template - FEAA - Alexandru Ioan Cuza

advertisement

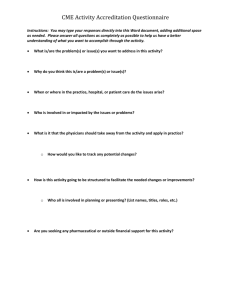

THE STRATEGIC ROLE OF SALES PROFESSIONALS IN THE PHARMACEUTICAL INDUSTRY Ruxandra Ciulu “Alexandru Ioan Cuza” University Iaşi, Romania ruxandra.ciulu@uaic.ro Abstract The pharmaceutical industry is one of the most spectacular industries worldwide in terms of number of mergers and acquisitions, its exposure to globalization and its specificity in terms of sales and marketing. Also, it has been one of the industries less affected by the crisis, which makes us wonder about the its key advantages. At the same time, company sales force is of growing importance, especially when analysing competitive advantages. Based on prior empirical studies presented in the international literature, this study empirically examines how salespersons in the pharmaceutical industry participate in strategic communication activities. The role of sales persons has expanded beyond the traditional selling function and includes a strong connection to the market, as well as information about competitors’ strategies. Therefore, salespersons have come to play a strategic role in gathering information which can lead to change in company strategy. The degree to which company managers accept suggestions and value market feed-back differs from company to company and from market to market. The current study analyses the nature of strategic communication activities in pharmaceutical companies in Romania. As the top twenty pharmaceutical companies on the Romanian market is strongly dominated by multinationals, it is natural to obtain results comparable to those at international level. Still, Romanian companies are highly affected by deffective upwards communication, which can generate wrong strategic approaches and ignorance in terms of market trends and competitors’ strategies. The study proves that strategic communication activities encourage individual selling performance and can lead to increase in company value. Keywords: boundry spanning, information asymmetry, pharma, sales, strategic communication The concept of ‘sales strategy’ is highly debated in the literature and is part of dayto-day reality in all companies. Therefore, we do not aim at analysing the types of sales strategies companies use or their effects on the market. Moreover, we are interested in the factors that influence or should influence the sales strategy. Namely, we have focused on the role of the sales professionals in providing useful information to the company, in order to help it adjust the strategy to the market conditions. Some would simply call it feed-back, while others analyse the strategic implications of the information and refer to it as ‘strategic communication’ [7]. Strategic communication should be a consequence of current sales strategy and the basis for the future (adapted) sales strategy. Recently, research [18] elevated sales strategy from a tactical component in a firm's promotional mix to a more strategic component with ramifications for the performance of business firms. Sales strategy influences all three sales force performance dimensions (behavioral, outcome, and CRM), as well as firm financial performance, while it enables firms to better allocate resources (e.g., selling effort, and sales calls) across customers [18]. 1. MARKET ORIENTATION AND STRATEGIC COMMUNICATION Turbulence in the international environment during the first decade of the twentyfirst century has forced companies to reconsider their selling approaches and sales strategies [1]. From this perspective, the role of the sales force has increased and companies try to identify new ways of using its expertise as a strategic advantage. As sales organizations grow in their use and understanding of teams, it is imperative that they learn how the organization influences sales teams, how sales teams function, how sales teams play a learning role for the sales organization, and what makes sales teams effective [20]. On the open market, firms are used to putting the customer first and to adjusting their output in order to fulfil the customer needs. Still, the current business environment moves this further to understanding the customer’s end-use markets. The seller is analysing the market of the buyer in order to build competitive advantage together through market intelligence and superior market sensing capabilities [17] (see Fig.1). This is the turning point from conventional selling to strategic customer management. Transactional Customer Demands Salesperson as Order Taker Salesperson as Order Maker Salesperson as Strategic Customer Manager Relational Customer Demands Fig. 1. Evolution of the sales role [17] In business markets, firms often rely heavily on the sales function to target customers as well as to build differentiation by supporting customers and by building strong and profitable relationships with customers [1]. Moreover, the seller needs to actively manage the company processes that impact on customer value [17], starting from internal (with senior management) and external communication (with suppliers) to