course - Webster in china

advertisement

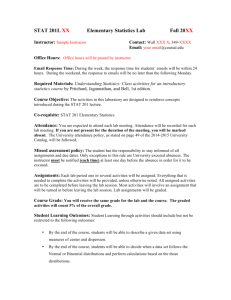

Joint MBA Program SUFE -WEBSTER University Graduate Course Syllabus COURSE: Location: FINC 5880: ADVANCED CORPORATE FINANCE Shanghai P.R.C. Term: 2014 Key Course THE INSTRUCTOR: Name: Availability: Paul P.M. Bon e-mail Mobile Phone: Office Phone: E-mail: 021-53935331 (Fax: 021 65361956) paul_pmbon@yahoo.com and paulusbon@msn.com About the instructor Paul P.M. Bon is a member of Webster University’s adjunct faculty (dutch campus) and a visiting professor to teach for the joint MBA program of SUFE and Webster University in Shanghai and Shenzhen P.R.C. He has been CFO for ICI Plc.’s Specialty Chemical business formerly a division of Unilever Plc., and Business Group Director at SCA AB of Sweden, Vice President F&P Packaging at Buhrmann Tetterode NV, and Group Controller for SONY (Japan). He has been teaching for Webster’s Joint Programs in China, and Europe graduate and undergraduate courses for Strategy, Finance, Marketing, Negotiations, Operations Management, Financial Accounting, Managerial Accounting, Business Statistics and Management over the period 2000-now. Paul is an Adjunct Faculty for City London University’s EMBA Program (UK) New York Stern University’s MBA (US) and Duke University’s MBA (US) and works part time for Duke Corperate Education (US) working with Corporations globally. He is a member of the Academic Board of AIA (UK). THE COURSE Course Definition (source: Webster University Graduate Catalogue) The student examines the nature of financial management, the American financial system, taxes, and the major financial decisions of corporations. Specific attention is given to dividend policy of corporations, inestment banking; long term debt; leasing; working capital management; derivatives and risk management; valuation; risk and asset pricing; financial analysis and forecasting; financial decisions and market efficiency as well as capital structure. Problemsolving methodology is used to illustrate the theories and tools in financial decision making. Prerequisite: FINC 5000 and Business Statistics The course is a hands on course that focusses higly on applying learned concepts to day to day business decisions and during the course students arerequired to work on a S&P 500 company of their choice. During the courses students will be asked to follow the financial and business news on a daily basis especially any news considering the company that they used to work on in this course. ATTENDANCE POLICY This course is a required or core course for the MBA degree program. Therefore the instructor will be strict on attendance. Any student who would like to take a leave from a class has to follow the Academic Policies of the University and need written proof for his/her absence. Students who have to travel for their business need writen approval from their line managers. In case a student has to miss 2 or more classes of this course we will urge the student to withdraw from the course and take the next scheduled course of this subject; this will delay the graduation for this student. You are required to consider the consequences of traveling decisions for your progress in this program before you make the decision. Course Content Course content can be covered using a variety of teaching methods. Lecture, problems, and case studies can be integrated into the course to teach and reinforce the material. Students should be able to demonstrate, either through direct testing or homework/case assignments, the ability to understand and perform the following: Apply dividend policy to a selected S&P 500 company (Note: other then S&P 500 companies are NOT allowed for this course also we strongly advise NOT to choose a Bank or Insurance Company to work on because of the difficulty of their financial statements) and buy backs of shares Use regression analysis to find relations between the performance of a company and macro economic data to test cyclicallity of companies. Use regression analysis to estimate the beta of corporations and to find specific properties of the share performance. Calculate and optimize the WACC% (Weighted Average Cost of Capital %) of a corporation and optimize it by using default spreads and the Hamada equation for unlevered beta’s. Understand the framework of valuation and the way to calculate company and equity value of a corporation based on projections of Free Cash Flow and the optimized WACC%. Understand the business of Investment Banking, and the issues of long term financial securities such as corporate bonds and the Initial Public Offerings (IPO’s) of shares of a corporation. Understanding the issuing of long term debt by companies and the concept of hybrid financing . Understanding what working capital management is and how it can be used to increase shareholder’s value. Understand capital/financial leasing and operational (off balance ) leasing and how companies use it to finance the business. Understand financial instruments such as forwards, futures, swaps and options. Understand how derivatives such as forwards, futures, swaps and options can be used to hedge interest and currency risks of corporations. Understand how capital structure is related to investing decisions and the value of a company and how it can be optimized. Being able to read and interpret the financial statements of a corporation and use the financial information to calculate firm value. Describe techniques used to forecast financial statements and apply these technoques. Understand Mergers and Acquisitions theory in finance and how a value and a price can be established for take over targets. Understand Multinational Financial Management. Understand Bankruptcy, Reorganization and Liquidation of corporations (this is a topic of current interest; we will cover some time to discuss these issues). Understand and follow closely the financial news The valuation of Financial Options and Futures Incoming Competency (Also See Course Definition Above) Finance (basic course) ; Business Statistics; Financial Accounting What Students Will Learn During the Course Finance is more and more moving to the center of strategic management and more and more non-financial managers need to have knowledge of the main financial concepts. Students start with the basic goals of finance that they learned during FINC 5000 and the relationship to the creation of shareholder’s value in businesses. Based on their own choice of a S&P 500 company that they would like to work on during the course they will be asked to apply the theory to “their” company. In order to enable the students to get a deep and integrated understanding of the S&P 500 company and its financial issues, they