlinear fn of L = q=aL = q=aL2-bL3 (e.g.) 1. TP = total product = total physical units of output = total quantity of output (=q) 2. AP = average product = output per unit of input = output of ‘average’ input = slope of line from origin to TP curve= a = TP/L = q/L = aL/L MP = marginal product = additional output per unit of additional input = slope of TP curve = output of last input unit = TP/L = TP/L =a 3. NOTE: = TP/L = q/L = (aL2-bL3)/L = aL = bL2 when MP > AP, AP is increasing when MP < AP, AP is decreasing when MP = AP is either at a maximum or constant = TP/L = TP/L = 2aL – 3bL2 Linear Production Function TP TP = aL L AP MP a AP = MP L Nonlinear Production Function Input Productivity Increase Total Product Cobb-Douglas Production Function Example: Q = F(K,L) = K.5L.5 K is fixed at 16 units. Short run production function: Q = (16).5L.5 = 4L.5 Production when 100 units of labor are used? Q = 4 (100).5 = 4(10) = 40 units Revenue Concepts that are a fn of the level of input usage. 1. Total Revenue Product = = = 2. Average Revenue Product 3. Marginal Revenue Product = = = = = = 4. Value of the Marginal Product = = = Note: MP = P in pure competition - MRP = VMP TRP TP x P paired observations on the S value of output and physical units of a variable input ARP AP x P revenue per unit of input MRP MP x MR add’l revenue per unit of add’l input VMP MP x P the market value of the add’l output per unit of additional input SR Revenue Product Function Example Q = K1/2L1/2 where K = 16 q = 4L1/2 = TP 1/ 2 TP 4 L AP = L L 4 L TP 2 1/ 2 1 MP (1 / 2)(4) L L L Revenue Products if P of output = 50 TRP = P • TP = 50 (4L1/2) = 200L1/2 ARP = P • AP = 50 ( 4 L 200 )= L MRP = P • MP = 50 ( 2 L )= 100 L Total ‘Cost’ Concepts as Functions of Input Level TVC TFC TC = = = = = = = total variable costs wL total fixed costs rK total costs TVC + TFC r K + wL Graphs of Total ‘Cost’ Concepts as Functions of Input Level Marginal Factor Cost (MFC) = the additional cost per unit of additional input = the wage rate (w) if the additional input is an additional unit of labor => MFC = w = the price of labor $ $ S MFC=w D L Firm L Mkt ‘Optimal’ input level (usage) Profit-maximizing input level A manager should keep using additional Qs of an input up to the point where the additional income equals the additional cost from the last input unit (sometimes called MFC = marginal factor cost) e.g. labor, MRP = W (= MFC) Profit-Maximizing Input Level SR Profit-Maximizing Input Level (Solution Procedure) Given: prod fn, r, w, P Derive: product concept equations as fns of L (e.g. TP, AP, MP) Derive: revenue concept equations as fns of L TRP = TP x P ARP = AP x P MRP = MP x P Find optimal L* Set MRP = MFC (=w) and solve for L Calculate optimal profit at L* = TRP – TFC – wL* Firm D for Variable Input (e.g. L) Input D Factors 1. 2. 3. Input price Output price Input productivity the demand for an input is a ‘derived’ demand (i.e. derived from factors that determine the profitability of using that input) Increased D for Labor (examples) LR Input P Disequilibrium LR Equilibrium Competitive Input P