build understanding of the sources of company sales success and how to sustain them. It is extremely important to build salesforce awareness regading their role in implementing company strategy while customers become more sophisticated and demanding, the environment is more competitive and market channels become more complex [17]. Especially in conditions of high uncertainty, customers become interested in investing in long-term partnerships with their suppliers, therefore by encouraging suppliers to adjust their objectives and strategies for the relationship [18]. In the context of change which affects markets and customers, some [14] even question the role of the salesforce. If customer expectations change even faster than organizations can respond with new products, service strategies, sales strategies, it can be argued that salesforce may become obsolent. 1.1. Boundry spanning and information asymmetry – the basis for strategic communication A boundaryrole person (boundry spanner) is defined as an individual who is responsible for contacting people outside his/her own group [20] and this type of activity is considered an important aspect of strategy formulation and implementation. Boundary spanning involves five classes of activities: (1) transacting input acquisition and output disposal; (2) filtering inputs and outputs; (3) searching for and collecting information; (4) representing the organization and (5) protecting and buffering the organization from external threats and pressures [20]. The boundary spanner’s role as information processor helps to protect the organization from information overload as boundary spanners filter, interpret, and channel relevant information to appropriate functional departmental areas of the firm [22]. On the other hand, information asymmetry exists when the salesperson acts as as boundry spanner and has more precise information than the sales manager about the selling environment [10]. The salesperson has the advantage of being closer to the customer and, therefore, has the opportunity of gather more and better information (in terms of quantity and quality). Essentially, the issue is related to the fact that boundry spanners may know more about customers than the company knows. Should this be the case, another issue arrises – pricing authority or pricing delegation. When customer types, needs and requirements are similar, salespeople do not need to have pricing authority as the price will probably be fixed. When customers are heterogenous, the salesperson is more likely to receive pricing authority in order to be able to negotiate the price based on specific customer information. From this point of view, customer heterogeneity can function similarly to information asymmetry [10]. Pricing authority can also have drawbacks, especially for risk averse salespeople. They can be tempted to sell at lower prices in order to close the deal, as they are evaluated based on immediate results [10]. Therefore, even if decision-making autonomy can be motivating, a survey performed in 2008 by Hansen, Joseph, and Krafft [11] found that only 11% of all firms fully delegate pricing decisions, while 28% of the responding companies offer no pricing authority at all to their sales forces, price being determined by the headquarters. 1.2. Strategic communication As the environmental instability increased and the sales organization becomes more aware of customer needs, it must be ready to change as quickly as the changing needs of the customer. The sales force assume that the organization is ready to change to maintain a sustainable competitive advantage [20]. Also, if the salesperson believes that long-term relationships with customers are important, he/she will also be more likely to be an active participant in strategic communication activity. As a consequence, salesperson trust in the manager leads to greater participation in strategic communication activities [7]. Webster [24] even suggested that the salesperson's ability to gather information is perhaps an even more critical capability than their ability to promote, as it can influence mid- and long-term market approach and can be decisive for success or failure. By synthesizing information, employees may affect upper-management's view of the organization which, in turn, can determine how limited resources are allocated [6]. Cohen and Levinthal [4] argue that the ability of a firm to recognize the value of new external information, assimilate it, and apply it to commercial ends is critical to its success. Sales teams are responsible for detecting changes in the business environment, gaining knowledge about customers, and improving members’ collective understanding of various business situations [20]. Harker and Harker [12] support the idea that sales teams play a vital role in a company’s turnaround process, as they generate income while developing and implementing successful strategies. Salespeople engage in strategic communication in addition to conventional selling roles by becoming ‘linking pins’ between customers and management, therefore they are often