will work in a team of maximum 5 students. The students will work on different S&P 500 companies. Once a team has chosen a group of companies another team will not be able to chose the same companies/theme to work on during the course. Students are strongly advised to chose a company from the DOW 30 in order to be able to use Valueline documents. (http://www.valueline.com/dow30/index.cfm) In this advanced finance course students will learn additional concepts of finance and how to apply their knowledge of FINC 5000 and these new concepts to real world events. The course will have a high “in the financial news” content to learn from real world phenomena in the financial markets and businesses. The valuation of corporations is a central theme in finance and of this course. The intent of the course is to take the student through the "big picture" of what financial management is, what it means, and how it is used from day to day by large corporations to create shareholder’s value. This knowledge will help the student gain the decision-making and problem-solving skills in the field of finance that is so crucial in today's business environment. Required Reading Material Students enrolled for FINC5000 will use the same textbook as for FINC5000. NOTE: You are again STRONGLY advised to use the Damodaran on line help sources to do your Homework assignments and to help you fill the gaps in your knowedge. Required Material Good command of Excel’s statistical and financial formula’s MINITAB 14; to be downloaded for free from . http://www.minitab.com/ Access to a computer with (fast) internet capabilities Recommended Reading Material Reading the Wall Street Journal/Financial Times (www.ft.com) is highly recommended The Economist (Business) Mc Kinsey Quarterly www.CFO.com Yahoo Finance, Bloomberg, Fool.com, Moody’s, Standard&Poors, www.bondsonline.com www.Fitch.com CNN-http://money.cnn.com/ ACADEMIC POLICIES Webster University's Graduate Grading System: Letter grades mean that in the opinion of the instructor the work was A (4.0), A- (3.67): Superior B+ (3.33), B (3.0), B- (2.67): Satisfactory C (2.0): Barely adequate F (0.0) Unsatisfactory. No credit is granted Other Designations I: Incomplete work NR: Not reported W: The student withdrew from the course Attendance, Participation, Assignments Students and auditors are required to attend all classes and participate actively. Their grade will partly reflect this. It is usually appropriate for class participation to account for roughly 20% of the grade. Auditors do not receive academic credit, but participate in all other classroom work. All classes include assignments (such as presentations or papers). Students must report to the instructor all assistance they received and all sources they used in carrying out their assignments, otherwise they will fail the course and may face other penalties as well. The Instructors Will Evaluate the Student's Work as Follows: Description: Attendance is mandatory Company Project & Assignments- Presentation of Assignments Mid-term Quiz/Exam Final Exam Percentage: 30% 30% 40% Students and Instructors will be asked to evaluate the course in a form handed out during the last lesson. PLAGIARISM Plagiarism is using another person’s words or ideas without telling the reader. This applies to books, articles, but also to sources from the internet, or copying work from your fellow students. Those who are discovered cheating or plagiarizing will normally receive a failing grade for the entire course and may even be subject to dismissal. Please don’t fall into this trap, make proper references in your work and include a bibliography in all your papers (for more information, see the Student Handbook on our website). Please respect your sources, your audience and yourself The first session of a course is very important and should not be missed. Therefore, in accordance with Student Guidelines on Attendance, the instructor can request that students missing the first class without valid reason, and without having obtained permission beforehand, be dropped from the course. For this course, the instructor has requested that this rule is enforced. Mid-Term and Final Exam Dates The dates are as specified in the year calendar of the university. PRE-COURSE WORK DEADLINES: Class: Spring I --2012 Nr: 1. Select the S&P 500 company that your team will work on during the course. Select the class mates that you will work with during this course (each team can consist of maximum 5 members) Please make an A-4 document in WORD and put the names and student numbers of your team as well as the company that you have chosen and send it to the instructor before the course starts. Feed Back scores FINC 5000 Introduction to this course (FINC 5880) Dividend Policy Prepare for this session A 3 PPT slides presentation to introduce your company and team to your class mates during our first class. Class: Spring I-Nr. Capital Structure – The DISNEY Demo Prepare for this session Class: Prepare for this session Class: Prepare for this session Class: Prepare for this session Class: Prepare for this session Class: 2. Read Chapter on Capital Structure and start working on your Homework! We have covered this partly in FINC 5000 Spring I-Nr. 3. Bottom Up Beta’s Read Materials on Damodaran and continue to work on your Homework! Spring I-Nr. 4. Leasing-Lease Financing Read Chapter on Leasing and continue to work on your Homework! Spring I-Nr. 5. MID EXAM/MID PORTFOLIO Mid Term Exam and Investment Banking and IPO’s Read Chapter on Investment Banking and IPO’s and Hand in your Homework of week 1-4. Spring I-Nr. 6. Working Capital Management and Hybrid Financing Read Chapters on WC Management and Hybrid Financing and continue to work on the second half of your Homework. Spring I-Nr. 7. Financial Derivatives /Risk Management – BS Model Futures and SWAP’s Prepare for this session Read Chapters on the Black & Scholes Model Futures and SWAPs and continue to work on your homework. Class: Spring I-Nr. 8. Chapter 24: bankruptcy-Reorganization and Liquidation Read Chapter on Reorganization/Bankruptcy and continue to work on your Homework for Hand in Next Week! Prepare for this session Class: Prepare for this session Spring I-FINAL EXAM All Materials week 1-8 Nr. 9. IMPORTANT: Additional Information for the students: Students will be asked occasionally during classes to present their assignments in Power Point slide form. To run this efficiently you are kindly requested to: Focus your presentation on the cases of that week and make sure your Homework is up to date. Make sure that your presentation file is on the desktop before the class starts (you can do this in the Break of the class). Thank You! October 2014 Shanghai