in the best position to participate in strategic communication [7]. According to Floyd and Lane [8], top managers are generally involved in decisionmaking, middle managers engage in strategic communication roles, while operational-level employees engage in roles focused on reacting to information and conforming to uppermanagement. Flaherty & Pappas [7] argue that salespeople's perceptions of (1) their firm's orientation toward change, (2) their firm's orientation toward long-term customer relationships, and (3) trust in their manager all play an important role in their likelihood to engage in greater strategic communication activity. While some managers may be open to creative ideas and strategic solutions coming from sales personnel, others feel strongly that employees should focus solely on their main role [8]. Some managers believe that the employee is not only capable of performing but also valuable to the organization in the sense that he/she can effectively implement new strategies [7]. 2. THE ROLE OF SALES REPRESENTATIVE IN THE PHARMACEUTICAL INDUSTRY During the past fifty years, the pharmaceutical industry has had a spectacular evolution, especially due to investments in research and development and to a qualitative jump towards new methods of preventing and treating a broad range of maladies. It is a mature industry, proved by the low expansion level at the end of the 20th century and it is dynamic as it generates a scientific and technological revolution. The pharmaceutical industry has gone through a large number of mergers and acquisitions between 1990 and 2010. Some specialists consider that the consolidation of the industry is not over yet, even though it seems that a small number of companies dominate the market. At the beginning of the 21st century, a ‘superleague’ of large pharmaceutical companies is obvious. The top 5 pharmaceutical companies have doubled their market share up to a total 30%, while the last 5 in top 20 add only 1% to their market share of a total 7%. The pharmaceutical industry has an important dilema: who is the customer? The customer can be 1. the hospital or the distributor (or their decision-makers) who purchase the product directly from the manufacturer, 2. the medical doctor or the pharmacist who prescribes / offers alternatives to the end-user; 3. the end-user or the patient who uses the products. In strictly commercial terms, the customer is in the first category. When discussing prescription drugs, it is probably realistic to say that the medical doctor is the customer and maybe the pharmacist can influence in a small percentage what is sold. In terms of over-the-counter (OTC) drugs (e.g. vitamins), which do not require prescription and can be advertised in the media, the customer and the end-user are the same. The pharmaceutical industry deals with two types of products: 1. blockbuster drugs (innovative, patented drugs, who generate worldwide sales of at least 1 billion USD per year and, as estimated in 2007, who require investments of at least 1.3 billion USD to develop [3]) and 2. generic drugs (former innovative drugs whose patent expired and which can be produced by any manufacturer worldwide). Some companies target innovation (e.g. Pfizer), others are not interested in innovation or do not have the financial support to innovate, therefore they focus on generic drugs (e.g. Teva), while many combine the two, trying to replace themselves their innovative drugs which go off-patent with generic drugs (e.g. Novartis and its generics division Sandoz). Based on this market approach, companies develop their sales force accordingly, trying to reach the customer in the most appropriate manner. Many companies go for the mass-distribution techniques, especially when promoting blockbuster drugs worldwide. Since the discovery of the human genome, the new tendency is to develop personalized drugs which address the genetic requirements of each individual. In this new world, the role of companies in the pharmaceutical industry is difficult to predict. The implications of personalized drugs on companies that focus on mass promotion of innovative drugs can be rather devastating. They will be forced to bring changes in several stages of the value chain, from product discovery, through development and until distribution. New technologies for innovation and development will be required and distribution of personalized drugs will have to be made differently. This is where strategic communication becomes absolutely essential in shaping company strategy and in being able to address the needs of each customer. One study performed on American pharmaceutical companies suggests that performance in sales and marketing provide for 42% of increase in financial performance. Each important innovative product is lauched through a global and extremely expensive marketing campaign. This campaign involves a full set of marketing tools, including advertising in the media, large information packages, special events for doctors, presentations during conferences, dedicated sales force and, more and more, the Internet [21]. At the end of the 20th century, when regular sales mostly turned to electronic sales, many believed that about 50% of salespeople would lose their jobs. In 2000, even if the industry was revolutionised by online exchanges and Web-based ordering, Merck announced the expansion of its salesforce by 30 per cent to build sales of existing and new products [17]. The Internet is not the only option for the pharmaceutical industry and not even the first option. Contact with the customer is essential and, probably, it will never be totally replaced. Sales work in the pharmaceutical industry is almost exclusively team work. Most companies do not have their own sales force, they only employ people specialized in the field (e.g. medical doctors, pharmacists, people with other backgrounds who have experience in the pharma business) as medical representatives to promote their products to medical doctors and to decision-makers. In this case, sales should be automatically generated based on prescriptions from doctors and on orders from hospitals who use products internally. Regardless of type of team members, the pharmaceutical industry is generally using team performance as a factor in determining the compensation of individual salespeople [16]. In 2002, a study published by McKinsey in the Wall Street Journal argued that team mismanagement if highly pervasive in the pharmaceutical industry, while others estimated that the opportunity cost of retaining one area/regional sales manager who co-ordinates three average or below average teams can be up to USD 20 million per year [16]. The pharmaceutical industry is confronted with at least three challenges which affect customer behaviour: 1. medical doctors are less and less willing to discuss with medical representatives or with salespeople; 2. at international level, governments aim at reducing costs for their health systems; and 3. patients are more and more involved in the therapy they are prescribed, leading to failure of some marketing campaigns and of investments made by pharmaceutical manufacturers. As argued before, in changing times, in uncertainty conditions strategic communication becomes essential, therefore it should become one priority for companies in the pharmaceutical industry. 3. RESEARCH DESIGN Research was partially designed based on a prior study by Flaherty and Pappas [7] who analysed strategic communication in sales organizations in the healthcare sector in the United States and partially based on the author’s expertise in the Romanian pharmaceutical market. Similar research designs were chosen to enable to compare results for Romania and the US. The top 20 pharmaceutical companies in Romania (see Table 1) were considered the most relevant for the study. They account for 77.1% of sales on the market and they are companies with large numbers of salespeople (mostly over 100 per company). Each of them was approached by telephone, then one area sales manager (ASM) from each company was e-mailed the materials. The area sales managers were randomly chosen by the company and we did not have access to their names. They received: 1. cover letter explaining the purpose of the study and prior work in the field. Area sales managers were asked to choose three subordinates (one aboveaverage – Q1, one average – Q2 and one below-average – Q3) to fill-in the questionnaire. Only the ASM knew the significance of the codes, so that no disconfort can be created to the team. They were asked to return the questionnaires to the author by e-mail from private e-mail addresses which did not mention the name – they were only asked to mention the company in order to make sure that results can be connected; 2. supervisory questionnaire, which included questions about company products, company sales strategy and assessments for subordinated who filled-in the questionnaire (e.g. why they were included in the first, second or third category). All core questions included in the four types of questionnaires (ASM, Q1, Q2 and Q3) were based on a 7-point Likert-type multi-item scale. The questionnaire comprised 25 core questions and 7 identification questions. ASMs were ask three suplementary questions on general information about the company and three questions about each type of employee. Core questions were divided into six categories for research purposes, then mixed to prevent respondents from connecting questions and answering similarly. Respondents were classified based on current position in the company, work experience (number of years: 0-5, 6-10, 11-15, 16-20; over 20 was not necessary as pharmaceutical sales have only been established in Romania starting with 1990), level of studies, duration of working experience with the current supervisor, type of company (local or multinational) and frequency of communication with the supervisor on the overall strategy of the company. Table 1 – Top 20 pharmaceutical companies in Romania [23] Market share % Rank Company (Sept-Dec 2009) 1. Sanofi-Aventis (including Zentiva) 9.7 2. Hoffman La Roche 9.1 3. Pfizer 6.7 4. GSK (including Europharm) 6.2 5. Novartis (including Sandoz) 2.4 6. Servier (including Egis) 5.2 7. Merck & Co (including 4.6 ScheringPlough) 8. Daiichi Sankyo (including Terapia 3.8 – Ranbaxy) 9. AstraZeneca 3.5 10. Abbott (including Solvay) 2.7 11. Bayer-Schering 2.5 12. Antibiotice 2.4 13. Eli Lilly 2.4 14. Menarini 2.1 15. Labormed (including Ozone) 2.0 16. KRKA 1.9 17. Actavis 1.7 18. Johnson & Johnson 1.6 19. Gedeon Richter 1.4 20. Reckitt Benckiser 1.4 Market share % (Jan-Apr 2010) 9.4 8.8 6.7 6.1 6.0 5.3 4.6 3.6 3.8 2.7 2.4 2.3 2.4 2.0 2.0 1.9 1.5 1.8 1.5 1.5 Hypotheses were chosen in accordance with the Flaherty and Pappas study so that results can be compared. We used four hypotheses: H1. Orientation toward change is positively associated with salesperson strategic communication. H2. Relationship selling is positively associated with salesperson strategic communication. H3. Salesperson trust in the manager is positively associated with salesperson strategic communication activity. H4. Participation in strategic communication activity is related positively to individual-level sales performance. 4. ANALYSES, RESULTS AND CONCLUSIONS Out of the top 20 pharmaceutical companies initially included in the study, 5 provided complete and usable questionnaires, corresponding to a rate of 25%. Even though they were all explained that name of companies or of respondents would not be made public and that information would be used exclusively for academic purposes, Romanian managers are still much more reluctant than managers from developed countries to answer questions, especially when the purpose of the study is not directly linked to their daily job. Some argued that confidentiality agreements do not allow them to answer, even though the questionnaire was anonymous and it did not ask any question which could infringe such an agreement. The sample of respondents all have at least university studies, if not master degree or doctoral studies. ASMs are generally more experienced in the industry then their subordinates, with an average number of 8 years of experience in the field. All respondents discuss with their managers about company strategy at least once a week or once a month. Before beginning the analysis, all answers were grouped together and each respondent received an identification code, which would allow us to link his/her answer to his/her peers and ASM. Then, all core questions (together with answers) were regrouped into the six original categories for analysis. The validity of the hypotheses was then tested. Hypotesis H1 was confirmed, as respondents with inclination towards change are more likely to engage in strategic communication. Even if the vast majority of repondents regularly scan the market for information, they do not come up with strategic suggestions to the managers. This can be due to strict procedures and to lack of trust in others’ judgement, especially if coming from subordinates. 86% of repondents indicated that their managers are keen on innovation and change, creativity and new ideas, proving that, at least at strategic level, these are company goals. Hypothesis H2 is partially confirmed, as subordinates express their interest in strategic communication, but they either aren’t confident enough to put things into perspective for the managers or they are not allowed to do it. Hypothesis H3 is also partially confirmed. Subordinates trust their manager, 62% argue that they would never be interested in spying on their boss, 25% answered that they would do it seldom, and only 13% say that they would like to do it many times. They would also like to have the manager influence them to some degree. Still, most of them (62%) would never let the manager have full control of their future in the company. Some of the subordinates who really trust their manager reported being involved in typical activities of strategic communication. Still, others do not get involved, even though they trust the manager. This makes us wonder what other barriers (possibly organizational barriers) they can encounter to putting strategic communication into practice. In our study, hypothesis H4 is not confirmed. We were not able to identify a pattern for respondents engaging in strategic communication. This can be due to different perceptions on what we generally consider ‘strategy’ and some repondents might consider executive-level tasks as having strategic implications, while others can be too modest. Other study limitations can be linked to studying only one industry, receiving a low percentage (25%) of usable respondent sheets due to the perception that any small piece of information that leaks from the company can have devastating effects and a rather short time for performing the analysis (April – June 2010). The results of the Romanian study are consistent with the US study results. As Flaherty and Pappas concluded, selling performance of sales professionals is at least partly determined by their participation in roles and activities that extend beyond the traditional selling function. Also, their findings indicate that participation in strategic communication activities is positively associated with individual sales performance. Further, they found that salespeople's perceptions of (1) their firm's orientation toward change, (2) their firm's orientation toward long-term customer relationships, and (3) trust in their manager all play an important role in their likelihood to engage in greater strategic communication activity. If the manager demonstrates an appreciation for change, flexibility, and innovativeness, then the salesperson will engage in a higher level of strategic communication activity. References [1] Avlonitis, G.J., N.G. Panagopoulos (2010). Selling and sales management: An introduction to the special section andrecommendations on advancing the sales research agenda, Industrial Marketing Management; IMM-06444 ; Article in press doi:10.1016/j.indmarman.2009.12.006 [2] Burgelman, R. (1994). Fading memories: A process theory of strategic business exits in dynamic environments. Administrative Science Quarterly, 39, 24−56. [3] Ciulu, R. (2008). Strategii concurenţiale în managementul companiilor din industria farmaceutică, Ed. Princeps Edit, Iaşi, 2008 [4] Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128– 152. [5] Cravens, D.W., F.G. Lassk, G.S. Low, G.W. Marshall, W.C. Moncrief (2004). Formal and informal management control combinations in sales organizations. The impact on salesperson consequences, Journal of Business Research 57, 241– 248 [6] Dutton, J. E., & Ashford, S. J. (1993). Selling issues to top management. Academy of Management Review, 18, 397−428. [7] Flaherty, Karen E. & James M. Pappas (2009). Expanding the sales professional's role: A strategic re-orientation?, Industrial Marketing Management 38, 806–813 [8] Floyd, S. W., & Lane, P. J. (2000). Strategizing throughout the organization: Managing role conflict in strategic renewal. Academy of Management Review, 25(1), 154−177. [9] Floyd, S.W., & Wooldridge, B. (1992). Middle management involvement in strategy and its association with strategic type. Strategic Management Journal, 13, 153−167. [10] Frenzen, H., A.K. Hansen, M. Krafft, M.K. Mantrala, S. Schmidt (2010). Delegation of pricing authority to the sales force: An agency-theoretic perspective of its determinants and impact on performance, International Journal of Research in Marketing 27, 58–68 [11] Hansen, A., Joseph, K., & Krafft, M. (2008). Price-delegation in sales organizations. Business Research, 1(1), 94–104. [12] Harker, M., & Harker, D. (1998). The role of strategic selling in the company turnaround process. Journal of Personal Selling and Sales Management, 18(2), 55– 63. [13] Jaworski B.J., V. Stathakopoulos, H.S. Krishnan (1993). Control combinations in marketing: conceptual framework and empirical evidence. Journal of Marketing, 57:57– 69 (Jan). [14] Jones, E., L.B. Chonko, J.A. Roberts (2004). Sales force obsolescence: Perceptions from sales and marketing executives of individual, organizational, and environmental factors, Industrial Marketing Management 33, 439– 456 [15] Kern, R. (1989). Letting your salespeople set prices. Sales and Marketing Management, 14, 44–49. [16] Lambe, C. J., K.L. Webb, C.Ishida (2009). Self-managing selling teams and team performance: The complementary roles of empowerment and control, Industrial Marketing Management 38, 5–16 [17] Lane, N., N. Piercy (2004). Strategic Customer Management: Designing a Profitable Future for Your Sales Organization, European Management Journal Vol. 22, No. 6, pp. 659–668 [18] Panagopoulos, N.G., G.J. Avlonitis (2010). Performance implications of sales strategy: The moderating effects of leadership and environment, International Journal of Research in Marketing 27, 46–57 [19] Piercy, N.F., G.S. Low, D.W. Cravens (2010). Country differences concerning sales organization and salesperson antecedents of sales unit effectiveness, Journal of World Business, (Article in press) [20] Rangarajan, D., L.B. Chonko, E. Jones, J.A. Roberts (2004). Organizational variables, sales force perceptions of readiness for change, learning, and performance among boundary-spanning teams: A conceptual framework and propositions for research, Industrial Marketing Management 33, 289– 305 [21] Rasmussen, B. (2002). Implications of the Business Strategies of Pharmaceutical Companies for Industry Developments in Australia, Centre for Strategic Economic Studies, Melbourne – Australia [22] Russ, G. S., Carmen, M., & Ferris, G. (1998). Power and influence of the human resources function through boundary spanning and information management. Human Resource Management Review, 8(2), 125–148. [23] Stanciu, M. (2010). Topul celor mai mari 20 jucatori din piata farma, WallStreet Journal Romania, 19 May 2010, http://www.wallstreet.ro/top/Companii/85953/Topul-celor-mai-mari-20-jucatori-din-piatafarma.html (accessed 5th July 2010) [24] Webster, F. E., Jr. (1965). The industrial salesman as a source of market information, Business Horizons, 77−82 (Spring). [25] Weitz, B. A., & Bradford, K. D. (1999). Personal selling and sales management: A relationship marketing perspective. Journal of the Academy of Marketing Science, 27(2), 241– 254.